Enterprise Modeling and Simulation: Complex Dynamic Behavior of a

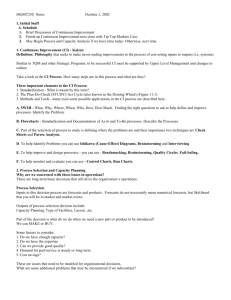

advertisement