GROUP BENEFIT PLAN

advertisement

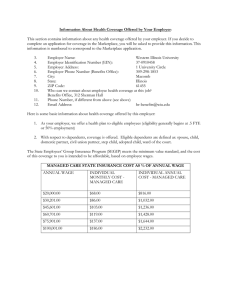

GROUP BENEFIT PLAN CABRILLO COMMUNITY COLLEGE Life TABLE OF CONTENTS Group Life Insurance Benefits PAGE CERTIFICATE OF INSURANCE.............................................................................................................................3 SCHEDULE OF INSURANCE .................................................................................................................................4 Who is eligible for coverage? ................................................................................................................................4 When will You become eligible? (Eligibility Waiting Period) ................................................................................4 What is Evidence of Good Health? ........................................................................................................................4 When will Evidence of Good Health be required?..................................................................................................4 What Life benefits are available to You?................................................................................................................5 What reductions in Your coverage will occur due to Your age?..............................................................................5 ELIGIBILITY AND ENROLLMENT .......................................................................................................................5 Must You contribute toward the cost of coverage? .................................................................................................5 How do You request coverage for Yourself?..........................................................................................................5 When does coverage start? ....................................................................................................................................5 What is the Deferred Effective Date provision for employees? ...............................................................................5 When are changes effective?..................................................................................................................................6 BENEFITS................................................................................................................................................................6 Life Insurance Benefit ...........................................................................................................................................6 Accelerated Death Benefit .....................................................................................................................................7 TERMINATION.......................................................................................................................................................8 When does Your coverage terminate? ....................................................................................................................8 Under what conditions can Your insurance be continued under the continuation provisions? ..................................8 CONVERSION PRIVILEGE ....................................................................................................................................9 GENERAL PROVISIONS ......................................................................................................................................10 DEFINITIONS........................................................................................................................................................ 11 1 INSURER INFORMATION NOTICE NOTICE REQUIREMENT IF YOU HAVE A COMPLAINT, AND CONTACTS BETWEEN YOU AND THE INSURER OR AN AGENT OR OTHER REPRESENTATIVE OF THE INSURER HAVE FAILED TO PRODUCE A SATISFACTORY SOLUTION TO THE PROBLEM, THEN YOU MAY CONTACT: STATE OF CALIFORNIA INSURANCE DEPARTMENT CONSUMER COMMUNICATIONS BUREAU 300 SOUTH SPRING STREET, SOUTH TOWER LOS ANGELES, CA 90013 1-800-927-HELP THE HARTFORD'S ADDRESS AND TOLL-FREE NUMBER IS: THE HARTFORD GROUP BENEFIT'S DIVISION POLICYHOLDER SERVICES, P.O. BOX 2999 HARTFORD, CT 06104-2999 TELEPHONE: 1-800-572-9047 2 HARTFORD LIFE AND ACCIDENT INSURANCE COMPANY Hartford, Connecticut (Herein called Hartford Life) CERTIFICATE OF INSURANCE Under The Group Insurance Policy As of the Effective Date Issued by HARTFORD LIFE to The Policyholder This is to certify that We have issued and delivered the Group Insurance Policy (Policy) to the Policyholder. The Policy insures the Policyholder's employees who: • are eligible for the insurance; • become insured; and • continue to be insured, according to the terms of the Policy. The terms of the Policy which affect an employee's insurance are summarized in the following pages. This Certificate of Insurance, and the following pages, will become Your Booklet-certificate. The Booklet-certificate is a part of the Policy. This Booklet-certificate replaces any other which We may have issued to the Policyholder to give to You under the Policy specified herein. Richard G. Costello, Secretary John C. Walters, President 3 Some of the terms used within this Booklet-certificate are capitalized and have special meanings. Please refer to the definitions at the end of this Booklet-certificate when reading about Your benefits. SCHEDULE OF INSURANCE Final interpretation of all provisions and coverages will be governed by the Group Insurance Policy on file with Hartford Life at its home office. The Policyholder: CABRILLO COMMUNITY COLLEGE The Policy Number: GL-853461 Policy Effective Date: July 1, 2006 THE BENEFITS DESCRIBED HEREIN ARE THOSE IN EFFECT AS OF DECEMBER 1, 2008. Anniversary Date: Who is eligible for coverage? Eligible Class(es): October 1 of each year, beginning in 2009. All Active Full-time Employees who work 20 hours or more per week and are employed at least 9 months duration who are U.S. citizens or U.S. residents, excluding temporary and seasonal employees When will You become eligible? (Eligibility Waiting Period) If You are working for the Employer prior to the Policy Effective Date and are covered under the Prior Plan, You are eligible for coverage on the later of the Policy Effective Date or the date You enter an eligible class. If You start working for the Employer after the Policy Effective Date, You are eligible for coverage on the first day of the month coincident with or next following Your date of hire. What is Evidence of Good Health? Evidence of Good Health is information about a person's health from which We can determine if coverage or increases in coverage will be effective. Information may include questionnaires, physical exams, or written documentation as required by Us. Inquiries as to the status of Your submission of Evidence of Good Health should be addressed to Your Employer and/or Benefit Administrator. We, Your Employer and/or Benefit Administrator will notify You of approvals. We will notify You, in writing, of any disapprovals. When will Evidence of Good Health be required? Evidence of Good Health is required if You elect no coverage when eligible to do so and later opt for coverage for any Amount of Life Insurance for Yourself. Evidence of Good Health must be provided at Your own expense. If Evidence of Good Health is not approved in the situation(s) described above, no coverage will become effective. AMOUNT OF LIFE INSURANCE Employee Only 4 853461(GL)7.3 What Life benefits are available to You? Amount of Life Insurance: An amount equal to 1 times Your annual rate of basic Earnings, rounded to the next higher multiple of $1,000, if not already such a multiple, subject to a maximum of $75,000. In no event however will Your Amount of Life Insurance be less than $10,000. Your Amount of Life Insurance will be reduced by any life benefit: 1. paid to You under an accelerated death benefit in the Prior Plan; and 2. in force for You under any disability extension provision of the Prior Plan. If You convert, does it affect the Amount of Life Insurance benefit payable? The Amount of Life Insurance under the Policy will be reduced by the amount of the individual life insurance issued in accordance with the Conversion Privilege for reasons other than reductions in coverage. REDUCED AMOUNTS OF INSURANCE What reductions in Your coverage will occur due to Your age? Your Amount of Life Insurance will decrease by 35% on the Anniversary Date which occurs on or next follows the date You attain age 65 and by 50% when You attain age 70. The reduction will apply to the Amount of Life Insurance in force immediately prior to the first reduction made. Additionally, if: 1. You become insured under the Policy; or 2. Your coverage increases, on or after the date You attain age 65, We reduce the amount of coverage for which You would otherwise be eligible in the same manner. Reduced amounts of Life Insurance will be rounded to the next higher multiple of $500, if not already such a multiple. ELIGIBILITY AND ENROLLMENT Must You contribute toward the cost of coverage? With respect to Life Insurance coverage, You do not contribute toward the cost. How do You request coverage for Yourself? If You are not required to contribute toward the cost of coverage, You are not required to request coverage. Enrollment will be automatic. However, You will be required to complete a beneficiary election form. When does coverage start? If You are not required to contribute toward the cost of coverage, You will become insured on the date You become eligible for coverage. All effective dates of coverage are subject to the Deferred Effective Date provision. What is the Deferred Effective Date provision for employees? If You are absent from work due to a physical or mental condition on the date Your insurance, an increase in coverage or a new benefit added to the Policy would otherwise have become effective, the effective date of Your insurance, any increase in insurance or the additional benefit will be deferred until the date You return to work as an Active Full-time Employee. 5 Are there exceptions to the Deferred Effective Date provision? If You were insured under the Prior Plan on the day before the Policy Effective Date and You would be eligible for coverage on the Policy Effective Date except that You are not able to meet the requirements of the Deferred Effective Date provision, then: 1. the Deferred Effective Date provision will not apply to the original effective date of coverage; and 2. the coverage amount shown in the Schedule of Insurance will not apply to You. Instead, You will be considered to be insured and Your coverage amount will be the lesser of: 1. the Amount of Life Insurance under the Prior Plan; or 2. the Amount of Life Insurance shown in the Schedule of Insurance, reduced by: 1. any coverage amount in force or otherwise payable due to any disability benefit extension under the Prior Plan; or 2. any coverage amount that would have been in force due to any disability benefit extension under the Prior Plan had timely election for the disability provision been made. You will remain insured under this provision until the first to occur of: 1. the date You return to work as an Active Full-time Employee; 2. the date Your insurance terminates for a reason stated under the Termination provision; 3. the last day of a period of 12 consecutive months which begins on the Policy Effective Date; or 4. the last day You would have been covered under the Prior Plan, had the Prior Plan not terminated. When are changes effective? The provisions, terms and conditions of the Schedule of Insurance or this Booklet-certificate may be modified, amended or changed at any time; consent from any covered individual is not required. If there is any type of change in Your class, Earnings, the Schedule of Insurance or the Booklet-certificate which: 1. decreases an amount of coverage or deletes, limits or restricts the availability of a benefit or provision, then that decrease, deletion, limitation or restriction will be effective on the date the change in class, Earnings, the Schedule of Insurance or the Booklet-certificate is effective; 2. increases an amount of coverage or adds, improves or increases availability of a benefit or provision, then that increase, addition or improvement will be effective on the date the change in class, Earnings, the Schedule of Insurance or the Booklet-certificate is effective, subject to application of the Deferred Effective Date provision and Our approval where Evidence of Good Health is required. BENEFITS Life Insurance Benefit To whom and how are benefits paid? A completed claim form, a certified copy of the death certificate and Your enrollment form must be sent to the Employer or Us. When the required claim papers are received and approved by Us, the Amount of Life Insurance will be paid. Your death benefit will be paid in a lump sum to the beneficiary(ies) designated by You in writing and on file with the Employer. Unless You have requested something different, payment will be made as follows: 1. If more than one beneficiary is named, each will be paid an equal share. 2. If any named beneficiary dies before You, His share will be divided equally among the named surviving beneficiaries. If no beneficiary is named, or if no named beneficiary survives You, We may, at Our option, pay: 1. up to $500 of Your life insurance to any party that We deem is entitled because of their payment of burial expenses. We will be released from further liability for any amount so paid; and/or 2. the executors or administrators of Your estate; or 6 3. Your surviving relatives in the following order: a) all to Your surviving spouse; or b) if Your spouse does not survive You, in equal shares to Your surviving children; or c) if no child survives You, in equal shares to Your surviving parents. If a minor does not have a legal guardian, We may, until such a guardian is appointed, pay the person We deem to be caring for and supporting him. Such payment will be in monthly installments of not more than $200. If a death benefit payable meets Our guidelines, then the benefit is payable into a checking account. Your beneficiary owns the checking account. A lump sum payment may be elected by writing a check for the full amount in the checking account. Accelerated Death Benefit What is the benefit? If You are diagnosed as being Terminally Ill and proof of such diagnosis is provided by an attending physician licensed to practice in the United States, and You are: 1. less than age 60; and 2. insured for at least $10,000, then You may request that a portion of Your Amount of Life Insurance be paid to You prior to death. The request cannot exceed 80% of the in force Amount of Life Insurance, and is subject to a minimum of $3,000 and a maximum of $500,000. You may exercise this option only once per person. For example, if You have an Amount of Life Insurance equal to $20,000 and You are Terminally Ill, You can request any portion of the life insurance between $3,000 to $16,000 to be paid to You now instead of to Your beneficiary at Your death. However, if You decide to request only $3,000 now, You cannot request the additional $13,000 in the future. What does Terminal Illness/Terminally Ill mean? Terminally Ill or Terminal Illness means that an individual has a life expectancy of 12 months or less. RECEIPT OF ANY BENEFITS IN ACCORDANCE WITH THIS PROVISION WILL REDUCE LIFE INSURANCE BENEFITS PAYABLE UPON DEATH. What if an individual is no longer Terminally Ill? If diagnosed as no longer Terminally Ill, coverage may or may not remain in force. Coverage which remains in force will be reduced by any amount of Accelerated Death Benefits received and premium is due for this reduced amount. If coverage does not remain in force, then the reduced amount of coverage may be converted. What limitations apply to this benefit? The Accelerated Death Benefit provision will be subject to all applicable terms and conditions of the Policy. No Accelerated Death Benefit will be paid if You are required by law to accelerate benefits to meet the claims of creditors, or if a government agency requires You to apply for benefits to qualify for a government benefit or entitlement. What if You made an assignment under this plan? If You have executed an assignment of rights and interest with respect to Your Amount of Life Insurance, in order to pay benefits to You under this provision, We must receive a release from the individual to whom the assignment was made before any benefits are payable. 7 TERMINATION Employee Coverage When does Your coverage terminate? Unless continued in accordance with the Exceptions to Termination section, Your insurance will terminate on the first to occur of: 1. the date the Policy terminates; 2. the last day of the period for which You made any required premium contribution, if You fail to make any further required contribution; 3. the date You are no longer in a class eligible for coverage; 4. the date Your Employer terminates Your employment; or 5. the date You are absent from work as an Active Full-time Employee. EXCEPTIONS TO TERMINATION Under what conditions can Your insurance be continued under the continuation provisions? If You are absent from work as an Active Full-time Employee, Your insurance may be continued up to the maximum period of time stated. In each instance, such continuation shall be at the Employer's option, but must be according to a plan which applies to all employees in the same way. Continued coverage: 1. is subject to any reductions in the Policy; 2. is subject to payment of premium by the Employer; and If You are laid off due to lack of work, all of Your coverages may be continued for 3 month(s) following the month in which the layoff commenced. What is Waiver of Premium? Waiver of premium is a provision which allows for continued employee life insurance, without payment of premium, while You are Disabled. To what coverages does the Waiver of Premium apply? These provisions apply only to Your Life Insurance. What conditions must be satisfied before You qualify for Waiver of Premium? 1. You must be less than age 60, insured and Disabled; and 2. acceptable proof of Your condition must be furnished to Us within one year of Your last day of work as an Active Full-time Employee. What does Disabled mean? Disabled means that You have a condition that prevents You from doing any work for which You are or could become qualified by education, training or experience and it is expected that this condition will last for at least nine consecutive months from Your last day of work as an Active Full-time Employee; or You have been diagnosed with a life expectancy of 12 months or less. When will We waive premium? We will waive premium after proof that You are Disabled is provided by an attending physician licensed to practice in the United States and We approve the proof. You will be notified by Us of the date We will begin to waive premium. Continued coverage will be subject to any age reductions provided by any part of the Policy. What if You die before You qualify for Waiver of Premium? If: 1. You should die within one year of Your last day of work as an Active Full-time Employee but prior to qualifying for waiver of premium; and 2. You were Disabled, 8 We will pay the Amount of Life Insurance which is in force for You. Can We have You examined for proof that You continue to be Disabled? During the first two years following the date You qualify as Disabled, We may have You examined at reasonable intervals. Thereafter, We will only require an annual examination to confirm that You continue to be Disabled. If You fail to submit any required proof or refuse to be examined as required by Us, then Your coverage will terminate. What if You are no longer Disabled? If, for any reason, You are no longer Disabled, Your premium will no longer be waived. On that date, You may or may not return to work. If You return to work in an Eligible Class, then all of Your coverages will be reinstated subject to the terms of the Policy in effect on the reinstatement date. If You do not return to work within an Eligible Class, and You are not eligible for any other group life insurance, then You are entitled to the Conversion Privilege. You may convert the Amount of Life Insurance that is in force for You on the date it is determined that You are no longer Disabled. How long will premiums be waived? Your premium will be waived and Your coverage will be continued until You attain Normal Retirement Age. On the date waiver of premium terminates, if You do not return to work, You will be entitled to convert Your coverage. You may convert no more than Your Amount of Life Insurance that is in force on the date waiver of premium terminates. What if the Policy terminates before You qualify for waiver of premium? If the Policy terminates before You qualify for waiver of premium, You may be eligible to convert. Additionally, You may later be approved for waiver of premium. What if the Policy terminates after You qualify for waiver of premium? Termination of the Policy will not affect Your coverage under the terms of this provision. CONVERSION PRIVILEGE When can an individual convert? If insurance, or any portion thereof, terminates, then any individual covered under the Policy may convert his life insurance to a conversion policy without providing Evidence of Good Health. If the qualifying event is policy termination or termination of coverage for a class then the individual must have been insured for at least 5 years under the Policy in order to be eligible for this conversion privilege. What is the conversion policy? The conversion policy will: 1. be on one of the life insurance policy forms, except term insurance, then customarily issued by Us for conversion purposes; 2. contain no disability, supplementary or AD&D benefits; and 3. be effective on the 32nd day after group life insurance terminates. How much can be converted? If the qualifying event is policy termination or termination of coverage for a class, then the amount which may be converted is limited to the lesser of: 1. the amount of group coverage in force prior to the qualifying event, reduced by the amount of any other group coverage for which the individual becomes covered within 31 days of termination of group coverage; or 2. $2,000. If conversion is due to retirement or any other qualifying event, the full amount of coverage lost may be converted. 9 How does an individual convert coverage? To convert life insurance, the individual must, within 31 days of the date group coverage terminates, make written application to the Us and pay the premium required for his age and class of risk. What if death occurs during the conversion election period? If the individual should die within the 31 day conversion election period, We will, upon receipt of acceptable proof of His death, pay the Amount of Life Insurance He was entitled to convert. GENERAL PROVISIONS When can this plan be contested? Except for non-payment of premium, the Policy cannot be contested after two years from the Policy Effective Date. No statement relating to insurability will be used to contest the insurance for which the statement was made after the insurance has been in force for two years during the individual's lifetime. In order to be used, the statement must be in writing and signed by the affected individual. Who interprets policy terms and conditions? We have full discretion and authority to determine eligibility for benefits and to construe and interpret all terms and provisions of the Policy. Are there any rights of assignment? You have the right to absolutely assign all of Your rights and interest under the Policy including, but not limited to, the following: 1. the right to make any contributions required to keep the insurance in force; 2. the privilege of converting; and 3. the right to name and change a beneficiary. However, You may not assign rights to the Employer, and if You are terminally ill, You may not make an absolute assignment if the benefits under the Policy would be used as collateral for a loan. No absolute assignment of rights and interest shall be binding on Us until and unless: 1. the original of the form documenting the absolute assignment; or 2. a true copy of it, is received and acknowledged by Us at our home office. We have no responsibility: 1. for the validity or effect of any assignment; or 2. to provide any assignee with notices which We may be obligated to provide to You. How do You designate or change Your beneficiary? You may designate or change a beneficiary by doing so in writing on a form satisfactory to Us and filing the form with the Employer. Only satisfactory forms sent to the Employer prior to Your death will be accepted. Designations will become effective as of the date You signed and dated the form, even if You have since died. We will not be liable for any amounts paid before receiving notice of a beneficiary change from the Employer. In no event may a beneficiary be changed by a Power of Attorney. 10 DEFINITIONS Active Full-time Employee – An employee who works for the Employer on a regular basis in the usual course of the Employer's business. An employee must work at least the number of hours in the Employer's normal work week. This must be at least 20 hours. You will be considered actively at work with Your Employer on a day which is one of Your Employer's scheduled work days if You are performing, in the usual way, all of the regular duties of Your job on a Full-time basis on that day. You will also be considered actively at work on a paid vacation day or a day which is not one of Your Employer's scheduled work days only if You were actively at work on the preceding scheduled work day. Earnings - Regular pay, not counting: 1. commissions; 2. bonuses; 3. overtime pay; or 4. any other pay or fringe benefits. Employer – The Policyholder named in the Schedule of Insurance. He/His – He or she. His or her. Normal Retirement Age – The Social Security Normal Retirement Age as stated in the 1983 revision of the United States Social Security Act. It is determined by Your date of birth. Prior Plan – A plan of group term life insurance sponsored by the Employer which was in force on the day before the Policy Effective Date. We/Us/Our – The Hartford Life and Accident Insurance Company. You/Your – The employee to whom this Booklet-certificate is issued. 11 The Plan Described in this Booklet is Insured by the Hartford Life and Accident Insurance Company Hartford, Connecticut Member of The Hartford Insurance Group 853461(GL)7.3 Printed in U.S.A. 12 -'08