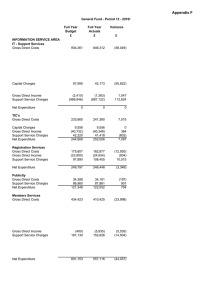

Appendix B Car Parking (1,313,172) (1,357,230) (1,429,390) (72,160)

advertisement

Appendix B Assets & Leisure Service Area Service Car Parking Markets Industrial Estates Surveyors Allotments Handyman Parklands Administration Building Svs Property Services Parks & Open Spaces Foreshore Community Centres Sports Centres Leisure Complexes Other Sports Recreation Grounds Pier Pavilion Foreshore (Community) Woodlands Management Cromer Pier Public Conveniences Investment Properties Leisure CCTV Total Net Costs Capital Charges Reffcus Support Service Charges Support Service Recharges Net Cost of Service 2011/12 Actual 2012/13 Updated Budget 2012/13 Revised Budget £ £ £ (1,313,172) (1,357,230) (1,429,390) 24,762 15,724 16,258 (107,248) (85,716) (87,281) (50) (50) (50) (36,413) (34,317) (37,156) (32,571) (26,480) (27,006) 374,193 413,849 387,253 406,218 367,513 350,316 343,650 391,017 388,048 96,234 133,197 124,179 4,811 4,189 6,189 214,311 193,382 234,848 393,809 374,393 399,445 45,129 59,451 51,789 12,108 8,086 8,086 89,837 96,377 96,897 378,759 374,763 382,287 74,518 93,109 90,411 10,589 22,829 17,829 443,556 408,256 411,739 (93,049) (135,544) (116,607) 141,609 145,334 143,646 145,984 150,758 157,351 1,617,574 1,569,081 (43,809) 585,463 625,522 571,369 0 126,714 20,000 1,374,545 1,356,390 1,304,520 (1,304,268) (1,347,903) (1,238,226) (54,153) (106,714) (51,870) 109,677 2,273,314 1,612,890 Variance 2012/13 Revised to 2012/13 Updated £ (72,160) 534 (1,565) 0 (2,839) (526) (26,596) (17,197) (2,969) (9,018) 2,000 41,466 25,052 (7,662) 0 520 7,524 (2,698) (5,000) 3,483 18,937 (1,688) 6,593 2,373,613 2,226,744 (146,869) Appendix B ASSETS & LEISURE SERVICE AREA 2011/12 Actual £ Car Parking Gross Direct Costs Gross Direct Income Capital Charges IAS19 Pension Adjustment Support Service Charges Net Expenditure Markets Gross Direct Costs Gross Direct Income Support Service Charges Net Expenditure 677,748 2012/13 Updated Budget £ 617,495 2012/13 Revised Budget £ 695,219 Variance Explanation for Major Variances £ 77,724 (£1,500) - Virement of overtime costs to Markets. £20,000 - Increase in repairs & maintenance to cover additional costs associated with new ticket machines. £15,760 Increase in rental costs offset by additional fee income. (£8,237) - Reduction in NNDR costs due to revaluations. £1,552 - Additional credit card fees due to increased payments by credit card. £49,320 - Additional contract management and PCN contract costs. (1,990,920) (1,974,725) (2,124,609) (149,884) (£94,472) - Additional fee income. (£52,005) Additional PCN income. (£1,343) - Further rental income. (£2,171) - Insurance claims reimbursed. (7,103) 0 143,118 14,205 0 135,080 14,205 0 125,060 (1,177,157) (1,207,945) (1,290,125) 0 0 (10,020) (£3,010) - Reduced Customer Services recharge. (£10,380) - Reduced Property Services recharge. £3,170 - Increased Fakenham Connect recharge for Car Parks Office accommodation. (82,180) 104,744 (79,982) 54,849 79,611 93,009 (77,285) 45,980 61,704 93,543 (77,285) 46,670 62,928 (4,433) (102,815) 40,441 18,473 (104,189) 40,441 17,642 (104,923) 29,052 44,976 47,410 51,320 (21,831) 2,135 (6,909) (9,044) (50) 3,321 3,271 (50) 3,370 3,320 (50) 2,930 2,880 0 (440) (440) 82,639 82,921 80,498 (119,052) 55,241 (117,238) 57,740 (117,654) 46,040 Net Expenditure 18,828 23,423 8,884 Parklands Gross Direct Costs 15,229 35,860 27,960 (47,800) (62,340) (54,966) 585 23,508 (8,478) 585 21,310 (4,585) 585 22,830 (3,591) Industrial Estates Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Net Expenditure Surveyors Allotments Gross Direct Income Support Service Charges Net Expenditure Handyman Gross Direct Costs Gross Direct Income Support Service Charges Gross Direct Income Capital Charges Support Service Charges Net Expenditure 534 0 690 1,224 (831) (734) (11,389) (£11,118) - Reduced depreciation charges resulting from property revaluation. 3,910 £1,760 - Increased Property Services recharge. £2,030 - Increased Accountancy recharge. (2,423) (£4,000) - Virement of consumable materials costs to Public Conveniences. (416) (11,700) (£16,050) - Reduced Property Services recharge. £2,780 - Increased Depots recharge. £3,870 - Increased Accountancy recharge. (14,539) (7,900) £1,500 - Virement from Industrial Estates for increased repairs & maintenance costs. (£10,000) - Reduction in electricity costs offset by equivalent reduction in recoverable costs for electricity. 7,374 £10,000 - Reduced recoverable electricity costs, offset by reduced expenditure. (£1,666) Commission income following sale of caravans. (£960) - Additional rental income. 0 1,520 No major variances 994 Appendix B ASSETS & LEISURE SERVICE AREA 2011/12 Actual £ 2012/13 Updated Budget £ 2012/13 Revised Budget £ Variance Explanation for Major Variances £ Administration Building Svs Gross Direct Costs 460,910 506,662 482,875 (23,787) £3,750 - Increased overtime costs, offset in part by (£2,477) virement from standby costs and Foreshore overtime budgets. (£51,548) Reduction in NNDR costs due to revaluation of Cromer Offices & Fakenham Connect back to 2010/11. £4,130 - Additional NNDR costs for Upper Sheringham Depot following delay in disposal. £8,000 - Additional repairs & maintenance costs for disaster recovery room at Fakenham Connect as a result of disposing of Annexe building. £11,977 - Additional other fees resulting from external work undertaken on NNDR revaluations. £2,000 - Additional expenditure on canteen consumables. Gross Direct Income (86,717) (92,813) (95,622) 81,528 81,527 78,476 111,571 102,570 106,890 (479,846) 87,446 (539,327) 58,619 (496,624) 75,995 (2,809) (£3,708) - Increased rental for NHS Trainers continued occupation of Cromer Offices. (3,051) (£3,019) - Reduced depreciation following property revaluations. 4,320 £3,130 - Increased Accountancy recharge. Reduced recharges out reflecting lower costs 42,703 incurred. 17,376 410,750 367,513 350,316 (4,532) 0 0 13,659 0 0 176,427 180,810 179,030 Support Service Recharges Net Expenditure (582,645) 0 (561,982) 0 (529,346) 0 Parks & Open Spaces Gross Direct Costs Gross Direct Income Gross Direct Costs - Reffcus 462,619 (118,969) 0 441,032 (50,015) 0 438,063 (50,015) 20,000 27,668 91,145 30,909 91,420 27,386 81,200 462,463 513,346 516,634 Capital Charges Support Service Charges Support Service Recharges Net Expenditure Property Services Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Capital Charges Support Service Charges Net Expenditure (17,197) (£34,372) - Staffing changes following vacancy and management restructure. £3,752 Additional overtime costs. £1,459 - Further costs from Pay & Grading review. £1,000 Additional CPD training requirement. £9,282 Recruitment costs following vacancy and management restructure. £1,504 - Additional other fees resulting from requirement to procure external revaluation work for final accounts process. 0 (13,659) Reduced intangible amortisation costs following delay in capital expenditure in relation to Asset Management System. (1,780) (£3,340) - Reduction in Customer Services recharge. £6,460 - Additional Computer Applications Team recharge. (£3,880) Reduced Admin Buildings recharge. £14,690 Accountancy recharge reflecting more accurate time allocations. (£11,520) - Corporate Leadership Team recharge. 32,636 Reflects lower costs incurred. 0 (2,969) (£3,539) - NNDR now paid by lessee 0 20,000 Sheringham Skate Park (reflecting requirement to show capital expenditure on non NNDC assets) (3,523) No Major Variances (10,220) (£21,720) - Lower recharge from Leisure services as a result of changes in duties following the officer restructure. £6,250 - Legal work undertaken for Parks Services 3,288 Appendix B ASSETS & LEISURE SERVICE AREA 2011/12 Actual 2012/13 Updated Budget £ £ Foreshore Gross Direct Costs 2012/13 Revised Budget £ Variance Explanation for Major Variances £ 96,234 133,197 130,376 (2,821) £2,197 - Increase in repairs & maintenance costs offset by additional recoverable charges. (£1,152) - Virement of overtime costs to Admin Buildings. (£3,441) - Reduced staffing costs. 0 0 (6,197) 7,354 0 39,447 7,885 0 59,030 7,213 0 47,120 143,035 200,112 178,512 (6,197) (£2,197) - Increase in recoverable charges, offset by additional repairs & maintenance costs. (£4,000) - Additional monies received for an insurance claim, where expenditure was incurred in a prior year. (672) 0 (11,910) (£3,420) - Reduced Property Services recharge. (£11,070) - Reduced Coastal Team recharge. (21,600) 7,543 (2,732) 6,189 (2,000) 6,189 0 27 3,643 8,481 27 3,660 7,876 19 5,000 11,208 349,834 346,504 374,970 (135,523) (153,122) (140,122) Capital Charges Support Service Charges 0 124,894 12,831 128,470 11,188 111,150 Net Expenditure 339,205 334,683 357,186 22,503 Leisure Complexes Gross Direct Costs 402,784 374,393 399,445 Gross Direct Income Capital Charges Support Service Charges Net Expenditure (8,975) 305,560 27,048 726,417 0 305,559 28,470 708,422 0 305,404 24,640 729,489 25,052 £6,300 - Repair and maintenance (roof repairs to be undertaken at The Splash). £18,752 Inflation on management contract 0 (155) No Major Variances (3,830) No Major Variances 21,067 Other Sports Gross Direct Costs 116,869 71,088 109,289 Gross Direct Income (71,740) (11,637) (57,500) Support Service Charges 31,278 31,520 58,540 Net Expenditure 76,407 90,971 110,329 Recreation Grounds Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Net Expenditure 12,309 (201) 520 3,109 15,737 9,086 (1,000) 520 3,120 11,726 9,086 (1,000) 285 2,740 11,111 Gross Direct Income Capital Charges IAS19 Pension Adjustment Support Service Charges Net Expenditure Community Centres Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Net Expenditure Sports Centres Gross Direct Costs Gross Direct Income Pier Pavilion 0 2,000 £2,000 - Reduced rental income following transfer of properties to Wells Community Trust. (8) 1,340 3,332 28,466 £6,500 - Professional fees relating to business case at North Walsham Sports Centre - funded from the sports hall reserve. £4,000 - North Walsham hall repairs carried out in the year. (£11,158) - Salaries and oncosts as a result of a vacant post. £30,046 - Pay & Grading implementation costs. 13,000 Income from Sports Halls lower than anticipated. (1,643) No Major Variances (17,320) (£5,370) - Lower recharge from Leisure Services as a result of changes in duties following the officer restructure. (£14,600) Lower recharge from Accountancy reflecting a more accurate allocation of time. 38,201 £25,731 - Mobile Gym staff contracts extended. £6,219 - Other expenses relating to the Mobile Gym. This will be funded by additional grants. £4,208 - Pay & Grading implementation costs. (45,863) (£45,863) - Contributions towards Mobile Gym services. 27,020 £22,060 - Higher recharge from Leisure Services as a result of changes in duties following the officer restructure. 19,358 0 0 (235) (380) (615) No Major Variances No Major Variances No Major Variances No Major Variances Appendix B ASSETS & LEISURE SERVICE AREA £ 89,837 14,115 2012/13 Updated Budget £ 96,377 15,840 Net Expenditure 103,952 112,217 Foreshore (Community) Gross Direct Costs 382,399 379,513 387,037 Gross Direct Income Support Service Charges Net Expenditure (3,640) 31,704 410,463 (4,750) 32,290 407,053 (4,750) 31,300 413,587 Woodlands Management Gross Direct Costs 179,730 111,709 161,473 (105,212) (18,600) (71,062) 1,386 81,920 157,824 1,386 79,670 174,165 1,386 79,380 171,177 26,177 38,417 34,317 (15,588) 5,232 23,824 (15,588) 5,232 470 (16,488) 5,232 6,690 39,645 28,531 29,751 451,240 410,439 426,854 Gross Direct Income (7,684) (2,183) (15,115) Capital Charges 70,217 76,380 68,262 Support Service Charges 53,444 57,980 43,830 567,217 542,616 523,831 Gross Direct Costs Support Service Charges Gross Direct Income Capital Charges Support Service Charges Net Expenditure Cromer Pier Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Net Expenditure Public Conveniences Gross Direct Costs Net Expenditure 2011/12 Actual 2012/13 Revised Budget Variance Explanation for Major Variances £ £ 96,897 520 No Major Variances 12,870 (2,970) (£2,720) - Lower recharge from Leisure Services as a result of changes in duties following the officer restructure. 109,767 (2,450) 7,524 £5,000 - Emergency phone rentals, in line with 11/12 actual. £2,524 - Bathing Water Directive 2006/7/EC – requirement for provision of public information. This is funded from general reserve agreed roll forward as part of 11/12 closedown 0 (990) No Major Variances 6,534 49,764 £25,521 - Spend on Access to Nature project, funded by grant. £18,325 - Emergency tree works at Warren Woods (52,462) (£2,000) - Additional sales of Firewood. (£5,000) - Additional car parking income at Holt Country Park. (£3,000) - Woodland Trust, contract for site management at Pretty Corner. (£42,462) - Access To Nature grant. 0 (290) No Major Variances (2,988) (4,100) (£5,000) - Maintenance costs lower than expected. (900) 0 6,220 £5,350 - Higher recharge from Coast Protection 1,220 16,415 £4,000 - Virement to repairs & maintenance from Handyman consumable materials to reflect where expenditure is actually incurred. £12,932 - Additional repairs & maintenance expenditure relating to two public conveniences, to be offset by receipt of insurance claim monies. (12,932) Increase in insurance claims following vandalism incidents in two public conveniences, offset by additional repairs & maintenance expenditure. (8,118) Reduced depreciation following property revaluations. (14,150) (£19,670) - Reduced Property Services recharge. £4,730 - Increased Accountancy recharge reflecting more accurate time allocations. (18,785) Appendix B ASSETS & LEISURE SERVICE AREA 2011/12 Actual 2012/13 Updated Budget £ £ Investment Properties Gross Direct Costs 2012/13 Revised Budget £ Variance Explanation for Major Variances £ 119,571 89,243 100,486 (212,620) (224,787) (217,093) 0 126,714 0 Capital Charges 26,569 24,569 12,869 Support Service Charges 65,569 60,740 83,800 (911) 76,479 (19,938) Leisure Gross Direct Costs 141,609 146,034 144,346 Gross Direct Income Support Service Charges 0 100,168 (700) 101,260 (700) 68,610 (241,777) (246,594) (212,256) 0 0 0 189,041 (43,057) 195,954 (45,196) 198,645 (41,294) 25,479 70,226 9,807 68,180 9,807 66,880 241,689 228,745 234,038 Gross Direct Income Gross Direct Costs - Reffcus Net Expenditure Support Service Recharges Net Expenditure CCTV Gross Direct Costs Gross Direct Income Capital Charges Support Service Charges Net Expenditure Gross Direct Costs Gross Direct Income Gross Direct Costs - Reffcus Capital Charges Support Service Charges Support Service Recharges Net Expenditure 11,243 £2,200 - Additional repairs & maintenance costs incurred for reletting of premises, offset by virement from North Walsham Offices. £8,000 - One off growth in repairs & maintenance costs incurred as a result of essential lift maintenance for the Rocket House. £1,028 - Other fees & charges, offset in part by other recoverable charges. 7,694 (£4,500) - Additional rental income from Chalets and Beach Huts. £2,210 - Reduced rental income. £10,737 - Reduction in recoverable charges as a result of inability to recover previous years service charges already accrued for. (126,714) Reduced charge following delay in capital expenditure in relation to Wells Sackhouse and Maltings schemes. (11,700) Reduced depreciation following property revaluations. 23,060 £9,260 - Increased recharge from Property Services. £10,920 - Increased recharge from Accountancy. (96,417) (1,688) (£5,000) - Savings in training, travel and computer purchases. £3,922 - Pay & Grading implementation costs. 0 No Major Variances (32,650) (£24,420) - Lower recharge from Accountancy reflecting a more accurate allocation of time. (£9,470) - Reduced recharge from Legal Services 34,338 Reduced recharges out reflecting lower costs incurred. 0 2,691 No Major Variances 3,902 £3,902 - Contributions from businesses lower than expected. 0 (1,300) £6,410 - Recharge from Fakenham Connect to reflect the space taken by the CCTV control room. (£3,930) - Lower recharge from Accountancy reflecting a more accurate allocation of time. 5,293 4,775,383 4,571,108 4,765,526 194,418 (3,157,809) (2,958,218) (3,196,445) (238,227) 0 126,714 20,000 (106,714) 585,463 625,522 571,369 (54,153) 1,374,545 1,356,390 1,304,520 (51,870) (1,304,268) (1,347,903) (1,238,226) 109,677 2,273,314 2,373,613 2,226,744 (146,869)