Relational Contracts in a Persistent Environment Suehyun Kwon February 9, 2015

advertisement

Relational Contracts in a Persistent Environment

Suehyun Kwon∗

February 9, 2015

Abstract

This paper studies relational contracts with partially persistent states, where

the distribution of the state depends on the previous state. The optimal contracts have properties similar to those of stationary contracts in Levin (2003),

but stationary contracts are no longer optimal. After characterizing the optimal contracts, the paper considers two types of persistent states, and the joint

surplus in the second best increases with the state in both cases. A sufficient

condition for stationary contracts to be optimal is provided.

Keywords: Relational contracts, persistence, moral hazard.

JEL: C73, D82, D86, L14

1

Introduction

Real-world interactions don’t always take place in an i.i.d. environment. A shock to

the cost of raw material is likely to persist for some time, and if it becomes costly to

perform a task this year, a firm may not expect the cost of performing the task next

year to be distributed in the same way as it would after a good year. The production

technology this period can also depend on the past realization of the productivity.

Anticipating the persistence of the states, the employers may not expect the same

∗

Kwon: University College London, suehyun.kwon@ucl.ac.uk, Department of Economics, University College London, Gower Street, London, WC1E 6BT United Kingdom. +4402076795843 I’m

very grateful to Glenn Ellison. I thank Martin Cripps, Michael Powell, Juuso Toikka and Muhamet

Yildiz, participants at the AEA 2013, SAET 2013 and MIT Theory Lunch seminar for helpful

comments and Samsung Scholarship for financial support.

1

effectiveness of the compensation scheme every period, and the optimal compensation

scheme may in fact depend on the state.

I study a relational contract model similar to that of Levin (2003) when the

states are partially persistent and there is moral hazard. The principal and the agent

trade every period over an infinite horizon, and both parties are risk-neutral with a

common discount factor. At the beginning of each period, the payoff-relevant state

is realized and becomes observable to both the principal and the agent. Under a

relational contract, the principal offers a compensation scheme each period, and the

agent decides whether or not to accept it and how much effort to exert if he accepts

the offer. The principal doesn’t observe the agent’s effort, which leads to moral

hazard, but he observes the outcome, which is a noisy signal of the agent’s effort, and

therefore can promise contingent payments on outcomes.

There is a large literature on relational contracts, including Levin (2003) and

Baker, Gibbons, and Murphy (2002). Earlier literature on relational contracts focused

on the symmetric information case. See for example, Shapiro and Stiglitz (1984), Bull

(1987), MacLeod and Malcomson (1989), Kreps (1990). More recent papers consider

environments with asymmetric information, and most of the literature assumes that

the environment is either stationary or i.i.d. over time. My paper is most closely

related to Levin (2003), which shows that for i.i.d. states, the principal can focus

on maximizing the joint surplus and the optimal contracts can be stationary. The

necessary and sufficient condition to implement an effort schedule with stationary

contracts is that it satisfies the IC constraint and the dynamic enforcement constraint.

Levin (2003) considers both adverse selection and moral hazard while I focus on moral

hazard. In Levin (2003), the optimal contract with moral hazard either implements

the first best or is a step function. Other related literature is discussed at the end of

this section.

Section 3 considers the results that hold for any type of persistence. As was the

case with i.i.d. states, the distribution of the joint surplus between the principal and

the agent can be separated from the problem of efficient contracting, and in characterizing the Pareto-optimal contracts, it is sufficient to focus on the joint surplus

from the relationship. When the states follow a first-order Markov chain, the realization of the state this period is a sufficient statistic for the distribution of the future

states, and the principal can provide all incentives by bonus payments at the end

of this period. In particular, the principal can offer a history-independent contract.

2

However, it may not be stationary as defined in Levin (2003) in that the fixed wage

has to depend on the state. Under a relational contract, there is a temptation to

renege which leads to the dynamic enforcement constraint as in the i.i.d. case. A

necessary and sufficient condition for an effort schedule to be implementable by a

history-independent contract is that it satisfies the IC constraint and the dynamic

enforcement constraint. I also show a necessary and sufficient condition for an effort

schedule to be implementable by a stationary contract. This condition is stronger

than the condition for history-independent contracts. The optimal contract either

implements the first-best level of effort, or it takes the form of a step function.

I also consider two mechanisms through which the persistence of the states affect

relational contracts. In an optimal history-independent contract, the joint surplus

in the first best can vary with the state which will affect the dynamic enforcement

constraint, and incentive provision for a given bonus cap can also vary with the state

through the IC constraint. I consider two mechanisms separately, holding the other

constant. I find that in both cases, if the joint surplus in the first best increases with

the state, or if the implementable level of effort for a given bonus cap increases with

the state, the difference in the joint surplus between the first best and the second

best decreases with the state. The joint surplus increases with the state in the second

best. In addition, I show that in the first case when the joint surplus in the first best

increases with the state, stationary contracts are optimal.

There are a growing number of papers on games, relational contracts or an implicit

contract equilibrium with persistent states. Thomas and Worrall (2010) consider a

two-sided incentive problem where the states and the efforts are observable and the

players have limited liability. McAdams (2011) considers joint-partnership games in

which the states are persistent and both the states and efforts are observable. The

players decide whether to stay in the relationship and how much effort to exert. The

main difference from my model is that there is no asymmetric information in their

models, and there is limited liability in Thomas and Worrall (2010). In Jovanovic

(1979a), the quality of a match is fully persistent and unknown to both parties at the

beginning. In his model, the new pair gets an i.i.d. draw from a known distribution.

In Kwon (2014), I consider moral hazard with persistent states and full commitment. States are unobservable in Kwon (2014). Garrett and Pavan (2012, 2014)

have moral hazard and persistent private information. There are also papers on

dynamic adverse selection with persistent private information. Athey and Bagwell

3

(2008) study collusion with private cost shocks, and Battaglini (2005) considers consumers with Markovian types. Escobar and Toikka (2013) show folk theorem results

with Markovian types and communication.

Lastly, this paper is also related to literature on partnership games with persistent

states. Rotemberg and Saloner (1996) and Haltiwanger and Harrington (1991) study

collusion in nonstationary markets. In Rotemberg and Saloner, the potential gain

from deviating is higher in a higher state, and the future surplus is not affected by

the state. In my first model in section 4, the gain from deviating is constant across

the states, and it is the future surplus that varies with the state; my model is closer

to Haltiwanger and Harrington.

The rest of the paper is organized as follows. Section 2 describes the model,

and the general results are presented in section 3. Section 4 discusses the types of

persistence of states and their implications on the joint surplus in the second best.

Section 5 concludes.

2

Model

The principal and the agent have the opportunity to trade over an infinite horizon,

t = 0, 1, 2, · · · . Both the principal and the agent are risk-neutral, and the common

discount factor is δ < 1.

The principal has limited commitment power and can only employ relational contracts. At the beginning of period t, the principal offers a compensation scheme to the

agent, which consists of a fixed salary wt and a contingent payment bt . Both the fixed

salary and the contingent payment can be functions of the history, which I will define

momentarily. The agent decides whether to accept the offer, and a payoff-relevant

parameter θt is realized. Both the principal and the agent observe the state. Note

that the principal offers the compensation scheme before the realization of the state;

he offers functions as the fixed salary and the bonus payment.

The state θt is drawn from the support Θ = [θ, θ̄]. The distribution of the state

θt depends only on the previous state θt−1 by P (θt |θt−1 ). It is time-invariant, and we

have P (θt |θt−1 ) = P (θ1 |θ0 ) for all t ≥ 1. In the initial period, the state θ0 is distributed

by P0 (θ0 ). The distributions P (θt |θt−1 ) and P0 (θ0 ) are common knowledge.

4

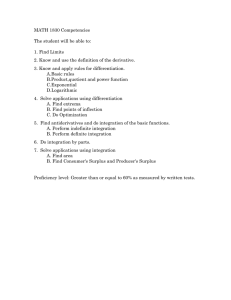

Timing in Each Period

Principal

makes

an offer.

Agent

accepts

/rejects.

θt becomes

observable.

Agent

chooses et .

Outcome yt

is realized.

Bonus

payment

is made.

Assumption 1. The distribution of state θt+1 when the previous state was θt is given

by P (θt+1 |θt ) and is identical for all t ≥ 0.

After the principal offers a compensation scheme, the agent decides whether or

not to accept, dt ∈ {0, 1}. If the agent accepts the compensation scheme, the agent

chooses how much effort to exert, et ∈ E = [0, ē]. The cost of effort, c(et , θt ), increases

with e, and c(e = 0, θ) = 0 for all θ, cee > 0. The agent’s effort generates outcome yt

with the distribution F (y|e, θ) and the support Y = [y, ȳ].1 The expected per-period

joint surplus can be written as a function of θ and e, S(e, θ) = E[y|e, θ] − c(e, θ).

Throughout the paper, when capitalized, S(e, θ) denotes the per-period joint surplus

in state θ if the agent chooses effort e.

I allow the distribution of the outcome and the cost function to depend on the

state. If neither of them depends on the state, we are back in an i.i.d. environment,

and in general, we can have one and/or the other to be state-dependent.

Each period, there are three pieces of payoff-relevant information: The costrelevant parameter θt , the agent’s effort et , and the outcome yt . The agent observes

all three parameters, but the principal observes only θt and yt . The performance

outcome is φt = {θt , yt }, and the set of all performance outcomes is denoted by Φ.

At the end of each period, the principal is obliged to pay the fixed salary wt , but

the contingent payment is only promised. The fixed salary wt : Ht × Θ → R is a

function of the state, and the contingent payment bt : Ht × Φ → R is a function of the

performance outcome, where Ht is the set of period-t histories. If bt > 0, the principal

decides whether to pay the agent, and if bt < 0, the agent has to decide whether to

make the payment. Denote the total payment to the agent by Wt ; Wt = wt + bt if the

contingent payment is made, and it is Wt = wt if not.

If the agent rejects the principal’s offer, the parties receive their outside option

for the period. The agent’s outside option is ū, and the principal’s outside option is

1

Most results of section 3 hold for any distribution of the outcome. The characterization of the

second-best contract requires an additional assumption.

5

π̄. The joint surplus from the outside option is denoted by s̄ = ū + π̄. I also assume

that the outside options ū, π̄ are independent of the state and constant over time.

Assumption 2 (Efficiency). The maximum joint surplus is strictly bigger than the

outside option for any state, but the outside option is weakly better than no effort.

For all θ ∈ Θ, maxe S(e, θ) > s̄ ≥ S(0, θ).

Given the distribution of the states, P (θt+1 |θt ), we can define the distribution of

θt+τ given θt , P (θt+τ |θt ). Let p(θt+1 |θt ) be the pdf of θt+1 , then we have

Z

p(θt+τ |θt ) =

Z

···

p(θt+τ |θt+τ −1 ) · · · p(θt+1 |θt )dθt+τ −1 dθt+1 ,

and P (θt+τ |θt ) can be constructed from p(θt+τ |θt ). The discounted payoffs to the

parties from date t given θt−1 are

∞

X

δ τ −t {dτ (Wτ − c(eτ , θτ )) + (1 − dτ )ū}|θt−1 ],

ut (θt−1 ) = (1 − δ)E[

τ =t

πt (θt−1 ) = (1 − δ)E[

∞

X

δ τ −t {dτ (yτ − Wτ ) + (1 − dτ )π̄}|θt−1 ],

τ =t

where the expectations are taken over θτ , (dτ , Wτ , eτ ), τ ≥ t, and F (·|e, θ). In period

0, the expectation is also taken over θ0 . At each period, the parties maximize their

expected payoffs. I define the expected joint surplus from period t and on as

st (θt−1 ) = ut (θt−1 ) + πt (θt−1 ).

Note that st (θt−1 ) is the expected discounted joint surplus, as it is discounted by 1−δ.

When capitalized, S(e, θ) is the expected joint surplus from the given period for e, θ.

Let ht = (w0 , d0 , φ0 , W0 , · · · , wt−1 , dt−1 , φt−1 , Wt−1 ) be the history up to period t

and Ht be the set of possible period-t histories. Given any period t and history ht ,

a relational contract specifies the compensation the principal offers, whether or not

the agent accepts it, and if the agent accepts the offer, it also specifies the effort

level. The compensations wt , bt are allowed to be functions of the history, and they

6

are functions of the following form:

wt : Ht × Θ → R,

bt : Ht × Φ → R.

A relational contract is self-enforcing if it forms a perfect public equilibrium of the

repeated game.

3

Optimal Contracts

This section characterizes the optimal relational contracts. The optimal contract

can be independent of history, but it may not be stationary as in Levin (2003), and

the fixed wage depends on the state. The self-enforcement leads to the dynamic

enforcement constraint as with i.i.d. states. The necessary and sufficient condition to

implement an effort schedule with stationary contracts is stronger than the dynamic

enforcement constraint. An optimal contract either implements the first-best level of

effort or takes the form of a step function.

A relational contract forms a perfect public equilibrium of the repeated game, and

there is multiplicity of equilibria. Instead of characterizing all relational contracts,

I focus on efficient contracting and focus on the Pareto frontier of the payoffs. The

first result is to note that the problem of efficient contracting can be separated from

the problem of distribution even if the states are persistent. The intuition is same as

in Levin (2003). The principal can always adjust the fixed salary to redistribute the

surplus.

Proposition 1. Suppose there exists a relational contract with expected joint surplus

s > s̄. Any expected payoff pair (u, π) with u ≥ ū, π ≥ π̄, u + π = s can be

implemented with a relational contract.

Any proof that is not presented in the text is in the appendix. As long as the

expected payoff is greater than the outside option, the parties are willing to initiate

the contract. The principal can adjust the distribution of the joint surplus by the fixed

salary of the initial period, and the resulting contract is still self-enforcing because the

incentives are not affected. Given Proposition 1, we can restrict attention to optimal

relational contracts that maximize the joint surplus from the contract.

7

The next result is that despite the persistence of the states, the maximum joint surplus can be achieved with history-independent contracts. I define history-independent

contracts as follows:

Definition 1. A contract is history-independent if Wt = w(θt ) + b(φt ), et = e(θt ) at

every t on the equilibrium path for some w : Θ → R, b : Φ → R and e : Θ → E.

Compared to stationary contracts in Levin (2003), the fixed wage in a historyindependent contract may depend on the realization of the state.

Definition 2. A contract is stationary if Wt = w + b(φt ), et = e(θt ) at every t on

the equilibrium path for some w ∈ R, b : Φ → R and e : Θ → E.

Note that the contract is independent of history on the equilibrium path. Without

loss of generality, we can assume that off the equilibrium path, the parties revert to

the static equilibrium of taking the outside option every period. With a historyindependent contract, the principal offers the identical compensation scheme every

period. The compensation scheme is independent of the history if it only depends on

the performance outcome of the given period. The fixed salary may depend on the

state, but given the same state, the fixed salary is constant over time.

Proposition 2. The maximum joint surplus can be attained with a history-independent

contract.

The proof of Proposition 2 goes as follows. When the states follow a Markov

process, the current state is a sufficient statistic for the distribution of future states.

Since it is observable to both the principal and the agent, there is no information

asymmetry regarding the distribution of the states or continuation values. Together

with risk-neutrality, the principal can provide a fixed continuation value for each state

and provide all incentives by the bonus payments in the given period. The incentive

provision becomes myopic, and the principal can further isolate each state, since it is

observable at the beginning of each period. Then the principal can provide optimal

incentives in each state in each period.

It is crucial that the states are Markov, observable to both the principal and

the agent and that they are both risk-neutral. It is also important that there is

no limited liability. If the state wasn’t observable to the principal, the principal

updates his belief about the state after observing the outcome. The principal and the

8

agent can have different beliefs on the state after the agent deviates, and the agent’s

deviation payoff is different from what the principal believes he’s providing the agent

with. The agent’s IC constraint has to take into account future periods, and we can

no longer isolate the incentive provision by each period. The principal also cannot

frontload all payments if the agent wasn’t risk-neutral or has limited liability. The

key to the proof is to recognize that the principal can provide a constant continuation

value for each state, independent of the history, and all incentives can be provided by

the bonus payments. If the states are exogenous and persistent but not Markov, then

the principal can offer a constant continuation value in each state, but the payments

have to depend on more than one period, and the optimal contract is not necessarily

history-independent.

With relational contracts, neither the principal or the agent commits to the contingent payment, and there exists a temptation to renege on the promised payment.

The contract is self-enforcing if the principal and the agent have no incentives to

renege. Since we are interested in the maximum joint surplus, there is no loss of generality in assuming that a deviation leads to the static equilibrium behavior.2 The

maximum joint surplus increases when the joint surplus after a deviation decreases,

and the payoffs of the principal and the agent are bounded from below by their outside options; therefore, the maximum joint surplus is attained when the parties revert

to the static equilibrium after a deviation.

The principal makes the promised payment if and only if

δ

(πt+1 (θt ) − π̄) ≥ sup b(θt , y), ∀θt ,

1−δ

y

and for the agent to make the promised payment, we need

δ

(ut+1 (θt ) − ū) ≥ − inf b(θt , y), ∀θt .

y

1−δ

From Proposition 1, the principal can redistribute the surplus by adjusting the

fixed wage, and the above inequalities can be combined in the dynamic enforcement

2

Specifically, the strategies are as follows. The possible deviations are (i) the principal offers an

unexpected compensation scheme, (ii) the agent rejects the offer when his strategy is to accept, (iii)

the agent accepts the offer when his strategy is to reject and (iv) the parties renege on the payment.

After a deviation, the principal makes no bonus payment, the agent’s expected payoff is his outside

option and the agent exerts zero effort in all future periods. The parties have correct beliefs, and

the principal takes his outside option after a deviation.

9

constraint:

(DE)

δ

(st+1 (θt ) − s̄) ≥ sup W (θt , y) − inf W (θt , y).

y

1−δ

y

The enforceable effort schedules are characterized by the agent’s IC constraint and

the dynamic enforcement constraint. The left-hand side of the dynamic enforcement

constraint is the maximum difference between any two bonus payments for a given

state, and I call it the bonus cap.

Theorem 1 and Proposition 3 generalize the results for stationary contracts in

Levin (2003) to history-independent contracts. The main intuition is that since the

states are observable and Markov, the principal can frontload all the incentives and

provide a constant continuation value.

Theorem 1. An effort schedule e(θ) with expected joint surplus s(θ) can be implemented with a history-independent contract if and only if there exists a payment

schedule W : Φ → R such that for all θ ∈ Θ,

(IC)

(DE)

e(θ) ∈ arg max Ey [W (φ)|e, θ] − c(e, θ),

e

δ

(s(θ) − s̄) ≥ sup W (θ, y) − inf W (θ, y).

y

1−δ

y

Note that the continuation payoffs from period t + 1 matter for the dynamic

enforcement constraint, but they don’t enter the agent’s IC constraint. Since the

states are persistent, the continuation payoffs ut+1 (θt ) and πt+1 (θt ) depend on the state

θt . But the principal also observes θt , and by Proposition 2, the principal can offer a

history-independent continuation contract, and the continuation value is independent

of the outcome yt . Therefore, even though the agent’s expected payoff from period t

is W (φt ) + δut+1 (θt ), ut+1 (θt ) doesn’t matter for the agent’s IC constraint.

However, the fixed wage in the optimal history-independent contract may vary

with the state. It only depends on the current state, but since the states are partially

persistent, providing a constant fixed wage for all states may be suboptimal.

Theorem 2. An effort schedule e(θ) with expected payoffs u(θ), π(θ) can be implemented with a stationary contract if and only if there exists a payment schedule

10

W : Φ → R such that for all θ ∈ Θ,

(IC) e(θ) ∈ arg max Ey [W (φ)|e, θ] − c(e, θ),

e

δ

δ

inf [

(u(θ) − ū) + inf W (φ)] + inf [

(π(θ) − π̄) − sup W (φ)] ≥ 0,

y

θ 1−δ

θ 1−δ

y

(SE)

(IR) u(θ) ≥ ū, π(θ) ≥ π̄.

I named the second condition in Theorem 2 the self-enforcement constraint. The

bonus payments are self-enforcing when the self-enforcement constraint is satisfied;

it is an analogue of the dynamic enforcement constraint for history-independent contracts. Theorem 2 shows that the necessary and sufficient condition for a stationary

contract is stronger than the IC and the dynamic enforcement constraint.

Proof of Theorem 2. (⇒) Suppose e(θ) can be implemented with a stationary contract w ∈ R, b : Φ → R. We need both parties to make the bonus payment:

δ

(π(θ) − π̄) ≥ sup b(φ) = sup(W (φ) − w),

1−δ

y

y

δ

(u(θ) − ū) ≥ − inf b(φ) = − inf (W (φ) − w).

y

y

1−δ

We can combine the inequalities to

δ

δ

(u(θ) − ū) + inf W (φ) ≥ w ≥ −

(π(θ) − π̄) + sup W (φ).

y

1−δ

1−δ

y

Since the inequality holds for all θ, we get the self-enforcement constraint,

inf [

θ

δ

δ

(u(θ) − ū) + inf W (φ)] + inf [

(π(θ) − π̄) − sup W (φ)] ≥ 0.

y

θ

1−δ

1−δ

y

The agent’s IC constraint has to be satisfied, and the continuation values for both

parties are weakly greater than the outside options.

(⇐) When the conditions are satisfied, the agent chooses e(θ) in each θ, and the

parties are willing to initiate the relationship. When the self-enforcement constraint

is satisfied, we can pick w such that

inf [

θ

δ

δ

(u(θ) − ū) + inf W (φ)] ≥ w ≥ − inf [

(π(θ) − π̄) − sup W (φ)],

y

θ 1−δ

1−δ

y

11

and the parties will make the bonus payment. By construction, the contract is selfenforcing in every period.

Comparing Theorems 1 and 2, we can see that stationary contracts may be suboptimal; the self-enforcement constraint in Theorem 2 is stronger than the dynamic

enforcement constraint. Specifically, we know that providing a constant fixed wage

is no longer optimal when the states are persistent. Also note that when a contract

is stationary, the continuation value for the agent may vary with the state. The

principal cannot frontload all the payments and provide the constant continuation

value.

We also know from the dynamic enforcement constraint that the per-period joint

surplus and the expected joint surplus decrease with the outside option s̄.

Corollary 1. The per-period joint surplus and the expected joint surplus weakly decrease with the outside option s̄.

Lastly, from Theorem 1, we obtain the following characterization of optimal contracts. Assumption 3 is maintained throughout the rest of the paper.

Assumption 3. The distribution of the outcome F (y|e, θ) satisfies the MirrleesRogerson constraints: F (y|e, θ) has the monotone likelihood ratio property, (fe /f

increases with y) and F (y|e, θ) is convex in e for any θ.

Proposition 3. Suppose Assumption 3 holds. An optimal contract either (i) implements eF B (θt ) or (ii) takes the form of a step function at each θt . When e(θt ) <

eF B (θt ), there exists y(θt ) such that W (θt , y) = W̄ (θt ) for y ≥ y(θt ) and W (θt , y) =

δ

(st+1 (θt ) − s̄), and the likelihood ratio fe /f

W (θt ) for y < y(θt ). W̄ (θt ) = W (θt ) + 1−δ

changes the sign at y(θt ).

When the distribution of the outcome satisfies the Mirrlees-Rogerson constraints,

the per-period joint surplus is concave in e. Together with risk neutrality of both

parties, the principal wants to use the strongest incentives possible. If an optimal

contract cannot induce the first-best effort eF B (θt ) in state θt , the DE constraint

binds, and the strongest incentives is to provide a step function that jumps when the

likelihood raio changes the sign.

History-independent contracts generalize the stationary contracts for i.i.d. states

in Levin (2003). However, stationary contracts are suboptimal with persistent states,

and the fixed wage under the optimal contract depends on the state.

12

4

Joint Surplus in the Second Best

I consider the joint surplus in the second best for two types of persistence in this

section. From Theorem 1, we know that an effort schedule can be implemented

with a history-independent contract if and only if the IC and the DE are satisfied.

Different states can affect the IC and/or the DE differently; for the given bonus cap,

the implementable action can vary with the state, and the joint surplus can also vary

with the state which will affect the DE. I consider two channels separately.

In the first case, the joint surplus in the first best increases with the state. When

the cost function is separable and strictly decreases with the state, incentive provision

is identical in each state, and in particular, given a bonus cap, the principal can

implement the same level of effort in every state. The second type of persistence I

consider is when the incentive provision becomes easier in a higher state. The joint

surplus in the first best is identical in all states. In both cases, the joint surplus

increases with the state in the second best; the difference in joint surplus between the

first best and the second best decreases with the state. I also show that stationary

contracts are optimal in the first case, even though they are not optimal in general.

4.1

Joint Surplus Varies with the State

In this section, I consider the case in which the joint surplus varies with the state

and the incentive provision is constant across the states. Specifically, I assume the

following.

Assumption 4. The cost of effort is separable and strictly decreases with the state:

There exist c1 : E → R, c2 : Θ → R such that

c(e, θ) = c1 (e) + c2 (θ), ∀e ∈ E, θ ∈ Θ

and c02 < 0 for all θ ∈ Θ.

Assumption 5. F (·|e, θ) is independent of θ.

Assumption 6. θt > θt0 implies P (·|θt ) %FOSD P (·|θt0 ).

I also define ∆W (θ) as the minimum bonus cap to be able to induce the first-best

13

level of effort in state θ. Given a state θ, eF B (θ) can be a solution to

e(θ) ∈ arg max Ey [W (φ)|e] − c(e, θ),

e

∆W ≥ sup W (θ, y) − inf W (θ, y)

y

y

if and only if ∆W ≥ ∆W (θ).

As a benchmark, I first show the implications of Assumptions 4-6 in the first best

and in the case the principle has a within-period commitment power.

Proposition 4. Suppose Assumptions 4-6 hold. Both the per-period joint surplus

and the expected joint surplus in the first best strictly increases with the state. The

first-best level of effort is constant across all states θ ∈ Θ. The minimum bonus cap

to implement the first-best level of effort, ∆W (θ), is also constant across the states.

If the principal can credibly promise W (φ), the principal implements the same level

of effort, e∗ = eF B in all states.

Proof. The first-best effort maximizes the expected joint surplus in state θ,

Z

Ey [y|e] − c(e, θ) =

yf (y|e)dy − c1 (e) − c2 (θ).

Since the cost of effort is separable, the maximization problems for any two states

are constant transformations of each other, and the first-best level of effort is constant across the states. The cost strictly decreases with the state, and the expected

per-period joint surplus in the first best in state θ strictly increases with the state.

By the persistence of states, the joint surplus also increases with the state. Since

the maximization problems are a constant transformation of each other, ∆W (θ) is

constant across the states.

If the principal can commit to bonus payments, the only constraint is the agent’s

IC constraint. By the efficiency assumption, it is efficient to induce the first-best level

of effort than to take the outside option in all states θ, and the principal induces the

first-best level of effort in all θ.

Now consider relational contracts under Assumptions 4-6. Define sF B (θ) as the

expected joint surplus in the first best when the previous state is θ. We know from

δ

Proposition 4 that ∆W (θ) is constant over θ. Denote ∆W ∗ = ∆W (θ). If 1−δ

(sF B (θ)−

s̄) ≥ ∆W ∗ , the principal can implement the first-best level of effort in all states with

14

relational contracts, and the problem becomes trivial. I will make the following

assumption:

Assumption 7. The principal cannot induce the first-best level of effort in the lowest

state:

δ

(sF B (θ) − s̄) < ∆W ∗ .

1−δ

Define e(θ|∆W ) to be the solution to the optimization problem

maxe Ey [y − c|e, θ] s.t. e(θ) ∈ arg max Ey [W (φ)|e] − c(e, θ),

e

∆W ≥ sup W (θ, y) − inf W (θ, y).

y

y

e(θ|∆W ) is the level of effort that maximizes the per-period joint surplus in state θ

when the bonus cap is ∆W . From the Mirrlees-Rogerson constraints, the joint surplus

is concave in e. If ∆W ≤ ∆W ∗ , the principal cannot implement the first-best level of

effort, and e(θ|∆W ) < eF B (θ). Since the principal can always mimic the payments

with ∆W 0 if ∆W ≥ ∆W 0 , the implementable level of effort weakly increases with the

bonus cap, and we have e(θ|∆W ) ≥ e(θ|∆W 0 ), ∀θ.

Lemma 1. The implementable level of effort e(θ|∆W ) weakly increases with ∆W for

all θ.

Proof. The proof follows from the fact that the principal can always mimic the compensation scheme with ∆W 0 if ∆W ≥ ∆W 0 .

Under relational contracts, the expected joint surplus from the following period

limits the principal’s ability to induce effort, and Proposition 4 states that the joint

surplus in the first best strictly increases with the state. The implementable level of

effort is lower in a worse state, and given the persistence of states, the difference in

the expected joint surplus is reinforced by the implementable effort. Under Assumptions 4-7, the joint surplus under an optimal relational contract increases with the

state, and the difference in the joint surplus between the first best and the second

best decreases with the state.

Proposition 5. Suppose Assumptions 4-7 hold. Let sSB (θ) be the expected joint

surplus under an optimal relational contract. sSB (θ) strictly increases with θ, and

FB

∂sSB

≥ ∂s∂θ > 0. The difference in the joint surplus between the first best and the

∂θ

15

second best, sF B (θ)−sSB (θ), weakly decreases with the state. The difference is strictly

positive at θ.

Proof. We know from Lemma 1 that the implementable level of effort, e(θ|∆W ),

weakly increases with ∆W . From Proposition 4, the expected joint surplus in the

first best increases with the state, and Assumption 7 says that the expected joint surplus in the state θ is not big enough to induce the first-best level of effort. Since the

distribution of the states increases with the state in the sense of first-order stochastic

dominance, the implementable level of effort under an optimal relational contract increases with the state, and the expected joint surplus in the second best also increases

with the state.

Consider the difference in per-period joint surplus between the first best and the

second best.

S(eF B , θ) − S(e(θ|∆W ), θ)

=(E[y|eF B ] − c(eF B , θ)) − (E[y|e(θ|∆W )] − c(e(θ|∆W ), θ))

=(E[y|eF B ] − c1 (eF B )) − (E[y|e(θ|∆W )] − c1 (e(θ|∆W ))).

Given ∆W , e(θ|∆W ) is constant across the states, and we also know that

E[y|e(θ|∆W )] − c1 (e(θ|∆W ))

increases with ∆W . Therefore, the difference in the per-period joint surplus,

S(eF B , θ) − S(e(θ|∆W ), θ),

decreases with the state, and by the persistence of the states, the difference in the expected joint surplus also decreases with the state. From Assumption 7, the difference

is strictly positive at θ.

When the per-period joint surplus in the first best increases with the state, the

persistence of the states enter the optimization problem through the bonus cap, and

the expected joint surplus under an optimal relational contract also increases with

the state. The dynamic enforcement constraint magnifies the impact of persistent

states, and the expected joint surplus varies more in the second best than in the first

best.

16

The next theorem shows that, however, stationary contracts are optimal in this

environment.

Theorem 3. Suppose Assumptions 4-7 hold. The joint surplus can be maximized

with stationary contracts.

Proof. I’m going to construct a stationary contract under which the joint surplus is

maximized. From Proposition 2, we know that the joint surplus can be maximized

with a history-independent contract. Let e(θ) and s(θ) be the effort and the expected

joint surplus given state θ under the history-independent contract that maximizes the

joint surplus. From Theorem 1, there exists a payment schedule W : Φ → R such

that for all θ ∈ Θ,

(IC) e(θ) ∈ arg max Ey [W (φ)|e, θ] − c(e, θ),

e

δ

(s(θ) − s̄) ≥ sup W (θ, y) − inf W (θ, y).

y

1−δ

y

(DE)

We also know from Proposition 3 that the contract either implements the first-best

action or takes a form of a step function at the given θ:

(

W (φ) =

W (θ)

W (θ) +

δ

(s(θ)

1−δ

if y < ŷ

− s̄) if y ≥ ŷ,

where fe changes the sign at ŷ. In particular, from the FOC-IC, we know that if

e(θ) 6= eF B , then e(θ), s(θ) satisfy

ȳ

Z

fe (y|e(θ))dy

ŷ

δ

(s(θ) − s̄) = ce (e(θ), θ)

1−δ

(∗)

I will now construct a payment schedule W̃ : Φ → R such that for all θ ∈ Θ,

s(θ) = u(θ) + π(θ) and

(IC) e(θ) ∈ arg max Ey [W̃ (φ)|e, θ] − c(e, θ),

e

(SE)

inf [

θ

δ

δ

(u(θ) − ū) + inf W̃ (φ)] + inf [

(π(θ) − π̄) − sup W̃ (φ)] ≥ 0,

y

θ

1−δ

1−δ

y

(IR) u(θ) ≥ ū, π(θ) ≥ π̄.

Then it follows from Theorem 2 that e(θ), u(θ), π(θ) can be implemented with a

17

stationary contract.

From Proposition 5, there exists θ̂ such that the DE binds if and only if θ ≤ θ̂.

The principal implements eF B for θ > θ̂. Since the contract implements the first-best

action or takes a form of a step function, we know that on [θ, θ̂]

(

W (φ) =

W (θ)

W (θ) +

if y < ŷ

δ

(s(θ) − s̄) if y ≥ ŷ,

1−δ

If a stationary contract maximizes the joint surplus, the second term in the SE becomes

δ

δ

δ

(π(θ) − π̄) − sup W̃ (φ) =

(π(θ) − π̄) − (inf W̃ (φ) +

(s(θ) − s̄))

y

1−δ

1−δ

1−δ

y

δ

=−

(u(θ) − ū) − inf W̃ (φ),

y

1−δ

and the SE simplifies to

δ

(u(θ) − ū) + inf W̃ (φ) = w

y

1−δ

for some w ∈ R and all θ ≤ θ̂.

Denote inf y W̃ (φ) = Ŵ (θ). Construct W̃ such that

all θ, and define

Ŵ (θ)

W̃ (φ) =

Ŵ (θ) +

Ŵ (θ) +

δ

(s(θ)

1−δ

δ

(s(θ̂)

1−δ

δ

(u(θ) − ū) + Ŵ (θ)

1−δ

= w on

if y < ŷ,

− s̄) if y ≥ ŷ, θ ≤ θ̂

− s̄) if y ≥ ŷ, θ > θ̂.

By construction, the IC and the SE are satisfied, and it remains to verify that the IR

is also satisfied. We can express the expected payoff of the agent and the principal

18

as below:

Z

(1 − δ)(Ey [W̃ (φ)] − c(e, θ0 )) + δu(θ0 )dP (θ0 |θ)

u(θ) =

θ̂

Z

(1 − δ)w + δū + (1 − F (ŷ))δ(s(θ0 ) − s̄) − (1 − δ)c(e, θ0 )dP (θ0 |θ)

=

θ

Z

+

θ̄

(1 − δ)w + δū + (1 − F (ŷ))δ(s(θ̂) − s̄) − (1 − δ)c(eF B , θ0 )dP (θ0 |θ),

θ̂

Z

π(θ) =

Z

=

(1 − δ)S(θ0 ) + δs(θ0 )dP (θ0 |θ) − u(θ)

θ̂

(1 − δ)(E[y|e(θ0 )] − w) + δπ̄ + F (ŷ)δ(s(θ0 ) − s̄)dP (θ0 |θ)

θ

Z

+

θ̄

(1 − δ)(E[y|eF B ] − w) + δπ̄ + F (ŷ)δ(s(θ̂) − s̄) + δ(s(θ0 ) − s(θ̂))dP (θ0 |θ).

θ̂

On [θ, θ̂], we have

d

δ

[(1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 )]

0

dθ

1−δ

∂

δ

= 0 [(1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 )]

∂θ

1−δ

de

d

δ

+ 0 (θ0 ) [(1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 )]

dθ

de

1−δ

∂

δ

= 0 [(1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 )]

∂θ

1−δ

by the IC. We know from Proposition 5 that s(θ0 ) increases with θ0 , and c02 < 0

from Assumption 4. Therefore, the integrand in u(θ) increases with θ0 , and from

Assumption 6, u(θ) also increases with θ. It is sufficient to verify u(θ) ≥ ū.

19

For the principal, on [θ, θ̂], we have

δ

d

δ

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 ))]

[S(θ0 ) +

0

dθ

1−δ

1−δ

∂

δ

δ

= 0 [S(θ0 ) +

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 ))]

∂θ

1−δ

1−δ

δ

δ

de

d

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 ))]

+ 0 (θ0 ) [S(θ0 ) +

dθ

de

1−δ

1−δ

∂

δ

δ

= 0 [S(θ0 ) +

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 ))]

∂θ

1−δ

1−δ

de

d

+ 0 (θ0 ) S(θ0 )

dθ

de

by the IC. From the Mirrlees-Rogerson constraints, the per-period joint surplus is concave in e. Since s(θ0 ) increases on [θ, θ̂] from Proposition 5, it follows from Lemma 1

that e(θ0 ) also weakly increases on this interval. The second term in the above expression is weakly positive. By rearranging the terms, we get

∂

δ

δ

[S(θ0 ) +

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄) − c(e(θ0 ), θ0 ))]

0

∂θ

1−δ

1−δ

∂

∂

δ

δ

s(θ0 ) − ((1 − F (ŷ|e(θ0 )))

(s(θ0 ) − s̄)]

= 0 [S(θ0 ) + c(e(θ0 ), θ0 )] + 0 [

∂θ

∂θ 1 − δ

1−δ

It follows that the integrand in π(θ) increases with θ0 , and from Assumption 6, π(θ)

increases with θ. It is sufficient to verify π(θ) ≥ π̄.

As long as the expected joint surplus at θ is weakly greater than s̄, we can always find w such that both IR constraints are satisfied. Fix w such that the IR is

satisfied, then u(θ), π(θ) are pinned down for all θ. From our construction of W̃ (φ)

δ

(u(θ) − ū) + Ŵ (θ) = w, b(φ) is pinned down for all φ ∈ Φ. The IC and the

and 1−δ

SE are satisfied. Therefore, the joint surplus can be maximized with a stationary

contract.

The self-enforcement constraint for stationary contracts is stronger than the dynamic enforcement constraint for history-independent contracts in general. However,

when the cost function is separable and the joint surplus increases with the state,

then stationary contracts are optimal, and the principal can maximize the joint surplus with stationary contracts. In general, if we don’t know that u(θ) and π(θ) are

monotone, it is difficult to verify whether a fixed salary w such that the IR is satisfied

at all θ exists. However, we know from Proposition 5 that the joint surplus increases

20

with the state, and one can show that stationary contracts are in fact optimal in this

setting.

4.2

Incentive Provision Varies with the State

This section considers the alternative case in which the joint surplus in the first best

is constant across the states but the incentive provision varies with the state.

I assume that the first-best level of effort is constant across the states. This is

without loss of generality for any interior solution eF B . I also assume that for a given

bonus cap, the maximum per-period joint surplus strictly increases with the state,

and the principal cannot implement the first-best level of effort in the worst state,

even if the bonus cap was given by the first best.

Assumption 8. The first-best level of effort is constant in all states. The per-period

joint surplus in the first best is constant across the states: S(eF B , θ) = S ∗ for all θ.

Assumption 9. For a given bonus cap ∆W , if the principal cannot induce the firstbest level of effort, the maximum per-period joint surplus strictly increases with the

state. i.e., S(e(θ|∆W ), θ) strictly increases with θ for all e(θ|∆W ) < eF B .

Assumption 10. The principal cannot implement the first-best level of effort in the

lowest state, that is e(θ|sF B ) < eF B .

Under Assumptions 6, 8-10, the expected joint surplus in the second best strictly

increases with the state, and the difference in the expected joint surplus between

the first best and the second best decreases with the state. We have the following

proposition which is an analogue of Proposition 5.

Proposition 6. Suppose Assumptions 6, 8, 9 and 10 hold. There exists θ∗ ∈ Θ such

that sSB (θ) strictly increases with θ for θ ≤ θ∗ , and sSB (θ) = S ∗ for θ > θ∗ . The

difference in the joint surplus between the first best and the second best, S ∗ − sSB (θ),

weakly decreases with the state. The difference is strictly positive at θ.

Proof. By Assumptions 9, 10 and the persistence of the states, the per-period joint

surplus in the second best weakly increases with θ, and it increases strictly for all θ

such that e(θ|sSB (θ)) < eF B . Therefore, the expected joint surplus in the second best

also increases with the state. Since the first-best joint surplus is constant across the

states, the difference between the first best and the second best decreases with the

state.

21

I have considered two types of persistent states. In both environments, the difference in the expected joint surplus between the first best and the second best decreases

with the state. If the two factors, the level of joint surplus in the first best and the

difficulty of incentive provision, move in the same direction, the effect will be magnified. If they move in the opposite directions, the difference in the joint surplus will

be determined by which effect dominates.

5

Conclusion

I study relational contracts in a persistent environment. I show that when there is

no asymmetric information about the state, history-independent contracts are optimal, and I derive necessary and sufficient conditions to implement an effort schedule

with history-independent contracts. These properties show that history-independent

contracts are appropriate generalization of stationary contracts. Stationary contracts

are no longer optimal when the states are partially persistent. The necessary and sufficient condition to implement an effort schedule with stationary contracts is stronger

than the dynamic enforcement constraint.

Suboptimality of stationary contracts means that the persistence of the underlying

environment changes the optimal contract qualitatively. If the environment is persistent, providing bonus payments may not be sufficient, and the fixed wage may also

have to vary with the state. Given that many compensation schemes have a constant

fixed wage in every state, the firms will be strictly better off with state-dependent

wages.

When the states are observable and follow a first-order Markov chain, the state

in any given period is a sufficient statistic for the distribution of future states. In

particular, the outcome doesn’t carry any information about the distribution of future

states, and the principal can provide incentives by the bonus payments in the given

period. It is optimal to provide the same expected per-period payoff in every state.

If in some period the continuation contract for a given state provides the maximum

joint surplus for the given state, the principal can provide the same continuation

contract in every period for the given state. Since the agent gets the same expected

payoff in all states, the agent’s IC constraints are still satisfied when the principal

replaces the continuation contract, and the optimal contract can be independent of

history. The principal can also redistribute the surplus through the fixed wage, and

22

we get the dynamic enforcement constraint as with i.i.d. states. An effort schedule

can be implemented with history-independent contracts if and only if it satisfies the

IC constraint and the dynamic enforcement constraint. I also show that an effort

schedule can be implemented with stationary contracts if and only if it satisfies the

IC, the IR and the self-enforcement constraint which is stronger than the dynamic

enforcement constraint.

Persistent states can affect the relational contracts through two mechanisms. The

persistence of the states implies that if the joint surplus depends on the state, the

bonus cap in the DE also varies with the state, and the implementable level of effort

depends on the state, even if the incentive provision for the given bonus cap is identical

in each state. On the other hand, in the IC, the incentive provision for the given

bonus cap can also change with the state. Analyzing those channels separately, I

have shown that if the joint surplus in the first best increases with the state, or if

the implementable level of effort for a given bonus cap increases with the state, the

joint surplus in the first best and the second best increase with the state, and the

gap between the two decreases with the state. I also show that with separable cost

functions, stationary contracts are optimal. When the cost function is separable and

decreasing with the state, the joint surplus in the second best increases with the state,

and one can construct a stationary contract that maximizes the joint surplus.

I have considered partially persistent environments where the states are observable

and the persistence is of first-order. If the states are observable, the optimal contract

can be independent of history. However, if the states were unobservable, there could

be information asymmetry between the principal and the agent about the future

states. The belief about the agent’s effort matters for the future, and the relational

contract will likely have to take into account the private information. It will be

interesting to study relational contracts and their implications for the market when

the information about the future states is no longer symmetric.

A

Proofs

Proof of Proposition 1. Consider the relational contract that provides s. In the initial

period, the principal offers w(θ0 ), b(φ0 ), and if the agent accepts, he exerts effort e(θ0 ).

The continuation payoffs under the contract are denoted by u(φ0 ) and π(φ0 ), and the

expected payoffs from the contract are u0 and π0 . Without loss of generality, we can

23

assume that off the equilibrium path, the parties revert to the static equilibrium of

(ū, π̄). The first period payment W is a function of φ0 .

The contract is self-enforcing if and only if the following conditions hold:

(i) u0 ≥ ū, π0 ≥ π̄,

(ii) e(θ0 ) ∈ arg max Ey [(1 − δ)W (φ0 ) + δu(φ0 )|e, θ0 ] − c(e, θ0 ),

e

δ

δ

u(φ0 ) ≥

ū,

1−δ

1−δ

δ

δ

π(φ0 ) ≥

π̄,

− b(φ0 ) +

1−δ

1−δ

(iii) b(φ0 ) +

and (iv) each continuation contract is self-enforcing.

Given any (u, π) such that u ≥ ū, π ≥ π̄, u + π = s, the principal can offer the

same b(φ0 ) and continuation contracts and adjust w(θ0 ) to

ŵ(θ0 ) ≡ w(θ0 ) −

π − π0

.

1−δ

The conditions are satisfied with the new contract, and it provides (u, π) as the

expected payoffs.

Proof of Proposition 2. Suppose a contract that maximizes the joint surplus provides

wt , bt and the agent chooses et . The first step is to construct an alternative contract

ŵt , b̂t under which the agent chooses the same level of effort et and his expected

payoff is equal to ū in every state.

The distribution of the states from period t + 1 only depends on θt , and the

outcome yt doesn’t carry any information about the future states. The principal can

adjust the contingent payment bt and keep the expected payoff in each state constant.

Specifically, consider the following contract. Let ut (ht , φt ) be the continuation value

of the agent under the given contract, and define ŵt , b̂t as follows:

δ

(ut (ht , φt ) − ū),

1−δ

ŵt (ht , θt ) ≡ ū − Eyt [b̂t (ht , φt ) − c(et (ht , θt ), θt )|et (ht , θt )].

b̂t (ht , φt ) ≡ bt (ht , φt ) +

From

b̂t (ht , φt ) +

δ

δ

ū = bt (ht , φt ) +

ut (ht , φt ),

1−δ

1−δ

24

the agent chooses the same level of effort et under the new contract. The agent’s

expected payoff is ū for all t, ht , θt .

The next step is to show that we can choose w̃ : Θ → R, b̃ : Φ → R such that

the principal offers w̃, b̃ in every period. Consider ŵt and b̂t . The agent’s expected

payoff is constant over all t, ht , and θt , which implies that the agent’s IC constraint

is determined by the within-period compensation scheme. Specifically, the agent

chooses e such that

et (ht , θt ) ∈ arg max Eyt [b̂t (ht , φt )|e, θt ] − c(e, θt ).

e

When the agent’s IC constraints are myopic, the principal can replace a compensation scheme for any given period with another compensation scheme without affecting

the incentives. The principal can also treat each θ separately, because the state is

observable before the agent chooses the effort. Specifically, let b̃ be the compensation

scheme that maximizes the expected per-period joint surplus for state θ:

b̃(θ, ·) ≡ arg maxb̂t (ht ,θ,·),ht Ey [y|et (ht , θ), θ] − c(et (ht , θ), θ)

s.t. et (ht , θ) ∈ arg max Ey [b̃t (ht , θ, ·)|e, θ] − c(e, θ).

e

If there’s a multiplicity of the compensation schemes, we can pick one without loss of

generality.

Given b̃ : Φ → R, the agent chooses e : Θ → E such that

e(θ) ∈ arg max Ey [b̃(φ)|e, θ] − c(e, θ).

e

Define w̃ as

w̃(θ) ≡ ū − Ey [b̃(φ) − c(e(θ), θ)|e(θ), θ],

and we have a history-independent contract that maximizes the expected joint surplus. By construction, it is self-enforcing, and it provides the same expected payoff

to the agent in all t, ht , θt . Let s∗ be the minimum expected per-period joint surplus

over the states under b̃, w̃:

s∗ ≡ min{Ey [y|e(θ), θ] − c(e(θ), θ)}.

θ

The principal can adjust the fixed salary and can provide any u such that ū ≤ u ≤

25

s∗ − π̄ to the agent as the constant expected payoff.

Proof of Theorem 1. (⇒) Suppose e(θ) is implementable. Let u(θ) and π(θ) be the

continuation value for the agent and the principal when the previous state was θ. The

IC constraint has to be satisfied, and we also know that

δ

(π(θ) − π̄) ≥ sup b(θ, y), ∀θ,

1−δ

y

δ

(u(θ) − ū) ≥ − inf b(θ, y), ∀θ

y

1−δ

(1)

(2)

have to hold. Adding the two inequalities, we have the dynamic enforcement constraint.

(⇐) Suppose W (φ) and e(θ) satisfy the IC constraint and the dynamic enforcement constraint. Define

b(φ) = W (φ) − inf W (φ̂),

φ̂

w(θ) = ū − Ey [b(φ) − c(e(θ), θ)|e(θ), θ],

and consider the history-independent contract with w(θ), b(φ) and e(θ). The parties

revert to the static equilibrium if a deviation occurs. The agent receives ū as the

expected payoff in each state, and the principal receives π(θ) = s(θ)− ū if the previous

state was θ. By the dynamic enforcement constraint, s(θ) ≥ s̄ and π(θ) ≥ π̄ for all

θ. From the IC constraint, the agent chooses e(θ) in each state θ, and it can be

verified that Inequalities (1) and (2) are satisfied. By construction, the contract is

self-enforcing in every period.

Proof of Corollary 1. From the dynamic enforcement constraint, the bonus cap decreases with the outside option s̄. The maximum per-period joint surplus weakly

decreases with s̄, which further suppresses the bonus cap through the expected joint

surplus. Therefore, both the per-period joint surplus and the expected joint surplus

decrease with s̄.

Proof of Proposition 3. We know from Proposition 1 that we can focus on maximizing the joint surplus, and Proposition 2 implies that we can focus on historyindependent contracts. By the Mirrlees-Rogerson constraints, we can replace the

26

agent’s IC constraint with the first-order condition. The optimal history-independent

contract solves

max Eθ,y [y − c|e(θ), θ]

e(·),W (·,·)

subject to

d

{Ey [W (θ, y) − c(e, θ)|e = e(θ), θ]} = 0, ∀θ,

de

δ

(s(θ) − s̄) ≥ sup W (θ, y) − inf W (θ, y),

θ,y

1−δ

θ,y

X

s(θ0 ) = (1 − δ)E[

δ t {dt (yt − c(et , θt )) + (1 − dt )s̄}|θ0 ].

t=0

From the Mirrlees-Rogerson constraints, the principal wants to maximize e when

e(θt ) < eF B (θt ). We get

(

W (θ, y) =

W̄ (θ)

W (θ)

if y ≥ y(θ)

,

if y < y(θ).

and fe changes the sign at y(θ), and W̄ (θ) = W (θ) +

δ

(s(θ)

1−δ

− s̄).

References

[1] Athey, Susan, and Kyle Bagwell. “Collusion with Persistent Cost Shocks.”

Econometrica 76 (2008): 493-540.

[2] Baker, George, Robert Gibbons, and Kevin J. Murphy. “Relational Contracts

and the Theory of the Firm.” Quarterly Journal of Economics 117 (2002): 3984.

[3] Battaglini, Marco. “Long-Term Contracting with Markovian Consumers.” American Economic Review 95 (2005): 637-58.

[4] Bull, Clive. “The Existence of Self-Enforcing Implicit Contracts.” Quarterly

Journal of Economics 102 (1987): 147-59.

[5] Eeckhout, Jan. “Minorities and Endogenous Segregation.” Review of Economic

Studies 73 (2006): 31-53.

27

[6] Escobar, Juan F., and Juuso Toikka. “Efficiency in Games with Markovian Private Information.” Econometrica 81 (2013): 1887-1934.

[7] Fudenberg, Drew, Bengt Holmstrom, and Paul Milgrom. “Short-Term Contracts

and Long-Term Agency Relationships.” Journal of Economic Theory 51 (1990):

1-31.

[8] Fujiwara-Greve, Takako, and Masahiro Okuno-Fujiwara. “Voluntarily Separable

Repeated Prisoner’s Dilemma.” Review of Economic Studies 76 (2009): 993-1021.

[9] Garrett, Daniel, and Alessandro Pavan. 2014. “Dynamic Managerial Compensation:

On the Optimality of Seniority-based Schemes.”

http://faculty.wcas.northwestern.edu/∼apa522/.

[10] Garrett, Daniel, and Alessandro Pavan. “Managerial Turnover in a Changing

World.” Journal of Political Economy 120 (2012): 879-925

[11] Ghosh, Parikshit, and Debraj Ray. “Cooperation in Community Interaction

Without Information Flows.” Review of Economic Studies 63 (1996): 491-519.

[12] Haltiwanger, John, and Joseph E. Harrington, Jr. “The Impact of Cyclical

Demand Movements on Collusive Behavior.” RAND Journal of Economics 22

(1991): 89-106.

[13] Jovanovic, Boyan. “Job matching and the theory of turnover.” Journal of Political Economy 87 (1979): 972-990.

[14] Jovanovic, Boyan. “Firm-specific capital and turnover.” Journal of Political

Economy 87 (1979): 1246-1260.

[15] Kranton, Rachel E. “The Formation of Cooperative Relationships.” Journal of

Law, Economics, and Organization 12 (1996): 214-33.

[16] Kranton, Rachel E. “Reciprocal exchange: A self-sustaining system.” American

Economic Review 86 (1996): 830-851.

[17] Kreps, David M. “Corporate Culture and Economic Theory.” In Perspectives on

Positive Political Economy, edited by James E. Alt and Kenneth A. Shepsle,

90-143. Cambridge: Cambridge University Press, 1990.

28

[18] Kwon, Suehyun. 2014. “Dynamic Moral Hazard with Persistent States.”

http://www.ucl.ac.uk/∼uctpskw.

[19] Levin, Jonathan. “Relational Incentive Contracts.” American Economic Review

93 (2003): 835-57.

[20] MacLeod, W. Bentley, and James M. Malcomson. “Implicit Contracts, Incentive

Compatibility, and Involuntary Unemployment.” Econometrica 57 (1989): 44780.

[21] MacLeod, W. Bentley, and James M. Malcomson. “Motivation and markets.”

American Economic Review 88 (1998): 388-411.

[22] McAdams, David. “Performance and Turnover in a Stochastic Partnership.”

American Economic Journal: Microeconomics 3 (2011): 107-42.

[23] Rayo, Luis. “Relational Incentives and Moral Hazard in Teams.” Review of Economic Studies 74 (2007): 937-63.

[24] Rogerson, William P. “The First-Order Approach to Principal-Agent Problems.”

Econometrica 53 (1985): 1357-67.

[25] Rotemberg, Julio J., and Garth Saloner. “A Supergame-Theoretic Model of Price

Wars during Booms.” American Economic Review 76 (1986): 390-407.

[26] Shapiro, Carl, and Joseph E. Stiglitz. “Equilibrium Unemployment as a Worker

Discipline Device.” American Economic Review 74 (1984): 433-44.

[27] Tchistyi,

Alexei. 2013. “Security Design with Correlated Hidden Cash Flows:

The Optimality of Performance Pricing.”

http://faculty.haas.berkeley.edu/Tchistyi/.

[28] Thomas, Jonathan, and Tim Worrall. “Foreign Direct Investment and the Risk

of Expropriation.” Review of Economic Studies 61 (1994): 81-108.

[29] Thomas, Jonathan, and Tim Worrall. 2010. “Dynamic Relational Contracts with

Credit Constraints.” The School of Economics Discussion Paper Series 1009.

[30] Watson, Joel. “Starting Small and Renegotiation.” Journal of Economic Theory

85 (1999): 52-90.

29