S F M I

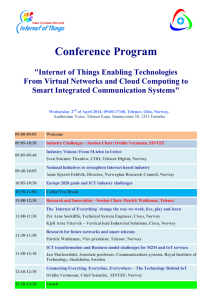

advertisement