Brands, Product Differentiation and EU Competition Law Ioannis Lianos

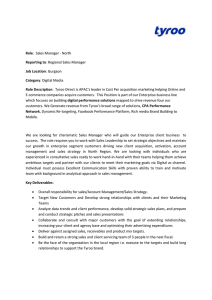

advertisement