Document 12920974

advertisement

Stati-Arbitrage optimal subrepliating strategies

for Basket Options

David Hobson

Peter Laurene

Tai-Ho Wang

1

Department of Mathematial Sienes,

University of Bath, Bath, BA2 7AY. UK.

and

Operations Researh and Finanial Engineering,

Prineton University, Prineton, NJ 08544, USA.

Dipartimento di Matematia,

Universita di Roma, "La Sapienza",

Piazzale Aldo Moro 2

00185 Roma, Italia

Department of Mathematis,

National Chung Cheng University,

160, San-Hsing, Min-Hsiung, Chia-Yi 621, Taiwan

June 1, 2005

Abstrat

In this paper we investigate the possible values of basket options.

Instead of postulating a model and priing the basket option using that model, we

onsider the set of all models whih are onsistent with the observed pries of vanilla

options of all strikes. In the ase of basket options on two omponents we nd, within

1Corresponding

author.

Tel: +886-5-2720411 ext 66130; Fax: +886-5-2720497

E-mail address: thwangmath.u.edu.tw

1

2

this lass, the model for whih the prie of the basket option is smallest. This prie,

as disovered by Rapuh and Ronalli, is assoiated to the lower Frehet opula. We

omplement their result in this paper by desribing an optimal subrepliating strategy.

This strategy is assoiated with an expliit portfolio whih onsists of being long and

short a series of alls with strikes hosen as the zeros of an auxiliary funtion.

Keywords and Phrases: Basket Options; Anti-monotoniity; Sub-repliation; Arbitragefree bounds; Copula.

JEL Classiation Number: G13.

AMS (2000) Subjet Classiation: 62P05, 90C46, 91B30.

3

1. Introdution

Options on a basket of stoks are fundamental instruments in world nanial markets. Examples thereof are exhange traded instruments suh as equity index options,

usually written on at least 15 stoks, and urreny basket options, written on two

or more assets. Curreny baskets are ustomized produts whih are traded over the

ounter.

An index I on n underlying stoks Si ; i = 1; ; n is usually dened as a basket on

n

P

the n stoks with xed weights wi , so that I = wi Si . A European all option on

=1

i

the index, struk at K , with maturity T has a payo (I K )+ , and arbitrage priing

theory gives the value of this option at time zero as

"

!+

#

n

X

d(S1 ; : : : ; Sn ) ;

E e rT

wi Si K

=1

i

where is a risk neutral measure assoiated with the joint distribution of the underlying pries of Si at time T . This prie is uniquely determined in a omplete market

for in suh markets is known unequivoally. In pratie, however, markets are

inomplete and a myriad of possible risk neutral measures an be used to alulate

the option prie. The most standard setting in nane, the Blak-Sholes setting,

assumes the assets are driven by orrelated exponential Brownian motions so that

the distribution under the risk-neutral measure at time T , assuming no dividends are

paid between 0 and T , is

i2

)t

i = 1; ; n

Si (T ) = Si (0) exp i Wt + (r

2

where i are onstants as are the orrelations ij ; i; j = 1; n between the driving

Brownian motions.

However, even for options written on one asset, the standard Blak-Sholes model

is not onsistent with the so-alled smile eet in option pries, and a substantial

amount of researh over the last deade has been devoted to priing and hedging

assuming the underlying evolves aording to alternative stohasti proesses. Among

the most popular are level-dependent models, in whih the volatility is allowed to

depend on spot and time, stohasti volatility models, unertain volatility models,

and jump-diusion or pure jump proesses. Suh models an be used to aount for

4

the smile eet in the observed market values of vanilla alls and puts. The plethora

of alternative models available for priing and hedging leave pratitioners with a wide

spetrum of models at their disposal, but little information about whih, if any, is

the orret model to use.

In suh an environment a omplementary approah, useful both for risk management purposes and to provide a sanity hek for the pries and hedges obtained from

parametri models, is to derive distribution free no-arbitrage pries and hedges. This

seond approah is less ambitious in sope in the sense that it does not aim to derive

a unique fair prie, but more robust in the sense that it is not dependent on the

eÆay of an underlying model. The aim is to provide bounds on the possible prie

of the basket option whih are onsistent with no-arbitrage given the market pries of

vanilla puts and alls. In essene, rather than using a single model, we onsider the

lass of all models whih are onsistent with the observed all pries, and rather than

quoting a single option prie we give the range of pries whih arise under models

from this lass.

In this paper this philosophy will be applied to basket options in the setting of

a one-period stati arbitrage model and we will fous on the ase of lower bounds

for baskets written on two assets. We will also assume that pries of all options on

the two underlying stoks with a ontinuum of strikes are known. In reality only a

disrete number of strikes for eah maturity are traded. The ase of only a disrete

number of strikes is not a straightforward extension of the ontinuum of strikes ase.

We onsider only lower bounds in this paper. The ase of upper bounds was solved,

in the general n-asset ase, for both the ontinuum of strikes ase and for the disrete

set of strikes ase, in our previous paper [18℄. (The upper bound problem is also

onsidered in the ontinuous strike ase by Dhaene et al [12℄, Goovaerts et al [17℄

and Kaas et al [21℄ using the theory of stohasti ordering.) It may seem surprising

that one annot treat both upper and lower bounds by the same method. It turns

out however that deriving distribution-free lower bounds is far more omplex then

deriving distribution-free upper bounds. At the root of this diÆulty is the fat that

optimal upper bounds turn out to be assoiated with superrepliating strategies for

whih the hedger takes long positions in all the underlying omponents and a zero

position in ash and it then only remains to determine, among the strikes trading on

5

the individual options, whih ones are assoiated with the heapest possible superrepliating portfolio2. In [18℄ we proved that the optimal superrepliating strategy

involves the seletion of only two strikes per asset and we gave a simple and omputationally eÆient way to determine these strikes. In the ase of lower bounds it turns

out that it is not in general suÆient, as illustrated in this paper in two asset ase,

to onsider subrepliating strategies involving one or two strikes per asset and the

optimal strategy involves both long and short positions in alls as well as a ash omponent. The optimal subrepliating strategy may involve many strikes. These strikes

are the zeros of a ertain funtion uniquely determined by the all prie funtions as

funtions of strike.

Some insight into the added omplexity of optimal lower bounds may be useful and

is gained by a review of earlier results in this diretion. Let us reall the rst one

derived in the ase of one underlying asset by Bertsimas and Popesu in [4℄:

Given pries qi = q (Ki ) = E [(X Ki )+ ℄; i = 1; ; n of all options with strikes

0 K1 K2 Kn on a stok S , the range of all possible valid pries for

a all option with strike prie K where K 2 (Kj ; Kj +1) for some j = 0; ; n is

[q (K ); q + (K )℄ where

K Kj 1

Kj K

Kj +2 K

K Kj +1

q (K ) = max qj

+ qj 1

; qj +1

+ qj +2

K

q + (K )

= qj

Kj +1

K

Kj +1

Kj

Kj 1

+ qj +1

Kj

K

Kj +1

Kj 1

Kj +2

Kj +1

Kj +2

Kj +1

Kj

Kj

Here K0 = 0, qn = qn+1 = qn+2 and Kn+2 > Kn+1 > Kn , although the preise values

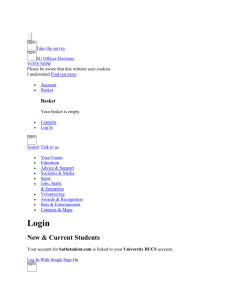

of these extra strikes does not matter. The situation is summarized in Figure 1.

Laurene and Wang [23℄ established a lower bound for basket options in the 2asset ase, under the assumption that there is only one traded asset and that, in

addition to an option on eah asset, the forward pries are presribed. The optimal

hedging strategy assoiated to the lower bound depends in a ompliated way on

the input forward and option pries and involves in some ases, both long and short

i

positions in options and long and short positions in ash. Let Fi = S0Kii and let

2Even for a small index, suh as DJX, with 30 assets in the index and 8 to 13 options traded

on eah omponent asset, this entails hoosing among the order of 1030 possible ombinations, if

hoosing only one strike per asset is optimal and many more if it turned out to be more eÆient to

"diversify" and selet more than one strike per asset.

6

Option

Price

12

10

8

6

q+ (k)

q(k)

q−2 (k)

q−1 (k)

2

90

95

100

105

110

115

120

Strike k

Figure 1: The gure illustrates the range of pries for options whose strikes lie between 100 and 110. The partiular

ase of strike 105 is emphasized. q+ stands for the upper bound and the larger of q1 and q2 stands for the lower

bound.

= K w1 K1 w2 K2 . If K > max(w1 K1 ; w2 K2 ) then the Laurene-Wang lower

bound is given by3

For D 0,

(1)

max A1 + w2 K2 F + ; A2 + w1 K1 F +; A1 + A2 + KF +; 0 ;

D

For D 0,

(2)

max

A1

+ (K

w1 K1 )F + ; A2

+ (K

w2 K2 )F + ; A1

+ A2 + KF + ; 0

;

where

= wi i

(

K

w i Ki

(3)

Ai

(4)

(5)

= F 1 + F2

F + = maxfF; 0g:

r

F

Ki

1;

)(S0i

i )

for

i

= 1; 2;

3Laurene and Wang allow a non zero short rate, but here and throughout this paper we will take

= 0 for simpliity.

7

A simpler lower bound exists for K max(w1 K1 ; w2K2 ), see [24℄.

There are several open problems onerning the lower bound. Firstly, it is not

known, even when there are only two omponents in the basket, how to extend the

above bound to the ase when there are several strikes traded on eah omponent.

Seondly, the best lower bound is not known even when there is only one option

traded on eah asset, but n > 2. (It should be noted however than in an interesting

paper Aspremont and El Ghaoui [2℄ nd optimal bounds in losed form when an

option on eah omponent is traded, but forwards on the omponent assets are not.)

The results desribed above illustrate how muh more omplex the situation is in

the ase of lower bounds than for upper bounds. In this paper we are interested in

lower bounds (when n = 2) and we assume knowledge of a ontinuum of strikes on eah

of two assets. Breeden and Litzenberger's result [7℄ then implies that knowledge of

the full marginals is easily dedued from the all pries (but we have no information

on the joint distribution of assets). Indeed Breeden and Litzenberger showed how

to dedue the distribution of an asset from the rst derivative of the option prie

with respet to the strike. Applying this to eah of our stoks in turn, we then

reover knowledge of the full marginal of the stok from knowledge of the (assumed)

ontinuum of strike pries.

Now the problem of determining optimal joint distributions subjet to the onstraint of presribed marginals has a long history in mathematis. A omprehensive

and nearly up to date referene is the book by Joe [19℄. A tool that dates bak to the

work by Frehet [16℄ that has been used to attak suh problems is to use opulas.

Indeed the elebrated Sklar theorem tells us that for any joint probability distribution

F with margins F1 ; ; Fn there exists an n-opula C suh that for all x 2 R n we

have

F (x1 ; : : : ; xn )

= C (F1 (x1 ); : : : ; Fn(xn ))

Thus, in seeking optimal joint distributions subjet to presribed marginals, the

marginals have in eet been "fatored out" and the remaining problem is to determine the optimal opula. It was disovered by Dhaene and Goovaerts [11℄ that the

optimal opula for the basket options in the ase n = 2 is assoiated with the lower

Frehet bound. This result has been generalized to more general payo funtions

of ontingent laims on two assets by Rapuh and Ronalli [27℄. To establish their

8

result Rapuh and Ronalli also rely on a result of Muller and Sarsini onerning

the behaviour of onvex funtions under the onordane order [26℄. Sine their approahes rely in a entral way on the lower Frehet opula, their results are, as is ours,

restrited to the two-asset ase. Indeed it is well known [19℄ that in general the lower

Frehet bound does not orrespond to a opula for n 3. We omplement that result

in two ways: the rst and main ontribution is to provide an optimal subrepliating

strategy using what we refer to as STP portfolios. This striking lass of portfolios is

expressed as a series of long and short positions in all options of dierent strikes and

a long position in ash. An alternative more ompat desription in terms of long

positions in alls and short positions in puts is also given. A seond ontribution of

this paper is that we obtain, as a orollary, a diret proof of the optimal lower bound

that is independent of the Frehet bounds and of the Muller-Sarsini ordering result.

Sine, as mentioned above, the Frehet lower bound does not extend to n dimensions

for n 3, this opens up a roadmap to an n-dimensional generalization of the present

results.

We onlude this setion with a literature review. Most of the work on basket options fouses on the Blak-Sholes setting. Due the high dimension of these options

(most indies involve at least 17 assets) , their analytial and numerial valuation is

very hallenging even in the Blak-Sholes setting. Indeed, although an analytial formula for the all option does exist, see for example the text by Kwok, [22℄, the integral

is diÆult to evaluate in pratie and one must resort to Monte-Carlo methods, to

reursive methods, see Ware and Avelassani [29℄, or to methods using harateristi

funtions, see Ju [20℄, moment mathing, see Brigo et al [5℄ and Dufresne [13℄. Also

progress in handling diusion based models with non onstant volatility lose to expiration has been made in Avellaneda et al [3℄. Given the diÆulty of alulating exat

pries several authors, inluding Deelstra et al [9℄ and Kaas et al [21℄, have looked

for upper and lower bounds. In both of the papers a lever onditioning argument is

used to give a lower bound on the prie of the basket option. However this method

assumes that the underlyings follow orrelated exponential Brownian motions, so that

the lower bound is a model-based lower bound in the Blak-Sholes setting, and not

a model-independent lower bound suh as we propose. Corresponding bounds for

9

Asian options and in the ontext of atuarial siene are also onsidered in Dhaene

et al [10℄.

2. Problem formulation

We assume that a market exists in whih alls and puts of maturity T are traded on

the two omponent assets of the basket. We assume that options with a ontinuum

of strikes are traded on eah omponent asset: we may also think of the underlying

assets themselves as all options with zero strike. Our goal is to prie a basket option

on the two assets whih is traded with the same maturity T .

We address two problems whose solutions turn out to be dual to eah other in an

appropriate variational formulation that will be desribed below: i) the problem of

nding the inmum of all basket option pries when the joint distribution is onstrained by the (perfet) knowledge of the marginal distributions provided by the

individual all options, ii) The problem of nding the optimal subrepliating strategy

onsisting of alls, puts and ash. The ost of the optimal subrepliating strategy

orresponds to the highest bid prie of an investor who is oered the opportunity to

be long the basket option, but is not prepared to aept any risk. It is the highest

prie she is willing to pay, sine if she buys the basket at this prie and onstruts a

stati hedge by a portfolio of alls, puts and ash aording to the optimal portfolio,

she is sure the payo of the basket will be higher than the obligations arising from

her hedging portfolio in all states of the world. Moreover the portfolio (of alls, puts

and ash) is the most expensive one she an sell whilst still guaranteeing that the

basket superrepliates her portfolio.

A simple but important observation is that put-all parity ensures that any put is

equivalent to a all and ash. Therefore, in hoosing optimal subrepliating strategies

and or in minimizing the basket option prie subjet to the onstraint of a ontinuum

of all and put options of all strikes, we may redue the problem to one in whih

only alls and ash are the subrepliating instruments. Thus the problem will be

formulated in this setting 4.

4It will however turn out, as we will see in setion x 1.4 that the optimal subrepliating portfolio

takes a partiularly simple form when we use alls on one asset and puts on the other.

10

For expository reasons we begin by desribing the primal and dual variational problems in a somewhat informal and intuitively appealing form. Their rigorous formulation is deferred to the next setion. Consider the following onstrained minimization

problem

Z

inf

R2+

(x + y

K )+ (dx; dy )

where ranges over the spae of all risk neutral distributions on R 2+ , subjet to the

onstraints on the marginal distributions

Z

(x k1 )+ X (dx) = CX (k1 );

ZR+

(y k2 )+ dY (dy ) = CY (k2 );

ZR+

(dx; dy ) = 1:

R2+

Here X and Y are the marginal distributions.

Throughout this paper we have taken unit oeÆients (weights) in the basket and

zero interest rates and assume that the assets pay no dividends. If the weights are

dierent from one and interest rates are onstant we may redue to the present ase

by a simple saling argument (see [24℄) .

The dual problem for nding optimal subrepliating strategies is given by

Z

Z

(6)

sup

CY (k2 )2 (dk2 ) + CX (k1 )1 (dk1 ) +

R+

1 2 R+

; ;

subjet to the onstraints

Z

+

(7) (x + y K )

(x

R+

k1 )+ 1 (dk1 )

Z

R+

(y

k2 )+ 2 (dk2 )

8x 0

0;

y 0:

2.1. A review of Dhaene and Goovaerts' result.

Given knowledge of the all funtions CX (k1 ); CY (k2 ), Breeden and Litzenberger's

result implies that dkd1 CX = FX (k1 ) 1, dkd2 CY = FY (k2 ) 1 where FX and FY are the

distribution funtions of X and Y respetively. As mentioned in the introdution, by

Sklar's theorem any joint distribution F (x; y ) = P (X x; Y y ) an be represented

as C (FX (x); FY (y )) for some opula C .

11

Reall the lower and upper Frehet opula bounds: for any opula C (u1 ; u2 ) on

[0; 1℄2 we have

C

(u1 ; u2 ) C (u1 ; u2) C + (u1 ; u2 );

where

C + = min(u1; u2);

C = max(u1 + u2

1; 0):

Therefore, for any distribution funtion F with presribed marginals FX ; FY , we have

C

(FX (x); FY (y )) F (x; y ) C + (FX (x); FY (y )):

From this Dhaene and Goovaerts [11℄ (Theorem 3, p.206) dedue the following:

Proposition 1. The prie of a all option on a basket CB on X and Y whose marginal

distributions are

FX

and

FY

satises the bounds

CB

CB CB+

where CB+ and CB orrespond to the upper and lower Frehet bounds respetively,

that is, the joint distributions of (X; Y ) are given respetively by C + (FX ; FY ) and

C (FX ; FY ).

The result has been generalized to supermodular payo by Rapuh and Ronalli [27℄

from a result of Muller and Sarsini [26℄.

When the distribution funtions FX and FY are ontinuous, we have

C=C ,Y

C = C+ , Y

= FY 1 (1 FX (X );

= FY 1 (FX (X )):

For the lower bound note Zthis means that

(8)

CB

=

R+

[x + FY 1 (1

FX (x))

K ℄+ dFX (x):

2.2. A preise formulation of primal and dual problems.

In this setion we state the primal and dual problems in an appropriate innite dimensional setting. Our approah is adapted from that in Anderson and Nash [1℄. For

the reader's onveniene we summarize the bakdrop of these results in an Appendix,

see Setion 6. Let M denote the linear spae of all nite signed measures on R 2+ whih

deay at least linearly at innity in the sense that, for 2 M, (Br ( )) o(1=r)

12

as r goes to innity for every 2 R 2+ , where Br ( ) = f 2 R 2+ : j j > rg.

Let be the linear spae generated by the funtions p1 (x; y ; k1) := (x k1 )+ ,

K )+ dened on R 2+ . Dene

p2 (x; y ; k2 ) := (y

k2 )+ and pB (x; y ; K ) := (x + y

the pairing h; i between M and by integration, i.e.,

Z

h; f i =

f (x; y )(dxdy )

R2+

Denote by M+ the onvex one in M of all nite positive measures on R 2+ . We

onsider the following onstrained minimization problem

(9)

h; pB ( ; K )i

inf

2M+

subjet to the onstraints on the marginal distributions

h; p2 (; k2 )i = C

(10)

(11)

(12)

h; p1 ( ; k1 )i = CX (k1 );

Y

(k2 );

h; 1i = 1;

where CX and CY are given all prie funtions whih are neessarily nonnegative,

dereasing and onvex. Let H be the set of all nonnegative, dereasing and onvex

funtions dened on R + , S be the set of all nite signed measures over R + and the

pairing h; i between H and S is given by integration. Consequently, the dual problem

of primal problem (9-12) is the following onstrained maximization problem

(13)

sup

1 2

; ;

hCX ; 1 i + hCY ; 2 i + subjet to the onstraints

(14)

(15)

h; pB

1 ; 2

hp1 ; 1 i

2 S;

hp2 ; 2 i

i

2 R:

0; 8 2 M+;

As a matter of fat, (14) an be further realized as

(16)

pB

hp1 ; 1 i

hp2 ; 2 i

0; 8x 0

y

0:

Hene we have the dual problem in the form desribed as (6-7). Here we remark that

(6) is an expression for the most expensive value among subrepliating portfolios and

(7) is the ondition for subrepliation.

13

The omplementary slakness ondition (38) in the Appendix, written out in our

setting therefore reads

h; pB ( ; K )i

= h; hp1 (; k1 ); 1 i + hp2 (; k2); 2 i + i

Representing the inner produt in integral form and exhanging the order of integration on the right hand side yields

Z

Z Z

Z Z

pB (; K )d =

p1 (; k1 )d 1 (dk1 ) +

p2 (; k2 )d 2 (dk2 ) + Z

Z

(17)

=

CX (k1 )1 (dk1 ) +

CY (k2 )2 (dk2 ) + :

Therefore, in order to prove optimality by applying the omplementary slakness

ondition, we need to nd feasible measures , 1 , 2 and a real number suh that

the equality (17) holds.

2.3. A family of optimal subrepliating portfolios.

In this setion we introdue a family of subrepliating portfolios we all STPs5. An

intuitive derivation of the STPs from lower Frehet opula is postponed until Setion

3. Let C 0 + denote the right derivative of the all prie funtion, and C 0 the left

derivative. Dene the auxiliary funtion

(18)

(x)

:= CX0 + (x) + CY0 (K

x) + 1:

By onstrution , whih is only dened on [0; K ℄, is right-ontinuous. We also set

0 + (K ). Clearly is the dierene of two inreasing funtions and it's total

(K ) = CX

variation is bounded by the onstant 2. Dene

(19)

A

= fx : (x) > 0g:

Then A is a ountable union of disjoint intervals A = [j Aj . For the rest of this setion

we make the assumption: A is a union of a nite number n of intervals. Indeed the

ase that A onsists of innitely many intervals is degenerate. A disussion on this

assumption is given in Setion 3.2.

Suppose that the intervals (Aj )1j n are plaed in their natural order, and that the

boundary of Aj is given by the points fK12j 1 ; K12j g. Dene K2j = K K12n j +1 and

5"STP" is short for "sheep-trak portfolios" sine the graph of suh a portfolio is reminisent of

suh traks on British hillsides. A piture thereof is ontained in Figure 2 below.

14

onsider the dual variables dened by

1 (dk1 )

(20)

= Æ0 (k1 )dk1 +

2n

X

=1

2

n

X

i

(21)

2 (dk2 )

=

(22)

= Æ0 (k2 )dk2 +

n

X

=1

i

(K12i

=1

i

K12i 1 )

( 1)i ÆK1i (k1 )dk1 ;

( 1)i ÆK2i (k2 )dk2 ;

K

=

n

X

=1

(K22i

K22i 1 )

K:

i

These dual variables are shown to be feasible in the next setion.

Remark 2. In the speial ase that is C 1 in [0; K ℄, the determination of the strikes

K1i 's in the dual variables given above redues to nd the zeros fx : (x) = 0g of .

For the niteness of the zeros for C 1 funtions, we add the following observation that

shows that the niteness will hold exept in ertain (unavoidable) degenerate ases.

Let I R be a bounded open interval, h 2 C 1 (I ) and p be a regular value of h, i.e.,

h0 (x) =

6 0 for every x 2 h 1 (p). Then h 1(p) is nite. In our ase this means that

(x) has only nite number of zeros in (0; K ) provided that whenever x is suh that

0 (x) = C 0 (K x) 1, then C 00 (x) 6= C 00 (K x), i.e., the densities of X and Y

CX

Y

X

Y

are dierent at suh points.

Given the dual measures as in (20) and (21) the payo of the the assoiated portfolio

an be expressed by integrating (x ki ) against i (dki ). Partition R 2+ into (2n + 1)2

piees denoted by Ri;j using the denitions

R 2+

=

2[

n+1

i;j

=1

Ri;j ;

where Ri;j = f(x; y ) 2 R 2+ : K1i 1 x < K1i ; K2 j 1 y < K2 j g:

Here we have used the onvention that K10 = K2 0 = 0 and K12n+1 = K2 2n+1 =

The assoiated portfolio may be expressed in eah region Ri;j as

!

!

j

i

X

X

( 1)a (x K1a ) + y + ( 1)b (y K2b ) + :

x+

a

=1

1.

=1

b

or in the following more ompat form, whih applies simultaneously aross all regions

(23)

f1 (x) + f2 (y ) + ;

15

where the funtions fi are dened by

n

X

(24)

fi (z ) = z + +

f(z

=1

Ki2a )+

g

Ki2a 1 )+ :

(z

a

Note that eah of f1 (x) and f2 (y ) has an immediate interpretation in terms of a

hedging strategy involving all options. Moreover, a few lines of algebra show that

= 0;

f1 (K z ) + f2 (z ) + so that (23) simplies to

(25)

f1 (x)

f1 (K

y ):

Thus the hedging portfolio for basket all may be expressed as a portfolio of alls held

long and short on x and a portfolio of puts held long and short on y . The advantage

of this representation is that it does not involve ash.

The funtions fi will be referred to as STP funtions. The measures (20) and (21)

are in one to one orrespondene with the STP portfolio. We will refer to them as

the STP measures. An illustration of ST P funtion f is given in Figure 2.

STP Portfolio

y

|

|

|

K11

K12

K31

|

K41

|

K51

|

6

K1

K

x

Figure 2: The gure illustrates an STP portfolio whih, starting at zero, is pieewise linear with alternating slopes

one and zero. The points of transition dene K1i for odd and even i.

16

2.4. Feasibility of dual variables.

Feasibility is equivalent to establishing the following subrepliation property

(26)

f1 (x)

f1 (K

y)

(x + y

K )+ :

Sine f1 is pieewise linear with alternately slopes 0 and 1, by the mean value theorem

we learly have

(27)

f1 (z

+ u)

f1 (z )

u+

so we have (26). Feasibility is assured for our hedging portfolios provided they satisfy

(27).

2.5. A geometri onstrution of optimal bivariate proesses using STP.

Notie that equality is ahieved in (26) provided that one of the following 3 ases

holds:

(28)

(29)

(30)

=K

y

x>K

y

x

x<K

and f1 (x) = f1 (K

y and f1 (x) = f1 (K

y) + x + y

y );

i.e., x; K

i.e., x; K y 2 (K12j ; K12j +1 )

2j 1 ; K 2j )

y 2 (K1

1

K;

as is illustrated by Figure 3 below.

Suppose that X and Y are ontinuous random variables with stritly positive densities on [0; K ℄. In order to onstrut a bivariate proess (X; Y ) ahieving equality

in the inequality (26) it suÆes to hoose a ountermonoti proess Y = G(X ) with

G a non-inreasing funtion in suh a way that the support of (X; Y ) is onentrated on plaes where the onditions given in (28), (29) and (30) above hold. Sine

in this ase FX and FY 1 are ontinuous funtions this is ahieved by the hoie

G(X ) := FY 1 (1

FX (X )). Note that the set (G(x) < K

x) is preisely the set

(x) > 0, so that the points where G rosses the line x + y = K are exatly the

boundary points of the set A.

More generally, if U U [0; 1℄ and we dene X = FX 1 (U ) and Y = FY 1 (1 U )

then X and Y have the desired marginals, and moreover the joint law of (X; Y ) is

suh that all the mass is plaed at o-ordinates where equality holds in (26).

This is illustrated graphially in Figure 3.

17

y

4

1

K2 = K − K1

3

K2 = K − K1

2

x+y=K

2

2

3

1

K= K− K

1

4

K2= K − K 1

1

K1

2

K1

3

K1

4

K1

x

Figure 3: Joint distribution is optimal if supported in the shaded region.

2.6. Optimality.

Having established that there is equality in the relations E [(X + Y K )+ ℄ = E [f1 (X )

f1 (K Y )℄ when (X; Y ) is an anti-monotoni proess with support hosen as above,

we an easily dedue the following theorem:

Theorem 1. Suppose the all funtions

CX (x)

and CY (y ) are suh that the set A

dened in (19) is a union of nitely many intervals. Let 0 K01 K12n K be

the endpoints of these intervals, and let fi be dened as at (24).

Let U be a random variable with a standard uniform distribution. Dene X =

FX 1 (U ) and Y = FY 1 (1 U ). Then

Y )

The joint distribution funtion assoiated to the bivariate proess (X;

is a minimizer for the primal problem for the all on a two asset basket with

strike K ;

the portfolio dened via f1 (x) + f2 (y ) + is feasible and the optimal measures

1 ; 2 given by the formulas (20) and (21), together with form a triple that

is optimal for the dual problem (6), (7) .

18

Proof. In essene, all that remains to be proved is that the dual variables we have

onstruted are optimal not only among measures of the form given in (20) and (21),

but also amongst all measures in the original dual problem. The following hain

Y ) is feasible for the primal problem and

of inequalities makes this lear: sine (X;

1 ; 2 ) is feasible for the dual problem, we have

(;

hCX ; 1 i + hCY ; 2 i + =

sup

(1 ;2 ;)

hCX ; 1 i + hCY ; 2 i + sup

1 2 veries (14);(15)

; ;

hCX ; 1 i + hCY ; 2 i + Z

inf

2M+ ; veries (10);(11);(12)

Z

R2+

R2+

(x + y

K )+ (dx; dy )

K )+ (dx; dy )

(x + y

The rst and the last elements in the above hain are equal and hene the other

1 ; 2 ) respetively are also optimal for

inequalities are equalities. Hene and (;

the original primal and dual problem and the values of the primal and dual funtionals

evaluated on these funtions are equal.

2.7. Optimal subrepliating portfolio for basket put.

Using put-all parity for the basket we also have lower bound for the prie PB of

basket put and the orresponding subrepliating portfolio. Note that the prie PB is

given by PB = CB (x + y ) + K (reall we have redued to the ase of zero interest

rates). Thus one immediately obtains the lower bound for PB by subtrating the lower

bound for the prie of basket all by a forward prie. Moreover, sine the stoks x; y

may be thought of as options with strike zero, we may use this relation to determine

the STP type portfolio that subrepliates PB . In other words we have that

The hedging portfolio for the basket put option is equal to the hedging

portfolio for a basket all option ombined with a portfolio whih is

short both assets and long K units of ash.

Using the expliit form (23) for the hedging portfolio on the basket and (22) we

therefore get that the hedging portfolio for the put of the form

(31)

f1 (x)

f1 (K

y)

(K

y

x)

= f~(K

y)

f~(x)

19

where f~(z ) = z

(32)

f1 (z ),

or equivalently,

n

X

f~(x) =

f(x K12a 1 )+

=1

a

(x

g

K12a )+ :

As for (25), the hedging portfolio for the basket put is expressed as a portfolio of puts

held long and short on y and a portfolio of alls held long and short on x. Also the

advantage of the representation (31) is that it does not involve ash.

3. A derivation of optimal dual from optimal opula

We omplement the treatment in the previous setion by outlining how the STP

portfolio an be derived from the lower Frehet opula. Indeed it is this approah

that rst led us to the form of these portfolios. The seond part of the setion onsists

of a disussion on the niteness assumption on the set A dened by (19).

3.1. Optimal dual measures. Consider the following joint distribution of

Y given by

+

+

+

0

0

F (x; y ) = maxfFX (x) + FY (y ) 1; 0g = CX (x) + CY (y ) + 1

:

X

and

This joint distribution of X and Y an also be haraterized as: X is distributed

as FX 1 (U ) and Y is distributed as FY 1 (1 U ), where U is a random variable uniformly distributed in (0; 1) and FX 1 , FY 1 are the generalized inverse of FX and FY

respetively dened by

= inf fx : FX (x) > ug;

FY 1 (u) = inf fy : FY (y ) > ug:

FX 1 (u)

Now the joint distribution assoiated with the lower Frehet opula is feasible for the

primal problem and yields the primal value

Z1

+

E [(X + Y K ) ℄ =

(FX 1 (u) + FY 1 (1 u) K )+ du

0

Z

(FX 1 (u) + FY 1 (1 u) K )du

=

ZE

Z

1

=

(FX (u) K )du + FY 1 (1 u)du;

E

E

20

where E = fu 2 (0; 1) : FX 1 (u) + FY 1 (1

integrals we arrive at the formula6

u)

K >

0g. Computing these two

(33)E [(X + Y K )+ ℄ =

X

X

CX (0) + CY (0) K +

( 1)(x) CX (x) +

( 1)(y)+1 CY (K

x2 (AÆ )

y 2 (AÆ )

j j

y) + A :

at least under the assumption that A is a nite union of intervals. Here is dened

as

1 if x is a left endpoint in (AÆ );

(x) =

1 if x is a right endpoint in (AÆ );

If we now, for an intuitive derivation, assume strong duality we have

Z

Z

CY (k2 )2 (dk2 ) + CX (k1 )1 (dk1 ) +

R+

R+

X

X

= CX (0) +

( 1)(x) CX (x) + CY (0) +

( 1)(y)+1 CY (K

x2 (AÆ )

+ jf0 < x < K : (x) > 0gj

y 2 (AÆ )

y)

K:

Hene the optimal dual variables are (by omparing the oeÆients)

X

1 (dk1 ) = Æ0 (k1 )dk1

( 1)(x) Æx (k1 )dk1

2 ( Æ)

x A

2 (dk2 )

= Æ0 (k2 )dk2 +

X

( 1)(y) ÆK y (k2 )dk2

2 ( Æ)

y A

= jf0 < x < K : (x) > 0gj

K;

and these are the dual variables (20), (21) and (22) that we desribed in x2.3.

We an reverse the last stage of the above reasoning to give a seond proof of

strong duality. I.e., if we dene dual variables via (20), (21) and (22), where the

K1i 's are assoiated with the endpoints of the level set of fx : (x) > 0g, then the

above derivation shows that the omplementary slakness ondition (17) is satised

and hene strong duality holds.

3.2. Finiteness assumption on the set A. In this setion we show that although

it is perfetly possible for A to onsist of innitely many intervals, this is a degenerate

ase, in a sense of "measure zero".

6Details of derivation are provided in Setion 7.

21

Lemma 3. Let

be a measurable subset of an bounded open interval I . Then its

harateristi funtion E is of bounded variation if and only if E onsists of nitely

many intervals.

E

Proof. The intuition is that sine the harateristi funtion

is either 0 or 1, the

total variation is the number of times it hanges from 0 to 1 and from 1 to 0. Thus

we are left with a simple ounting argument. We refer to Volpert and Hudjaev [28℄

for bakground material on funtions of bounded variation.

E

The following lemma is a one dimensional version of a theorem in Evans and Gariepy

[14℄. We refer to their book (see Theorem 1, page 185) for details.

Lemma 4. Let f be a funtion of bounded variation dened on an open interval I .

Denote by Et the level set fx 2 I : f (x) > tg for f . Then, for almost every t 2 R ,

the harateristi funtion

Et

of

Et

is of bounded variation.

Hene, by Lemma 4 (sine is of bounded variation), for almost every t the harateristi funtion of set t := f > tg is of bounded variation and therefore a nite

union of intervals by Lemma 3. Thus the ase that A = 0 fails to be nite union of

intervals is degenerate.

4.

Extending beyond the finite union ase.

In this setion we show that even in the degenerate ase, i.e., A is not of bounded

variation, the joint distribution of X and Y onstruted in Setion 2.6, i.e, X FX 1 (U ) and Y FY 1 (1

U ) where U is a random variable uniformly distributed

in [0; 1℄, is still primal optimal. However, on the other hand, in this ase the dual

variables given by (20), and (21) involve innite sums and therefore are no longer

nite signed measures. Clearly in pratie it is not realisti to onsider portfolios

whih involve going long and/or short an innite number of alls. Instead we show

that, for any > 0, there exists an expliit -optimal subrepliating portfolio in the

sense that will be laried in the rest of the setion.

Let t denote the super level set fx 2 (0; K ) : (x) > tg. By Lemma 4, the

harateristi funtion t of t is of bounded variation for almost every t. Suppose

now that we are in the ase that A (reall that 0 = A) is not of bounded variation.

Then, given any > 0, there exists a positive t < =K with t of bounded variation

(hene t is a nite union of intervals by Lemma 3). We shall denote t by 22

hereafter for notational onveniene. We an then form a portfolio (1 ; 2 ; ) as the

one in (20), (21) and (22) by replaing the set A by . We shall refer to suh portfolio

determined by as an -optimal subrepliating portfolio for the reason whih will

be lear in the following alulation. Reall that in this ase = j j K . The prie

of suh portfolio satises

Z

CX (k1 )d1 (k1 ) +

=

CX (0) + CY (0) +

=

CX (0) + CY (0) +

=

=

=

Z

Z

Z

E

E

(x

Z

Z

CY (k2 )d2 (k2 ) + K

Z0

K )+ ℄

fK y2 g

u + t )

(FX 1 (u) + FY 1 (1

+Y

Z

FX (x)dx

(FX 1 (u) + FY 1 (1

E [(X

(x)dCX (x)

Z

K )dFX (x) +

Z

u)

K

0

FY (K

ydFY (y )

K )du

K )du

(y )dCY (K

y )d(K

t

t

y) +

y) +

Z

j j

j j

d(K

K

y)

K

j j

where E := fu 2 (0; 1) : FX 1 (u) + FY 1 (1 u + t ) K > 0g. Here we note that in

the inequality we have used that E := fu 2 (0; 1) : FX 1 (u) + FY 1 (1 u) K > 0g is

ontained in E (sine FY 1 is nondereasing and t > 0), that the integrand is positive

in E and that FY 1 (1 u + t ) FY 1 (1 u) (again sine FY 1 is nondereasing and

t > 0). Therefore, the prie of the portfolio (1 ; 2 ; ) onstruted from the super

level set is higher than, within an error, the primal value E [(X + Y K )+ )℄.

This is explains the term "-optimality".

Combing the above -optimal inequality with the weak duality between primal and

dual, we obtain

E [(X

+Y

K )+ ℄

hC

X ; d

1 i + hCY ; d2 i + E [(X + Y

for any > 0. In this sense, we say that the primal value E [(X + Y

distribution onstruted in Setion 2.6 is optimal.

K )+ ℄

K )+ ℄

with joint

23

5.

Numerial Results

In this setion we illustrate the hedging strategy in the ontext of the Blak-Sholes

model. We determine the optimal hedging strategy, by determining numerially the

zeroes of (see (18) in Setion 2.3).

Let us therefore assume that

1 2

t);

2 1

1 2

S2t = S02 exp(2 W2t

(35)

t);

2 2

where i ; i = 1; 2, are onstants and where W1t ; W2t are standard Brownian motions.

In order to simulate the anti-monotoni ase orresponding to the optimal lower

bound, we assume the following relation between the driving Brownian motions

(34)

S1t

= S01 exp(1 W1t

W2t

=

W1t :

As is well known, the distribution funtions FSi T (x) for stok i, i = 1; 2, at maturity T

are given by 1 N (d(2i) ), where N is the distribution funtion of the standard normal

random variable and d(2i) , whih appears in the Blak-Sholes formula, is given (when

r = 0) by the expression

2

i

log( Sx0 )

(

i)

p

d2 (x) =

i

i

T

2T:

Thus the funtion whose zeroes we seek to determine is given in our setting by

(x)

=

(1) (x))

N (d2

(2) (K

N (d2

x)) + 1:

In the paper, we have assumed for simpliity that the weights wi ; i = 1; 2, in the

portfolio are equal to 1. Adapting the results in this paper to positive weights that

are dierent from 1 involves only trivial adjustments. In Table 1 below we show

results when both weights are equal to :5. We have assumed geometri Brownian

motions for both stoks. We took T = :5, S01 = S02 = 100 and 1 = :355; 2 = :2

and w1 = w2 = :5. In the rst olumn the basket strike KB is shown. In the seond

olumn is the Monte Carlo prie of the basket in the ase where stok S1 and S2 are

anti-monotoni with the presribed marginals. In the third olumn is the prie of the

optimal hedging portfolio. In the next two olumns is part of the optimal hedging

portfolio that onerns stok S1 and involves a short w1 and a long w1 position in a

24

KB

81.5

84

86.5

89

91.5

94

96.5

99

100

102.5

105

107.5

110

112.5

115

117.5

MC Value Hedging Portfolio's Long w1 Call Short w1 Call

Value

with Strike K11 with Strike K12

18.52

18.50

absent

absent

16.03

16.00

absent

absent

13.55

13.50

absent

absent

11.02

11.00

absent

absent

8.5

8.50

absent

absent

5.97

6.00

absent

absent

3.98

3.99

51.24

89.40

2.73

2.69

44.47

101.61

2.28

2.29

42.50

105.76

1.54

1.54

38.52

115.19

1.02

1.03

35.41

123.73

0.69

0.69

32.83

131.73

0.45

0.46

30.65

139.30

0.32

0.31

28.78

146.59

0.21

0.21

27.12

153.64

0.14

0.14

25.64

160.48

Table 1: The hedging portfolio and optimal lower bound for primal and dual problem

all with the indiated strikes K11 and K12 . To this we must always add a long w1

position in the underlying stok S1 and a omplementary position in three w2 puts

on S2 : a short w2 position on a put with strike 2KB K11 , a long w2 position in a

put with strike 2KB K12 and a short w2 position in a put with strike 2KB . We are

assuming, as we do throughout this paper, that a ontinuum of strikes are traded

on eah asset. For the parameters onsidered, the funtion has either two zeroes

or none. When there are none (indiated by "absent" in fourth and fth olumn),

the optimal hedging portfolio onsists only of a long position in stok 1 and a short

position in a put on S2 , struk at the basket strike.

6. Appendix I

- Infinite Dimensional Linear Programming

In this setion we quote some results for linear programming in innite dimensional

spae. Please refer to Anderson and Nash [1℄ for details.

Let (X; X 0 ) and (Y; Y 0 ) be two dual pairs of linear spaes and denote by h; i for

both of their pairings. A linear programming problem is a onstrained optimization

25

problem of the form

minimize

subjet to

(36)

hx; i

Ax = b

x

0

where b and are given elements of Y and X 0 respetively,

map from X to Y . The dual problem to (36) is given as

maximize

subjet to

(37)

hb; y 0 i

A y 0 + y0 Y 0

where P is the dual one of P dened by

P

2

A

is a ontinuous linear

2 P

= fx0 2 X 0 : hx; x0 i 0 for all x 2 P g;

and A is the adjoint of A dened by hAx; y 0i = hx; A y 0i for all x 2 X and y 0 2 Y 0 .

The following two theorems are essential in our following analysis. Reall that a

program is alled onsistent if it has a feasible solution and the value of a onsistent

program (36) is dened as the inmum over feasible x of hx; i.

Theorem 5. (Weak duality) If both (36) and (37) are both onsistent, then the value

of (36) is greater than or equal to the value of (37) and both values are nite.

Theorem 6. (Complementary slakness) If x is primal feasible and y 0 is dual feasible

and

(38)

then

hx; x

A y 0 i

= 0;

is primal optimal and y 0 is dual optimal.

7.

Appendix II

In this setion we provide the details of the derivation for the equality (33) in

Setion 3.1. Reall that

Z

Z

+

1

E [(X + Y K ) ℄ = (FX (u) K )du +

FY 1 (1 u)du;

E

where E = fu 2 (0; 1) : FX 1 (u) + FY 1 (1

integrals out as follows.

E

u)

K >

0g. Now we ompute these 2

26

(1) By applying a hange of variables formula (by making u = FX (x)) to the rst

integral and notie that

= fx : x + FY 1 (1 FX (x)) K > 0g

[

= fx 2 [0; K ℄ : FX (x) + FY (K x) 1 0g (K; 1)

[

= fx 2 [0; K ℄ : CX0 (x) + CY0 (K x) + 1 0g (K; 1)

FX 1 (E )

we have

Z

E

=

[FX 1 (u)

Z1

0

[x

K ℄du

=

CX (0)

K

=

CX (0)

K

FX

Z

K ℄dFX (x)

=

Z

A

1 (E )

[x

[x

K ℄dFX (x)

K ℄dFX (x)

j

A

+

j

A

+

(x

K )FX (x)

(x

K )FX (x)

Z

Z

A

A

FX (x)dx

j j

0 (x)dx + A

CX

where A = fx 2 (0; K ) : CX0 (x) + CY0 (K x) + 1 > 0g and jAj is the Lebesgue

measure of A.

(2) Similarly for the seond integral, we make the hange of variable 1 u = FY (y )

and notie that

fy : 1 F (y) 2 E g = fy : F 1(1 F (y)) + y K > 0g

[

fy 2 [0; K ℄ : F (K y) + F (y) 1 0g (K; 1)

[

fy 2 [0; K ℄ : C 0 (K y) + C 0 (y) + 1 0g (K; 1)

Y

=

=

then we have

Z

E

=

X

Y

X

Y

FY 1 (1

CY (0)

Y

X

u)du

where B = fy 2 (0; K ) : CX0 (K

measure of B .

=

j

yFY (y )

Z

B

fy:1

+

Z

B

FY

1 (y)2E g

ydFY (y )

CY0 (y )dy + B

y ) + CY0 (y ) + 1 >

j j

0g and jB j is the Lebesgue

27

Now we have

j yF (y)j

+ C 0 (x)dx + C 0 (y )dy + jAj + jB j:

By applying the symmetry x 2 A () K x 2 B we obtain

(K x)F (x)j + yF (y )j = yF (K y )j + yF (y )j = y j = jB j;

E [(X

+Y

K )+ ℄

=

CX (0) + CY (0)

Z

A

X

A

Y

X

B

(x

K

Z

B

K )FX (x)

Y

A

B

Y

X

Y

B

B

B

here in the seond equality we have used the relation FX (K y ) + FY (y ) = 1 on B .

Hene, under the assumption that A is a nite union of intervals, we obtain

Z

Z

+

0

E [(X + Y K ) ℄ = CX (0) + CY (0) K +

CX (x)dx +

CY0 (y )dy + jAj

B

ZK

ZA K

0 (x)dx +

= CX (0) + CY (0) K +

A (x)CX

B (y )CY0 (y )dy + jAj

0X

0 X

(x)

= CX (0) + CY (0) K +

( 1) CX (x) +

( 1)(y)+1 CY (K y ) + jAj;

2 ( Æ)

2 ( Æ)

x A

y A

where in the last equality we have again used the symmetry x 2 A () K

AÆ denotes the interior of A and is dened as

1 if x is a left endpoint in (AÆ );

(x) =

1 if x is a right endpoint in (AÆ ):

x

2 B.

Aknowledgement

The authors wish to thank the anonymous referees for their helpful omments.

Referenes

[1℄ Anderson, E. J. and Nash, P., 1987. Linear programming in innte-dimensional spaes,

Wiley & Sons, 1987.

[2℄ Aspremont, A. and El Ghaoui, L., 2003. Stati arbitrage bounds on basket option pries,

Preprint, University of California, Berkeley, 2003.

[3℄ Avellaneda, M., Boyer-Olsen, D., Busa, J. and Friz, P., 2002. Restruturing volatility,

Risk Magazine, Otober, 91-95, 2002.

[4℄ Bertsimas, D. and Popesu, I., 2002. On the relation between option and stok pries: A

onvex optimization approah, Operations Researh, 2002, 50(2), 358-374.

[5℄ Brigo, D., Merurio, F., Rapisarda, F. and Sotti, R., 2004. Approximated momentmathing dynamis for basket options priing, Quantitative Finane, 4, 1-16, 2004.

[6℄ Brown, H.M., Hobson, D.G. and Rogers, L.C.G., 2001. Robust hedging of barrier options.

Mathematial Finane, 11, 285-314, 2001.

[7℄ Breeden, D.T. and Litzenberger, R.H., 1978. Pries of state-ontingent laims impliit

in option pries, J. of Business, 51, 621{651, 1978.

28

[8℄ Cherubini, U. and Luiano, E., 2002. Bivariate option priing with opulas, Applied Mathematial Finane, 9, 69{86, 2002.

[9℄ Deelstra, G., Liinev, J. and Vanmaele, M., 2004. Priing of arithmeti basket options by

onditioning. Insurane: Mathematis and Eonomis, 34, 55{77, 2004.

[10℄ Dhaene, J., Denuit, M., Goovaerts, M., Kaas, R. and Vynke, D., 2002. The onept

of omonotoniity in atuarial siene and nane: Appliations. Insurane: Mathematis and

Eonomis, 31(2), 133{161, 2002.

[11℄ Dhaene, J. and Goovaerts, M., 1996. Dependeny of risks and stop-loss order. ASTIN

Bulletin, 26(2), 201{212, 1996.

[12℄ Dhaene, J., Wang, S., Young, V.R. and Goovaerts, M., 2000. Comonotoniity and maximal stop-loss premiums. Bulletin of the Swiss Assoiation of Atuaries, (2), 99{113, 2000.

[13℄ Dufresne, D., 2002. Asian and basket asymptotis, University of Melbourne Preprint Series,

2002.

[14℄ Evans, L.C. and Gariepy, R.F., 1992. Measure Theory and Fine Properties of Funtions,

CRC Press, 1992.

[15℄ Figlewski, S., 2002. Assessing the inremental value of option priing theory relative to an

informationally passive benhmark, J. Derivatives, Fall, 80{96, 2002.

[16℄ Frehet , M., 1957. Les tableaux de orrelation dont les marges sont donnees, Ann. Univ.

Lyon, 20, 13-31, 1957.

[17℄ Goovaerts, M., Dhaene, J. and De Shepper, A., 2000. Stohasti upper bounds for

present value funtions. The Journal of Risk and Insurane, 67(1), 1{14, 2000.

[18℄ Hobson, D.G., Laurene, P. and Wang, T.H., 2005. Stati-arbitrage upper bounds on the

pries of basket options, Quantitative Finane, to appear.

[19℄ Joe, H., 1997. Multivariate Models and Dependene Conepts, Chapman Hall, London, 1997.

[20℄ Ju, N., 2002. Priing Asian and Basket Options Via Taylor Expansion, J. Computational

Finane, 5, No. 3, 2002.

[21℄ Kaas, R., Dhaene, J. and Goovaerts, M., 2000. Upper and lower bounds for sums of

random variables. Insurane: Mathematis and Eonomis, 27(2), 151{168, 2000.

[22℄ Kwok, Y.K., 1998. Mathematial Models of Finanial Derivatives, Springer, 1998.

[23℄ Laurene, P. and Tai-Ho Wang, 2004. What's a basket worth? Risk Magazine, February

2004.

[24℄ Laurene, P. and Wang, T.H., Sharp upper and lower bounds for basket options, Applied

Mathematial Finane, to appear.

[25℄ Milevsky, M.A. and Posner, S.E., 1998. Closed form approximation for valuing basket

options. J. Derivatives, 54-61, Summer 1998.

[26℄ Muller, A. and Sarsini, M., 2000. Some remarks on the supermodular order, Matt. Oper.

Researh, 26, no 1, 118-126, 2000.

[27℄ Rapuh, G. and Ronalli, T., 2002. Priing multi-asset options and redit derivatives with

opula, Credit Lyonnais working papers, 2002.

[28℄ Volpert, A.I. and Hudjaev, S.I., 1985. Analysis in lasses of disontinuous funtions and

equations of mathematial physis, Dordreht, Boston, M. Nijho, 1985.

[29℄ Ware, A. and Lari-Lavassani, A., 2001. Algorithms for Portfolio Options, Calgary, Preprint,

2001.