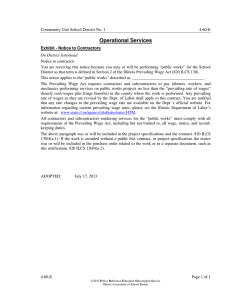

NEW JERSEY STATE PREVAILING WAGE ACT AND REGULATIONS

advertisement