Please Contact: Please email: Please Direct Dial on: 01263 516010 Emma Denny

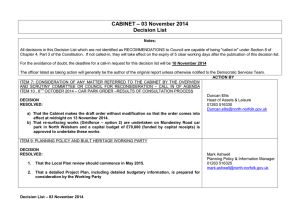

advertisement