CABINET

advertisement

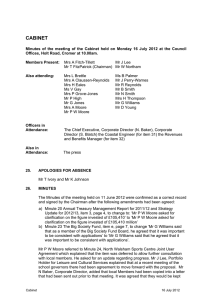

Agenda Item 2__ CABINET Minutes of the meeting of the Cabinet held on Monday 7 January 2013 at the Council Offices, Holt Road, Cromer at 10.00 am. Members Present: Mrs A Fitch-Tillett Mr J Lee Mr W Northam Also attending: Mrs S Arnold Mrs A Claussen-Reynolds Mr P High Mrs A Moore Ms B Palmer Mr R Reynolds Mr R Shepherd Mr N Smith Officers in Attendance: Also in Attendance: 90. Mr T Fitzpatrick (Chairman) Mr T Ivory Mr R Oliver Mrs L Brettle Ms V Gay Mr N Lloyd MrPMoore Mr J Punchard Mr E Seward Mr B Smith Mr D Young The Chief Executive, the Corporate Directors, the Head of Finance, the Economic and Tourism Development Manager, the Head of Customer Services, the Communications Manager and the Sustainability Assistant. Mr B Wright and Mr C Rabone (members of the public), the press APOLOGIES FOR ABSENCE None received 91. MINUTES The Minutes of the meeting held on 13 December 2012 were confirmed as a correct record and signed by the Chairman. 92. PUBLIC QUESTIONS None received. Mr B Wright and Mr C Rabone were present as public speakers on Agenda Item 16: Proposed Action in Respect of Structurally Unsound Properties at Star Yard and Long Term Empty Property at No.57 Oak Street, Fakenham (see Minute 95 below). 93. ITEMS OF URGENT BUSINESS None received. Cabinet 1 7 January 2013 94. DECLARATIONS OF INTEREST None received 95. PROPOSED ACTION IN RESPECT OF STRUCTURALLY UNSOUND PROPERTIES AT STAR YARD AND LONG TERM EMPTY PROPERTY AT NO.57 OAK STREET, FAKENHAM The Chairman agreed to bring this agenda item forward in deference to the two public speakers in attendance. Mr Rabone indicated that he and his wife had only become aware that this matter was to be under consideration today through reading an article in the local press. He hoped that Members appreciated that the problem at Star Yard was not of their making, any more than that it had been caused by the Council. In fact he and his wife had instigated action by contacting the Council because of the danger and disrepair of the properties either side of their own through falling flints etc. As owners of the two storey section of the buildings in Star Yard, the Rabones had been engaged in steadily improving the property until unofficially advised that it may not be a good idea to spend too much time on repairs. This was borne out by advice from surveyors examining the neighbouring property on either side. As far as Mr and Mrs Rabone were concerned, the ideal outcome would be for the rest of the property to be put into good order, allowing them to do the same with their part of the building. Mr Wright, on being invited to address the meeting, accepted that the Star Yard buildings were an eyesore and in poor structural condition. Unable to afford professional help, he had offered to carry out repair work himself. His intention was to make the buildings structurally sound, bricking up the window in line with adjacent buildings. For health reasons, he sought more time to be able to do this and stated that he required at least six months. As far as the Oak Street premises were concerned, he confirmed that the property was not empty but was being used for storage of items for his other business. He had boarded up the window and intended to paint it black and continue to use it for storage. In the long term, he wished to establish an antiques shop there, with flats above. In thanking the speakers, Mr T Ivory informed the meeting that the properties had been an issue for many years. The Star Yard property was unsound and presented a serious risk, especially as it was attached to other properties. Time was of the essence and, whilst he hoped to be able to work with the owner to secure a solution within the terms of the recommendation, he said that he felt six months was simply too long for the Council to wait. The Oak Street property, vacant for over twenty years, was an eyesore. He welcomed Mr Wright’s proposals, but action was needed more quickly than was being suggested. This view was supported by Mr Reynolds and Mrs Claussen-Reynolds, ward representatives who had been determined to move this forward on behalf of local residents. Mr Ivory moved the recommendation and was seconded by Mr Lee, who referred to the serious safety issues presented by these properties. Mr Reynolds was pleased to see that this matter had now come before the Cabinet after long negotiations. The shop was situated on a main thoroughfare into the town for pedestrians, cars and buses. The shop was a blot on the character of Oak Street, which comprised pleasant shops, terraced housing interspaced with some modern dwellings and a few short residential lanes leading to meadows. He could remember this shop being in use and totally in keeping with the surrounding area. Its Cabinet 2 7 January 2013 deterioration had become unacceptable to the local people and Town Council several years ago, but various approaches to encourage improvement had been unsuccessful. Since their election in 2011, Mr Reynolds and Mrs Claussen-Reynolds had attended many meetings with the owner and officers of the Council and were still being approached by concerned townspeople. Mrs Claussen-Reynolds reiterated these comments and informed Members of the many questions received over the last eighteen months as to when 57 Oak Street would be brought back to a respectable condition. As far as Star Yard was concerned, she was in favour of the protection of the heritage of Fakenham, with many old buildings having been lost, but feared that without prompt attention, and with the onset of winter, these buildings could deteriorate to a condition beyond repair. Ms V Gay agreed in principle with the proposal, but wondered what criteria were used to reach this conclusion in respect of a property. Mr P Moore thought that there were other properties which fell into a similar category and enquired as to the legal powers available for use to enforce action. Mt N Lloyd commented that a decision to enforce repairs or refurbishment could herald a long-winded process. The Corporate Director explained that emergency works had been undertaken at Star Yard, with the cost being charged to the owner. Further emergency works were required and, if the owner was unable to carry out the work, which was necessary to protect the adjoining properties, the Council would have to bear the costs in the short term. The position at Oak Street was not as clear cut, but the buildings were in the same ownership and a good opportunity therefore presented itself to secure improvement through a common approach. In response to Mr Lloyd’s observation, the Corporate Director agreed that there was a risk of setting in train a lengthy process at Star Yard, but the Council did have powers under the Building Acts to bring about a quick resolution. He added that different powers were applicable to either property. Mr Ivory pointed out that there were various powers which could be considered by the Enforcement Board in respect of empty properties and Mr FitzPatrick reminded Members that, if they were aware of any similar situation, then they could bring the matter to the attention of officers. RESOLVED: 1. To provide authority for officers to make an offer to purchase properties at No.57 Oak Street and Star Yard, Fakenham, based upon advice received from the District Valuer, less any direct costs associated with securing the structure of the buildings, with the objective of undertaking minor works to protect the properties from further deterioration and then seeking t advertise them for sale/redevelopment. 2. In the event of the Council being unable to reach agreement with the owner of the buildings regarding the proposed purchase of the properties by the end of January 2013, Cabinet authorises officers to take enforcement action against the owner of the properties so as to bring about an improvement in their condition and appearance and see them brought back into productive use. Reasons for the decision: To prevent further deterioration in the condition of the properties and then advertise them for sale/redevelopment, or alternatively take enforcement action, to bring about a positive outcome. Cabinet 3 7 January 2013 96. CONSIDERATION OF ANY MATTER REFERRED TO THE CABINET BY THE OVERVIEW AND SCRUTINY COMMITTEE OR COUNCIL FOR RECONSIDERATION None received. 97. CONSIDERATION OF ANY REPORTS FROM THE OVERVIEW AND SCRUTINY COMMITTEE None received. 98. COUNCIL TAX SUPPORT WORKING PARTY Mr W Northam, Chairman of the Working Party, presented the minutes and referred to the recommendation therein, which was the subject of the next agenda item. RESOLVED: That the minutes of the meeting of the Council Tax Support Working Party held on 23 November be received. 99. COUNCIL TAX SUPPORT SCHEME 2013/14 Mr Northam drew attention to two amendments to be made to the report: • • On page 16, paragraph 2.1 to read: “it will not be possible to have one scheme for Norfolk”. On page 19, paragraph 5.1 to replace “form” in the third line with “from”. He explained that the £8.3m paid in Council Tax benefits at present would be replaced by Council Tax Support, a scheme for which had been required to be set up. The Working Party had been established to look into this and had gone out to consultation before making recommendations. Meanwhile, £100m had been made available by Government to cover interim arrangements and the option put forward by the Working Party met the criteria for this transitional funding. Mr D Young queried the projected figures for initial additional income and the Head of Finance agreed to go through the details with him after the meeting. The Chief Executive pointed out that the levels of determinations for different categories of property were covered by the recommendation in the following item (see Minute 100 below). Mr Northam moved the recommendation and was seconded by Mr J Lee. RECOMMENDED TO FULL COUNCIL: That the Local Council Tax Support Scheme as set out in the report (option 3) be adopted. Reasons for the decision: Legislation requires a Council Tax Support Scheme to be agreed by full Council by 31 January 2013 prior to implementation on 1 April 2013. Cabinet 4 7 January 2013 100. DETERMINATION OF COUNCIL TAX DISCOUNTS AND LEVEL OF CHARGES FOR 2013/14 Mr W Northam moved the recommendation, commenting that reforms gave the Council the flexibility to raise taxes and /or get empty properties brought back into use. In seconding the proposal, Mr Ivory was pleased that the Council would now be able to look at empty homes. RECOMMENDED TO FULL COUNCIL: 1. That Council resolve, under Section 11A of the Local Government Finance Act 1992, and in accordance with the Local Government Finance Act 2012 and other enabling powers, that: (i) (ii) (iii) (iv) The Council Tax for dwellings defined as being within Class ‘A’ remains at 50% for the year 2013/14 (report para.3.4) The Council Tax for dwellings defined as being within Class ‘B’ be reduced to 5% for the year 2013/14 (report para.3.4) with the exceptions of: (a) Those dwellings identified under Regulation 6 of the Council Tax (Prescribed Classes of Dwellings)(England) Regulations 2003, which will retain the 50% discount; and (b) Those dwellings described or geographically defined at Appendix D which in the reasoned opinion of the Head of Finance are judged not to be structurally capable of occupation all year round and were built before the restrictions of seasonal usage were introduced by the Town and Country Planning Act 1947, will retain the 50% discount; The Council Tax discount for dwellings defined as being within Class ‘C’ to be set at 100% for three months for the year 2013/14 (report para.3.3); The Council Tax discount for Class ‘D’ properties to act as an incentive to bring them back into use is recommended to be a discount of 50% for a maximum of 12 months (report para.3.2). 2. That the Council resolve under Section 11B (2) of the Local Government Finance Act 1992 and in accordance of the provisions of the Local Government Finance Act 2012 and other enabling powers that a premium is charged for properties which have been empty and substantially unfurnished for two years or more of 50% of the Council Tax payable in relation to that home. 3. In accordance with the relevant legislation, these determinations shall be published in at least one newspaper circulating in North Norfolk before the end of the period of 21 days beginning with the date of the determinations. Reasons for decision: To recommend the Council Tax discount and premium determinations to come into effect on 1 April 2013; to raise additional Council Tax revenue and to encourage properties to be brought back into use. 101. DESTINATION MANAGEMENT ORGANISATION (DMO) FOR NORTH NORFOLK Mr J Lee moved the recommendation, saying that the Council was committed to the tourism industry and that it was vital to promote North Norfolk as a year-round Cabinet 5 7 January 2013 destination. This was seconded by Mrs Fitch-Tillett, who believed that anything that could be done to help kick start an organisation which would attract visitors to one of the most beautiful areas in the country must be beneficial. Ms Gay expressed some concerns as to whether the projected funding would materialise and also regretted the loss of 0.5 of a member of the Council’s tourism staff under the changes put forward. The Council had always had an integrated approach to tourism and now appeared to be proposing to hive off its seaside areas. Mr FitzPatrick pointed out the area covered by the new organisation, Visit North Norfolk Coast and Countryside Ltd, as defined in the report. In reply to a question from Mrs A Moore as to why Aylsham had been mentioned as part of that area, the Economic and Tourism Development Officer referred to earlier discussions which had worked on the basis of economic rather than district boundaries. Mr Lee reiterated that the proposal had to be made to work. Tourism could not always rely on Council funding. The Council would retain a degree of control of how its money was spent and the direction in which promotion of tourism was going through membership of the Board. Appointment of the representative on the Board would be a matter for the full Council. The Economic and Tourism Development Manager stated that since 2008 the Council had moved away from domination of the tourism industry. Succession planning, recognising the financial limitations placed upon the Council, had begun some time ago. Meanwhile, there had been a growth of interest on the part of the private sector. If the lead on tourism was not transferred to the private sector by 2015, the industry would be in distress, due to the lack of funding available to the Council. Against this background, the Council had been talking to the Borough Council of King’s Lynn and West Norfolk on ways of continuing local authority involvement and influence in tourism. The solution now proposed was of a type being sought by al local authorities involved in tourism. It would enable the Council to manage a strategic approach and, if unhappy with any aspect, to suspend the Service Level Agreement. Mr P Moore supported the efforts being made by the Economic and Tourism Development Manager, but remained concerned at the level of Board representation proposed. Mr FitzPatrick pointed out that this would be at the same level as the North Norfolk Business Forum. Mr Ivory felt that the Service Level Agreement was comforting in that it was very clear as to where the funding would be going and what the outcomes would be. Recognising that the relationship between public and private sectors would be new and needed testing, it was not necessarily a good idea for the Council to be in control of a Board of this nature. Mr Lloyd asked what incentive other contributors had, given that they would already be paying business rates and Council Tax. The Economic and Tourism Development Manager pointed out that these forms of revenue were not direct contributions to tourism promotion. Subscribing to an independent organisation with a private sector outlook would be advantageous to contributors. RECOMMENDED TO FULL COUNCIL: That the release of £25,000 per annum over the periods 2012/13, 2013/14 and 2014/15 (£75,000 for three years) from the NNDC Community Fund and £10,000 per Cabinet 6 7 January 2013 annum over the periods 2012/13, 2013/14 and 2014/15 (£30,000 for three years)from the Economic and Tourism Development Unit budget be authorised as the Council’s contribution to Visit North Norfolk Coast and Countryside Ltd. Reasons for decision: To support the bringing together and promotion of all aspects of the tourism industry in a major channel for communication, support and access to the market; to provide funding to assist the establishment of the DMO as the platform for the private sector to take a greater responsibility for destination management in the future. 102. BIG SOCIETY FUND LARGE GRANT APPLICATIONS Mr Ivory put forward the proposal and was seconded by Mr Northam, who referred to the assistance which had been afforded to organisations through this avenue. The specific grant referred to in the report had been requested by the Sheringham and District Sports Association towards the refurbishment of existing floodlit tennis courts and the transformation of the facility for all-weather use. RESOLVED: That a grant award of up to £15,000 be made, conditional upon the submission of substantial evidence (eg offers of support or grant approval letters) of the total funding package and a substantial and viable business case; such evidence should be to the satisfaction of the Chief Executive in consultation with the Portfolio Holder for Localism and the Big Society, prior to funding being awarded. Reasons for the decision: To ensure that the application gets the support necessary to give the project every chance of success, while safeguarding sufficient funds for other projects. 103. COLLECTIVE ENERGY SWITCHING SCHEME PROPOSAL Mr J Lee introduced the report, which put forward an initiative for groups of residents to band together to negotiate, through a third party, preferential terms for the supply of gas and electricity. Such schemes presented an opportunity to help more vulnerable residents from falling into fuel poverty. He drew attention to a scheme operated by Norwich City Council as an example of the savings that could be achieved. Mr Lee moved the recommendation and was seconded by Mr R Oliver. Mrs Fitch-Tillett said that some communities had already introduced local schemes, which were highly recommended. In response to a question from Mrs L Brettle, the Sustainability Assistant said that oil tariffs were covered by a different scheme. RESOLVED: That delegated authority be given to the Head of Economic and Community Development to progress with a collective energy scheme (option 2) as outlined in the report. Cabinet 7 7 January 2013 Reasons for decision: To assist local residents in reducing their energy bills, therefore helping to address fuel poverty issues and divert spending by residents from energy to local businesses etc; to gain a potential new stream of income for the Council. 104. REVIEW OF CCTV SERVICE In moving the recommendation, Mr Oliver pointed out that the Council’s CCTV service was discretionary and currently cost approximately £200,000 per annum. A review would carefully examine how any savings could be made. Mr Ivory seconded the proposal, welcoming the suggested cross-party approach. RESOLVED: 1. That a politically balanced working party be established to consider the potential options for the future management of the CCTV service and that the Group leaders notify Democratic Services of their nominations. 2. That nominations for the membership of the working party be notified to Council. Reasons for the decision: To provide a balanced forum for discussing the various options available for the future management of the service. 105. TOURIST INFORMATION Mr T FitzPatrick drew attention to the review of different delivery models for the provision of Tourist Information and the fact that an organisation in Wells had expressed an interest in running the Tourist Information Centre in the town. He felt that a better service could be provided overall as proposed and that the Expression of Interest under the Community Right to Challenge should, subject to ratification, be accepted. In moving the recommendations, he was seconded by Mr J Lee. In reply to a question from Ms Gay, the Chief Executive confirmed that any savings arising would be considered as a saving on the budget as a whole. In response to an enquiry from Mr Lloyd as to the use of the Tourist Information kiosks, the Head of Customer Services informed Members that usage had gone down and did not justify the technology involved. Mr Punchard welcomed the proposal, but cautioned that, when the Tourist Information point at Fakenham became the responsibility of a third party, the service had been reduced. RESOLVED: 1. That Cabinet accepts the ‘Community Right to Challenge’ Expression of Interest (EOI) from a relevant body to manage the Wells Tourist Information Centre, noting that the EOI meets the appropriate legal requirements. 2. That subject to a positive outcome from a detailed evaluation of the relevant body’s proposal, and the absence of any formal challenges or additional EOIs, Cabinet 8 7 January 2013 officers and the relevant Portfolio Members for Localism and Tourist Information Centres are given delegated authority to negotiate a Service Level Agreement with a relevant body with a view to the implementation of service transfer at the start of the 2013 season. 3. Should further EOIs be received, the organisation will undertake a procurement exercise in line wit the current contract standing orders. 4. The proposed reduction in TIC staffing levels be approved. 5. That officers are authorised to terminate the maintenance and support contracts with the New Vision Group for the24/7 kiosks and DMS systems. Reasons for the decision: To deliver Tourist Information services more efficiently and effectively, providing value for money that could produce savings to the Council with no overall loss of service. Parts (1) and (2) of the decision embrace the Government’s localism agenda to empower individuals and communities to take more responsibility for their own futures and to build a stronger civic society. The Meeting closed at 11.13 am _______________ Chairman Cabinet 9 7 January 2013