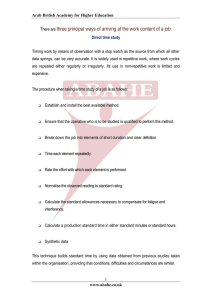

Information Society Statistical Profiles 2009 Arab States ITU-D

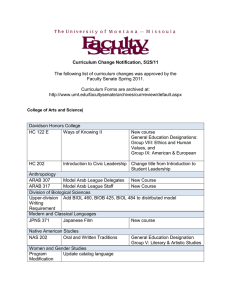

advertisement