WILLS AND TRUSTS Gerry Beyer* 1606

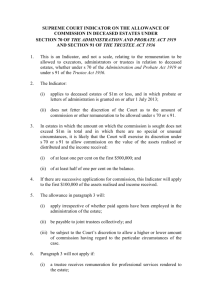

advertisement