Scaling Up Mobile Accessibility: Civil Society and Operators At Work

advertisement

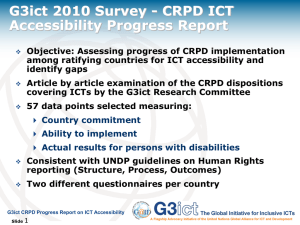

GLOBAL INITIATIVE FOR INCLUSIVE ICTs Promoting the Rights of Persons with Disabilities in the Digital Age Scaling Up Mobile Accessibility: Civil Society and Operators At Work Accessible Americas II: Information and Communication for ALL Panel on Successful International ICT Accessibility Experiences Medellin, Colombia 4, 5 and 6 November 2015 By Axel Leblois President and Executive Director, G3ict www.g3ict.org The Opportunity We Saw Today: Mobile Apps and Services Can Leverage Terrific Embedded Smart Phone Functionalities Visual Text-to-Speech Hearing Video Relay Service with sign language Speech Peer-to-peer video for sign language Dexterity Voice recognition for controls and input Cognition Icon interface Slide 2 Emerging Mobile Accessibility Features New forms of wearable computing Sign language recognition Secure sign-in with bio-recognition Interpretation of visual environment Guidance for cognitively impaired persons Interaction with devices to control physical environment Internet of Things Real time captioning in wearable glasses Slide 3 The Gap: Latin America: more phones than people, but: Actual penetration over population is uneven, 70% on average in Latin America Smart phones just passed 50% of new sales 30% to 35% is the penetration of smart phones over population, likely far less among persons with disabilities, especially among senior citizens Slide 4 SO, HOW TO CLOSE THE GAP? HOW TO ENSURE THAT THIS UNPRECEDENTED LEVEL OF INNOVATION BENEFITS ALL PERSONS WITH DISABILITIES? HOW TO PROMOTE ADOPTION? Slide 5 SO, HOW TO CLOSE THE GAP? HOW TO ENSURE THAT THIS UNPRECEDENTED LEVEL OF INNOVATION BENEFITS ALL PERSONS WITH DISABILITIES? HOW TO PROMOTE ADOPTION? Scaling Up! Success Stories Mobile Operators, Civil Society, Governments in Action Japan, USA, France, Turkey, Colombia, Mexico, Denmark Slide 6 Example #1: Japan The Raku Raku NTT DoCoMo Market Situation in 2002 NTT DoCoMo market share: 51% Saturation of young adult and adult market segment Opportunity: rate of utilization decreased significantly with age (90%+ aged 20 to 50; less than 30% above 70) Decision to tackle issue across organization, products and services Adoption of Universal Design principles Cell phone handsets, stores & services Slide 7 Source: NTT DoCoMo presentation at ITU – UNESCAP meeting in Bangkok, August 26, 2009 Slide 8 Sales Status of the Raku-Raku Phone Series RakuRaku phoneV 2008.8 15M units sold As of June 2009 20M as of June 2013 :3G(FOMA) :2G(mova) 500 RakuRaku RakuRaku phone phone 1999.10 2001.9 99.9 00.9 RakuRaku phone S 2002.9 01.9 FOMA RakuRaku phone FOMA 2005.8 RakuRaku phone 2004.9 RakuRaku phone 2003.9 02.9 03.9 FOMA RakuRaku phone 2006.9 04.9 Slide 9 RakuRaku phone 2007.8 RakuRaku phone basic 2007.4 RakuRaku phone Premium 2008.4 RakuRaku phone Basic 2009.4 RakuRakuRakuRaku phone phone Basic S S 2008.4 2008.5 RakuRaku phone simple 2005.12 05.9 06.9 07.9 08.9 Change of penetration rate in Japan Penetration rate of over 50s has dramatically increased Penetration rate of mobile phone in 2011 100% Dramatically increased 75% 50% 25% 0% 20s 30s 40s 50s 60s 70s Source: Survey on penetration rate of mobile phone by age, NTT DOCOMO Slide 10 10 2015: Japan National Post Office Watch Service Initiative with Apple and IBM with Free iPads for Seniors Japan Post: a government-owned holding company that runs 24,000 post offices as well as one of the world’s biggest banks and Japan’s largest insurer. Post Office Watch service: employees check in on elderly clients, offer them consultation services and report back to family members. Post now distributes free tablets to elderly persons with the support of a joint venture between IBM and Apple. Apps are designed to help connect Japan’s millions of seniors with healthcare services and with their families, with a target of serving 4 to 5 million families by 2020. Slide 11 Example #2: USA - AT&T Case Study Universal Design AAPAA: involving persons with disabilities in designing products and services Dedicated marketing Special rate plans Customer service 160,000 employees trained on disability and accessibility issues Slide 12 Example #3: France Multi-stakeholder Accessibility Charter Government, organizations of persons with disabilities, operators sign charter with roadmap and milestones in 2005 Voluntary program with milestones and monitoring for implementing features with defined priorities: 1. Necessary features 2. Comfort features 3. Desirable new features and evolution 4. Marketing codification of accessibility features Slide 13 Types of Metrics Monitored in Roadmad, Sample of Actual Results: By 2009: Each operator offers between 10 and 20 accessible handsets Implementation of multimodal customer service support centers for persons with disabilities by each operator By 2010: 193 specialized point of sales for accessible solutions in operation across France Personnel trained on disability and accessibility Mobile news service launched in sign language Launch of multiple mobile services for persons with disabilities: accessible city services, transportation mobile guide, accessible parking guide and accessible tourism web sites etc.) Slide 14 Example #4 – Audio Description for Movie Theaters offered by Operator “My Dream Partner” free mobile app and service for the visually impaired, current news, more than 70 columnists’, hundreds of thousands of audio-books, training programs and practical information Audio description feature allows users of “My Dream Partner” to enjoy watching movies in movie theaters through detailed description of non-dialogue scenes National roll-out in all Turkish movie-theaters. Blind movie-goers can choose the “cinema” category, select the movie and start listening to its synchronized audio description with their earphones. Available free-of-charge and open to customers of all operators who register to My Dream Partner Slide 15 In Summary: Operators’ Common Success Factors Focused accessibility team coordinating efforts across the organization Awareness campaigns Universal Design strategy Involving and hiring persons with disabilities Procurement integrating accessibility Dedicated marketing plan and service packaging Accessible point of sales Accessible web sites and apps Trained employees and customer service Alternative modes of communication with customers Slide 16 CIVIL SOCIETY AND GOVERNMENTS IN ACTION Slide 17 Example #5: Colombia - Video Relay and Remote Interpretation Services for the Deaf Free for all deaf users FENASCOL, National Federation of the Deaf is the operator Available and used nationwide by deaf users Video Remote Interpreting now also available nationwide free with 30 min cap per call 12,000 users in Colombia Funded by MinTic Great replicable option for Universal Service Funds Slide 18 Example #6: the MMF-GARI Database En Español Made Available in Mexico through IFT, Operators Slide 19 Success Story #7: Denmark Crowdsourced Services - Be My Eyes 301,095 Sighted volunteers 23,376 Blind users A Network of Eyes: Be My Eyes is an app that connects blind people with volunteer helpers from around the world via live video chat Slide 20 M-Enabling Summit: G3ict’s Annual Global Forum Promoting Mobile Accessibility Innovation World largest forum on accessible and assistive mobile solutions in cooperation with ITU: Promotes innovation Showcases solutions that work Fosters dialogue among all stakeholders: Mobile industry, innovators, policy makers, advocates, CIOs Facilitates networking among global mobile accessibility stakeholders and sharing of experience 540 participants in 2015 from 30 countries Next Edition June 13-14, 2016, Washington, D.C. www.m-enabling.com Slide 21 ITU - International Telecommunication Union FCC - Federal Communications Commission Companies and Organizations Supporting the G3ict Annual M-Enabling Summit Slide 22 Thank You for your Attention! www.g3ict.org axel_leblois@g3ict.org Slide 23