Document 12988220

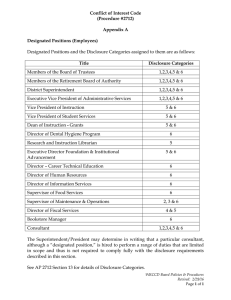

advertisement