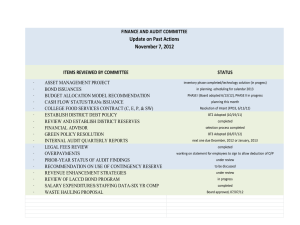

Document 12928168

advertisement