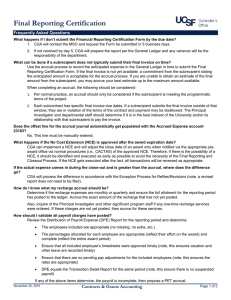

Financial Reporting and Closeout Process Purpose

advertisement

Financial Reporting and Closeout Process Purpose The new Contracts and Grants Accounting (CGA) process to improve the efficiency and accuracy of the sponsored research financial reporting and closeout processes for non-clinical trial Federal and Federal Flow-Through awards was implemented effective November 1, 2015. These changes enhance compliance by establishing system controls during the trail out period for expenses, and enable UCSF to adhere to the Uniform Guidance requirements for financial reporting, invoices and award closeouts. Eventually, after the successful roll-out of this process, non-federal awards will follow a similar process. Final Reporting Certification and Closeout Process 1. At award set-up, establish the award’s Trail Out Period by populating the RAS (PeopleSoft) field Processing End Date to prevent the posting of expenditures 65 days after the budget/project end date a. For non-LOC awards where the deliverable due date is 60 days or less after the budget/project end date, the Processing End Date will be set to the 8th business day after the next GL month close (e.g., Final Invoice is due 45 days after the award end date of 4/15/16, Processing End Date will be set to day 6/8/16) b. Note, Subcontractors have 60 days to close and invoice UCSF per the contracts; therefore, the last invoice will be received after the Processing End Date i. Accounts Payable (AP) will notify CGA when the invoice, approved by the PI, is received. CGA will modify the Processing End Date by 1 day to allow the invoice to be paid as long as the invoice is received prior to the CGA filing the final deliverable 2. RAS Award RSA and PI will only receive one notification 45 days prior to end date indicating the reporting and closeout process will begin and to take necessary steps to ensure expenditures are posted prior to the Processing End Date a. As part of this notification CGA will direct the RSA to the Final Reporting Certification Form, which must be completed in RAS/PeopleSoft by the RSA or his/her delegates 3. RAS Award RSA or his/her delegate must complete the Final Reporting Certification Form 15 days prior to the deliverable due date (i.e., FFR due day 90, CGA must receive the Form by day 75) a. If the Department believes additional expenses not yet posted to the General Ledger are allowable and belong on the award, the department should draft the non-payroll accrual journals/Payroll Expense Transfers (PETs) in PeopleSoft/PET process with adequate supporting documentation, and then list and justify the transactions on the Final Reporting Certification Form noting the associated journal ID/PET ID b. Before submitting the Final Reporting Certification Form, all submitted journals/PETs should be reviewed and have the informal approval of the Department Approver (notify the approver outside of system workflow) i. If approved, the Journal will be in error status ii. If denied, the approver should request that the Journal be deleted 4. RAS Award RSA will submit the Final Reporting Certification Form to the CGA Accountant via email to CGASvcDesk@UCSF.edu15 days prior to the deliverable due date. If not received, CGA will escalate to the Award MSO and a response must be received within 5 days a. If no response is received, CGA Accountant will proceed using the General Ledger and the department will be liable for variance between the final report/invoice and pending expenses 5. CGA Accountant reviews and validates the information provided in the Form a. If all information is accurate and the justification to support accruals is acceptable, CGA will modify the Processing End Date for 2 days later and inform the Department to process the journals/PETs within two business days i. Note: certain expenses though allowable may be denied if they meet CGA’s Small Balance Writeoff Threshold ii. Until the automation of PETs, CGA will work with Payroll to post the PET and will adjust the Processing End Date as necessary b. CGA Accountant may request additional clarification or information in order to adequately verify the allowability and reasonableness of the expenses, prior to accepting or denying charges 6. The financial report/invoice will be submitted to the sponsor by the due date Revised 4/19/2016 Contracts & Grants Accounting Quick Reference Guide Page 1 of 2 Financial Reporting and Closeout Process a. Most Federal Prime and State awards – 90 days b. Most subawards – 60 days c. Intercampus (IRR) awards – 45 days 7. Any expense adjustment requests after this period will be evaluated per the exception process (See following section) 8. The award will be closed by CGA in RAS by day 120 Exception Process for all Refiles and Revisions 1. Financial report/invoice is submitted by the sponsor due date, typically 90 days for Prime awards and 60 for subawards 2. Department identifies expenses they believe should have been reported to the sponsor after the budget/project after the end date of the award 3. If the Department believes additional expenses not yet posted to the General Ledger are allowable and belong on the award, they must file a revised Final Reporting Certification Form for the award a. The department should draft the journals/PETs in PeopleSoft/PET process with adequate supporting documentation, and justify them on the Final Reporting Certification Form noting the associated journal ID/PET ID b. Before submitting the Final Reporting Certification Form, all submitted journals/PETs should be reviewed and have the informal approval of the Department Approver (notify the approver outside of system workflow) i. If approved, the Journal will be in error status ii. If denied, the approver should request that the Journal be deleted 4. If approved, CGA Accountant will modify the Processing End Date for 2 days later and inform the Department to process the transfer within two business days Note: certain expenses though allowable may be denied, if they meet CGA’s Small Balance Write-off Threshold 5. CGA Accountant will inform the department of the final treatment of the expense(s) and the structure for the journal Instances when a refile/revision will be allowed: • All Refunds to Sponsor o CGA will determine if the refund is processed against the individual award or the clearing house o If processed against individual award, refile report If after liquidation, refile requires sponsor/PMS permission which will be obtained by CGA • Expense against Award Unexpended Balance o CGA will not consider any amount under $5,000 o If processed against individual award, refile report If after liquidation, refile requires sponsor/PMS permission which will be obtained by CGA Page 2 of 2 Contracts & Grants Accounting Quick Reference Guide Revised 4/19/2016