Inflection Point:

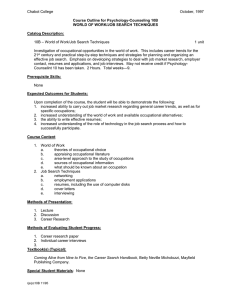

advertisement