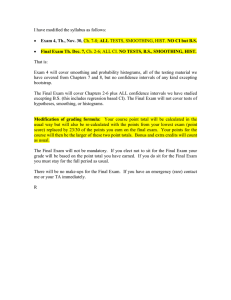

Smoothing, Nonsynchronous Appraisal and Cross-Sectional Aggregation in Real Estate Price Indices

advertisement