Department of Economics Working Paper Series The Economic Consequences of Dollar

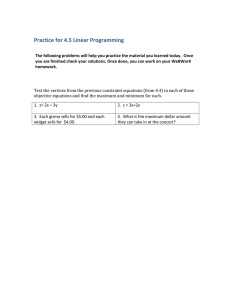

advertisement