W O R K I N G Business Cycle

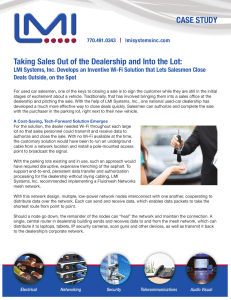

advertisement