The Economic Impacts of the Pennsylvania Marcellus Shale Natural

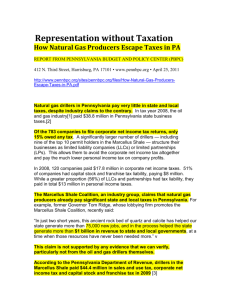

advertisement