Range 2014-15 Base Budget Planning Assumptions (Best, Mid, Worst Case) Worst Mid-

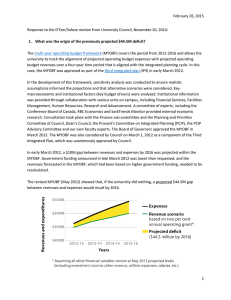

advertisement

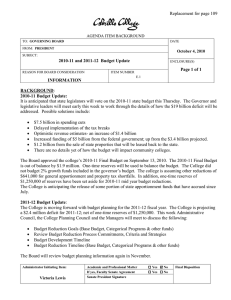

March, 2014 CPC- For information discussion 2014-15 Base Budget Planning Assumptions (Best, Mid, Worst Case) 2013-14 Structural Deficit 2013-14 Revenue Adjustments A. Restoration/Growth @ 1.63% 2014-15 Revenue Adjustment 2014-15 Revenue adjustments A. Restoration/Growth B. COLA- .86% C. Other TOTAL Revenue Adjustment Worst Case (750,000) Range MidRange (750,000) Best Case (750,000) 0 0 0 0 ? ? 0 0 470,000 ? 470,000 0 470,000 ? 470,000 78,000 117,000 (2.0) (324,000) (248,000) (50,000) (100,000) (33,000) (125,000) ? ? (802,000) (1,082,000) 1,082,000 0 (3.0) (300,000) (200,000) (50,000) (50,000) (23,000) (100,000) ? ? (606,000) (886,000) 2013-14 Expenditure Adjustments Full-time Faculty Obligation 39,000 2014-15 Funded- FON positions 192.25 (Fall 2014 FON TBD- will be unfrozen) Fall 2013 frozen FON- 177.6 (Fall Actual 187.25 excluding Children's Center teachers) (1.0) Step, Column, Longevity, etc (348,000) Medical Benefit Increase- 8% (50%-50% cost share = 1/2) (296,000) Retiree Medical Benefit Increase (50,000) Utilities (150,000) PERS (43,000) Net Operating Increases (150,000) Other? ? Labor/Negotiations agreeements ? Total Expenditure Adjustments (998,000) Projected 2014-15 Structural Balance (Deficit)* (1,748,000) One-time Reserves used to bridge deficit Net Deficit for 2014-15 (1,748,000) (886,000) * The ongoing deficit includes the ongoing portion of the salary increase for 2013-14 only. Does not include categorical program impacts on the general fund. The salary/benefit budget includes a credit to the expense lines of $300k for salary/benefit savings. March 2014 CPC- For Information Discussion ONE-TIME OPERATING RESERVES Operating Reserves unallocated as of 3/1/14 ADD: 2012-13 one-time increase from recalculation Anticipated Budget Savings from 2013-14 LESS: Reserves needed to balance 2014-15 budget Increase in SSSP/Student Equity Match Increase in Scheduled Maintenance Match/SIE Match Program Planning Funding for 2014-15 Projected Operating Reserves available in 2014-15* * Does not include FTES reserve of $1,000,000 or the 5% General Reserve Projected $500,000 $800,000 $2,000,000 ($1,082,000) ($1,100,000) ($908,000) ? $210,000 March 2014 CPC For Information Discussion 2014-15 through 2017-18 Base Budget Planning Parameters 2014-15 Projected Difference between ongoing Revenues & Expenses (Structural Deficit) 2015-16 Projected (750,000) 2016-17 Projected 2017-18 Projected (1,082,000) (1,437,000) (1,787,000) Increase in State Revenue Anticipated A. Restoration/Growth B. COLA @.86%, 1.0%, 1.0%,1.0% C. Other Net change in revenue 0 470,000 ? 550,000 ? 555,000 ? 560,000 (280,000) (532,000) (882,000) (1,227,000) Net Increases in Ongoing Expenses Full-time Faculty Position changes net of retirements & adjunct backfill Add Counseling Teaching Units for CG 51 Courses Step, Column, Longevity Increases, etc. Medical Plan Rate Increase-- 8% (50%-50% cost share in place) Retiree Benefit Increase PERS Rate Increase STRS Rate Increase Utilities Net Operating Increases Labor agreements Total Expenditure Increases 78,000 ? (324,000) (248,000) (50,000) (33,000) 0 (100,000) (125,000) ? (802,000) ? ? (324,000) (248,000) (50,000) (33,000) ? (100,000) (150,000) ? (905,000) ? ? (324,000) (248,000) (50,000) (33,000) ? (100,000) (150,000) ? (905,000) ? ? (324,000) (248,000) (50,000) (33,000) ? (100,000) (150,000) ? (905,000) Budget Reductions ? ? ? ? Ongoing Shortfall* (1,082,000) (1,437,000) (1,787,000) (2,132,000) Operating Reserves available to bridge deficit Deficit net of One-time funds * Cost of 1% for all employees = $427,000. The salary estimates do not include the one-time salary increase for 2013-14. RDA and EPA revenue shortfalls continue to be a major threat. The RDA shortfall was backfilled for 2012-13 and 2013-14 but there is no guarantee this will continue. 1,082,000 0