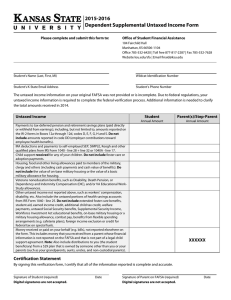

2016-2017 Dependent Supplemental Untaxed Income Form

advertisement

2016-2017 Dependent Supplemental Untaxed Income Form Please complete and submit this form to: Office of Student Financial Assistance 104 Fairchild Hall | 1601 Vattier Street Manhattan, KS 66506-1104 Office 785-532-6420 | Toll free 877-817-2287 | Fax 785-532-7628 Website ksu.edu/sfa | Email finaid@ksu.edu Student’s Name (Last, First, MI) Wildcat Identification Number Student’s K-State Email Address Student’s Phone Number The untaxed income information on your original FAFSA was not provided or is incomplete. Due to federal regulations, your untaxed income information is required to complete the federal verification process. Additional information is needed to clarify the total amounts received in 2015. Untaxed Income Student Annual Amount Parent(s)/StepParent Annual Amount Payments to tax-deferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Do not include amounts reported in code DD (employer contributions toward employee health benefits). IRA deductions and payments to self-employed SEP, SIMPLE, Keogh and other qualified plans from IRS Form 1040 - line 28 + line 32 or 1040A - line 17. Child support received for any of your children. Do not include foster care or adoption payments. Housing, food and other living allowances paid to members of the military, clergy and others (including cash payments and cash value of benefits). Do not include the value of on-base military housing or the value of a basic military allowance for housing. Veterans noneducation benefits, such as Disability, Death Pension, or Dependency and Indemnity Compensation (DIC), and/or VA Educational Work-Study allowances. Other untaxed income not reported above, such as workers’ compensation, disability, etc. Also include the untaxed portions of health savings accounts from IRS Form 1040 - line 25. Do not include extended foster care benefits, student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce Investment Act educational benefits, on-base military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g. cafeteria plans), foreign income exclusion or credit for federal tax on special fuels. Money received or paid on your behalf (e.g. bills), not reported elsewhere on the form. This includes money that you received from a parent whose financial information is not reported on the FAFSA and that is not part of a legal child support agreement. Note: Also include distributions to you (the student beneficiary) from a 529 plan that is owned by someone other than you or your parents (such as your grandparents, aunts, uncles, and noncustodial parents). XXXXXX Certification Statement By signing this verification form, I certify that all of the information reported is complete and accurate. Signature of Student (required) Digital signatures are not accepted. Date Signature of Parent on FAFSA (required) Digital signatures are not accepted. Date