Document 12927070

advertisement

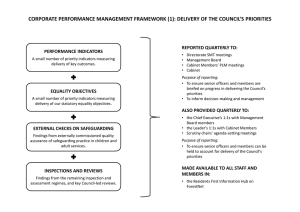

Cabinet 14 February 2011 Agenda Item No_____12________ PERFORMANCE MANAGEMENT (QUARTERLY REPORT AS AT 31st DECEMBER 2010) Summary: Conclusions: Recommendations: This report, its appendix and the Corporate Performance Management System present the performance information for the period ended 31st December 2010. Our performance overall continues to be good. Only 3 of our performance indicators are significantly (more than 15%) below target, one fewer than in quarter 2. However, there has been an increase in the number of indicators that are slightly below target. Managers are taking action to address the issues involved and achieve their annual targets. That the Members of Cabinet review the performance information for the period ended 31st December 2010 and approve or determine any action required to manage under- or over-performance. That the Members of Cabinet approve the withdrawal of the target for visits to museums (LC 007a) Cabinet member(s): All Contact Officer, telephone number, and e-mail: Ward(s) affected: All Helen Thomas, Policy and Performance Management Officer, 01263 516214, helen.thomas@north-norfolk.gov.uk 1. Information availability 1.1. This report presents an overview of the progress in improving performance across the Council. More detail on any particular performance indicator is available on the North Norfolk District Council (NNDC) Intranet site or through the Performance Portal on the North Norfolk Website. 1.2. If you would like further performance information or a copy of a report and you do not have access to the NNDC Intranet site or the NNDC web site please contact the Policy and Performance Management Officer. 2. Key Performance Indicators 2.1. A full list of the key performance indicators that we are monitoring during 2010/11 is given in Appendix N. 2.2. During the quarter ended 31st December 2010, performance information has been produced for 34 Key performance indicators. 2.3. The performance indicators as reported present the cumulative position to 31st December 2010. 2.4. A summary of the status of the indicators is given below: 2.5. Cabinet 2.6. 14 February 2011 Quarter 1 Quarter 2 Quarter 3 Key Performance Indicators 2010/11 2010/11 2010/11 2010/11 Significantly above target (15% or 9 8 8 more above target) On or above target 15 15 12 Slightly below target 6 6 11 Significantly below target (15% or 2 4 3 more below target) Missing information 0 1 0 Not Applicable 2 0 0 Where any data is estimated, the details and the reason will be shown in the comment column. 2.7. It should be noted that there are no missing data items for the quarterly key performance indicators for the third quarter of 2010/11. 2.8. Of the indicators that were above target 6 were significantly above. These are:Full Name Qtr 3 Qtr 3 Target Actual Economic and Tourism Development Comment ETD 007 (Q) (Cum) The number of new business startups supported each year 68 Some of these businesses are being assisted on an ongoing basis. As of December, a total of 88 businesses have been receiving support in the Pathfinder Business Advice Project since it started in May but these were not included in the figures reported here. 113 Some of these businesses are being assisted on an ongoing basis. As of December, a total of 88 businesses have been receiving support in the Pathfinder Business Advice Project since it started in May but these were not included in the figures reported here. 524,018 The website underwent optimisation in early September 2010 to increase its visibility and ranking on search engines, particularly Google, when people use them to browse the internet. This has resulted in more people accessing the website and thus, the significant increase in the number of estimated visitors during the second and third quarters. ETD 008 (Q) (Cum) The number of businesses assisted to retain jobs and/or increase employment each year. ETD 012 (Q) (Cum) Number of estimated users of the 'Visitnorthnorfolk. Com' website 25 9 220,000 Customer Services CS 004 (Q) (Cum) Number of People using 460,000 Tourist Information and Visitor Centres Revenues and Benefits 619,902 We are still continuing to see an increase in visitor numbers across the Tourist Information Centres. Cabinet 14 February 2011 Full Name RB 021(Q) (Cum) HB Security Prosecutions and Sanctions (Was RB 025) Qtr 3 Target Qtr 3 Actual Comment 32 43 Still above target. 5.67 The figures for the third quarter are slightly higher than at the same period last year. It is not possible at this stage to indicate what impact this will have on the annual overall figures yet. There has been an increase in the number of staff classed as long term sick for the first three quarters of the year 2010/11. The impact on long term absence on the first three quarters for 2009/10 was 54% of the total number of days sick and for the first three quarters for 2010/11 this has risen to 59%. Overall though the figures are positive. Organisational Development OD 001 (Q) (Cum) Working Days Lost Due to Sickness Absence (Whole Authority) (Was BV 012) 6.75 2.9. 2.10. Of the indicators that were below target, 3 were significantly below target. These indicators are detailed below. Where applicable, a reference to any relevant risk identified in the Council’s risk register is noted in the comment column for the performance indicator concerned and the risk itself is identified at the end of this report. 2.11. Full Name Qtr 3 Target Strategic Housing NI 181 (Q) (Cum) (Right time) Time taken to process Housing 12.0 Benefit/Council Tax Benefit new claims and change events SH 010 (Q) (Cum) Number of currently empty properties in the private sector brought back in to use 7 Qtr 3 Actual 15.3 1 Planning and Coastal Management Comment Throughout November resources have been stretched due to the planning, testing and training for the implementation of Civica release 13 (Benefits payment/overpayment system conversion). Undoubtedly this has had an affect on the workload outstanding, this will inevitably impact on performance until the outstanding workload has been cleared. We continue to work hard with owners of Empty Homes to encourage them to bring the properties back into use. We have approved 1 empty home this financial year and will be working hard with this owner and two others to complete these before the end of this financial year. We are also currently in negotiation with 4 new owners and hope to see some agreement with this later this year. Cabinet 14 February 2011 Full Name NI 157a (Q) (Cum) Processing of MAJOR planning applications (Quarterly Cumulative) (Was BV 109a) Qtr 3 Target 60.00% Qtr 3 Actual 33.33% Comment Significant effort has been put in to clear the majority of older outstanding major applications in the third quarter. 12 major applications have been determined in the third quarter of which 10 were more than 13 weeks old. This has had a significant effect on this performance measure over the three quarters of this year as there have only been 21 determinations in total. 2.12. 2.13. A summary schedule of the Key Performance Indicator figures as at 31st December 2010 is attached at (Appendix N). 3. Proposal to withdraw one target LC 007a Visits To and Use Of Museums: all visits (Was BV 170a) 3.1. The Norfolk Museums and Archaeology Service no longer collect this data, as the figures often proved inconsistent across the service. This was due to problems when recording different things for enquiries, etc., resulting in numbers varying greatly and therefore the figures could not be relied upon. The Leisure and Cultural Services Manager therefore recommends that we withdraw this target. 3.2. The Museums Service will still collect and record visits in person (LC 007b) and school visits (LC 007c). The Leisure and Cultural Services Manager will continue to monitor these figures to ensure the improved performance achieved over the past three years is maintained and continues to improve but does not propose replacing the current corporate target on all visits. Future targets can be developed as a part of the process to produce the new corporate plan. 4. Financial Implications 4.1. There are no direct financial implications associated with this report. However, there are performance measures and targets, and activities included in relevant service business plans, that are specifically related to finance. In addition, corrective action may have financial implications that would need to be made clear at the time any action is agreed. 4.2. The budget monitoring report is a separate report on this agenda and the two reports should be read together to provide an overall picture on the performance of the organisation. 5. Risks to the Council 5.1. 5.2. Failure to implement a robust Performance Management Framework, which produces evidence of performance improvements and identifies areas requiring corrective action, could have a number of consequences. These may include: • Inaccurate or less effective decision-making; • Inappropriate resource allocations; • Reduced reputation arising from poor data quality or accuracy; • Adverse comment in our annual direction of travel statement. • The Corporate Risk Register identifies the more significant risks that face the Council and could prevent it from meeting its objectives. The Performance and Risk Management Board, on 22nd October 2010, received and updated the Corporate Risk Register and agreed appropriate actions to mitigate and manage our risks. This was reported to the Audit Committee on 7th December 2010. Cabinet 5.3. 14 February 2011 Indicators given at 2.9 above are related to risk identified at the corporate level as follows: NI 181 (Q) (Cum) (Right time) Time taken to process Housing Benefit/Council Tax Benefit new claims and change events (days) Ref C014 The risk of continued decline in the economy or a detrimental unforeseen financial impact leading to (amongst other things) increased uptake of Housing Benefit which could have an impact on our ability to achieve housing benefit related targets. SH 010 (Q) (Cum) Number of currently empty properties in the private sector brought back in to use Ref C010 Challenge over ability to provide target number of affordable homes through a combination of lack of developer confidence because of recession / weak financial markets and pressure on public finances meaning reduced availability of grant funding for affordable housing provision.