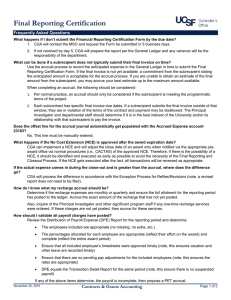

Financial Reporting & Closeout Process – Non-Payroll Accruals

advertisement

Financial Reporting & Closeout Process – Non-Payroll Accruals This document outlines the purpose and process for preparing and reversing a non-payroll accrual entry, which may be required under the Financial Reporting and Closeout Process. Contracts and Grants Accounting (CGA) is using the PeopleSoft Research Administration System (RAS) processing end date field to control spending and enable compliance with Uniform Guidance requirements. For expenses which have not yet posted to the General Ledger, the RSA or other department delegate can process an accrual entry and request approval by the Department Approver and CGA Analyst. If approved, the accrual will be posted to accurately report expenses to the sponsor. What is an accrual and why are they used in financial reporting? For sponsored awards at UCSF, an expense accrual is used to record a cost estimate for a product or service that was delivered during the award period but has not yet been recorded in the General Ledger. Creating an accrual ensures all direct expenses are recorded in the General Ledger at award close. Examples of expenses to accrue: • Subaward invoices for services delivered within the award period but for which the invoice will not be received prior to the processing end date • Recharges for services delivered within the award period but for which the charge will not be recorded prior to the processing end date • Travel which occurred within the award period but for which the charge will not be recorded prior to the processing end date • Vendor services which were provided within the award period but for which the invoice will not be received prior to the processing end date • Allowable post-award publication costs (see Uniform Guidance Key Concepts – Publication Costs) Award accruals are NOT used for: • Estimated unallowable expenses (e.g., goods/services occurring AFTER the award expiration date) • Cost transfers • Payroll Expense Transfers (PETUs) o See the job aid Financial Reporting and Closeout Process – Payroll Expense Transfers and Accruals for the proper procedure for recording payroll accruals. Creating a Non-Payroll Accrual Journal Login to MyAccess at http://myaccess.ucsf.edu (not shown). Scroll down to locate and select PeopleSoft from the applications menu. If you have set MyAccess to display “favorites”, you may need to change to “All Apps” or search for PeopleSoft. Click on Main Menu > General Ledger > Journals > Journal Entry > Create/Update Journal Entries This opens the Create/Update Journal Entries page March 2016 Contracts & Grants Accounting - Job Aid Page 1 of 4 Financial Reporting & Closeout Process – Non-Payroll Accruals Enter the correct Business Unit - defaults to the Business Unit set in your PeopleSoft System Profile Enter a Journal ID using the UCSF preferred “xxABCxxxx” format, where: • xx = the fiscal period of the journal • ABC = your specific 3-character Journal Preparer ID • xxxx = a sequential numbering scheme of your choosing Overwriting the default of NEXT allows you to locate your entered journals on the Find an Existing Value tab. Using this preferred method, you can easily change the Journal ID search to contains “ABC“ and quickly find any journal you have created. See the list of user-specific 3-character Journal IDs. Keep the Journal Date (defaults to current), OR • In the first five (5) business days of a given month, you may change the date to the previous month. Allow enough time for journal approval to ensure the journal posts before month-end close. • You may enter a date in a future period. You can save your journal, but you cannot edit or submit it for approval until the period opens. Click the Add button After navigating to components you frequently use, save them to your Favorites to make recalling them a breeze: 1. Click Favorites 2. Click Add to Favorites 3. Give the favorite a Description, 4. Click OK To recall a saved Favorite: 1. Click Favorites Preparing a Financial Journal – Header Tab On the Header tab, enter the following information: Long Description (required) – enter the award number/activity period and describe the accrual transaction Ledger Group – should be ACTUALS Source - enter 549 (Close-out encumbrances). Click the magnifying glass to look up the source code. Source defaults to 535 (financial source code). Note that the UCSF Attachment E tab will not appear until you enter Source code 549 and navigate to the Lines tab. Reference - (optional) 8-character field Attach all necessary backup documents (in PDF format) that support the journal. Examples include emails/invoice estimates from subrecipients, and outstanding purchase orders within BearBuy. Click the Attachments link (Not shown) Click the Add Attachment button from the Journal Entry Attachments pop-up. Click the Choose File/Browse button from the File Attachment pop-up. Select the file and click the Open button. Click the Upload button on the File Attachment pop-up. Net Position Report – Proj 12345 Enter a Description of the uploaded document Click OK when done to return to the journal entry screen Page 2 of 4 Contracts & Grants Accounting - Job Aid March 2016 Financial Reporting & Closeout Process – Non-Payroll Accruals Financial Journal – Lines Tab Click on the Lines tab to enter the financial information on the journal: Enter the SpeedType (if applicable) OR Enter the award chartstring information - Account, Fund, Dept ID, Project, Activity Period, Function, Flexfield Enter the debit Amount for each line (see instructions in the screenshot below for adding additional lines) • Enter the direct cost ONLY; the system will automatically calculate and post the corresponding indirect cost • Reminder: do not enter an accrual to record a Payroll Expense Transfer (PETU); the CGA Compliance Team will enter the accrual once the PETU is approved Scroll over to the far right of the screen, and enter a Journal Line Description (30-character) on each line of the journal that references the details for the particular expense line. This description will be displayed on the Transaction Detail Report in MyReports Enter the accrued liability chartstring information: • • Account is 23183 (OCL-spon rsch nonpay accrual) Fund, Dept ID, Project, Activity Period, Function, Flexfield are the same as the sponsored award Enter the credit Amount as the sum of all the Debit lines After entering all lines, Total Debits must equal Total Credits and the Journal Status should be N (not edited). Any mismatch must be corrected. Be sure to Save the journal before moving on to the next step To remove lines, click the Select checkbox, followed by the icon. To add more lines, type the number of lines in the Lines to add field and click the icon Financial Journal - UCSF Attachment E Tab The UCSF Attachment E tab must be completed for every Non-Payroll Accrual journal. • Answer questions 1 through 3 March 2016 Contracts & Grants Accounting - Job Aid Page 3 of 4 Financial Reporting & Closeout Process – Non-Payroll Accruals Edit and Submit a Financial Journal; Review Approval Status The Edit Journal process must be run prior to submitting any journal, and ensures that: • All chartfield combinations are valid • The Journal Date is in an open period • Total Debits equal Total Credits From the Lines tab, click the Process drop-down menu and select Edit Journal Click the Process button and wait until the edit process completes. If there are errors, the Journal Status will display “E” and the lines in error will be marked with an “X”. • If you have an error status but no lines are marked in error, this is most likely due to a missing Long Description, or Debits not equaling Credits. • Go to the Errors tab to review the error description. Refer to the Combo Edit Quick Reference Guide for more details. (Not shown) When the errors are corrected, click the Save button and re-run the Edit Journal process. (Not shown) If the Edit Process is successful and there are no errors, Journal Status is set to V (Valid). Change the Process drop-down menu to Submit Journal and click the Process button. Click on the Approval tab to view the Approval Status and list of approvers. The journal will be in the first approver’s worklist until action is taken. Return to the Approval tab at any time in the journal cycle to see the current step of the approval process. (Not shown) If the Processing End Date has already past, the journal status will display the Error Invalid RAS Project-Fund-Activity Period. Instead of Submit Journal, use the Notify button at the bottom of the screen to request the Department Approver to review and approve the journal in the draft (unsubmitted) form. Submit to Contracts and Grants Accounting (CGA) Include the Journal ID in the More Information section of the Final Reporting Certification (within PeopleSoft RAS at Main Menu > Grants > UCSF Reports > Final Reporting Certification) and submit the completed form. See the Instructions tab for directions on how to complete the rest of the Final Reporting Certification. • If all information is accurate and the accruals justifications are acceptable, CGA will modify the Processing End Date for 2 days later and notify the department to Submit and approve the journals within 2 business days. • CGA Accountant may request additional clarification or information to verify the allowability and reasonableness of the expenses prior to accepting/denying. Reversing the accrual journal • Upon receipt of the actual invoice/charge, prepare the invoice/charge for approval following normal procedures. • Prior to submitting to the central office for processing, submit the approved invoice/charge to the CGA Accountant via CGASvcDesk@UCSF.edu. CGA will prepare the reversing journal entry and modify the processing end date to allow the actual invoice/charge to post to the General Ledger. CGA will forward the approved invoice/charge to the central office for processing. Page 4 of 4 Contracts & Grants Accounting - Job Aid March 2016