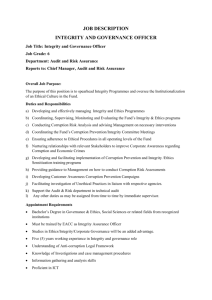

PDF file

advertisement