AMERICAN UNIVERSITY Department of Economics Comprehensive Exam

advertisement

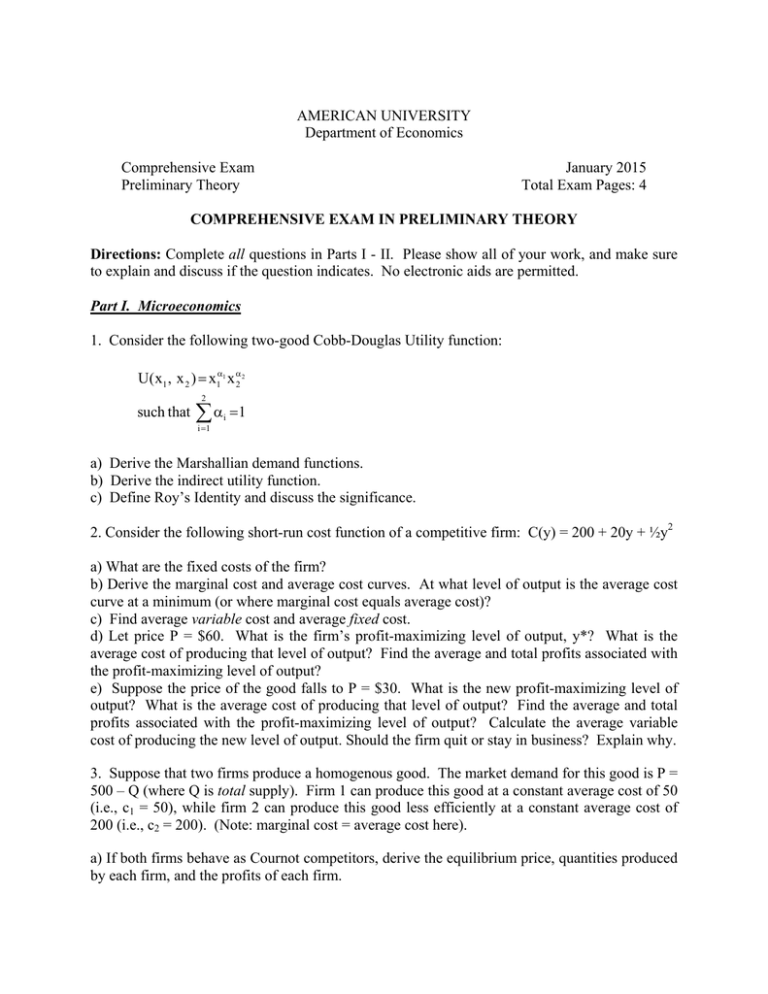

AMERICAN UNIVERSITY Department of Economics Comprehensive Exam Preliminary Theory January 2015 Total Exam Pages: 4 COMPREHENSIVE EXAM IN PRELIMINARY THEORY Directions: Complete all questions in Parts I - II. Please show all of your work, and make sure to explain and discuss if the question indicates. No electronic aids are permitted. Part I. Microeconomics 1. Consider the following two-good Cobb-Douglas Utility function: U(x1 , x 2 ) x11 x 2 2 such that 2 1 i 1 i a) Derive the Marshallian demand functions. b) Derive the indirect utility function. c) Define Roy’s Identity and discuss the significance. 2. Consider the following short-run cost function of a competitive firm: C(y) = 200 + 20y + ½y2 a) What are the fixed costs of the firm? b) Derive the marginal cost and average cost curves. At what level of output is the average cost curve at a minimum (or where marginal cost equals average cost)? c) Find average variable cost and average fixed cost. d) Let price P = $60. What is the firm’s profit-maximizing level of output, y*? What is the average cost of producing that level of output? Find the average and total profits associated with the profit-maximizing level of output? e) Suppose the price of the good falls to P = $30. What is the new profit-maximizing level of output? What is the average cost of producing that level of output? Find the average and total profits associated with the profit-maximizing level of output? Calculate the average variable cost of producing the new level of output. Should the firm quit or stay in business? Explain why. 3. Suppose that two firms produce a homogenous good. The market demand for this good is P = 500 – Q (where Q is total supply). Firm 1 can produce this good at a constant average cost of 50 (i.e., c1 = 50), while firm 2 can produce this good less efficiently at a constant average cost of 200 (i.e., c2 = 200). (Note: marginal cost = average cost here). a) If both firms behave as Cournot competitors, derive the equilibrium price, quantities produced by each firm, and the profits of each firm. 2 b) If both firms behave as Bertrand competitors, derive the equilibrium price, quantities produced by each firm, and the profits of each firm. c) In part b), after the equilibrium is determined, what would happen if firm 1 tried to behave as a monopolist? 4. Suppose there are two persons, A and B, and two goods, X and Y. Person A has 90 units of good X and 35 units of good Y. Person B has 30 units of good X and 25 units of good Y. Thus, the total supply of good X is 120 and the total supply of good Y is 60. However, this existing allocation of goods between the two persons may not be their utility-maximizing bundles. Suppose the utility function for person A is uA = XAYA and for person B is uB = XBYB. Let pX be the price of good X and let the price of good Y be normalized to 1. a) b) c) d) e) Write down the budget constraint for person A and that for person B. Maximize person A’s utility subject to her budget constraint, and do the same for person B. From part b), derive everyone’s demand for good X and for good Y. Given the fixed supplies of good X and good Y, find the market clearing price. Explain why, in part d), we need only find the market clearing price for one of the two goods. 3 Part II. Macroeconomics A. Short Answers 1. What is the ‘convergence controversy’: Is empirical evidence on correlations between initial GDP per capita and subsequent growth therein consistent with the implications of the neoclassical growth model? Explain. 2. Suppose there are two investment opportunities: Time t Time T (where T > t) Invest Buy a domestic bond valued at B domestically Risk free pay-off in period T is: B ei(T-t) Invest in a foreign bond Take the same amount of money, B, and convert it into the foreign currency at an exchange rate of St Receive back the principal and interest on the foreign bond in foreign currency: This yields a foreign-currency amount of B/St, where St=price of one unit of foreign currency per unit of domestic currency B eif(T-t) This amount is invested in the foreign bond at an amount of Bf Now convert this back into the domestic currency at the forward rate Ft,T: Ft,T eif(T-t) Bf = (Ft,T/St) eif(T-t) B To cover your risk, you also buy a forward contract for the foreign currency, to be bought at a fixed rate of Ft,T at time T. a. Use the no arbitrage condition to derive covered interest rate parity. [Assume risk neutrality]. b. Taking uncovered interest rate parity into account, what relationship between the spot and forward exchange rates is implied by (a.)? c. Briefly note whether the empirical evidence supports the prediction in (b.). B. Long answers 1. Overlapping generations Consider the following two-period overlapping generations model. People consume in both periods but work only in period two. The intertemporal utility of the representative individual in the first period is 4 U = log(c1) + β [ log(c2) + α log(1-n2) + γ log(g2) ] c1 and c2 are consumption in periods one and two respectively, while k1 (which is given) and k2 are the stocks of capital. n2 is labor and g2 is government expenditure in period two which is funded by a lump-sum tax in period two. Production in periods one and two are: y1 = Rk1 = c1 + k2 y2 = Rk2 + φ n2 = c2 + g2 a. Find the optimal centrally planned solution for c1. b. Find the private sector solutions for c1 and c2, taking government expenditures as given. c. Compare the two solutions. 2. Time consistency and the conservative central banker In the Barro-Gordon model, the expressions for aggregate output and inflation are: y = yn + a ( - e ) + π= m + v where variables are defined as follows: y yn π πe m v actual output potential output actual inflation expected inflation productivity shock change in money supply [the central bank’s policy instrument] velocity shock Suppose that, to address the problem of the inflation bias, the government can hire a conservative central banker who finds inflation more distasteful than the public at large. The conservative central banker’s loss function, Ucb, puts an extra weight, , on the value of keeping inflation down: Ucb = ( y – yn ) – (1/2)(1+δ) 2 a. Show how the magnitude of the ‘inflation bias’ under the conservative central banker compares to the one that would arise if the central bank’s preferences matched those of the public. Explain. b. Why is there still an inflation bias, even though this central banker is more inflationaverse? c. Using the society’s social welfare function (in which δ=0), show whether society is better off with the conservative central banker than it would be under (i) discretionary monetary policy, and (ii) a regime under which the central bank could commit to keeping inflation at its socially optimal rate. Explain.