Driving Value Through Strategic Planning and Budgeting

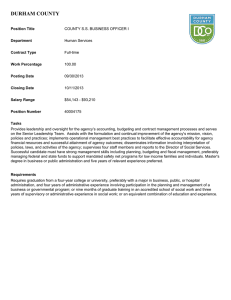

advertisement