Dynamic Moral Hazard with Persistent States Suehyun Kwon March 9, 2015

advertisement

Dynamic Moral Hazard with Persistent States

Suehyun Kwon∗

March 9, 2015

Abstract

This paper studies a principal-agent problem in a partially persistent environment. The costly unobservable action of the agent produces a good outcome

with some probability corresponding to the state. The state is unobservable and

follows an irreducible Markov chain. There exist second-best contracts resembling a tenure system: The agent is paid nothing during a probationary period

after which the principal implements the first-best action every period. A probationary period is necessary in the second best, and the second-best contract

becomes stationary after tenure. The paper provides a recursive formulation

for complete characterization of the second best. (JEL: C73, D82)

1

Introduction

There is a large literature on repeated moral hazard with i.i.d. states or fully persistent states.1 But some environments are better described by partially persistent

∗

Kwon: University College London, suehyun.kwon@ucl.ac.uk, Department of Economics, University College London, Gower Street, London, WC1E 6BT United Kingdom. I’m very grateful

to Glenn Ellison, Juuso Toikka and Muhamet Yildiz for time, advice and encouragement. This

paper has benefited from suggestions of V. Bhaskar, Gabriel Carroll, Martin Cripps, Robert Gibbons, Bengt Holmström, Johannes Hörner, Jean Tirole, Alexander Wolitzky, seminar participants

at Kyung Hee University, London Business School, Pennsylvania State University, Princeton University, Seoul National University, University College London, University of Essex, University of

Illinois at Urbana-Champaign, IFORS 2014 and lunch seminar participants at MIT. I thank Samsung Scholarship for financial support.

1

Dutta and Radner (1994), Fudenberg, Holmström and Milgrom (1990), Holmström and Milgrom

(1987), Malcomson and Spinnewyn (1988), Radner (1981, 1985), Rogerson (1985), Rubinstein and

Yaari (1983)

1

states. Productivity of an economic sector varies from year to year, but high productivity is more likely to come after a productive year than after an unproductive year.

Fundamentals or profitability of a firm can change over time. Technological advances

are also often clustered. Consider a firm whose fundamentals are unknown to the

investors and the manager. If the outcome reflects both the fundamentals and the

manager’s effort, then the investors and the manager learn about the fundamentals

from the observed outcome. The investors’ inference on the fundamentals depends

on their belief about the manager’s effort; the manager’s effort has both an informational value and the outcome consequence. An optimal contract should address this

potential information asymmetry in addition to moral hazard.

In this paper, I examine a model of dynamic moral hazard with partially persistent states; I note that persistent states create an informational rent for the agent

and explore properties of the second-best contracts. I find that there exist secondbest contracts resembling a tenure contract and they become stationary after tenure.

Specifically, I consider a principal hiring an agent over an infinite horizon. In each

period, the agent can work or shirk. The costly unobservable action, “work”, produces a good outcome with some probability, and the probability of a good outcome

depends on the state. The state is unobservable to both the principal and the agent,

and it follows an irreducible Markov chain with positive persistence. The principal

observes the outcome and pays the agent. The principal can commit to a long-term

contract. Both parties are risk-neutral, and the agent is subject to limited liability.

I start in Section 3 with an analysis of one and two-period versions of the model.

The two-period model illustrates one of the basic insights: Deviations by the agent

create an information asymmetry, and the agent receives an informational rent if

the principal wants him to work in both periods. When the state is persistent, the

outcome has an informational value in addition to its payoff consequence. If the

principal believes that the agent worked this period, the principal updates his belief

about the state accordingly. The agent’s deviation leads to an unproductive outcome

and an incorrect updating of the principal’s belief. Since the bad outcome lowers

the prior of being in the good state, the principal assigns a strictly lower probability

to the good state than the agent does in the period after the agent deviates. The

agent can ensure himself a strictly positive amount of rent by a one-stage deviation.

I characterize this informational rent as a function of the discount factor and the

persistence of the state. I also give conditions under which the principal wants the

2

agent to work in both periods.

Section 4 characterizes the second-best contracts of the infinite horizon model

which are the main results of the paper. There exist second-best contracts with

features of a tenure system. During a probationary period, the agent is paid nothing,

but once the agent is tenured, the principal implements the first-best action every

period, and the contract becomes stationary. The probationary period before tenure

is necessary in the second best.

The first property of the second-best contract is the tenure contract; once the

agent is paid, the principal implements the first-best action every period. If the principal backloads the payment, the agent’s continuation value becomes higher, and the

principal can offer a continuation contract with a higher expected surplus. However,

one needs to be careful with replacing continuation contracts when the state is persistent. The composition of payments in the continuation contract matters for the ICs

in earlier periods, and the principal can’t replace the continuation contract without

affecting the IC constraints even if the new contract provides the same continuation

value. In my model, the principal and the agent learn that they are in the good state

when they observe a good outcome, and the common knowledge of the state at the

time of payment allows the principal to replace the continuation contract. The principal doesn’t benefit from backloading the payment only if he is already implementing

the first-best action every period, and therefore, once the agent is paid, he is tenured.

If the principal wants the agent to work every period in the first best, the secondbest contract becomes stationary after tenure. The principal’s information changes

over time, but if the principal uses his information, the agent can deviate and create

an information asymmetry; the principal is better off by committing not to use his

information. I also show that the principal wants to take his outside option in the

second best, even if the first-best is to induce working every period; the second-best

contracts must involve probationary periods. When the principal takes an outside

option in some periods, he can lower the levels of the agent’s continuation values.

In addition to the level effect, taking the outside option in a persistent environment

provides a new channel of lowering the rent. The priors of the principal and the agent

after a deviation converge to the ergodic distribution of the state transition when the

principal takes his outside option. The agent’s informational advantage is reduced,

and the incentive power of the contract is lowered as a result.

I provide further characterizations of the second-best contracts in Section 5. I

3

provide a recursive formulation to complete the characterization with the length of

probationary periods. Because of a potential information asymmetry, the standard

recursive methods can’t be applied to my model; my recursive formulation takes the

joint limit of pairs of sets and makes use of the monotone convergence theorem rather

than the contraction mapping theorem. I characterize the second-best contract when

the efficiency assumption is relaxed, and I also discuss contracts with reports.

There are a few independent works in which the outcome carries information

about both the agent’s effort and the underlying state; they are Bhaskar (2012),

DeMarzo and Sannikov (2014), He, Wei and Yu (2014) and Jovanovic and Prat (2014).

The common finding, also in my model, is that the informational rent reduces the

agent’s incentives to exert effort, and there are different ways to reduce the agent’s

informational rent. In DeMarzo and Sannikov, the agent receives no payment for a

while and after the initial payment, there is a permanent distortion in the termination

policy.2 While the backloading is common in their paper and mine, there are two

differences after the initial payment. The first difference is that there is a permanent

distortion after the payout in their paper, but all the distortion happens before the

initial payment in my model; the principal implements the first-best actions after

tenure. Since the only inefficiency is through the termination policy in their model,

the principal may terminate the contract inefficiently, which can happen after the

initial payment. Meanwhile, in my model, the principal can take per-period outside

options and can delay the payments until he can implement the first-best action every

period. The second difference is that the principal doesn’t use all of his information

after the agent is tenured in my model; in their paper, the contract reaches a steady

state after the initial payment, but the payment is linear in the principal’s belief

about the state, using all of his information.3

He, Wei and Yu show that the informational rent, incentives and effort all decrease

under the deterministic contract.4 The contracts in my model are history-dependent,

but incentives also decrease over time in my model; once the agent is tenured, the

agent is essentially incentivized by per-period payments. However, the agent works

2

Since the agent in my model doesn’t benefit from his private information when the contract is

terminated, my model should be compared to the general setting in DeMarzo and Sannikov. The

outside option is exogenous in my model.

3

However, on the equilibrium path, the principal’s prior is from a finite set in my model, while

the principal’s belief about the mean of the normal distribution is a continuum in their model.

4

They define deterministic contracts as non-history-dependent contracts.

4

every period after tenure in my model, and the effort doesn’t decrease over time. They

also show that the optimal, history-dependent, contract provides higher incentives

after good performance; in my model, the agent’s continuation value increases after a

good outcome in a probationary period, and the agent receives a rent in every period

after a good outcome after tenure.

The state in Jovanovic and Prat is fully persistent, and because the information

accumulates over time, they find it optimal to recommend zero effort until the precision reaches a threshold after which the principal implements the highest effort at

every instant. There is no limited liability, and together with the exponential utility of the agent, they show that the payments are front-loaded. All three of the

aforementioned papers are in continuous time where the output flow is the sum of

the state, the agent’s action and a Brownian motion. The additive-normal outcome

structure implies that the agent’s action has the uniform effect in all states. The

agent’s action shifts the mean of the normal distribution. It is sufficient to consider

the informational rent in addition to the state and the continuation value. On the

contrary, different actions lead to different outcome distributions in my model, and

the composition of payments in the continuation contract matters. Bhaskar (2012) is

a discrete-time model with fully persistent states. He considers contracts with shortterm commitment power over a finite horizon that implements the high effort every

period. The minimum cost increases with the length of the horizon and the agent’s

discount factor.

The probationary period of the second-best contract in my model shares similarities with Chassang (2010). Fong (2009), Fong and Li (2010) and He (2009) also

find that the optimal contract has a probationary phase. In the first two papers,

the principal cannot commit to a long-term contract and the environment is i.i.d. or

has private types, whereas in my model, the principal can commit to a long-term

contract, and the state is partially persistent. In He (2009), cash flow is a geometric

Brownian motion and is observable. Zhu (2013) shows that shirking can occur on the

equilibrium path when there is no persistent information. Backloading of incentives

is also related to Thomas and Worrall (1994, 2010), where the states are i.i.d. or

observable, and the contracts must be self-enforcing. The stationarity of the continuation contract after tenure is related to the literature on sticky wages. In Townsend

(1982), long-term contracts and inefficient tie-ins can be optimal under private information. The stationary payments of the second best of my model shows that the

5

stationarity of a long-term contract is not necessarily because of enforcement costs.

Fernandes and Phelan (2000) and Zhang (2009) provide recursive formulations with

persistent private information. It has also been noted in other papers that the power

of incentives decreases over time. Garrett and Pavan (2014) define the power of incentives as the ratio of the marginal disutility of effort and the marginal utility of

consumption at the equilibrium level and consider conditions on the state persistence

and the agent’s risk aversion under which it decreases or increases over time. Farhi

and Werning (2013) show the mean reversion of labor wedge.

My paper is related to literature in dynamic financial contracts. The recursive

methods for dynamic contracts were pioneered by Green (1987) and Spear and Srivastava (1987).5 More recently, there are continuous-time models including Biais,

Mariotti, Rochet and Villeneuve (2010), DeMarzo, Fishman, He and Wang (2010),

DeMarzo and Sannikov (2006) and Sannikov (2008). In these papers, the principal and the agent share the same beliefs about the distribution of future outcomes,

whereas in my model, the agent’s deviation leads to an information asymmetry.

In Sannikov (2014), the agent’s action affects the output in the entire future, and

Strulovici (2011) considers renegotiation. Garrett and Pavan (2012) study optimal

contracts when the match quality between a firm and each manager changes over time

and is private information of the manager. They find that distortions in retention

decisions never disappear even in the long run, which contrasts with the second-best

contract of my model. In Kwon (2014), I consider relational contracts with persistent,

observable states.

There is also literature on dynamic adverse selection with persistent private information. With partially persistent types, the optimal contract is often historycontingent, but the principal achieves efficiency in the limit. Papers with Markovian types include Battaglini (2005), Athey and Bagwell (2008) and Williams (2011).

Battaglini (2005) considers consumers with Markovian types, and Athey and Bagwell (2008) study collusion with persistent private shocks. Tchistyi (2013) considers

security design when cash flow is correlated over time. Escobar and Toikka (2013)

show the folk theorem result with Markovian types and communication. Cole and

Kocherlakota (2001) consider agents with private income shocks and savings. Pavan,

Segal and Toikka (2014) study dynamic mechanism design with private information

arriving over time.

5

See also Clementi and Hopenhayn (2006), Phelan and Townsend (1991).

6

Lastly, my paper is also related to papers on experimentation and innovation.

Bergemann and Hege (1998, 2005) and Hörner and Samuelson (2013) study experimentation when the quality of the project is fixed. Manso (2011) considers a model

of two-armed bandit problem with one known arm. There is both adverse selection

and moral hazard in Halac, Kartik and Liu (2013). If the unknown state is fully

persistent, experimentation is a stopping problem, whereas in my model, the state

changes over time, and the principal is never certain about the state at the beginning

of a period.

The rest of the paper is organized as follows. Section 2 describes the model, and

one and two-period examples are discussed in Section 3. Section 4 characterizes the

second-best contract of the infinite horizon model, and Section 5 presents further

characterizations of the second best. Section 6 concludes.

2

Model

The principal hires the agent over an infinite horizon, t = 1, 2, · · · . The common

discount factor is δ < 1, and the principal and the agent can commit to a long-term

contract.

The contract specifies whether the principal takes his outside option in any given

period. Each period when the principal doesn’t take his outside option, the agent

can work or shirk. There are two outcomes, and the principal values a good outcome

at 1 and a bad outcome at 0. Shirking costs the agent nothing, but it produces a

bad outcome with probability 1. Work costs the agent c > 0, and it produces a good

outcome with some probability. The probability of a good outcome depends on the

state. The agent’s action is unobservable to the principal; the principal only observes

the outcome.

There are two states, the good state (state 1) and the bad state (state 2). Throughout the paper, the subscript 1 refers to the good state, and the subscript 2 refers to the

bad state. The state is unobservable to both parties. The state follows an irreducible

Markov chain with positive persistence; the cdf after the good state dominates the

cdf after the bad state in the sense of first-order stochastic dominance. Specifically,

let M be the Markov transition matrix for the state transition with entries

Mij = Pr(st+1 = j | st = i), i, j, st ∈ {1, 2},

7

1

p

1

1

p

M11

1

M12

t+1

t

1−p

M21

1−p

0

0

0

M22

0

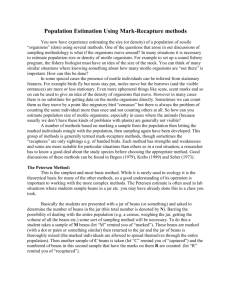

Figure 1: i.i.d. (on the left) vs. Persistent States. (on the right)

where st is the state in period t.6

Assumption 1 (FOSD). The Markov matrix M for the state transition satisfies

M11 > M21 , 0 < Mij < 1, ∀i, j.

M11 > M21 implies that the cdf after state 1 dominates the cdf after state 2. It

captures the positive persistence of the state. When the state has positive persistence,

the probability of being in the good state is strictly higher after being in the good

state than after being in the bad state. Note also that I’m assuming that there is

always a positive probability of transition from state i to state j, for all i, j = 1, 2,

which implies that the Markov chain is irreducible.

Work produces a good outcome in the good state and a bad outcome in the bad

state. Figure 1 shows the difference between i.i.d. states and the persistent states

of my model. When the states are i.i.d., the probability of a good outcome if the

agent works is constant across periods. In the figure, the probability is denoted by

p, and the probability of a bad outcome is 1 − p. On the contrary, when the state

is persistent, the probability of a good outcome depends on the state in the previous

period. In this sense, my model is the most immediate generalization of i.i.d. states

to persistent states.

The principal can take an outside option in any period, but in the first best,

the principal wants the agent to work every period. I define the first best to be an

optimal contract when the agent’s effort is verifiable but the state is not observable

to both parties. The second best is an optimal contract when the agent knows his

6

I assume that the state transition is exogenous. Whether the agent works or not doesn’t affect

the state transition.

8

action but the principal only observes outcomes. Let π t be the principal’s prior on

the state at the beginning of period t; π t := (π1t , π2t ), where πit is the probability

that the state in period t will be state i. I assume that the initial prior π 1 satisfies

M21 ≤ π11 ≤ M11 .7 Let u be the payoff to the principal from his outside option. I

assume that the payoff to the agent is zero if the principal takes his outside option.8

The following assumption says that in the first best, it is efficient to have the agent

work for any given prior on the state.9 I also assume u > 0. It follows that if the

principal doesn’t want the agent to work in a given period, the principal takes his

outside option rather than letting the agent shirk.1011 Assumption 2 is relaxed in

Section 5.2.

Assumption 2 (Efficiency). The parameters M, c and u are such that in the first

best, the principal wants the agent to work given prior (M21 , M22 ), and u > 0.

Both the principal and the agent are risk-neutral, and the agent is subject to

limited liability. There are three constraints to consider, the IR, the IC and limited

liability. The IR means that in period 1, the agent receives at least the payoff from

his outside option in expectation by participating in the contract. Limited liability

requires that the agent receives non-negative payments. I normalize the outside option

7

It follows that for all t ≥ 1, we have M21 ≤ π1t ≤ M11 .

Qualitatively, the second-best contract remains the same if the outside option for the agent is

strictly positive. I’m assuming full-commitment, which implies that the IR is relevant only in period

1. A positive outside option could change the continuation values in period 1, but the properties of

the second-best contract don’t change.

9

In the first best, the principal observes the agent’s action, and the continuation value can be

written as a function of prior. Since the principal can always mimic the strategy with prior π 0 , the

continuation value increases with π1 , the prior on the good state. Therefore, the first-best action is

a step function and increases with π1 . Given π1t ≥ M21 and Assumption 2, the first-best action is

to induce working for every prior.

10

When u = 0, we can characterize the optimal contract in the same way. The principal is

indifferent between taking his outside option and letting the agent shirk, but we can assume that

the principal takes his outside option when he doesn’t want the agent to work, and the rest of the

contract can be constructed similarly.

11

We can also characterize the optimal contract in the environment where the principal induces

the agent to work, shirk or the principal terminates the contract, i.e., there is no per-period outside

option. When the principal wants the agent to shirk, the agent can deviate and work. However, if

the agent produces a good outcome, the deviation is caught with probability 1, and the principal can

punish the agent. If the agent deviates but gets a bad outcome, the agent is more pessimistic than

the principal, but the agent’s deviation payoff is bounded from above by the on-the-equilibriumpath payoff. The proof follows from Lemmas 1 and 2 for the relaxed problem, and the agent never

deviates when he is supposed to shirk. This environment corresponds to having a per-period outside

option with zero payoffs to both the principal and the agent.

8

9

of the agent to zero, and the IR is implied by the IC and limited liability.12 The IC

has to be satisfied at every node at which the principal wants the agent to work. I

assume that if indifferent between working and shirking, the agent chooses to work.

Throughout the paper, ht refers to the outcome in period t. When the principal

takes the outside option, I denote it by ht = ∅. The history ht is the sequence of

outcomes up to period t, and I denote it by ht = (h1 , · · · , ht ). (ht , hk ) refers to the

history that ht is followed by hk ; hi in hk becomes ht+i in (ht , hk ).

In the first best, if the principal observes the actions of the agent, the principal

can pay the cost if and only if the agent works. However, the principal only observes

the outcomes. A contract specifies the principal’s decisions to take his outside option

and history-contingent payments w(ht ) for all histories ht . Since the principal and

the agent are risk-neutral, the principal can delay the payments, and there is more

than one contract that implements the same payoffs; the second-best contract is not

unique. I also define termination as the principal taking his outside option forever.

3

One and Two-Period Examples

This section describes the one and two-period examples of the model. The main

observation these models bring out is that an informational rent arises when the

principal wants the agent to work in both periods. The informational rent doesn’t

exist in the one-period example. The rent is proportional to the discount factor

and the persistence of the state, which is captured by M11 − M21 . When the discount

factor is low, it can be optimal to have the agent work in every period, and an optimal

contract is independent of the history.

3.1

One Period

In this section, I consider the case when the principal hires the agent for one period

and show that the principal can leave no rent to the agent.

Let π = (π1 , π2 ) be the common prior; π1 is the probability of the good state.

Since the principal only observes the outcome, and not the action of the agent, he

offers payments w(0) and w(1) as functions of the outcome. The agent’s IC constraint

12

As mentioned already, a positive outside option for the agent can change the continuation values

in period 1, but the IR is relevant only in period 1, and the second-best contract remains the same

qualitatively.

10

is given by

w(1)

−c + π

≥ w(0).

w(0)

The agent is subject to limited liability, and the optimal contract for the principal is

to provide

c

w(0) = 0, w(1) = .

π1

The agent receives zero rent in the one-period model.

3.2

Two Periods

In this section, I consider the two-period example of the model.

Proposition 1. Suppose the principal wants the agent to work in both periods. The

rent to the agent is bounded from below by

δc(M11 − M21 )

π11

.

M21

Proof. Consider the IC constraint for the one-stage deviation in period 1. Denote by

w(h) the payment after history h. Also denote by R1 and R0 the rents to the agent

in period 2 when the agent worked in period 1 and got a good outcome or a bad

outcome, respectively. The rents are given by the following expressions:

R1 = −c + M11 w(1, 1) + M12 w(1, 0),

R0 = −c + M21 w(0, 1) + M22 w(0, 0).

The one-stage deviation of the agent is to shirk in period 1 and work again in period

2. When the agent deviates and shirks in period 1, he doesn’t update his posterior

after observing the outcome. The agent’s prior in the beginning of period 2 is π 1 M .

The IC constraint for the one-stage deviation is given by

w(1) + δR1

w(0, 1)

1

−c + π

).

≥ w(0) + δ(−c + π M

w(0) + δR0

w(0, 0)

1

On the other hand, the IC constraint for period 2 after the bad outcome is

R0 ≥ w(0, 0)

⇐⇒

w(0, 1) − w(0, 0) ≥

11

c

.

M21

Limited liability implies w(0) + δw(0, 0) ≥ 0, and the first-period IC constraint

for the one-stage deviation becomes

−c + π

1

w(1) + δR1

w(0) + δR0

≥

=

≥

=

w(0, 1)

w(0) + δ(−c + π M

)

w(0, 0)

1

1

w(0) + δw(0, 0) + δ(−c + π M

(w(0, 1) − w(0, 0)))

0

π 1 M 10

δc(−1 +

)

M21

π1

δc(M11 − M21 ) 1 .

M21

1

The IC constraint and limited liability imply a minimum rent to the agent when

the principal wants the agent to work in both periods. Note that the bound on the

rent is proportional to the discount factor and the persistence of the state. If the state

were i.i.d., i.e., M11 = M21 , the principal can have the agent work in both periods

and leave no rent.

Note also that the rent to the agent depends on the payments in the second

period after the bad outcome. The payments in the second period after the good

outcome don’t matter for the minimum rent to the agent. When the agent deviates,

the principal offers the payments in the second period as if the outcome of working

was bad in the first period; and the agent’s continuation value after the deviation is

determined by the payments in the second period after the bad outcome.

Proposition 1 shows that there exists a lower bound on the rent the principal has

to leave in order to have the agent work in both periods. In Proposition 2, I show

that the lower bound is tight, and I also show a possible form of the contract the

principal can provide.

Proposition 2. Suppose the principal wants the agent to work in both periods. The

principal can achieve the minimum rent by offering a history-independent contract in

12

period 2:

w(0) = w(0, 0) = w(1, 0) = 0,

c

w(1) = 1 ,

π1

c

w(1, 1) = w(0, 1) =

.

M21

Throughout the paper, any proof that is not provided after the proposition is in

the appendix.

The contract in Proposition 2 is one of many contracts that the principal can

provide to attain the lower bound on the rent. Since both the principal and the

agent are risk-neutral, the principal can always delay the payment and pay the agent

later. The above contract has an attractive form because of the stationarity and the

simplicity. The principal makes positive payments only for good outcomes, and in

particular, the payments in the second period are independent of the outcome in the

first period. The principal is leaving the rent to the agent because the deviation of the

agent leads to an information asymmetry between the principal and the agent, and

one way to take care of the information asymmetry is to provide identical payments

in the second period, regardless of the outcome in the first period.

Propositions 1 and 2 assume that the principal wants the agent to work in both

periods. The next proposition shows what happens when the principal takes his

outside option in some periods. Since the outside option is inefficient, the principal

incurs a loss in surplus by taking his outside option. However, depending on the

timing of the outside option, the principal can prevent the information asymmetry

from the agent’s deviation and therefore, reduce the rent to the agent.13

Proposition 3. Suppose the parameters satisfy the following inequality:

π11

< min{−c + π11 − u, δπ21 (−c + M21 − u)}.

δc(M11 − M21 )

M21

It is optimal to induce work in both periods and leave the rent to the agent. An optimal

contract is the contract given in Proposition 2. Otherwise, it is optimal to take the

outside option in one of the two periods, and the agent receives no rent.

13

If the principal mixes the continuation contracts, it has the same effect as taking the linear

combination of the IC constraints, and it convexifies the set of payoffs.

13

4

Second-Best Contracts

This section characterizes the second-best contracts of the infinite horizon model. In

the second best, the principal pays nothing until the history of the outcomes reaches

a threshold, after which the principal implements the first-best action in every period.

To induce work in every period, the continuation contract is stationary after the first

period, and the principal offers a constant payment for a good outcome. I also show

that inducing work in every period is not optimal even though it is in the first best.

Theorem 1. There exists a second-best contract that pays only for good outcomes and

has uniformly bounded continuation values. Any such contract is a tenure contract;

once the principal makes a positive payment, the principal implements the first-best

action in all remaining periods. A possible continuation contract to implement the

first-best action every period after the initial payment is to offer

w(ht , 1) =

c

, w(ht , 0) = 0

M11

in the following period and to offer every period thereafter

w(ht , hk , 1) =

c

, w(ht , hk , 0) = 0, ∀hk , k ≥ 1.

M21

Under any second-best contract, there exists a history after which the principal takes

his outside option for at least one period.

In Theorem 1, the continuation contract after the initial payment implements

the first-best action in every period. Note that the contract becomes completely

stationary after two periods since the initial payment. In particular, we will observe

that the principal makes constant payments for good outcomes on the equilibrium

path. The state is changing, and the prior of the principal also changes over time, but

it is optimal to commit not to use his information and offer a stationary contract. The

stationarity of the continuation contract also implies that the agent is incentivized by

per-period payments after tenure, and the power of incentives decreases over time.

The proof of Theorem 1 follows from Propositions 4, 5 and 6. Proposition 4

stated below establishes the optimality of tenure contracts, and it’s proved in the

next section.

Definition 1. In a tenure contract, once the principal makes a positive payment, the

14

agent is tenured, and the principal implements the first-best action in all remaining

periods. A probationary period is all the periods before the initial payment.

Under a tenure contract, the agent is guaranteed to be incentivized to work every

period after the first payment. To induce work in every period, the principal never

takes his outside option, and in particular, the principal never terminates the contract

after the initial payment.

Proposition 4. If there exists a second-best contract, then there exists a second-best

contract that pays only for good outcomes and has uniformly bounded continuation

values. Any such contract is a tenure contract; once the principal makes a positive

payment, the principal implements the first-best action in all remaining periods.

I first show that a second-best contract takes the form of a tenure system in

Section 4.1. Sections 4.2 characterizes a cost-minimizing contract to implement the

first-best action every period, and Section 4.3 shows that a probationary period is

necessary in a second-best contract.

4.1

Proof of Tenure Contracts

This section shows the optimality of tenure contracts. The proof of Proposition 4 relies

on next two lemmas and the fact that the composition of payments in the continuation

contract after a good outcome doesn’t matter for the agent’s IC constraints. I refer

to the payment for each history as the composition of payments in the continuation

contract, as opposed to the expected payoff from all payments.

Lemma 1. Given a contract that satisfies the IC and limited liability, there exists

a contract that (i) satisfies all constraints, (ii) pays only for good outcomes, (iii)

has uniformly bounded continuation values and (iv) provides the same payoffs to the

principal and the agent as in the original contract.

Lemma 2. Suppose a contract satisfies limited liability and IC constraints for onestage deviations when the agent has never deviated before. Suppose the continuation

value of the agent after any history ht is uniformly bounded. Then the contract satisfies all IC constraints and limited liability.

In Lemma 2, we need to show that there is no profitable multi-stage deviation.

Since the principal doesn’t observe the agent’s action, the continuation contract is

15

always as if the agent has never deviated; a multi-stage deviation is when the agent

shirks more than once from the work sequence induced by the contract. Suppose

there is a finite sequence of deviations that provides the agent a strictly positive gain.

In the last period of the sequence, the agent assigns a weakly higher probability to

the good state than the principal does. The IC constraint in the last period is relaxed

when the agent has a higher prior on the good state, and the agent doesn’t deviate

as long as the IC constraint for the one-stage deviation with no previous deviation

is satisfied. By backward induction, we can show that there is no profitable finite

sequence of deviations. Together with continuity at infinity, we get Lemma 2.

To see why the composition of payments in the continuation contract after a good

outcome doesn’t matter for the agent’s IC constraints, consider the IC constraint for

the one-stage deviation. Given history ht , suppose the principal takes his outside

option for T ≥ 0 periods after the bad outcome. The IC constraint is given by

0

V1

t

T +1

T +1 V1

−c + π

≥ w(h , 0) + δ (−c + πM

),

V2

V20

where π is the principal’s prior after ht , and V1 is the sum of the present compensation and the continuation value after (ht , 1). V2 , V10 , V20 are defined similarly for

(ht , 0), (ht , 0, ∅, · · · , ∅, 1), (ht , 0, ∅, · · · , ∅, 0), respectively. Since only V1 enters the IC

| {z }

| {z }

T

T

constraints, the composition of it doesn’t matter for the agent’s incentives.

Now, I can show Proposition 4.

Proof of Proposition 4. From Lemma 1, if there exists a second-best contract, then

there is a second-best contract that pays only for good outcomes and has uniformly

bounded continuation values.

Given a contract, let R be the rent and L be the loss in surplus under the contract.

L is defined to be

L = (1 − δ)(YF B − Y ),

where YF B is the expected discounted sum of the outcome subtracted by the cost in

the first best, and Y is the expected discounted sum of the outcome subtracted by

the cost under the given contract. A second-best contract minimizes R + L.

From Lemma 1, for given prior π, let Xπ be the set of (R, L) corresponding

to contracts that have uniformly bounded continuation values, pay only for good

outcomes and satisfy the IC and limited liability.

16

I allow the principal to randomize over continuation contracts, and Xπ is a convex

set. In particular, there is a one to one mapping

f : [0, Lπ ] → [0, ∞)

such that the set of feasible (R, L) is given by

Xπ ≡ {(R, L)|R ≥ f (L), 0 ≤ L ≤ Lπ }.

Lπ is the expected loss in surplus when the principal takes the outside option forever.

Lπ is bounded from above. From Assumption 2, the principal doesn’t terminate the

contract after a bad outcome in the first best; if the principal implements the first-best

action every period, the agent can guarantee a positive rent by one-stage deviations,

and we have f (0) > 0. From the fact that Xπ is convex, we know that f (·) is strictly

decreasing in L for f (L) > 0.

Since both the principal and the agent are risk-neutral, the principal can always

delay the payment. Suppose the principal makes a positive payment for ht under a

second-best contract, and ht = 1. From Lemma 2, it is sufficient to consider onestage deviations. After a good outcome, only the sum of the present compensation

and the continuation value matters for the agent’s IC constraint, and the principal

can replace the continuation contract. Instead of paying w(ht ) and continuing with

the continuation value V (ht , M1 ), the principal can offer ŵ(ht ) = 0 and

1

V̂ (ht , M1 ) = w(ht ) + V (ht , M1 ).

δ

If V (ht , M1 ) < f (0), we get

f −1 (V̂ (ht , M1 )) < f −1 (V (ht , M1 )).

R hasn’t changed, but the principal can replace the continuation contract with a

contract with a lower L, and the principal’s payoff strictly increases.

Therefore, if the principal makes a positive payment under the second-best contract, he doesn’t gain from delaying the payment; the agent’s continuation value

V (ht , M1 ) is at least as big as the minimum rent under a cost-minimizing contract

to implement the first-best action every period. The principal can choose L = 0 and

17

doesn’t lose anything in surplus under the continuation contract. The principal implements the first-best action in every period after he makes a positive payment.

The conclusion of Proposition 4 applies to an i.i.d. environment as well, but the

proof of it highlights the interaction between persistence and backloading. When the

state is persistent, the agent can create an information asymmetry between him and

the principal, and the information asymmetry is the source of an informational rent.

In general with persistent states, the principal can’t replace the continuation contracts

without affecting the earlier IC constraints, even if the new continuation contract

provides exactly the same continuation value. The composition of payments in the

continuation contract matters. However, once the principal and the agent observe

a good outcome, they know they are in the good state, and there’s no information

asymmetry between the two. Proposition 4 relies on the fact that the principal makes

payments only for good outcomes and that there is no information asymmetry after a

good outcome. Therefore, the composition of payments in the contract after a good

outcome doesn’t matter, and the principal can replace the continuation contract as

long as it provides the same continuation value. Common knowledge of the state

at the time of payment is what allows the principal to delay payments until he can

implement the first-best actions every period. The principal can always replace the

continuation contract after a good outcome with a more efficient one, and it is optimal

to backload the payments.

4.2

Stationary Contracts

This section characterizes the continuation contract after tenure. If the principal

wants the agent to work in every period in the first best, a cost-minimizing contract

to implement the first-best action in every period is stationary after the first period.

The payment for a good outcome is constant, and the payment for a bad outcome is

zero.

Proposition 5. If the principal wants the agent to work in every period, a costminimizing contract is to provide

c

, w(0) = 0,

π11

c

, w(ht , 0) = 0, ∀ht , t ≥ 1.

w(ht , 1) =

M21

w(1) =

18

Before proving Proposition 5, I will first characterize the lower bound on the rent

to the agent when the principal wants him to work every period. I define the average

rent as the discounted sum of the rent multiplied by 1 − δ. The proof of Proposition 5

follows by showing that the principal attains the lower bound with the stationary

contract.

Lemma 3. If the principal wants the agent to work every period, the average rent to

the agent is bounded from below by

π1

δ(M11 − M21 )

c(δ + (1 − δ) 1 ).

1 − δ(M11 − M21 )

M21

Proof of Lemma 3. Consider the IC constraint for the one-stage deviation after history ht . The prior on the state after a good outcome is M1 = (M11 , M12 ), and the

prior after a bad outcome believing that the agent worked in the previous period is

M2 = (M21 , M22 ). Therefore, any subgame after a good outcome is identical, and any

subgame after a bad outcome is also identical.

If the principal wants the agent to work every period, he doesn’t take his outside

option after any history ht . The IC constraint for the one-stage deviation is given by

0

V1

V

t

t+1

−c+π

≥ w(h , 0) + δ(−c + π M 10 )

V2

V2

c

⇔ V1 − V2 ≥ t+1 + δ(M11 − M21 )(V10 − V20 ),

π1

t+1

where π t+1 is the principal’s prior after ht and V1 is the sum of the present compensation and the continuation value after (ht , 1). V2 , V10 and V20 are defined similarly

for (ht , 0), (ht , 0, 1) and (ht , 0, 0), respectively.

Let V1t and V2t be the sum of the present compensation and the continuation

value after ht = (0, · · · , 0, 1) and ht = (0, · · · , 0). We have the following set of IC

| {z }

| {z }

t−1

t

constraints:

V11 − V21 ≥

V1t − V2t ≥

c

+ δ(M11 − M21 )(V12 − V22 ),

1

π1

c

+ δ(M11 − M21 )(V1t+1 − V2t+1 ), ∀t ≥ 2.

M21

Since the principal can always provide w(ht , 1) = Mc21 , w(ht , 0) = 0, ∀ht and

induce the agent to work every period, V1t − V2t is uniformly bounded for all t under

19

an optimal contract. Summing over the IC constraints, we get

1

c

, ∀t ≥ 2,

M21 1 − δ(M11 − M21 )

c

c

δ(M11 − M21 )

V11 − V21 ≥ 1 +

.

π1 M21 1 − δ(M11 − M21 )

V1t − V2t ≥

Together with

V2t = w(0, · · · , 0) + δ(−c + M21 V1t+1 + M22 V2t+1 )

| {z }

t

≥ δ(−c + M21 (V1t+1 − V2t+1 ) + V2t+1 ), ∀t ≥ 1

we have

V2t ≥ δ(

δ(M11 − M21 )

c + V2t+1 ), ∀t ≥ 1

1 − δ(M11 − M21 )

and

V21 ≥

δ

δ(M11 − M21 )

c.

1 − δ 1 − δ(M11 − M21 )

The average rent to the agent is bounded from below by

(1 − δ)(−c + π11 V11 + π21 V21 )

=(1 − δ)(−c + π11 (V11 − V21 ) + V21 )

c

δ

c

δ(M11 − M21 )

δ(M11 − M21 )

+

)+

c)

1

π1 M21 1 − δ(M11 − M21 )

1 − δ 1 − δ(M11 − M21 )

δ(M11 − M21 )

π1

=

c(δ + (1 − δ) 1 ).

1 − δ(M11 − M21 )

M21

≥(1 − δ)(−c + π11 (

From Lemma 3, we can show Proposition 5 as follows.

Proof of Proposition 5. When the principal offers a stationary contract, following any

history ht , the agent chooses to work as long as

−c + π

t+1

w(ht , 1)

≥ w(ht , 0).

t

w(h , 0)

The agent’s IC constraints become myopic because there is no gain from creating an

information asymmetry. If the principal offers a constant payment for a good outcome,

20

the payment is unaffected by the principal’s prior, and the continuation value after a

deviation is the same as the continuation value on the equilibrium path. Therefore,

in deciding whether to work or shirk, the agent only cares about the payment in the

current period, and as long as the expected payoff from working is greater than the

payment for the bad outcome, the agent chooses to work.

The contract specified in Proposition 5 provides the following constant payments:

w(ht , 1) =

c

, w(ht , 0) = 0, ∀ht , t ≥ 1.

M21

Since the agent’s prior on the state satisfies π1t ≥ M21 , the agent’s IC constraints are

satisfied after any history ht , t ≥ 1. In period 1, the principal pays

w(1) =

c

, w(0) = 0,

π11

and again, the agent chooses to work.

To show the optimality of the contract, we need to show that the rent to the agent

is minimized with this contract. Under the specified contract, the agent gets a rent if

and only if the outcome in the previous period was good, and in each of those periods,

he gets

(M11 − M21 )c

.

−c + M11 w(ht , 1) =

M21

The probability of a good outcome in period t given the initial prior π 1 is

1

π M

t−1

1

,

0

and the average rent to the agent under the contract is

(1 − δ)

∞

X

t=1

t 1

δπ M

t−1

δ(M11 − M21 )c

π1

1 (M11 − M21 )c

=

(δ + (1 − δ) 1 ),

M21

1 − δ(M11 − M21 )

M21

0

which is the lower bound on the rent to the agent given in Lemma 3. Therefore, the

principal can attain the lower bound on the rent with a stationary contract, and the

cost-minimizing contract to have the agent work every period can be stationary after

the first period.

21

4.3

Necessity of Probationary Periods

This section shows that probationary periods are necessary; in the first best, the

principal wants the agent to work every period, but it is not optimal to induce working

every period in the second best. The principal is strictly better off by taking his

outside option after some histories.

Proposition 6. There exists t0 > 0 such that for any δ > 0, a contract that involves

taking the outside option after t0 consecutive bad outcomes from period 1 on gives

a strictly higher payoff to the principal than a cost-minimizing contract that induces

working in every period.

The proof of Proposition 6 goes as follows. The first step is done by Lemma 2

which shows that it is sufficient to consider the one-stage deviations of the agent.

When the IC constraints for the one-stage deviations are satisfied, the agent doesn’t

deviate more than once at a time, and all IC constraints are satisfied.

The second step is to show that by taking the outside option after some history,

the principal can lower the payments to the agent leading up to the specified history.

Consider the cost-minimizing contract from Proposition 5. If the principal takes his

outside option after t0 consecutive bad outcomes from period 1 on, the principal can

lower the payments w(0, · · · , 0, 1) for 0 ≤ k < t0 . When the reduction in rent is

| {z }

k

greater than the loss in surplus from taking the outside option, the principal prefers

to take the outside option after ht0 = (0, · · · , 0).

| {z }

t0

The number of consecutive bad outcomes before the principal takes his outside

option holds uniformly for all discount factors δ. Given the Markov matrix M , there

exists t0 such that for any discount factor δ, taking the outside option after t0 consecutive bad outcomes strictly dominates inducing the agent to work in every period.

Consider the IC constraint

0

V1

t

T +1

T +1 V1

−c + π

≥ w(h , 0) + δ (−c + πM

),

V2

V20

where π is the principal’s prior after ht , and V1 is the sum of the present compensation and the continuation value after (ht , 1). V2 , V10 , V20 are defined similarly for

(ht , 0), (ht , 0, ∅, · · · , ∅, 1), (ht , 0, ∅, · · · , ∅, 0), respectively. The principal takes his out| {z }

| {z }

T

T

22

side option for T periods after (ht , 0). We can rewrite the IC constraint as

0

V

−c + π1 (V1 − V2 ) ≥ δ (πM

− M2 M ) 10

V

2

1

(V10 − V20 ).

= δ T +1 (πM − M2 )M T

0

{z

}

|

T +1

T +1

T

informational advantage

When the principal takes his outside option, it can affect the right-hand side of the IC

in two ways. It can lower the difference in continuation values, but it can also reduce

the informational advantage of the agent. In a two-period model when the principal

takes his outside option after a bad outcome in the first period, or in an infinitehorizon model when the principal terminates the contract after a bad outcome, the

difference in continuation values becomes zero, and the IC constraint is relaxed.

But there is another channel through which taking a per-period outside option

can help the principal. The agent can create an information asymmetry by a onestage deviation, which is the source of his rent. If the principal takes his outside

option in some period, the prior on the state gets closer to the ergodic distribution of

the Markov matrix, and the agent’s informational advantage is reduced. The agent’s

informational advantage is captured by the expression multiplied to the difference in

the continuation values when the agent is induced to work again; it is the product

of the discount factors and the difference in the priors. When the principal takes his

outside option, this term is multiplied by the discount factor and becomes smaller. In

addition, with partially persistent states, the difference in the priors becomes smaller

when the principal takes his outside option, and the informational advantage becomes

even smaller. This effect on the difference in priors is unique to partially persistent

states, and it’s not present even with fully persistent states.

In any period leading up to the history after which the principal takes his outside

option, the difference in continuation values after the good outcome and the bad

outcome is reduced; the IC is relaxed in every period leading up to the history. On

the contrary, if the states were i.i.d., when the principal takes his outside option, the

levels of continuation values after the good and the bad outcomes are lowered, but the

difference in continuation values remains the same, and the incentive power remains

the same. This is true for more general outcome structures in an i.i.d. environment.

Suppose work produces a good outcome with probability pH , and shirking produces a

23

good outcome with probability pL < pH , pH , pL ∈ [0, 1]. When the principal takes his

outside option, it only affects the level of continuation values, and the difference in

continuation values after the good outcome and the bad outcome remains the same.

Proposition 6 shows that in addition to the level effect, in a persistent environment,

the outside option can reduce the informational advantage of the agent, which relaxes

the IC and lowers the incentive power of the contract.

It also follows from Proposition 6 that the agent is never tenured under a secondbest contract if all the outcomes have been bad. If the agent is tenured after T

consecutive bad outcomes from period 1 on, then there exists t0 such that the principal

is strictly better off by taking the outside option after T +t0 consecutive bad outcomes.

5

Discussion

This section presents additional results about the second-best contract. Section 5.1

presents the recursive formulation to pin down the timing of the first payment and

the outside options during the probationary period. Section 5.2 characterizes the

second-best contract when we relax Assumption 2. In Section 5.3, I discuss optimal

contracts with reports.

5.1

Recursive Formulation

From Proposition 6, we know that a second-best contract involves a probationary

period, and the principal can offer a stationary contract after two periods since the

initial payment. Until the agent is tenured, the contract is history-contingent, and

the timing of the initial payment and the outside options depends on the history of

the outcomes. I provide a recursive formulation to characterize the timing of the

initial payment and the outside options, thereby completing the characterization of

the second best.

The recursive formulation consists of two steps. The first step is to characterize

the pairs of continuation values (V1 , V2 ) with which the principal can induce working

in a given period and the IC and limited liability are satisfied in the continuation contract. From Proposition 4, I consider a second-best contract with which the agent’s

continuation value is uniformly bounded; I consider only the non-negative continuation values under the upper bound. Let S be the largest self-generating set in

24

{(π1 , 1 − π1 )|π1 ∈ [M21 , M11 ]} × [0, R̂]2 such that

S = conv({(π, V1 , V2 )|∃T ≥ 0, (π 0 , V10 , V20 ) ∈ S such that

(i)π 0 = M2 M T ,

0

V1

),

(ii)V2 = δ (−c + π

V20

c

(iii)V1 − V2 ≥

+ δ T +1 (M11 − M21 )T +1 (V10 − V20 )})

π1

0

T +1

(1)

δ(M11 −M21 )

δ

11

and R̂ = max{( M121 + 1) 1−δ(M

) + Mc21 , Lπ }. Lπ is the expected loss

c( 1−δ

+M

M21

11 −M21 )

in surplus if the principal takes his outside option forever. Lemma 2 allows us to

consider only the ICs for one-stage deviations. There is only one relevant IC after

any history, and it can be written as (1). V2 uses Lemma 1 and makes zero payment

for a bad outcome. Limited liability is captured by [0, R̂]2 .

The second step incorporates the loss in surplus under a given contract. A secondbest contract minimizes the sum of the rent to the agent and the loss in surplus

under a given contract. Let Xπ be the set of (R, L) of contracts satisfying the IC

and limited liability with uniformly bounded continuation values. The second-best

contract corresponds to min{R + L|(R, L) ∈ Xπ } where

Xπ = conv({(R, L)|∃T ≥ 0, (R1 , L1 ) ∈ XM1 , (R2 , L2 ) ∈ XM2 such that

(i)π 0 = πM T ,

T

(ii)R = δ (−(1 − δ)c + δπ

(iii)L = (1 − δ)

T

X

δ

k−1

0

R1

),

R2

(−c + πM

k=1

δ

δ

(iv)(π 0 ,

R1 ,

R2 ) ∈ S}).

1−δ

1−δ

k−1

1

T +1 0 L1

,

− u) + δ π

L2

0

(2)

Formally, Xπ consists of contracts such that the principal takes his outside option for

T periods, and the agent is induced to work again in the following period. After a good

outcome, the principal continues with a contract corresponding to (R1 , L1 ) ∈ XM1 .

After a bad outcome, the principal continues with (R2 , L2 ) ∈ XM2 .

25

Consider the following sequence of sets.

M11

δ(M11 − M21 )c

(δ + (1 − δ)

) ≤ R ≤ R̂},

1 − δ(M11 − M21 )

M21

δ(M11 − M21 )c

X20 = {(R, 0)|R2∗ ≡

≤ R ≤ R̂},

1 − δ(M11 − M21 )

X10 = {(R, 0)|R1∗ ≡

(3)

(4)

where R1∗ and R2∗ are the rents to the agent under the cost-minimizing contracts for

priors M1 and M2 from Lemma 3. Define

X1n+1 = conv({(R, L)|∃T ≥ 0, (R1 , L1 ) ∈ X1n , (R2 , L2 ) ∈ X2n such that

(i)π 0 = M1 M T ,

R1

(ii)R = δ (−(1 − δ)c + δπ

),

R2

T

X

T +1 0 L1

k−1

k−1 1

(iii)L = (1 − δ)

δ (−c + M1 M

,

− u) + δ π

L

0

2

k=1

0

T

(iv)(π 0 ,

δ

δ

R1 ,

R2 ) ∈ S}),

1−δ

1−δ

(5)

X2n+1 = conv({(R, L)|∃T ≥ 0, (R1 , L1 ) ∈ X1n , (R2 , L2 ) ∈ X2n such that

(i)π 0 = M2 M T ,

R1

(ii)R = δ (−(1 − δ)c + δπ

),

R2

T

X

k−1

k−1 1

T +1 0 L1

(iii)L = (1 − δ)

δ (−c + M2 M

− u) + δ π

,

0

L2

k=1

0

T

(iv)(π 0 ,

δ

δ

R1 ,

R2 ) ∈ S}).

1−δ

1−δ

(6)

(X1n , X2n ) corresponds to contracts where the principal takes his outside options

for at most n intervals over the infinite horizon. The next theorem establishes that Xπ

we are looking for is generated by the limit of (X1n , X2n ) as n goes to infinity. Instead

of the contraction mapping theorem, the proof relies on the monotone convergence

theorem.

Theorem 2. Define S, {X1n , X2n }∞

n=0 as in (1),(3)-(6). Let XM1 and XM2 be the limits

n

n

of X1 , X2 , and let Xπ be given by (2). A second-best contract given initial prior π

26

minimizes R + L such that (R, L) ∈ Xπ .

Once we find (R, L) ∈ Xπ that minimizes R + L, the contract can be constructed

as follows. Given (R, L) ∈ Xπ , there exist T ≥ 0, (R1 , L1 ) ∈ XM1 , (R2 , L2 ) ∈ XM2

supporting (R, L). The principal takes the outside option for T periods, and after the

first period the agent is induced to work, the continuation contract is determined by

(R1 , L1 ) and (R2 , L2 ). If the outcome is good and R1 < R1∗ , the contract continues

with (R1 , L1 ). If the outcome is good and R1 ≥ R1∗ , the agent is tenured and is paid

δ(R1 − R1∗ ) this period. The contract continues with (R1∗ , 0), the contract specified

in Proposition 5. If the outcome is bad, but R2 = R2∗ , the agent is tenured, and the

principal pays

c

, w(ht , 0) = 0

w(ht , 1) =

M21

from the following period. If the outcome is bad and 0 ≤ R2 < R2∗ , the contract continues with (R2 , L2 ). When the outcome is bad and R2 = 0, the contract terminates

after a bad outcome in the following period.

The next two results show that the continuation value of the agent during a

probationary period strictly increases after a good outcome, and the contract never

terminates after a good outcome.

Proposition 7. In the second-best contract from Theorem 1, given history ht , let R

and R1 be the agent’s continuation values after ht and (ht , 1), respectively. For any

ht such that (ht , 1) is in the probationary period, we have

R < R1 .

Corollary 1. The second-best contract from Theorem 1 never terminates after a good

outcome.

The proofs of Proposition 7 and Corollary 1 follow directly from the fact that the

agent is paid nothing during the probationary period and the agent’s continuation

value after a good outcome is higher than the continuation value after a bad outcome.

5.2

Relaxing Assumption 2

This section presents results when we relax Assumption 2 to Assumption 3. The

second-best contract is a tenure contract, and if the principal wants to take his outside

27

option in some periods in the first best, the continuation contract after tenure has a

finite memory and the payment for a good outcome is made in two levels.

21

Assumption 3 (Efficiency’). There exists π = (π1 , π2 ) such that (i) π1 < M21M+M

12

and (ii) for the parameters M, c and u, the principal wants the agent to work given

prior π in the first best. I also assume that u > 0.

Assumption 3 says that in the first best, the principal may take the outside option after a bad outcome, but the principal doesn’t want to take the outside option

forever.14 The principal wants to induce work after a good outcome. Let l be the

number of periods the principal wants to take his outside option in the first best after

a bad outcome. The following theorem states the analogue of Theorem 1.

Theorem 3. Suppose Assumption 3 holds. Let l be the number of periods the principal

wants to take his outside option in the first best after a bad outcome. If there exists

a second-best contract, there exists a second-best contract that pays only for good

outcomes and has uniformly bounded continuation values. Any such contract is a

tenure contract; once the principal makes a positive payment, the principal implements

the first-best action in all remaining periods. A possible continuation contract to

implement the first-best action after the initial payment is to offer

w(ht , 1) =

c

, w(ht , 0) = 0

M11

in the following period and to offer every period thereafter

w(ht , hk , 0) = 0, w(ht , hk , 1, 1) = w1 , w(ht , hk , 0, ∅, · · · , ∅, 1) = w2 ,

| {z }

l

for some w1 , w2 > 0 and all hk , k ≥ 1.

The proof of Theorem 3 follows from Propositions 4 and 8. Theorem 3 shows

that under Assumption 3, the second-best contract is never stationary. However,

14

u > 0 can be relaxed to u ≥ 0. The argument doesn’t change if the principal takes his outside

option when he doesn’t want the agent to work. If the principal chooses to let the agent shirk

than to take his outside option, one has to make an assumption about the off-the-equilibrium-path

strategy after getting a good outcome when the agent is supposed to shirk. Assuming the principal

terminates the contract after the agent is caught in a deviation, one can show that the agent never

works when he is supposed to shirk under an optimal contract. The rest of the argument works the

same.

28

the second-best contract has a finite memory once the principal makes a positive

payment. The payment for a bad outcome is always zero, and the payment for a

good outcome only depends on the prior on the state; the only relevant information

is whether the previous outcome was good and how many periods the principal should

take the outside option before inducing the agent to work again. The payments for

good outcomes are done in two levels.

Proposition 8. Suppose l > 0. The principal can minimize the rent and implement

the first-best action in every period by the following contract:

w(1) =

c

, w(0) = 0,

π11

w(ht , 0) = 0, w(ht , 1, 1) = w1 , w(ht , 0, ∅, · · · , ∅, 1) = w2 ,

| {z }

l

for some w1 , w2 > 0 and all ht , t ≥ 1.

The proof of Proposition 8 consists of three steps. I first derive the lower bound on

the rent when the principal wants to implement the first-best action in every period.

The next step is to show that the lower bound can be attained with two levels of

payments for good outcomes. The last step shows that the two levels of payments are

equal if and only if l = 0. Therefore, whenever l > 0, the cost-minimizing contract

provides two levels of payments for good outcomes.

When the first best involves taking the outside option in some periods, the costminimizing contract has a finite memory. Since the priors on the state after the

good and the bad outcomes differ sufficiently, it is not optimal to provide stationary

contracts. However, the agent’s IC constraint becomes simpler when the contract

only takes into account the last outcome, and the principal can minimize the rent to

the agent with two levels of payments for good outcomes.

5.3

Contracts with Reports

This section considers contracts under which the agent reports his action every period,

and the principal makes payments conditional on the history of outcomes and the

agent’s reports. It turns out that in this environment, the principal can do no better

than providing the second-best contracts characterized in Sections 4 and 5.

29

The timing is as follows. After the agent takes an action, the principal asks

the agent to report his action. The outcome is realized, and the principal makes a

payment. Denote by rt the agent’s reported action in period t and ht the outcome in

period t. A period-t history is given by ht = (r1 , h1 , r2 , h2 , · · · , rt , ht ).

Proposition 9. Suppose the principal asks the agent to report his action each period.

A contract specifies the payments and the principal’s decision to take his outside option

conditional on history ht = (r1 , h1 , r2 , h2 , · · · , rt , ht ). The contracts characterized in

Theorems 1 and 3 are optimal.

The main intuition is that the agent can always do a one-stage deviation and

report as if he didn’t deviate; this strategy provides the agent with the same amount

of rent as without reports.15 The principal can obtain the minimum rent by the

contracts in Theorems 1 and 3, and there is no need to introduce reports.

6

Conclusion

I study a model of principal-agent problem in a persistent environment and show

that an informational rent arises. When states are partially persistent, the agent’s

effort has both a payoff consequence and an informational value. If the principal

believes that the agent worked this period, the principal infers the state by observing

the outcome, and the agent’s deviation leads to a lower outcome and an information

asymmetry between the principal and the agent. Following a deviation, the agent

assigns weakly higher probabilities to the good state than the principal does in all

future periods, and the principal has to provide an informational rent.

In this environment, there are second-best contracts resembling a tenure system.

Once the principal makes a positive payment, he implements the first-best action

every period. Backloading of payments relies on common knowledge of the state at the

time of payment. In general, persistent states mean that the composition of payments

in the continuation contract matters for the agent’s IC, and replacing a continuation

contract affects ICs in earlier periods. However, in this setting, the principal makes

15

The revelation principle says that it is sufficient to consider as the message space the set of private

information of the agent and that the agent reports truthfully. In this setting, this corresponds to

the priors of the agent or the past deviations. The sufficiency of the ICs for one-stage deviations

means that the past deviations are already accounted for in the IC constraints. The agent’s action

in the current period is captured in the IC constraint, and there’s no need for an additional message.

30

payments only for good outcomes, and the principal and the agent both learn that

they’re in the good state if they observe a good outcome. Therefore, the principal

can replace continuation contracts after good outcomes and delay payments until he

can implement the first-best actions.

After the agent is tenured, the principal offers the cost-minimizing contract, which

either becomes stationary or has a finite memory. If the principal uses his information

to reduce the rent, the agent can deviate and get a positive rent from the one-stage

deviation. One way to prevent the deviation is to always provide the payments as

if the previous state was bad; if the first best involves working in every period, the

stationary contract minimizes the rent to the agent. The same principle holds for the

second-best contract when the first best involves taking the outside option in some

periods. The continuation contract after tenure is not stationary, but it can be done

with two levels of payments for good outcomes. The second-best contract has a finite

memory after the agent is tenured.

I also show that the probationary period is necessary in a second-best contract. If

the principal takes his outside option after enough number of bad outcomes, he can

reduce the informational advantage of the agent. The principal can relax the IC at

every node leading up to the specified history. Taking the outside option lowers the

levels of continuation values in an i.i.d. environment as well, but persistence implies

that the incentive power of the contract is also lowered. With fully persistent states,

the incentive power is lowered through discounting, but partially persistent states

imply that there is another channel through which the priors converge to the ergodic

distribution. The difference in continuation values is lowered if the principal takes

his outside option, and this is a unique feature of persistent states.

A

Proofs

Proof of Proposition 2. There are four IC constraints to consider: There are two IC

constraints in the second period after a good outcome or a bad outcome in the first

period, and there is the IC constraint for the one-stage deviation in the first period

and the IC constraint for the double deviation. When the agent deviates in both

periods, he gets w(0) + δw(0, 0), and the IC constraint for the double deviation is

implied by the IC constraint for the one-stage deviation and the IC constraint in the

second period after a bad outcome.

31

The relevant IC constraints are

w(1, 1)

R1 = −c + M1

≥ w(1, 0),

w(1, 0)

w(0, 1)

R0 = −c + M2

≥ w(0, 0),

w(0, 0)

w(0, 1)

1

1 w(1) + δR1

≥ w(0) + δ(−c + π M

,

−c + π

w(0) + δR0

w(0, 0)

where M1 and M2 are the first and the second rows of M .

One can verify that the IC constraints are satisfied under the given contract, and

the given contract yields the rent specified in Proposition 1.

Proof of Proposition 3. From Proposition 1, if the principal wants the agent to work

in both periods, the minimum rent is

δc(M11 − M21 )

π11

.

M21

If the principal takes his outside option after the good outcome in the first period

but wants the agent to work both in the first period and the second period after the

bad outcome, he has to leave the same amount of rent as inducing the agent to work

in both periods. Since the outside option is inefficient, the principal never wants to

take his outside option after the good outcome in the first period.

If the principal takes his outside option after the bad outcome in the first period,

the principal doesn’t have to leave any rent to the agent. The IC constraint in the

first period becomes

1 w(1) + δR1

−c + π

≥ w(0),

w(0)

and the principal can offer

w(0) = w(1, 0) = 0,

c

w(1) = 1 ,

π1

c

w(1, 1) =

.

M11

Since the principal is already leaving no rent, the principal prefers to have the agent

work in the first period and the second period after the good outcome. The loss in

32

surplus in this case is

δπ21 (−c + M21 − u).

If the principal takes his outside option in the first period, the second period

problem becomes the same as the one-period model, and the principal can induce

working in the second period without leaving any rent. The loss in surplus is

−c + π11 − u.

If the principal mixes the continuation contract, it has the same effect as taking

the linear combination of the IC constraints, and it convexifies the set of payoffs.

Therefore, the principal’s problem is to choose the contract that minimizes the

sum of the rent and the loss in surplus, and he prefers to leave the rent to the agent if

the loss from taking the outside option is greater than the rent. This happens when

δc(M11 − M21 )

π11

< min{−c + π11 − u, δπ21 (−c + M21 − u)}.

M21

If the inequality doesn’t hold, the expected loss in surplus from taking the outside

option in some period is smaller than the rent to the agent, and the principal prefers

to take his outside option in that period. The agent receives no rent.

Proof of Theorem 1. The existence of a second-best contract follows from Theorem 2.

Since X1∞ , X2∞ are closed sets, the set of (R, L) corresponding to contracts that satisfy

the IC and limited liability, pay only for good outcomes and have uniformly bounded

continuation values is closed. There exists (R, L) ∈ Xπ that minimizes R + L. The

rest of the proof follows from Propositions 4, 5 and 6.

I will first show Lemma 2 and then Lemma 1.

Proof of Lemma 2. Randomizing the continuation contracts is the same as taking the

linear combination of the IC constraints, and it is sufficient to prove the lemma for

pure strategies. Suppose the principal takes his outside option for k ≥ 0 times after

history (ht , 0). The IC constraint for the one-stage deviation after ht is given by

0

V1

t

k+1

k+1 V1

−c + π

≥ w(h , 0) + δ (−c + πM

),

V2

V20

33

where π is the principal’s prior after ht when he believes that the agent worked in

every period, and V1 is the sum of the present compensation and the continuation

value after (ht , 1). V2 , V10 , and V20 are defined analogously for (ht , 0),(ht , 0, ∅, · · · , ∅, 1)

| {z }

k

and (ht , 0, ∅, · · · , ∅, 0). Remember ∅ refers to a period in which the principal takes

| {z }

k

his outside option.

By subtracting V2 = w(ht , 0) + δ k+1 (−c + M2 M k

that the IC constraint is equivalent to

−c + π1 (V1 − V2 ) ≥ δ

k+1

V10

V20

) from both sides, we know

0

V1

,

(πM − M2 )M

V20

k

which is again equivalent to

V1 − V2 ≥

c

+ (δ(M11 − M21 ))k+1 (V10 − V20 ).

π1

Suppose there is a finite sequence of deviations with which the agent is strictly