September 8, 2014 2014-18 Budget Planning Page 1 of 5

advertisement

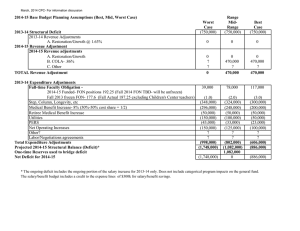

AGENDA ITEM BACKGROUND TO: GOVERNING BOARD DATE FROM: PRESIDENT September 8, 2014 SUBJECT: 2014-18 Budget Planning REASON FOR BOARD CONSIDERATION ENCLOSURE(S) ITEM NUMBER Page 1 of 5 ACTION BACKGROUND: The 2014-15 Preliminary Budget was approved by the Board of Trustees in June 2014. The college received funding allocations from the state in late July. Other updates such as the year-end close balances and enrollment trends have been updated and are reflected in the budget planning documents attached: 2014-15 Base Budget Planning Assumptions (Attachment A) 2013-14 Update: The structural deficit for 2013-14 was eliminated as a result of the reduction of the deficit factor (funding shortfall) for RDA. The deficit factor was estimated at 2% when the 2013-14 budget was developed. However, the college closed the fiscal year with an estimated deficit factor of 1.25%. The deficit factor is used to estimate the one-time and ongoing funding shortfall and, therefore, it is reevaluated each budget cycle. Cabrillo’s enrollment has declined below its current enrollment cap of 10,887. The college was in budget stability for the 2013-14 fiscal year. If the enrollment of a community college declines below the funded maximum level (cap), the college will go into budget stability in the year of decline. The college receives full funding at the maximum level in the year of the decline. If the college does not return to the base level in the year immediately following the year of decline (2014-15), a permanent reduction in apportionment revenue will be instituted. The college has in its revenue base a $1.1 million allocation for maintaining credit FTES of 10,000. If the college falls below 10,000 FTES the college will lose the funding on a permanent basis. The college also has in its revenue base a $1.1 million allocation for maintaining 1,000 credit FTES at the Watsonville Center. If the college falls below 1,000 FTES at the Watsonville Center the college will lose this funding on a permanent basis. The 2014-15 budget planning assumptions are the same used to develop the 2014-15 Final Budget: o .85% COLA, approximately $430,000 for Cabrillo. o No restoration/growth funding is assumed for 2014-15. The mid-case assumes the college will drop from an enrollment cap of 10,887 to a cap of 10,775; a 1% reduction. The RECOMMENDATION: It is recommended that the Board of Trustees approve the 2014-15 Final Budget Planning assumptions. (continued) Administrator Initiating Item: Graciano Mendoza Victoria Lewis Academic and Professional Matter If yes, Faculty Senate Agreement Senate President Signature No Final Disposition o o o o o o o o deficit factor applied to apportionment is 1.25%. These changes result in a permanent loss of revenue of $555,000. There is risk in lowering the deficit factor to 1.25%. The state is believed to have overestimated the growth in property tax revenue for 2014-15. One time RDA payments were used to estimate 8% growth is state property tax revenues. The deficit factor is adjusted throughout the year to reflect anticipated funding. The expenditure assumptions include the replacement of four full-time faculty positions. Three and one half vacant faculty positions will be eliminated from the base budget. Ongoing expenditures will increase, i.e., column and step increments, medical benefits, retiree benefits, utility expenses, PERS and other maintenance and repairs. The college’s share of the medical benefit increase is $364,000. The retire benefit contribution for 2014-15 includes a reduction of $105,000 based on the actuarial study. An increase in the employer STRS contribution rate of .63% has been added to the expenditure assumptions as a result of the Governor’s proposal to fully fund the STRS liability. The 1% ongoing salary increase for all employee groups is included in the assumptions; $462,000. Indirect reimbursements from grants have declined by $67,000. The 2014-15 Final Budget was developed using the mid-case scenario. The projected deficit for planning purposes is approximately $1.1 million. 2014 through 2018 Multi-Year Base Budget Planning Assumptions (Attachment B) The long-term projection for 2014 through 2018 is that the only new unrestricted revenue we expect to receive is COLA. The college’s enrollment will be evaluated on an ongoing basis. The college is nine positions over the faculty obligation requirement. It is anticipated that the faculty obligation number will decline by the same percentage as the enrollment decline. It is assumed that six full-time faculty will retire at the end of 2014-15 and none of the positions will be replaced by permanent full-time faculty. Each vacant position will be removed from the base budget and backfilled with thirty adjunct teaching units in 2015-16. The STRS and PERS increases are projected into the future using current estimates from PERS and STRS. The increases in the employer STRS contribution will rise to: 2.48%, 4.33% and 6.18% respectively. The college’s 50%/50% cost share for health and welfare benefits will continue. Budget reductions will be necessary as the college realigns the operating budget to the new, reduced, funded enrollment cap. Grant and categorical funding will be leveraged to reduce the impact of these programs on the unrestricted general fund deficit. Enterprise revenue sharing models will be developed to increase revenue from non-unrestricted general fund programs to the base budget. One-Time Operating Reserves (Attachment C) The unrestricted ending fund balance is $11.2 million. The balance includes the $3 million 5% general reserve, the $.3 million FTES reserve, and $5 million in one-time and carryover allocations. Based on current projections, the anticipated deficit for 2014-15 will be $1.1 million. The college will use operating reserves to cover the shortfall. Unallocated reserves in the 2014-15 budget are $1.4 million. It is anticipated that the college will reduce the budget for 2015-16 and that operating reserves will be needed to balance a portion of the 2015-16 projected deficit. September 8, 2014 Board Meeting Attachment A 2014-15 Base Budget Planning Assumptions (Best, Mid, Worst Case) 2013-14 Structural Deficit 2013-14 Revenue Adjustments A. Restoration/Growth @ 1.63% 2014-15 Revenue Adjustment 2014-15 Revenue adjustments A. Permanent Loss of Apportionment Funding (FTES Assumptions 10,675, 10,775, 10,887) with a Deficit factor of 1.25% (funding shortfall) B. COLA - .85% C. Restoration/Growth D. Other, misc. revenue increases TOTAL Revenue Adjustment 2014-15 Expenditure Adjustments Full-time Faculty Obligation 2014-15 Funded- FON positions 187.75 (Fall 2014 Estimated FON 176.6) Vacant base budget faculty position eliminated from the budget Step, Column, Longevity, etc Add 12 units for Counseling CG courses Medical Benefit Increase - 8% (50%-50% cost share = 1/2) Retiree Medical Benefit Increase Utilities PERS STRS - .63% increase Net Operating Increases Reduction in indirect from grants Labor/Negotiations agreeements (1% ongoing increase all groups) Total Expenditure Adjustments Projected 2014-15 Structural Balance (Deficit)* One-time Reserves used to bridge deficit Net Deficit for 2014-15 Worst Case 200,000 Range MidRange 200,000 Best Case 200,000 0 0 0 (965,000) 0 0 25,000 (940,000) (555,000) 430,000 0 50,000 (75,000) 0 450,000 0 75,000 525,000 156,000 156,000 156,000 (4.0) (430,000) (21,000) (400,000) (50,000) (100,000) (33,000) (167,000) (150,000) (100,000) (482,000) (1,777,000) (2,517,000) (4.0) (420,000) (21,000) (364,000) 105,000 100,000 (28,000) (160,000) (103,000) (67,000) (462,000) (1,264,000) (1,139,000) (4.0) (410,000) (21,000) (328,000) 105,000 0 (23,000) (153,000) 0 0 (442,000) (1,116,000) (391,000) (2,517,000) (1,139,000) (391,000) * The ongoing deficit includes the ongoing portion of the salary increase for 2014-15; 1%. Does not include categorical program impacts on the general fund. The salary/benefit budget includes a credit to the expense lines of $300k for salary/benefit savings. September 8, 2014 Board Meeting Attachment B 2014-15 through 2017-18 Base Budget Planning Parameters 2014-15 Projected 2015-16 Projected 2016-17 Projected 2017-18 Projected FTES 10,775 Budget Stability Difference between ongoing Revenues & Expenses (Structural Deficit) 200,000 (1,139,000) (1,983,000) (5,767,000) ? 550,000 (2,000,000) 555,000 ? 560,000 ? ? (589,000) (3,428,000) (5,207,000) Change in State Revenue Anticipated A. Permanent Loss of Apportionment Revenue (FTES Assumptions- MidCase = 10,775 with a 1.25% Deficit Factor B. COLA @.85%, 1.0%, 1.0%,1.0% C. Restoration/Growth D. Other Misc. Revenue increases Net change in revenue Net Increases in Ongoing Expenses Full-time Faculty Position changes net of retirements & adjunct backfill Add Counseling Teaching Units for CG 51 Courses Step, Column, Longevity Increases, etc. Medical Plan Rate Increase-- 8% (50%-50% cost share in place) Retiree Benefit Increase PERS Rate Increase. 0.9%, 1.4%, 2.1% STRS Rate Increase, 0.63%, 2.48%, 4.33%, 6.18% Utilities Net Operating Increases Reduction in indirect from grants Labor agreements Total Expenditure Increases (555,000) 430,000 0 50,000 (75,000) 0 10,400 Budget Stability? 156,000 (21,000) (420,000) (364,000) 105,000 (28,000) (160,000) 100,000 (103,000) (67,000) (462,000) (1,264,000) 240,000 ? (420,000) (364,000) (50,000) (150,000) (450,000) (100,000) (100,000) ? ? (420,000) (364,000) (50,000) (460,000) (795,000) (100,000) (150,000) ? ? (420,000) (364,000) (50,000) (666,000) (1,100,000) (100,000) (150,000) ? (1,394,000) ? (2,339,000) ? (2,850,000) Budget Reductions ? ? ? ? Ongoing Shortfall* (1,139,000) (1,983,000) (5,767,000) (8,057,000) Operating Reserves available to bridge deficit Deficit net of One-time funds The salary estimates include an ongoing increase of 1% for all employee groups. The one-time salary increase of 1.43% is budgeted in the one-time fund. RDA and EPA revenue shortfalls continue to be a major threat. (1,139,000) Attachment C September 8, 2014 Board Meeting ONE-TIME OPERATING RESERVES Projected Unrestricted General Fund Ending Fund Balance (base budget, carryover, one-time) $11,257,000 LESS: Minimum 5% Reserve FTES Reserve balance One-time new and carryover allocations Base/Carryover allocations Reserves needed to balance 2014-15 budget *Increase in SSSP Match Program Planning Funding for 2014-15 Other Projected Operating Reserves available in 2014-15 FTES Reserve Balance Balance as of 6/30/14 Allocation to fund a portion of the CCFT 1.43% one-time salary increase for 2014-15 Balance of funding available (3,000,000) (312,000) (1,798,000) (3,566,000) ($1,139,000) ? ? ? $1,442,000 $596,838 ($284,707) $312,131