Default Stickiness among Low-Income Individuals

advertisement

Default Stickiness among Low-Income Individuals

John Beshears, Stanford University and NBER

James J. Choi, Yale University and NBER

David Laibson, Harvard University and NBER

Brigitte C. Madrian, Harvard University and NBER

October 11, 2012

Abstract: Defaults powerfully affect economic outcomes, but there is limited evidence on which

types of individuals are most influenced by defaults. A key challenge is distinguishing whether

an individual remains at a default because he is generically more susceptible to defaults or

because the default is close to the outcome he would have actively chosen. We present evidence

that 401(k) defaults are particularly influential for low-income individuals. Low-income

employees’ contribution rate choices in a neighborhood of the default are more concentrated at

the default. The average income of employees remaining at the contribution rate default is below

that of those who opt out, even when the default is far from what the typical low-income

employee actively chooses. And low-income employees’ portfolio allocations shift more

strongly towards funds with equity exposure when the default investment option changes from a

money market fund to a balanced or target date retirement fund.

A previous version of this paper circulated under the title “The Limitations of Defaults.” The research

reported herein was supported by the U.S. Social Security Administration (SSA) through grant #10-M98363-1-02 to the National Bureau of Economic Research (NBER) as part of the Retirement Research

Consortium (RRC) and by the FINRA Investor Education Foundation. We also acknowledge individual

and collective financial support from the National Institute on Aging (grants R01-AG-021650 and T32AG-000186). The findings and conclusions expressed are solely those of the authors and do not represent

the views of SSA, any agency of the Federal Government, the RRC, NBER, or FINRA. We are grateful to

Jeffrey Brown and Ulrike Malmendier for helpful comments, and we thank Yeguang Chi, Andrew Chong,

and Colin Gray for excellent research assistance.

Choice architecture—the design of the context in which decisions are made—can

“nudge” individuals towards a particular outcome (Thaler and Sunstein, 2008). An especially

powerful tool of choice architecture is the default, which is the option that is implemented when

an individual does not actively make a selection herself. In domains as diverse as e-mail

marketing (Johnson, Bellman, and Lohse, 2003), organ donation (Johnson and Goldstein, 2003;

Abadie and Gay, 2004), automobile purchases (Park, Jun, and MacInnis, 2000), and retirement

savings and investment (Madrian and Shea, 2001; Choi et al., 2002 and 2004; Beshears et al.,

2008), individuals are likely to accept the default passively. Therefore, the chooser of the default

is often able to determine the modal outcome.

While a large literature has documented the effects of choice architecture and defaults,

less attention has been devoted to studying which types of people are more influenced by nudges.

One difficulty in addressing this issue is the fact that a person’s characteristics are often

correlated with the person’s preferences over options within a choice set. Carroll et al. (2009)

show that individuals who opt out to savings plan contribution rates that are further away from

the default tend to opt out sooner, which is consistent with default effects being weaker when the

default is further from the outcome an individual would choose for herself if an active decision

were compulsory. Previous research has documented that low-income individuals are less likely

to opt out of savings plan defaults (Madrian and Shea, 2001; Choi et al., 2004), but it is unclear

whether this pattern is primarily the result of defaults implementing outcomes close to those that

low-income individuals would have selected for themselves anyway, or primarily the result of

low-income individuals having a stronger general tendency to accept defaults passively. From a

policy perspective, the distinction is crucial for understanding the extent to which a nudge is, for

better or for worse, inducing individuals to adopt alternatives that they might not have chosen

otherwise. In addition, the distinction is important for predicting the effects of a nudge that is

deployed to promote an option that has not previously been promoted.

In this paper, we propose three methods for disentangling a subpopulation’s general

susceptibility to defaults from the alignment of the subpopulation’s preferences with the default

outcome. We apply these methods to identify heterogeneity across income groups in their

receptiveness to defaults in three employer-sponsored defined contribution retirement savings

plans. At these firms, unless an employee actively opts out, part of her paycheck every pay cycle

is deducted at a default contribution rate and invested in a default investment fund. Each of our

1

three empirical methods finds that low-income employees are less likely to opt out of defaults in

general.

Our first empirical method examines the frequency with which different income groups

remain at the default instead of opting out to an alternative very similar to the default. If the

default had no influence, the distribution of actual contribution rates would equal the distribution

of target contribution rates that individuals would choose for themselves if an active decision

were compulsory. The key insight is that if the probability density function of target contribution

rates is continuous, then the density of target contribution rates in a neighborhood of the default

should be approximately uniform, regardless of the global shape of the target density function.

Therefore, the mass at the default in the actual contribution rate distribution as a percent of the

total mass in a neighborhood of the default measures the strength of the default’s influence.

When we examine different income groups, we find that low-income groups exhibit a larger

relative spike at the default, indicating that low-income employees are in general more

influenced by the default.

Our second empirical method compares the propensity of low- versus high-income

employees to opt out when the default is relatively more suitable for low-income employees

versus when the default is relatively more suitable for high-income employees. We identify how

suitable the default is for low- versus high-income employees by using the average income of

employees who opted out to nearby alternatives. Under the null hypothesis that an employee’s

propensity to opt out to her target contribution rate is entirely driven by the proximity of the

default to her target contribution rate (and is unrelated to income except via income’s correlation

with the default’s proximity to the target), the average income of those who have opted out to a

given contribution rate before a given point in time is an unbiased estimate of the average

income of all employees whose target contribution rate equals that contribution rate. If the

function mapping target contribution rates to the average income of all employees with that

target contribution rate is smooth, we can use interpolation from non-default contribution rates to

estimate the average income of all employees whose target contribution rate equals the default.

We find that when the default is more suitable for low-income employees, the average

income of those who opt out is above that of those who remain at the default, indicating that

high-income employees for whom the default is unattractive opt out quickly relative to lowincome employees for whom the default is more attractive. But when the default is more suitable

2

for high-income employees, the average income of those who opt out is still higher than that of

those who remain at the default, indicating that low-income employees for whom the default is

unattractive opt out slowly relative to high-income employees for whom the default is more

attractive.

Our third empirical method compares how high-income and low-income employee

outcomes change after a large shift in the default. Our identifying assumption is that low-income

employees’ preferences are not more closely aligned than high-income employees’ preferences

with both the old and the new default. We believe that this assumption is satisfied in the case of a

firm that changed the default asset allocation in its retirement savings plan from a money market

fund to a series of investment funds featuring significantly higher exposure to equities (a

balanced fund and then a collection of target date retirement funds). After this change in the

default, low-income employees exhibited a greater shift than high-income employees in average

portfolio allocations to funds with equity exposure.

Our three empirical methods provide convergent evidence that the economic outcomes of

low-income individuals are more influenced by defaults than those of high-income individuals,

holding fixed the degree of alignment between individuals’ preferences and the particular options

that are selected as defaults. This finding should be an important consideration for policymakers

and managers who design retirement savings institutions. Some caveats do apply to our analysis.

Our results do not allow us to distinguish among several possible explanations for the greater

influence of defaults on low-income individuals. Such individuals might be more likely to

remain at defaults because of higher cognition or action costs for opting out, a higher

susceptibility to time-inconsistent procrastination, a lack of expertise or information about

financial decisions, or a greater willingness to accept the default setter’s implicit endorsement of

the default option. A given deviation from one’s target contribution rate or asset allocation may

have a smaller utility consequence for a low-income individual because of the shape of his utility

function or because he faces high implicit marginal tax rates due to the means testing of welfare

benefits. Furthermore, our conclusions are based on an examination of defaults in the domain of

defined contribution retirement savings plans, and the results may not extend to other choice

architecture strategies or to other decision domains.

This research is most closely related to the recent work of Chetty et al. (2012), who use

Danish tax records to study individual responses to government and employer savings policies.

3

They document that individuals with a higher ratio of wealth to income have a greater propensity

to offset changes in employer-mandated pension contributions by adjusting savings on other

margins, a finding that is similar in spirit to our result that high-income individuals are in general

more likely to opt out of defaults in employer-sponsored savings plans.

The paper proceeds as follows. In Section I, we describe the three retirement savings

plans that we study and explain the construction of our data sets. Sections II, III, and IV

implement, in turn, our three empirical methods for analyzing the differential influence of

defaults by income. We offer concluding remarks in Section V.

I. Three Retirement Savings Plans

A. Defined Contribution Plan Design and Data at Firm A

Firm A is an information sector company with more than 10,000 employees.1 We study

employees who were hired at the firm between January 1, 2005 and December 31, 2006 and who

remained at the firm for at least twelve full calendar months. We further restrict our attention to

full-time employees 21 years of age or older who were eligible upon hire for the firm’s main

401(k) plan.3 The sample also excludes Highly Compensated Employees (HCEs), as these

employees were potentially subject to special restrictions on their contributions to the plan.4

Throughout the time period studied, employees in our sample were automatically

enrolled in the 401(k) plan approximately one month after hire at a 3% before-tax contribution

rate, and employees could opt out of this default to another contribution rate at any time. Beforetax contributions were subject to IRS annual contribution limits, and after-tax contributions were

not allowed.

Instead of providing employer matching contributions, Firm A made employer

contributions of 4% of pay that were not contingent on employee contributions. These employer

1

Beshears et al. (2010) analyze the response of Firm A employees to a change in the structure of employer

contributions to the firm’s retirement savings plan. The current paper restricts attention to the time period after this

3

Part-time employees could only become eligible for the plan after reaching one year of tenure. We directly observe

age but do not directly observe whether an employee was full-time or part-time. To exclude part-time employees, we

drop employees who did not become eligible for the plan within their first two full calendar months of tenure. The

two-month window allows for the possibility of administrative delays in processing eligibility.

4

The Highly Compensated Employee (HCE) designation is used for the purposes of non-discrimination testing, and

the definition is primarily based on income but sometimes takes other factors such as firm ownership into account.

We use IRS income thresholds but not other factors for the purposes of identifying HCEs. The thresholds were

$95,000 in 2005 and $100,000 in 2006.

4

contributions vested immediately. In addition, Firm A made profit-sharing contributions to

employee accounts. These profit-sharing contributions were not contingent on employee

contributions and were not guaranteed in advance, but they were typically in the range of 3% to

5% of pay. Profit-sharing contributions vested only after five years of tenure at the firm.

During 2005, the automatic enrollment default investment option was a money market

fund. On January 1, 2006, the default investment option became a balanced fund with exposure

to equities (approximately two-thirds of assets) and bonds (approximately one-third of assets).

Starting in September of 2006, target date retirement funds (TDRFs) were introduced to the

menu of investment options, and the default investment option became an age-appropriate

TDRF. TDRFs invest in a mix of stocks and bonds, with the allocation shifting towards bonds as

the “target date” approaches. Employees were matched to default TDRFs by five-year age bins.

The youngest employees had default TDRFs with equity allocations of approximately 90%,

while employees close to retirement had default TDRFs with equity allocations of approximately

30%. A typical newly hired employee had a default TDRF with an equity allocation of more than

two-thirds. Employees who were hired early in 2006 and who had not opted out of the balanced

fund default investment option as of September 2006 had their contributions automatically

redirected to age-appropriate TDRFs from September onwards, but their existing holdings in the

balanced fund were not reallocated. We refer to employees hired in 2005 as the Conservative

Default Fund Cohort and employees hired in 2006 as the Aggressive Default Fund Cohort. In

addition to the money market fund, the balanced fund, and the TDRFs, the plan investment menu

contained nine other options, including Firm A stock.

Firm A data were provided by Aon Hewitt, the 401(k) plan administrator. We have yearend cross-sectional snapshots of all individuals employed by Firm A during the years 2005,

2006, and 2007. The data include individual-level demographic information such as gender and

age;5 employment information such as hire date, termination date (if applicable), and salary; and

savings plan information such as initial participation date and investment fund balances. In

addition, we have monthly snapshots of employee contribution rates covering January 2005 to

December 2007, with the exception of February 2006.

We are interested in studying employees during their first twelve full calendar months of

tenure. Our analysis uses employee demographic variables and salary as of the end of the

5

Unlike for Firms B and C, marital status information is not available for Firm A.

5

calendar year in which an employee was originally hired. Because the data span multiple years,

salaries are adjusted to December 2005 wage levels using the seasonally adjusted Employment

Cost Index for wages and salaries for private industry workers published by the U.S. Bureau of

Labor Statistics. Since monthly contribution rate data are available, contribution rates are

measured as of the end of twelve full calendar months of tenure.6 Portfolio allocations are

measured using investment fund balances at the end of the calendar year in which an employee

was hired.7

We make final adjustments to our sample to account for companies that Firm A acquired.

Employees from acquired companies were not subject to the plan enrollment procedures

described above when they first joined the firm, so we take three steps to eliminate these

employees from our sample. First, we drop employees residing in states where the acquired

companies were headquartered. Second, we exclude employees who do not appear in the yearend data snapshot for the year of their original hire date.8 Third, we drop employees who appear

in multiple year-end snapshots with original hire dates that differ by more than one calendar

month.

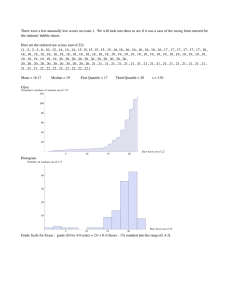

Our final sample has 1,572 employees, 742 of whom were hired in 2005 (the

Conservative Default Fund Cohort) and 830 of whom were hired in 2006 (the Aggressive

Default Fund Cohort). Table 1 reports summary statistics for each of these groups separately,

while Figure 1 shows the pooled distribution of employee contribution rates at one year of

tenure. Approximately half of the sample is female, and the mean age is 34. Mean annual salary

falls in the $40,000 to $42,000 range. The default of 3% is the modal contribution rate, and a

substantial fraction of employees opt out to a 0% contribution rate. For the Conservative Default

Fund Cohort, the mean portfolio allocation to aggressive funds—which we define as funds with

some equity exposure—is only 15%, while the mean portfolio allocation to aggressive funds is

6

The lack of February 2006 data generates missing values for 57 employees. We replace these missing values with

the employees’ contribution rates from March 2006, which coincide with those employees’ contribution rates from

January 2006 in all but five cases.

7

Portfolio allocations are not calculated for employees with zero or missing balances. There are 60 employees

without balances data who initiated participation in the plan before the end of the year in which they were hired. In

41 of these cases, it is likely that the missing balances are in fact zero balances because of administrative lags when

an employee enrolled in the plan at the end of the calendar year.

8

We make exceptions to this rule when an employee is hired at the end of a calendar year and does not appear in the

year-end data snapshot, likely as a result of administrative delays.

6

96% for the Aggressive Default Fund Cohort. We will analyze how the magnitude of this asset

allocation shift varies by income level in Section IV.

B. Defined Contribution Plan Design and Data at Firm B

Firm B has more than 50,000 employees engaged in a range of job functions, including

manufacturing, marketing, research and development, and administration. We study the firm

during the period July 2006 through June 2008.

The firm has its headquarters in the United Kingdom, and we limit our attention to the

pension plan for U.K. employees. The firm maintains legacy defined benefit plans for some of its

employees, but all employees hired during the time period we study are eligible only for a

defined contribution plan. We restrict our analysis to the firm’s main defined contribution plan.

Less than one percent of employees hired during this period are not eligible for the main plan but

are instead eligible for a plan with a different structure.9 These employees generally have low

salaries, and we exclude them from our analysis because they face distinct plan rules and are too

few in number to be examined separately.

All new employees besides the small group described above are eligible for the firm’s

main defined contribution plan and are automatically enrolled upon hire at a 12% default

contribution rate. Employees can opt out of the plan entirely, but in order to remain active plan

participants they must contribute at least 4% of every paycheck to the plan, with occasional

exceptions that are granted on a case-by-case basis. Subject to the 4% floor, employees can elect

any contribution rate at any time.11 The firm offers one-for-one employer matching contributions

up to 6% of pay, which vest immediately, on any employee contributions that exceed 12% of

pay. That is, if the employee’s contribution rate is c, the match is min{max{0, c – 12%}, 6%}.

However, in order to obtain matching contributions, an employee must elect a contribution rate

greater than 12% within her first three months of hire or within the three-week open enrollment

9

These employees are automatically enrolled at a default contribution rate of 4%, and they begin to receive an

employer match when their contribution rate exceeds 4%.

11

Some fraction of the first 12% of employee contributions is actually designated as employer contributions for the

purposes of determining National Insurance contribution levels. We do not observe the magnitude of this fraction.

The designation affects neither the amount of money that is credited to employee defined contribution accounts nor

the corresponding deduction from employee pay, but the designation does reduce payments to the National

Insurance system. Despite the relabeling of this portion of contributions, we still refer to the contributions as

“employee contributions” because this term most accurately reflects the relationship between pay deductions and

cash flows into employee accounts.

7

period in late May and early June, and the employee must agree to maintain her selected

contribution rate until the next open enrollment period. Employees who choose contribution rates

greater than 12% outside of the designated windows do not receive matching contributions.12 All

contributions to the plan are before-tax.

Plan balances can be allocated according to the employee’s wishes across eleven different

investment funds, one of which is a cash fund, two of which are bond funds, and eight of which

are equity funds. During the time period studied, the plan did not offer target date retirement

funds or employer stock in the investment menu. Employees who do not elect otherwise have

their contributions invested according to a default asset allocation, which is a mix of bonds and

equities.

Our analysis of the Firm B retirement plan relies on monthly administrative plan records

from three data extracts. The first extract covers March 2006 through October 2007; the second

extract covers November 2007 through March 2008; and the third extract covers April 2008

through June 2008. Each extract includes all employees who were active participants in the plan

as of the end of the extract period (October 31, 2007; March 31, 2008; or June 30, 2008). We

restrict our attention to the 671 employees who began their tenure at the firm between July 1,

2006 and June 30, 200713 and who have data records for their first twelve full calendar months of

employment. Note that our analysis excludes employees who left the firm or plan before the end

of their twelfth tenure month, as well as employees who left the firm or plan after the end of their

twelfth tenure month but before the end of the extract period that would have included their

twelfth tenure month.

The data set includes the gender, marital status, age, and hire date of each employee. In

addition, for each month, we observe employee compensation, the value of employee

contributions to the plan, and the value of employer contributions to the plan. We adjust salaries

to December 2005 levels using the U.K. Office of National Statistics Average Weekly Earnings

Index for seasonally adjusted private sector earnings, excluding bonuses. To calculate employee

and employer contribution rates, we divide contributions by compensation. However, we make

some adjustments to these calculations because administrative processes in the retirement

12

In rare individual cases, the firm can allow an employee to earn matching contributions by choosing a contribution

rate greater than 12% outside the designated windows, to change a match-earning contribution rate before the next

open enrollment period, or to earn matching contributions even with a contribution rate less than or equal to 12%.

13

We do not include employees hired between March and June of 2006 because the retirement plan rules were in

flux during that period.

8

savings plan often lag those in the employee payroll system. For instance, if an employee

receives a pay raise, the compensation record will increase accordingly, but the plan

contributions may stay at the amount appropriate for the previous compensation level, leading to

a misleadingly low ratio of contributions to compensation. In this example, the subsequent

month’s contribution amounts may (or may not) adjust upwards to reflect the new compensation

level and to make up for the missed contributions in the previous month, leading to a

misleadingly high ratio of contributions to compensation. More complicated scenarios arise

when an employee experiences multiple salary changes within a short timeframe. In addition, a

similar issue affects plan contributions at the beginning of an employee’s tenure: contributions in

the first or second month of tenure may represent contributions for that month and for previous

month(s). In all of these cases, we reattribute contributions to the appropriate months before

generating contribution rates.

Another factor that affects the calculation of contribution rates is the ability of employees

to contribute to the savings plan out of their bonus pay. Bonuses do not appear in our

compensation data, so plan contributions out of bonuses can create misleadingly large

contribution rates. Our analysis attempts to ignore contributions out of bonus compensation by

adopting the following procedure. Because bonuses are often awarded in April, any employee

contribution rate in April that exceeds both the March contribution rate and the May contribution

rate is set equal to the March contribution rate. After the contribution rate calculations have been

corrected for misalignment between the compensation and contribution records and adjusted for

contributions out of bonus pay, there still remain some non-integer contribution rates, and these

are rounded to the nearest integer rate.

Our data set does not include a variable indicating which employees are participants in

the firm’s main defined contribution plan. However, the difference in structure between the main

plan and the other plan allows us to identify employees who are likely to be members of the

other plan. The main plan provides employer matching contributions when the employee

contribution rate exceeds 12%, while the other plan provides a match when the employee

contribution rate exceeds 4%. An employee who receives a match on contributions above 4% of

pay would therefore be identified as a participant in the other plan, although no such employees

in fact exist in our sample. To be conservative, our analysis excludes employees whom we never

9

observe contributing more than 4% of pay, even though some of these individuals may be

participants in the main plan. This restriction eliminates five employees, or 0.7% of the sample.

Table 2 presents summary statistics for the 671 employees in our Firm B sample. All

variables are measured as of one year of tenure. A little more than half of the employees are

female, and slightly less than half are married. The mean age is 35 years. At £26,400, the median

salary is slightly higher than the typical salary of a U.K. worker, but there is considerable

variation in pay across the firm’s employees. The mean employee contribution rate is 9.4% of

pay. Figure 2, which displays the distribution of employee contribution rates, reveals that the

most common contribution rates are the 12% default rate, the 4% rate that is the minimum

allowable rate for most employees, and the 18% minimum rate necessary for obtaining the

maximum possible employer matching contribution.

C. Defined Contribution Plan Design and Data at Firm C

Firm C is an insurance company with more than 25,000 U.S. employees. We study data

on the company’s 401(k) plan covering January 1, 2003 to January 1, 2008. We drop part-time

employees from our sample because only full-time employees were eligible for the plan upon

hire.14 We also drop Highly Compensated Employees (HCEs) because they faced lower caps on

their contribution rates than other employees.15

Throughout the period we study, employees in our sample were automatically enrolled in

the 401(k) plan one month after their hire date. Before May 2005, the default was a 3% beforetax contribution rate, with contributions invested in a fund providing exposure to a combination

of bonds and equities. Starting in May 2005, the default became a 5% before-tax contribution

rate, and the default investment fund remained unchanged. Employees could opt out of these

defaults at any time.16 During our sample period, the plan offered approximately 20 investment

funds. Firm C stock was not an investment option.

14

As in the case of Firm A, we do not directly observe the full-time versus part-time status of employees at Firm C,

so we operationalize the restriction to full-time employees by excluding employees who did not become eligible for

the plan within their first two full calendar months of tenure.

15

We adopt the procedure applied to Firm A and use IRS income thresholds to identify HCEs. The thresholds were

$90,000 in 2003 and 2004, $95,000 in 2005, and $100,000 in 2006.

16

Starting in April 2005, employees could opt into an automatic contribution rate escalation program, which

allowed them to set a schedule of future contribution rate increases. Contribution rate escalation was not part of the

automatic enrollment default.

10

Before January 1, 2005, Firm C offered employer matching contributions of 62 cents per

dollar of before-tax or after-tax employee contributions up to 7% of pay. Matching contributions

were reduced to 50 cents on the dollar starting in January 2005. The firm had the option to make

additional matching contributions of up to 50 cents per dollar on the first 7% of pay contributed

by an employee. Any additional match rate was applied uniformly to all employees. Employer

matching contributions were 50% vested after one year of tenure at the firm, and an employee

was fully vested after serving for two years.

Data on the Firm C retirement plan were provided by Aon Hewitt and have the same

structure as the data for Firm A, with the exception that marital status information is available for

Firm C. We use year-end cross-sectional data snapshots for 2003 through 2007, as well as

monthly snapshots of employee contribution rates covering January 2003 to August 2007. As

with Firm A, we focus on employee contribution rates at one year of tenure, and we measure all

other variables as of the end of the calendar year in which an employee was hired, adjusting

salaries to December 2005 wage levels using the Employment Cost Index described in Section

I.A.

Our analysis focuses on two groups of employees: the Before Group and the After Group.

The Before Group consists of employees who were hired between January 1, 2003 and February

29, 2004 and remained at the firm for at least twelve months.17 These employees completed one

year of tenure at the firm before the automatic enrollment default contribution rate increased

from 3% to 5%. The After Group consists of employees who were hired between June 1, 2005

and July 31, 2006 and who remained at the firm for at least one year. These employees were

hired after the default contribution rate had increased.

To parallel our treatment of Firm A, we adjust our sample to account for the possibility of

company acquisitions by Firm C. We exclude employees who do not appear in the data snapshot

at the end of the calendar year in which they were hired, and we exclude employees whose

recorded original hire date differs by more than one calendar month across year-end snapshots.

Our final sample contains 6,550 individuals, with 2,785 in the Before Group and 3,765 in

the After Group. The characteristics of these groups are summarized in Table 3. Approximately

17

We exclude employees hired in March or April of 2004 because of a special communications campaign during

March 2005 that targeted employees who were not participating in the 401(k) plan or who were participating in the

plan but not receiving the full employer match. These employees received special encouragement to join the plan or

increase contributions to the plan, as appropriate.

11

60% of employees are female, although the fraction is slightly higher for the Before Group and

slightly lower for the After Group. Half of the Before Group is married, and 43% of the After

Group is married. The mean age is 34 years in the Before Group and 33 years in the After Group,

and mean salary is in the $42,000 to $44,000 range. Figures 3 and 4 display the distributions of

before-tax contribution rates for the two groups. In both cases, the default rate and the minimum

rate necessary to maximize employer contributions are the most frequent contribution rates.

II. Bunching at the Default

Our first empirical strategy analyzes the extent to which the default contribution rate

alters the distribution of employee contribution rates in the neighborhood of the default. If each

employee has a target contribution rate that she would choose if forced to actively elect a rate

and the default had no power, the actual distribution of employee contribution rates would

coincide with the distribution of target contribution rates. Let f(c*) be the probability density

function of target contribution rates, and let d be the default contribution rate. Then the density in

a neighborhood of the default is approximately f(d) + f'(d)ε, which is approximately equal to f(d)

when ε is small if f (c*) is continuous in a neighborhood of d. In other words, the density of target

contribution rates is approximately uniform in a neighborhood of the default. Deviation from a

uniform density in the distribution of actual contribution rates, which we measure by the mass at

the default divided by the total mass in a neighborhood of the default, is a signal of how

powerful the default is. In this section, we compare the degree of local concentration at the

default exhibited by different income groups.

The advantage of this strategy is that it can be applied to most situations where there is a

default, provided there are non-default choices that are sufficiently close to the default and the

default is not in the neighborhood of a discontinuity in f(c*) such as the employer match

threshold, where we would expect significant piling up because of the kink in the budget set

there. The major drawback of this strategy is that it requires some strong identifying

assumptions. First, when comparing the strength of the default across groups, the accuracy of the

uniform approximation must not vary significantly across groups. Second, the distribution of

target contribution rates outside the neighborhood, where the linear approximation is not good,

12

must not affect the fraction of people who still remain at the default.18 This assumption would be

satisfied if everybody with a target contribution rate outside of the neighborhood has already

opted out of the default by the time the contribution rate distribution is measured. Because

average time until opt-out is decreasing with the distance of the target rate from the default rate,

we would expect there to be a window of time where a significant fraction of people with a target

inside the neighborhood remain at the default but nearly everybody with a target outside the

neighborhood has opted out.

In Table 4, we focus our attention on employees in our Firm A sample who had

contribution rates of 2%, 3% (the default), or 4% at one year of tenure. We report the distribution

of employees across these three contribution rates for each income quartile of this subgroup.19

While 94% of the lowest income quartile is at the 3% default, only 88% of the highest income

quartile is at the default. We provide a formal test of this difference in Table 5, which presents

the results of probit regressions that use the same subgroup of employees. The outcome variable

is an indicator for the employee contributing at a 3% rate, and the explanatory variable of interest

is the logarithm of salary. With or without controls for gender, age, and month of hire, we find

that a 10% increase in salary predicts a statistically significant 0.6 or 0.7 percentage point

decrease in the likelihood of contributing at the default of 3% at one year of tenure. The evidence

indicates that low-income employees exhibit a greater degree of bunching at the default,

suggesting that they are more influenced by defaults.

We repeat the default bunching analysis for our Firm B sample, which had a 12% default

contribution rate. Table 6 shows that among employees with a contribution rate of 11%, 12%, or

13% at one year of tenure, 92% of the lowest income quartile versus 83% of the highest income

quartile has a contribution rate of 12%. The fraction does not decrease monotonically across

quartiles, but Table 7 reports probit regression results that indicate that the overall relationship is

negative. As in Table 5, the outcome variable is an indicator for the employee contributing at the

default rate, and the primary explanatory variable is the logarithm of salary. Without additional

18

To see the potential problem, consider a situation where all high-income employees who have a target rate outside

the neighborhood have a target rate that is very far from the default, whereas all low-income employees who have a

target rate outside the neighborhood have a target rate that is relatively close to the default. Then even if the opt-out

hazard function conditional on distance between the default and the target does not vary by income, we would

observe more low-income employees at the default until everybody with a target outside the neighborhood has opted

out.

19

The sizes of the quartiles are not exactly equal because we place employees with identical salaries in the same

quartile.

13

controls, a 10% increase in salary predicts a statistically significant 0.8 percentage point decrease

in the probability of contributing at the default rate. With controls, the effect estimate is no

longer statistically significant, but the magnitude is comparable to the estimate without controls.

At Firm C, we conduct the default bunching analysis separately for the Before Group,

which experienced a 3% default, and the After Group, which experienced a 5% default. In Panel

A of Table 8, we see some evidence that among Before Group employees at contribution rates of

2%, 3%, or 4%, the low-income quartiles are more likely than the high-income quartiles to be at

the default of 3%. The probit regression results reported in Panel A of Table 9 indicate that the

relationship between income and likelihood of having the default contribution rate is indeed

negative but not statistically significant. The After Group provides stronger evidence of a

negative relationship. Restricting attention to employees at contribution rates of 4%, 5%, or 6%,

Panel B of Table 8 shows that 89% of the lowest income quartile is at the default of 5%, while

only 75% of the highest income quartile is at the default. Panel B of Table 9 reports the probit

regression estimates of this relationship. A 10% increase in income predicts a statistically

significant 1.3 or 1.4 percentage point decrease in the likelihood of being at the default in this

sample.

Overall, the results of the default bunching analysis indicate that the distribution of

contribution rates among low-income employees exhibits a larger spike at the default, relative to

adjacent contribution rates, than the distribution for high-income employees. Thus, low-income

employees seem to be more influenced by the default.

III. Propensity to Opt Out of More Attractive Versus Less Attractive Defaults

Our second empirical strategy compares the propensity of low- versus high-income

employees to opt out when the default is relatively more suitable for low-income employees

versus when the default is relatively more suitable for high-income employees. We begin by

estimating the average income of employees for whom the default is the target contribution rate,

using the average income of employees who opt out to choices close to the default. Our null

hypothesis is that the propensity to opt out of a default as a function of the distance between the

default and the individual’s target contribution rate does not vary by income. If this is true, then

the average income of employees who opt out to a non-default contribution rate is an unbiased

estimator of the average income of all employees who have that non-default contribution rate as

14

a target. If the function mapping target contribution rates to the average income of employees

with that target contribution rate is continuous, we can use interpolation from non-default

contribution rates to infer the average income of all employees who have the default contribution

rate as a target.

For Figure 5, we group employees in our Firm A sample into contribution rate bins as of

one year of tenure. In this figure and in the regressions that accompany it (see Table 10),

contribution rates greater than 15% are recoded as being equal to 15%. For each contribution rate

bin, the circle plotted in Figure 5 gives the mean of the logarithm of annual salary, and the error

bars indicate two standard errors on either side of this mean. To predict average log salary for

employees whose target is the default contribution rate of 3%, we perform an ordinary least

squares regression of log salary on the employee contribution rate, the employee contribution

rate squared, and an indicator variable for the employee contribution rate being equal to 3%. The

fitted values from this regression, restricting the indicator variable to be zero at all contribution

rates, are given by the solid line in Figure 5, and the dotted lines represent two standard errors on

either side of the fitted values. The line shows that higher contribution rates are on average

desired by employees with higher incomes. Some contribution rate bins (e.g., 9%, 13%, and

14%) have a mean log salary that is far from the predicted value, but these deviations are easily

explained by the small sample sizes in these bins. The default contribution rate bin of 3%, which

has a substantial number of observations, is not used in the regression specification to form the

predicted values.

The regression estimates that the average log salary of those with a target contribution

rate of 3% is 10.558 (=log 38,486), which is 3 log points above the 10.530 (=log 37,404) average

log salary of the entire sample in Figure 5. Therefore, the 3% default is about right for the

average employee.20 The average log salary of those who remain at the default one year after hire

is 10.490 (=log 35,941), which is significantly below the average log salary of those for whom

the default is predicted to be optimal (see Table 10). In fact, those who remain at the default have

a lower average salary than those who opt out ($39,090 versus $44,494, t = 5.46, p < 0.01),

indicating that despite the fact that the default slightly favors higher-income employees, it is the

lower-income employees who persist longer at the default.

20

Recall that Firm A makes a non-contingent employer contribution and a profit-sharing contribution that typically

total 7% to 9% of income, which helps explain why the average employee has such a low target employee

contribution rate.

15

We repeat the above analysis for Firm C, which has a 3% default contribution rate for the

Before Group and a 5% default for the After Group. Figure 6 and 7 and Table 11 are analogous

to Figure 5 and Table 10. Contribution rates greater than 15% are recoded as being equal to 15%.

For both the Before Group and the After Group, we find that employees who remain at the

default have salaries that are significantly lower by 5 to 9 log points than would be predicted by

the salaries of employees who opt out to other contribution rates. The average log salary of those

in the Before Group with a target contribution rate of 3% is 10.522 (=log 37,110), which is 5 log

points below the 10.571 (=log 38,981) average log salary of the entire sample in Figure 6. Since

a 3% default is better-suited for low-income employees, it may not be surprising that the average

salary of those who remain at the default is lower than that of those who opt out ($36,781 versus

$44,371, t = 12.37, p < 0.01). However, when the default rises to 5% in the After Group, the

average salary of those who remain at the default is still lower than that of those who opt out

($39,895 versus $45,485, t = 9.85, p < 0.01), even though the predicted average log salary of

those for whom the 5% default is the target (10.623 = log 41,051) is similar to the sample

average log salary (10.637 = log 41,628).

Finally, we analyze Firm B, whose high default contribution rate of 12% makes the

results starker. For Firm B, contribution rates less than 4% are recoded as being equal to 4%, and

contribution rates greater than 18% are recoded as being equal to 18%. In Figure 8, the sparsely

populated contribution rate of 17% deviates significantly from the predicted value. The

important deviation, however, is the difference between mean logarithm of salary at the 12%

default and the predicted value. As can be seen in Figure 8 and Table 11, employees at the 12%

default have an average income that is approximately one-third lower than the average for

employees with 12% as a target contribution rate. The average log income for those with 12% as

a target rate is 10.436 (=log 34,073), which is considerably higher than the sample-wide average

log salary of 10.232 (=log 28,788). Therefore, the 12% default is more suitable for high-income

employees than low-income employees. Nevertheless, the average income of those who remain

at the default is significantly lower than that of those who opted out (£28,880 versus £33,739, t =

2.75, p < 0.01), indicating that low-income employees are more likely to stay at the default even

when it is far from their typical target.

Overall, the findings from the three companies indicate that the default has a stronger

influence on the outcomes of low-income employees.

16

IV. Impact of a Changing Default

Our final method for gauging the impact of defaults on low-income employees is to

examine a setting in which the default changed and compare the resulting changes in low-income

employees’ outcomes to the resulting changes in high-income employees’ outcomes. This

method requires that the old default and the new default must not both on average be more

aligned with the target outcome of low-income employees than with the target outcome of highincome employees. We believe that this assumption is satisfied in the case of the change in the

default investment fund from a money market fund to a balanced fund and then to a collection of

target date retirement funds (TDRFs) at Firm A. This change represents a major shift in the

default asset allocation from a portfolio with no equity exposure to a portfolio with substantial

equity exposure. Even if low-income employees are somewhat more or less risk averse than

high-income employees, the change from an extremely conservative default fund to an

aggressive default fund is unlikely to create a setting in which the old and new defaults are both

more aligned with the target portfolio of low-income employees than with the target portfolio of

high-income employees.

We have only approximate information on the percent of each TDRF that is invested in

equities. We therefore divide all Firm A funds into aggressive funds, which have some exposure

to equities, and conservative funds, which have no exposure to equities. For each employee in

our Firm A sample with positive balances as of the end of the calendar year of initial hire, we

calculate the portfolio allocation to aggressive funds.21 Table 13 shows mean portfolio

allocations to aggressive funds by cohort and income quartile. Employees hired in 2005, when

the default fund was conservative, have much lower allocations to aggressive funds than

employees hired in 2006, when the default funds were aggressive. This effect is more

pronounced for employees with lower income: the lowest income quartile exhibited a shift from

a 7% to a 97% mean allocation to aggressive funds, while the highest income quartile exhibited a

shift from 28% to 92%.

21

Appendix Figures 1 and 2 show mean portfolio allocations disaggregated at the asset class level for the employees

in our sample who experienced a conservative default and for the employees in our sample who experienced an

aggressive default, respectively. The money market, stable value, and bond funds are classified as conservative, and

all other funds are classified as aggressive.

17

We confirm the statistical significance of the differential effect of the default change by

performing ordinary least squares regressions with allocation to aggressive funds as the outcome

variable.22 Columns 1 and 2 of Table 14 report the results when the key explanatory variables are

an indicator for being hired in 2006 (after the change in the default), the demeaned logarithm of

salary, and the interaction between the two. The change in the default leads to an average shift in

the allocation to aggressive funds of 80 percentage points. Before the change in the default, a

10% increase in salary predicts a 2.0 percentage point increase in the allocation to aggressive

funds. A 10% increase in salary also predicts a 2.4 percentage point decrease in the size of the

effect of the default change. The same pattern of findings is demonstrated in columns 3 and 4 of

Table 14, which use indicator variables for income quartiles instead of treating income as a

continuous variable. Before the change in the default, the highest income quartile had aggressive

fund allocations that were 22 percentage points higher than the aggressive fund allocations of the

lowest income quartile. In response to the change in the default, the lowest income quartile

exhibited an increase in aggressive fund allocations of 91 percentage points, and the increase

exhibited by the highest income quartile was smaller by 27 percentage points.

V. Conclusion

Using data on the defined contribution retirement savings plans of three firms, we

implement three methods for studying the impact of default options on low-income versus highincome employees. The evidence consistently suggests that low-income employees are more

influenced by defaults. First, in their distribution of contribution rates, low-income employees

exhibit a greater degree of bunching at the default relative to contribution rates near the default.

Second, low-income employees are less likely to opt out of the default even when it is relatively

unattractive for them, as indicated by the salaries of employees who opt out to contribution rates

adjacent to the default. Finally, the portfolios of low-income employees are more affected by a

change in the default investment fund from a money market fund to a series of funds that have

much higher exposure to equities. The particularly powerful impact of defaults on low-income

individuals may be an argument for setting defaults that conform most closely to the interests of

these individuals.

22

This outcome variable is censored above and below. Tobit regressions that account for the censoring give results

that are qualitatively similar.

18

Our analysis has focused on defaults in employer-sponsored savings plans. While our

finding that defaults have a stronger influence on low-income individuals may generalize to

some contexts, there are likely to be contexts where the opposite is true or where the relevant

dimension of heterogeneity is entirely different. It would be valuable to apply our empirical

techniques to these other decision domains and choice architecture strategies in future research.

References

Abadie, Alberto, and Sebastien Gay, 2006. “The impact of presumed consent legislation on

cadaveric organ donation: A cross-country study.” Journal of Health Economics 25, pp. 599-620.

Beshears, John, James J. Choi, David Laibson, and Brigitte C. Madrian, 2008. “The importance

of default options for retirement saving outcomes: Evidence from the United States.” In Stephen

J. Kay and Tapen Sinha, eds., Lessons from Pension Reform in the Americas, Oxford: Oxford

University Press, pp. 59-87.

Beshears, John, James J. Choi, David Laibson, and Brigitte C. Madrian, 2010. “The impact of

employer matching on savings plan participation under automatic enrollment.” In David A.

Wise, ed., Research Findings in the Economics of Aging, Chicago: University of Chicago Press,

pp. 311-327.

Carroll, Gabriel D., James J. Choi, David Laibson, Brigitte C. Madrian, and Andrew Metrick,

2009. “Optimal defaults and active decisions.” Quarterly Journal of Economics 124, pp. 16391674.

Chetty, Raj, John N. Friedman, Soren Leth-Petersen, Torben Heien Nielsen, and Tore Olsen,

2012. “Active vs. passive decisions and crowd-out in retirement savings accounts: Evidence

from Denmark.” Working paper.

Choi, James J., David Laibson, Brigitte C. Madrian, and Andrew Metrick, 2002. “Defined

contribution pensions: Plan rules, participant decisions, and the path of least resistance.” In

James Poterba, ed., Tax Policy and the Economy, Cambridge: MIT Press, pp. 67-113.

Choi, James J., David Laibson, Brigitte C. Madrian, and Andrew Metrick, 2004. “For better or

for worse: Default effects and 401(k) savings behavior.” In David A. Wise, ed., Perspectives on

the Economics of Aging, Chicago: University of Chicago Press, pp. 81-121.

Johnson, Eric J., Steven Bellman, and Gerald L. Lohse, 2002. “Defaults, framing and privacy:

Why opting in-opting out.” Marketing Letters 13, pp. 5-15.

Johnson, Eric J., and Daniel Goldstein, 2003. “Do defaults save lives?” Science 302, pp. 13381339.

19

Madrian, Brigitte C., and Dennis F. Shea, 2001. “The power of suggestion: Inertia in 401(k)

participation and savings behavior.” Quarterly Journal of Economics 116, pp. 1149-1187.

Park, C. Whan, Sung Youl Jun, and Deborah J. MacInnis, 2000. “Choosing what I want versus

rejecting what I do not want: An application of decision framing to product option choice

decisions.” Journal of Marketing Research 37, pp. 187-202.

Thaler, Richard H., and Cass R. Sunstein, 2008. Nudge: Improving Decisions about Health,

Wealth, and Happiness. New Haven: Yale University Press.

20

Table 1. Firm A Sample Characteristics

Panel A of this table presents summary statistics for the 742 full-time employees who were hired

at Firm A between January 1, 2005 and December 31, 2005, who remained at the firm for at least

one year, and who were not Highly Compensated Employees. Panel B presents summary

statistics for the 830 full-time employees who were hired at the firm between January 1, 2006

and December 31, 2006, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. Contribution rates are measured as of one year of tenure for each

employee. All other variables are measured as of the end of the calendar year in which the

employee was hired. Note that portfolio allocations to aggressive investment funds are not

calculated for employees with zero year-end balances, so the sample sizes for this variable are

616 in Panel A and 696 in Panel B.

Panel A: Employees Hired January 1, 2005 – December 31, 2005 (Conservative Default Fund)

Mean

51.3%

Std. Dev.

10th

Percentile

Age (years)

33.8

9.6

23.8

30.9

49.3

Annual salary ($1000s)

40.4

18.3

20.0

36.4

69.9

Employee contribution rate

(percent of pay)

Portfolio allocation to

aggressive investment funds

3.6

4.5

0.0

3.0

6.0

15.3%

32.4%

0.0%

0.0%

80.9%

Female

Median

90th

Percentile

Panel B: Employees Hired January 1, 2006 – December 31, 2006 (Aggressive Default Fund)

Mean

48.9%

Std. Dev.

10th

Percentile

Age (years)

33.6

9.8

23.5

30.6

49.4

Annual salary ($1000s)

42.2

19.3

23.2

36.8

72.6

Employee contribution rate

(percent of pay)

Portfolio allocation to

aggressive investment funds

3.8

4.3

0.0

3.0

8.0

95.7%

14.9%

85.7%

100.0%

100.0%

Female

Median

90th

Percentile

Table 2. Firm B Sample Characteristics

This table presents summary statistics for the 671 employees who were hired at Firm B between

July 1, 2006 and June 30, 2007 and whom we observe in the data for at least one year. The

variables are measured as of one year of tenure for each employee. For the employee

contribution rate, contributions out of bonuses are disregarded.

Female

Mean

55.0%

Married

47.7%

Std. Dev.

10th

Percentile

Median

90th

Percentile

Age (years)

35.0

9.4

24.4

33.1

48.5

Annual salary (£1000s)

32.5

20.6

14.5

26.4

59.8

Employee contribution rate

(percent of pay)

9.4

5.7

4.0

9.0

18.0

Table 3. Firm C Sample Characteristics

Panel A of this table presents summary statistics for the 2,785 full-time employees who were

hired at Firm C between January 1, 2003 and February 29, 2004, who remained at the firm for at

least one year, and who were not Highly Compensated Employees. Panel B presents summary

statistics for the 3,765 full-time employees who were hired at the firm between June 1, 2005 and

July 31, 2006, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. Contribution rates are measured as of one year of tenure for each

employee. All other variables are measured as of the end of the calendar year in which the

employee was hired.

Panel A: Employees Hired January 1, 2003 – February 29, 2004 (3% Default Contribution Rate)

Female

Mean

62.6%

Married

50.4%

Std. Dev.

10th

Percentile

Median

90th

Percentile

Age (years)

34.4

10.2

23.1

32.2

50.3

Annual salary ($1000s)

41.9

16.8

24.6

37.8

67.2

Employee contribution rate

(percent of pay)

5.4

4.4

1.0

4.0

10.0

Panel B: Employees Hired June 1, 2005 – July 31, 2006 (5% Default Contribution Rate)

Female

Mean

57.2%

Married

42.5%

Std. Dev.

10th

Percentile

Median

90th

Percentile

Age (years)

33.1

10.1

22.9

29.9

49.2

Annual salary ($1000s)

44.2

16.2

27.6

41.2

67.9

Employee contribution rate

(percent of pay)

6.1

4.2

0.0

7.0

10.0

Table 4. Relative Frequency of Nearby Contribution Rates at Firm A

This table examines full-time employees who were hired at Firm A between January 1, 2005 and

December 31, 2006, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. The analysis is further restricted to employees who, at one year of

tenure, had contribution rates equal to, one percentage point below, or one percentage point

above the default contribution rate of 3%. This subsample is divided into quartiles by income,

and the table reports the fraction of each income quartile that has a given contribution rate.

Fraction at Contribution Rate of

3%

4%

2%

Income

Quartile 1

(N = 252)

Income

Quartile 2

(N = 245)

Income

Quartile 3

(N = 251)

Income

Quartile 4

(N = 245)

2.4%

93.7%

4.0%

2.0%

93.9%

4.1%

2.8%

92.0%

5.2%

2.9%

88.2%

9.0%

Table 5. Regressions for Relative Frequency of Nearby Contribution Rates at Firm A

This table reports marginal effects from probit regressions in which the outcome variable is an

indicator for the employee’s contribution rate as of one year of tenure being equal to the default

contribution rate. The table examines full-time employees who were hired at Firm A between

January 1, 2005 and December 31, 2006, who remained at the firm for at least one year, and who

were not Highly Compensated Employees. The sample is further restricted to employees who, at

one year of tenure, had contribution rates equal to, one percentage point below, or one

percentage point above the default contribution rate of 3%. Standard errors are in parentheses. *,

**, and *** indicate statistical significance of underlying probit coefficients at the 10%, 5%, and

1% levels.

Outcome:

log(Annual salary)

Indicator for contribution rate of 3%

-0.060***

(0.020)

Female

Age (years)

Hire month fixed effects

R2

Sample size

No

0.015

N = 993

-0.067***

(0.021)

0.010

(0.017)

0.002**

(0.001)

Yes

0.058

N = 948

Table 6. Relative Frequency of Nearby Contribution Rates at Firm B

This table examines employees who were hired at Firm B between July 1, 2006 and June 30,

2007 and whom we observe in the data for at least one year. The analysis is further restricted to

employees who, at one year of tenure, had contribution rates equal to, one percentage point

below, or one percentage point above the default contribution rate of 12%. This subsample is

divided into quartiles by income, and the table reports the fraction of each income quartile that

has a given contribution rate.

Fraction at Contribution Rate of

12%

13%

11%

Income

Quartile 1

(N = 49)

Income

Quartile 2

(N = 49)

Income

Quartile 3

(N = 49)

Income

Quartile 4

(N = 48)

2%

91.8%

6.1%

2%

95.9%

2%

6.1%

87.8%

6.1%

6.3%

83.3%

10.4%

Table 7. Regressions for Relative Frequency of Nearby Contribution Rates at Firm B

This table reports marginal effects from probit regressions in which the outcome variable is an

indicator for the employee’s contribution rate as of one year of tenure being equal to the default

contribution rate. The table examines employees who were hired at Firm B between July 1, 2006

and June 30, 2007 and whom we observe in the data for at least one year. The sample is further

restricted to employees who, at one year of tenure, had contribution rates equal to, one

percentage point below, or one percentage point above the default contribution rate of 12%.

Standard errors are in parentheses. *, **, and *** indicate statistical significance of underlying

probit coefficients at the 10%, 5%, and 1% levels.

Outcome:

log(Annual salary)

Female

Married

Age (years)

Hire month fixed effects

R2

Sample size

Indicator for contribution rate of 12%

-0.079**

-0.051

(0.035)

(0.035)

-0.061

(0.040)

-0.100**

(0.048)

-0.001

(0.002)

No

Yes

0.037

0.199

N = 195

N = 190

Table 8. Relative Frequency of Nearby Contribution Rates at Firm C

Panel A of this table examine full-time employees who were hired at Firm C between January 1,

2003 and February 29, 2004, who remained at the firm for at least one year, and who were not

Highly Compensated Employees. Panel B examines full-time employees who were hired at the

firm between June 1, 2005 and July 31, 2006, who remained at the firm for at least one year, and

who were not Highly Compensated Employees. In each panel, the analysis is further restricted to

employees who, at one year of tenure, had contribution rates equal to, one percentage point

below, or one percentage point above the default contribution rate. This subsample is divided

into quartiles by income, and the table reports the fraction of each income quartile that has a

given contribution rate.

Panel A:

Employees Hired January 1, 2003 – February 29, 2004

(3% Default Contribution Rate)

Fraction at Contribution Rate of

3%

4%

2%

Income

Quartile 1

(N = 272)

Income

Quartile 2

(N = 273)

Income

Quartile 3

(N = 268)

Income

Quartile 4

(N =268)

7.7%

86.8%

5.5%

5.9%

87.2%

7.0%

11.9%

74.3%

13.8%

6.0%

84.3%

9.7%

Panel B:

Employees Hired June 1, 2005 – July 31, 2006

(5% Default Contribution Rate)

Fraction at Contribution Rate of

3%

4%

2%

Income

Quartile 1

(N = 261)

Income

Quartile 2

(N = 264)

Income

Quartile 3

(N = 262)

Income

Quartile 4

(N = 256)

6.1%

88.5%

5.4%

11.0%

78.8%

10.2%

8.4%

82.4%

9.2%

9.0%

74.6%

16.4%

Table 9. Regressions for Relative Frequency of Nearby Contribution Rates at Firm C

This table reports marginal effects from probit regressions in which the outcome variable is an

indicator for the employee’s contribution rate as of one year of tenure being equal to the default.

Panel A examines full-time employees who were hired at Firm C between January 1, 2003 and

February 29, 2004, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. Panel B examines full-time employees who were hired at the firm

between June 1, 2005 and July 31, 2006, who remained at the firm for at least one year, and who

were not Highly Compensated Employees. For each regression, the sample is further restricted to

employees who, at one year of tenure, had contribution rates equal to, one percentage point

below, or one percentage point above the default. Standard errors are in parentheses. *, **, and

*** indicate statistical significance of underlying probit coefficients at the 10%, 5%, and 1%

levels.

Panel A: Employees Hired January 1, 2003 – February 29, 2004

(3% Default Contribution Rate)

Sample:

Outcome:

log(Annual salary)

Female

Married

Age (years)

Hire month fixed effects

R2

Sample size

Employees at 2%, 3%, or 4%

Indicator for contribution rate of 3%

-0.047

-0.044

(0.034)

(0.036)

0.026

(0.026)

-0.054**

(0.024)

0.004***

(0.001)

No

Yes

0.002

0.028

N = 1,081

N = 1,081

Panel B: Employees Hired June 1, 2005 – July 31, 2006

(5% Default Contribution Rate)

Sample:

Outcome:

log(Annual salary)

Female

Married

Age (years)

Hire month fixed effects

R2

Sample size

Employees at 4%, 5%, or 6%

Indicator for contribution rate of 5%

-0.133***

-0.144***

(0.037)

(0.040)

-0.011

(0.025)

-0.059**

(0.027)

0.003

(0.001)

No

Yes

0.013

0.034

N = 1,043

N = 1,043

Table 10. Regression Analysis of Employee Salaries by Contribution Rate at Firm A

This table reports coefficients from ordinary least squares regressions in which the left-hand-side

variable is the logarithm of annual salary and the right-hand-side variables are as shown.

Contribution rates are measured as of one year of tenure for each employee. Employee

contribution rates greater than 15% are recoded to be equal to 15%. All other variables are

measured as of the end of the calendar year in which the employee was hired. The sample is

composed of the full-time employees who were hired at Firm A between January 1, 2005 and

December 31, 2006, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. Standard errors robust to heteroskedasticity are in parentheses. *, **,

and *** indicate statistical significance at the 10%, 5%, and 1% levels.

log(Annual salary)

Outcome:

Indicator for contribution rate

equal to 3% (default)

Contribution rate (percent of pay)

-0.041*

(0.024)

0.042***

(0.004)

-0.072***

(0.025)

0.062***

(0.010)

No

0.094

N = 1,572

-0.050**

(0.022)

0.006***

(0.001)

Yes

0.152

N = 1,572

Contribution rate squared (÷100)

Female

Age (years)

Hire month fixed effects

R2

Sample size

-0.068***

(0.025)

0.064***

(0.011)

-0.002**

(0.001)

No

0.097

N = 1,572

-0.072***

(0.023)

0.062***

(0.010)

-0.002**

(0.001)

-0.050**

(0.022)

0.006***

(0.001)

Yes

0.152

N = 1,572

Table 11. Regression Analysis of Employee Salaries by Contribution Rate at Firm C

This table reports coefficients from ordinary least squares regressions in which the left-hand-side variable is the logarithm of annual

salary and the right-hand-side variables are as shown. Contribution rates are measured as of one year of tenure for each employee.

Employee contribution rates greater than 15% are recoded to be equal to 15%. All other variables are measured as of the end of the

calendar year in which the employee was hired. The sample in the left half of the table is composed of the full-time employees who

were hired at Firm C between January 1, 2003 and February 29, 2004, who remained at the firm for at least one year, and who were

not Highly Compensated Employees. The sample in the right half of the table is composed of the full-time employees who were hired

at the firm between June 1, 2005 and July 31, 2006, who remained at the firm for at least one year, and who were not Highly

Compensated Employees. Standard errors robust to heteroskedasticity are in parentheses. *, **, and *** indicate statistical

significance at the 10%, 5%, and 1% levels. Note that 7% is the minimum contribution rate necessary to obtain the full employer

match.

Outcome:

Indicator for contribution rate

equal to 3% (Before Group default)

Indicator for contribution rate

equal to 5% (After Group default)

Contribution rate (percent of pay)

Employees Hired Jan 1, 2003 – Feb 29, 2004

log(Annual salary)

-0.070*** -0.053*** -0.070*** -0.053***

(0.015)

(0.014)

(0.015)

(0.014)

0.034***

(0.002)

0.029***

(0.002)

No

0.137

N = 2,785

-0.191***

(0.013)

0.058***

(0.013)

0.005***

(0.001)

Yes

0.236

N = 2,785

Contribution rate squared (÷100)

Female

Married

Age (years)

Hire month fixed effects

R2

Sample size

0.038***

(0.005)

-0.033

(0.037)

No

0.137

N = 2,785

0.029***

(0.005)

-0.000

(0.036)

-0.191***

(0.013)

0.058***

(0.013)

0.005***

(0.001)

Yes

0.236

N = 2,785

Employees Hired June 1, 2005 – July 31, 2006

log(Annual salary)

-0.085***

(0.013)

0.034***

(0.002)

-0.076***

(0.012)

0.028***

(0.001)

No

0.149

N = 3,765

-0.146***

(0.010)

0.046***

(0.011)

0.008***

(0.001)

Yes

0.268

N = 3,765

-0.083***

(0.013)

0.033***

(0.004)

0.013

(0.028)

No

0.149

N = 3,765

-0.079***

(0.013)

0.031***

(0.004)

-0.020

(0.027)

-0.146***

(0.010)

0.046***

(0.011)

0.008***

(0.001)

Yes

0.268

N =3,765

Table 12. Regression Analysis of Employee Salaries by Contribution Rate at Firm B

This table reports coefficients from ordinary least squares regressions in which the left-hand-side

variable is the logarithm of annual salary and the right-hand-side variables are as shown. All

variables are measured as of one year of tenure for each employee. For the employee

contribution rate, contributions out of bonuses are disregarded. Employee contribution rates less

than 4% are recoded to be equal to 4%, and employee contribution rates greater than 18% are

recoded to be equal to 18%. The sample is composed of the employees who were hired at Firm B

between July 1, 2006 and June 30, 2007 and whom we observe in the data for at least one year.

Standard errors robust to heteroskedasticity are in parentheses. *, **, and *** indicate statistical

significance at the 10%, 5%, and 1% levels.

Outcome:

Indicator for contribution rate

equal to 12% (default)

Contribution rate (percent of pay)

-0.347***

(0.051)

0.042***

(0.004)

Contribution rate squared (÷100)

Female

Married

Age (years)

Hire month fixed effects

R2

Sample size

No

0.149

N = 671

log(Annual salary)

-0.321*** -0.343***

(0.048)

(0.064)

0.030***

0.039

(0.004)

(0.026)

0.013

(0.124)

-0.199***

(0.037)

0.113**

(0.041)

0.013***

(0.003)

Yes

No

0.283

0.149

N = 671

N = 671

-0.304***

(0.063)

0.018

(0.026)

0.052

(0.120)

-0.198***

(0.038)

0.115**

(0.042)

0.013***

(0.003)

Yes

0.283

N = 671

Table 13. Conservative and Aggressive Default Funds and Asset Allocation at Firm A

This table examines the 1,312 full-time employees who were hired at Firm A between January 1,

2005 and December 31, 2006, who remained at the firm for at least one year, who were not