Document 12988273

advertisement

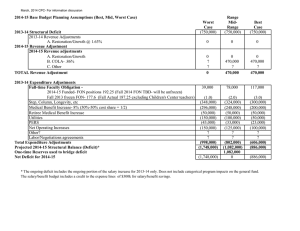

AGENDA ITEM BACKGROUND TO: GOVERNING BOARD DATE FROM: PRESIDENT June 11, 2012 SUBJECT: 2012-13 Budget Planning Parameters Update - May Revise REASON FOR BOARD CONSIDERATION ENCLOSURE(S) Page 1 of 10 ITEM NUMBER INFORMATION BACKGROUND: The Governor’s May Revise was released on May 14, 2012. The budget shortfall is expected to increase from $9.2 billion to $15.7 billion. The Governor has proposed $4.1 billion in new spending reductions bringing total reductions to $8.3 billion. The California Community College League has updated budget simulations. The League scenario A assumes the November tax proposals pass and scenario B assumes a 6.156% workload reduction if the tax increases do not pass, resulting in a reduction of $2.9 million for Cabrillo. The dissolution of redevelopment agencies has also been identified as a major threat. The state is reducing state apportionment on a dollar for dollar basis effective immediately for future RDA revenue streams (see page X for a copy of the League scenarios). The workload reduction of 6.156% would be a permanent reduction of funding. The potential 7.3% deficit related to RDA funds is considered a one-time reduction for 2012-13. The college was notified on May 22nd that the May 2012 apportionment payment for all colleges would be frozen until the state could determine total RDA funds that would be received in 2011-12. Cabrillo’s May apportionment payment is approximately $2.2 million. The state assumes the total funds received in 2011-12 will be $116 million statewide; approximately $1 million for Cabrillo. This shortfall in cash was not anticipated by the college. The college cannot pursue outside borrowing on short notice. The only option that is available is internal borrowing from existing funds. In the end, the state has decided to reduce the May apportionment payment by the anticipated $116 million. This left Cabrillo with a cash shortfall of approximately $1 million for May 2012 (last month). This exemplifies the major threat the college will continue to struggle with during 2012-13 in addition to the funding cuts. The following attachments were reviewed by the College Planning Council and are included for the Governing Board’s action: Overview of the May Revise- Vice Chancellor of Fiscal Policy, Dan Troy Budget Simulation: Cabrillo CCD Updated Carryover and One-time balances as of 5/23/12 Updated 2012-13 Base Budget Planning Assumptions including best, mid-range and worst-case scenario Updated Multi-year Base Budget Planning Parameters for 2012-13 through 2015-16 Projected Operating Reserves for 2011-12 and 2012-13 Administrator Initiating Item: Victoria Lewis Academic and Professional Matter If yes, Faculty Senate Agreement Senate President Signature Yes No Yes No Final Disposition A best, mid and worst case scenario has been developed based on the May Revise (see page X). The college will develop the 2012-13 Final Budget based on the mid-case scenario. The mid-case assumption includes one half of the 6.156% cut based on the tax increases not passing. This scenario assumes the state will identify other revenue solutions that mitigate the impact of the tax increases not passing. As footnoted on page X of the multi-year planning assumptions, the RDA deficit will be treated as one time. Treating the RDA deficit as one-time lessens the amount of reserves available to bridge the 2012-13 ongoing deficit in the base budget. The mid-case scenario also includes an assumption that one half of the 7.3% one-time deficit of RDA will occur in 2012-13. The updated ongoing structural deficit for 2012-13 is currently projected at approximately $4.3 million after the implementation of Phase I through III. One of the major components of the structural deficit is the built in increases in expenses that the college must budget each year. The college is currently in negotiations with all employee groups for concessions for 2012-13. It should be noted that Cabrillo reduced the number of full-time faculty positions in the budget by ten and one half. The reduction of faculty positions has yielded significant savings in the budget to date. The college is planning to utilize $1.5 million in operating funds to bridge the 2012-13 deficit leaving a balance of approximately $2.8 for 2012-13. The college will use the $1.0 million FTES reserve to offset additional reductions beyond those planned in the mid-case assumptions. The college has set another budget reduction target of $2.5 million for the second phase of 2012-13 budget planning. The college has begun work on Phase IV reduction plans. It is anticipated that the college will bring Phase IV reduction plans to the Governing Board as information in August. The updated planning assumptions will be presented for Governing Board action in August. The budget calendar will be updated and will be included with the August planning documents for Governing Board approval. May Revise, 2012-13 The Big Picture: The Budget shortfall, which in January was $9.2 billion, is now estimated at $15.7 billion. Why has the problem increased? CY revenues were $4.3 billion short of January estimates The Prop 98 Guarantee has grown by $2.4 billion over the 2-year period. The federal government and court decisions have removed about $1.7 billion in potential savings solutions. The Governor proposes $4.1billion in new spending reductions in the May revise, bringing total proposed reductions to $8.3 billion. Proposition 98: Prop 98 grows to about $54 billion in the 2012-13 fiscal year, up from the $52.4 billion estimated in January. Why does P98 grow when revenues are down? Because the Governor merged his tax initiative with the Millionaire’s Tax initiative, the initiative would generate more revenue in the 12-13 year ($8.5B rather than $6.9B). Also, the P98 calculation is driven on year-over-year growth, so diminished CY revenues makes the year-over-year percentage change higher. CCCs: While there are still a number of assumptions and moving pieces to sort through, the Governor does not make major changes to his January proposal for the California Community Colleges. The increased growth of the P98 guarantee (assuming successful passage of the November ballot initiative) would continue to be used to buy down the cost of deferrals. Under May Revise, $313M in deferrals would be bought down, while only $218M was proposed in January. Given the major reductions absorbed in recent years, we believe it is reasonable to request any new money should go to supporting student services and adding back course sections. The Governor continues to pursue his proposal to consolidate categorical funding and to revise the current FTES funding model, though we note that the Legislature has shown little interest in these proposals. Similar to January, there is no proposal to fund growth, COLA, or increase funding for categorical programs. The Governor proposes to fund the $48 million in SB 70 programmatic money through Proposition 98 in the Budget Year. Generally, these funds, part of the QEIA agreement, have been funded as non-Prop 98. This proposal would help save the state money on the non-Prop 98 side of the budget. The Governor also alters his mandates block grant reform proposal to include two newly adopted mandates and increase the funding per FTES to $28. Total funding proposed is $33.4 million. Further, 1 the Governor would eliminate the mandate claiming process, which would more or less force districts to participate in the block grant program (or file suit, perhaps…). RDAs – The Governor now anticipates $116M in current year property tax revenue, as opposed the $146.7M estimated in January, due to the dissolution of RDAs. We remain concerned that these dollars will not materialize as estimated and that enacting the General Fund cuts may add to the current year deficit. Triggers: If the November initiative fails, K-14 education is slated for a trigger cut of nearly $5.5 billion. The CCCs would lose the $313M in deferral repayments mentioned earlier and then take an additional base cut of approximately $300 million. We note the Governor has not broken down the triggers between K-12 and the CCCs, so we are assuming an 11% share of the reduction. A base reduction of that magnitude would represent an approximate workload reduction of 6%. Clearly, this would be a devastating hit to our colleges. Cal Grants: The Governor maintains the $311 million in cuts to Cal Grants that he proposed in January. The May Revise further proposes to restrict Cal Grant awards to institutions that graduate students at a rate of at least 30% and where default rates are below 15%. Our initial understanding is that this new proposal will not impact the CCCs. Current Year Deficit: In February, the Chancellor’s Office had the regrettable duty to inform the CCC community that the P1 report showed a deficit of $179 million, of which $149 million was unanticipated (the other $30 million was a statutory trigger cut). While the Governor does not address the issue in his May Revise proposal, we can report that the deficit will be lower at P2. While not final, we believe the revised deficit will be approximately $125 million. The improvement in the situation comes from a modest increase in fee revenues and from the San Mateo Community College District’s shift into basic aid status. Overall, the statewide deficit will decrease from approximately 3.3% to approximately 2.4%. We still have significant work remaining to finalize P2, but we thought it best to communicate this news as quickly as possible for planning purposes. Conclusion: The Governor chooses to spend the higher growth in the Prop 98 guarantee to pay down more deferrals. This does not seem like the best use of new dollars given the needs of the CCC districts, students, and the state. We will work with the Administration and the Legislature to shift these funds back into program so we can serve more students and serve them better. 2 Just as the January proposal included many risks, so does the May Revise. We remain concerned about the estimates of new property tax revenues that owe to the dissolution of RDAs. We are also concerned about the lack of specificity of the triggers. The Governor does not specify the K12/CCC split trigger split. Also unanswered is the impact of adding SB 70 funding to Proposition 98 – would those $48 million need to be tacked on the trigger in order to make room within the guarantee? That has not yet been answered. Further, the May revise includes significant new reductions to Medi-Cal, IHSS, state employee compensation, and other areas. If the Legislature is unwilling to make some or all of these cuts, would they consider cuts in Proposition 98? Of course, the biggest uncertainty remains the willingness of the voters to pass the November tax initiative. A recent poll showed the proposal passing at 54% of the vote. While a full campaign has not yet been run for the initiative, generally, successful ballot initiatives tend to start out with a higher level of support early on. Further, the Molly Munger initiative appears to have enough signatures to also make the ballot. Will competing initiatives split the support vote or turn off enough voters to kill the Governor’s initiative? It’s too early to say. It should further be noted that the Munger initiative would cancel out the Brown initiative if it receives a higher vote total, so CCCs could also be subject to trigger cuts in a scenario where the Brown initiative reaches 50% but receives less support than the Munger initiative. Clearly, the CCC budgets look much better with the successful passage of Governor’s initiative than without it. At this point, I cannot recommend that districts assume that the ballot initiative will pass. The outcome is too uncertain, and the repercussions of making drastic midyear are too large. I strongly advise districts to budget very cautiously for the 2012-13 fiscal year. I will provide more information to you as it becomes available. Regards, Dan Troy Vice Chancellor for Fiscal Policy Chancellor’s Office of the California Community Colleges dtroy@cccco.edu (916) 445‐0540 3 Budget Simulation: Cabrillo CCD 2012-13 May Revise Budget Underlying Assumptions The reduction simulations assume a dollar reduction in each of credit, noncredit and CDCP FTES in a proportional manner across the district's offerings. Because noncredit and CDCP are funded at a lower rate, the percentage of FTES reduced is greater. Similar to 2011-12, each district would likely be able to decide the exact blend of its reductions. The base FTES assumptions are assuming proportional reductions of the 2011-12 workload reduction, as identified in the Chancellor's Office Budget Workshop information. All non-excess local property tax districts are included, as the 2011-12 small district exemption was a one-time policy decision. 2012-13 Base revenue (before reductions) Number and percent credit FTES Number and percent noncredit FTES Number and percent CDCP FTES $54,088,568 10,518 (98.16%) 197 (1.84%) 0 (0.00%) Quick Comparison Scenario A: Governor's Budget and Tax Package Scenario B: Governor's Budget, with Failure of Tax Package Net Apportionment Change: $0 $-2,988,537 Workload reduction percent: 0% -6.156% 0 -659.00 up to $-3,557,000 up to $-3,557,000 TOTAL FTES Reduced Redevelopment risk Scenario B Details Reduced credit FTES Reduced noncredit FTES Reduced noncredit CDCP FTES -647.00 -12.00 0.00 Redevelopment Revenue Risk Deficit Risk $-3,557,000 (0.0732 Deficit) 061112 Board Mtg. 2012-13 Base Budget Planning (Best, Mid, Worst Case) Worst Case Range MidRange Best Case (4,233,200) (4,233,200) (4,233,200) (2,988,537) (400,000) (250,000) (75,000) (1,494,269) (300,000) (250,000) (50,000) 0 (200,000) (250,000) 0 30,000 40,000 50,000 (7,916,737) (6,287,469) (4,633,200) Full-time Faculty Obligation - 420,000 420,000 420,000 FON:( current frozen; 196, when unfrozen 205) Step, Column, Longevity, etc (10.5) (320,000) (10.5) (320,000) (10.5) (320,000) Medical Benefit increase- 5% increase of Fed. One-time Funds (200,000) (200,000) (200,000) Retiree Medical Benefit Increase (20,000) (20,000) (20,000) PERS rate increase to 11.417% (60,000) (60,000) (60,000) Increase in Worker's Comp., Gen. Liability, (75,000) (50,000) (25,000) TRAN Interest Expense (70,000) (60,000) (50,000) Utilities 70,000 90,000 110,000 Operating Cost Increases (60,000) (50,000) (40,000) Reduction in Indirect Reimbursements from Grant programs (50,000) (38,000) 0 Recalculation of 5% Reserve 209,000 209,000 209,000 (156,000) (79,000) 24,000 Projected 2012-13 Structural Balance (Deficit) (8,072,737) (6,366,469) (4,609,200) Reductions (Phases I through III) 2,071,965 2,071,965 2,071,965 66 2/3 of One-time Reserves used to bridge deficit 1,000,000 1,500,000 2,000,000 Net Deficit for 2012-13 (5,000,772) (2,794,504) (537,235) 2011-12 Structural Deficit 2012-13 Revenue Adjustment 2012-13 Reductions in revenue A. November Tax Proposal (passes/ fails (assumes state identifies some other solutions) C. Property tax shortfall D. Student Fee Revenue Shortfall Non-Resident Tuition Other TOTAL Revenue Adjustment 2012-13 Total Expense Adjustments Labor Agreements- Salary/Benefit concessions and/or position reductions Cost of 1% for all groups $446,000 (including adjuncts)-base budget ? * Does not include categorical program reductions for 2012-13 for restricted funds ? ? May Revise 061112 Board Mtg. 2012-13 through 2015-16 Base Budget Planning Parameters 2012-13 Mid-Range Projected 2013-14 Projected 2014-15 Projected 2015-16 Projected (4,233,200) (4,294,504) (4,159,504) (4,549,504) 1,100,000 1,100,000 1,100,000 (6,287,469) (3,194,504) (3,059,504) (3,449,504) Net Increases in Ongoing Expenses Full-time Faculty Position changes (-10.5, -6, +6, +6) (net of adjunct backfill) Step, Column, Longevity Increases, etc. Medical Plan Rate Increase-- 5%, 8%, 8%,8% Retiree Benefit Increase PERS Rate Increase STRS Rate Increase Worker's Comp, Unemployment Insurance TRAN Interest Expense Utilities Net Operating Increases Reduction in Indirect Reimbursements from grants Labor agreements Recalculation of 5% reserve Total Expenditure Increases Budget Reductions Phase I Budget Reductions Phase II Budget Reductions Phase III Ongoing Shortfall* 420,000 (320,000) (200,000) (20,000) (60,000) ? (50,000) (60,000) 90,000 (50,000) (38,000) ? 209,000 (79,000) 938,864 679,333 453,768 (4,294,504) 200,000 (300,000) (360,000) (85,000) (120,000) ? (100,000) (240,000) (345,000) (360,000) (145,000) (150,000) ? (50,000) (240,000) (345,000) (360,000) (145,000) (175,000) ? (50,000) (100,000) (100,000) (50,000) (150,000) (50,000) (175,000) ? ? ? (965,000) ? (1,490,000) ? (1,540,000) ? (4,159,504) (4,549,504) (4,989,504) Allocation of 66 2/3% of operating reserves 1,500,000 *Deficit net of One-time funds (2,794,504) Difference between ongoing Revenues & Expenses (Structural Deficit) Increase in State Revenue Anticipated November Tax Proposals fail, 1/2 of the 6% reduction Property Tax Shortfall 2012-13 Student Fee Revenue Shortfall Possible Increase in CCC Prop 98 allocation- if tax proposals pass (2%) Reduction in Non-Resident Tuition Other changes in revenue * 1/2 of RDA Risk budgeted as one-time deficit (See Operating Reserves) Net change in revenue (1,494,269) (300,000) (250,000) (50,000) 40,000 *If the Governor's tax proposal is not approved by voters, the deficit will increase by another $2.9 million (6.156%). One half of the increase is reflected above based on mid case planning assumptions. The RDA Revenue shortfall is estimated at up to 7.3% for 2012-13. The total risk is $3.5 million for Cabrillo. One half of the RDA risk is budgeted as a one-time loss of revenue for 2012-13. Use of one-time funds for RDA risk reduces the operating reserves available to bridge the 2012-13 deficit in the base budget CABRILLO COLLEGE GENERAL FUND BALANCE Board June 11, 2012 Projected Operating Reserves OPERATING RESERVES Beginning Balance (Mid Year-Bridge Fund Reserves, Final Budget) ADD: Carryover and One-time Fund Give Backs One-time transfer from Bookstore Fund Projected Ending balance (increased by $175,500 in mid-year reductions) 2012-13 Estimated One-Time Subfund Allocations LESS: 2011-12 Increase in Student Fee Revenue Shortfall (February 2012) 1/2 RDA Risk 66.67% Allocated to 2012-13 Deficit Projected Ending Operating Reserves = (2,450550-1778,500+1,500,000) *66.67% Projected FY 2011-12 1,309,000 666,050 200,000 1,675,500 (200,000) Projected @ 66.67% FY 2012-13 2,450,550 1,500,000 (1,200,000) (1,778,500) (1,500,000) 2,450,550 672,050 3,950,550 2,633,832