ACCT 417 | Advanced Accounting for Non-Accounting Majors

advertisement

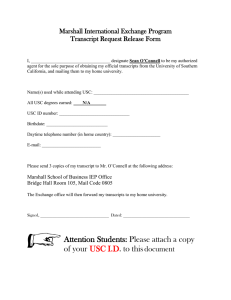

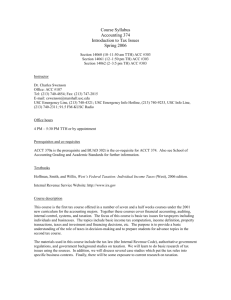

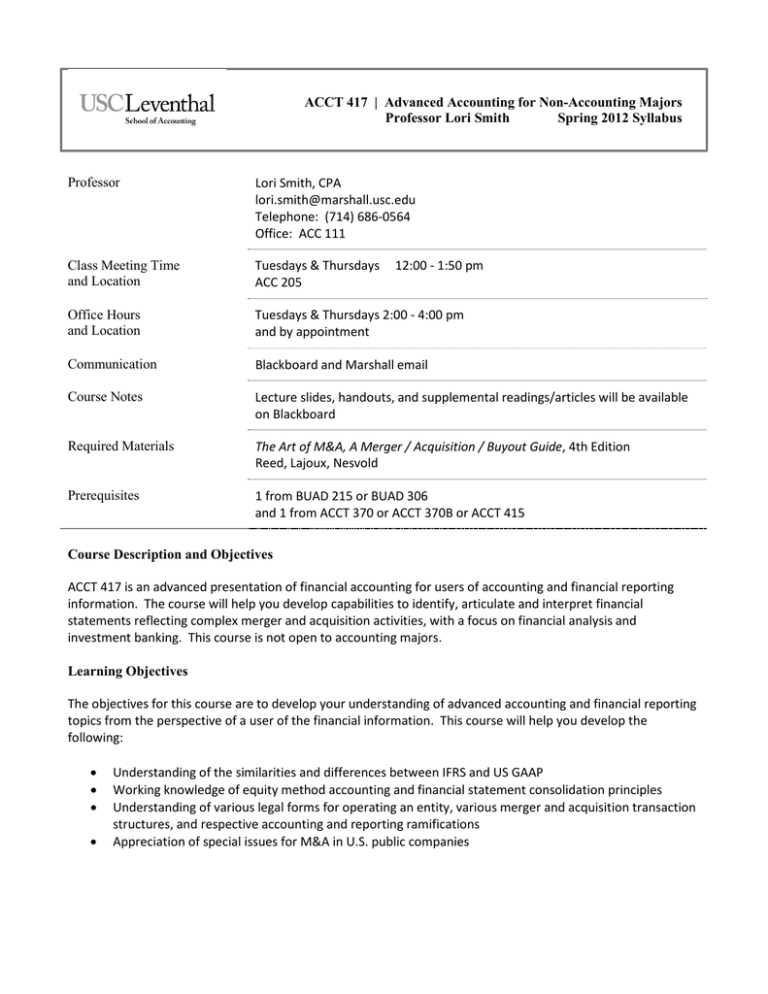

ACCT 417 | Advanced Accounting for Non-Accounting Majors Professor Lori Smith Spring 2012 Syllabus Professor Lori Smith, CPA lori.smith@marshall.usc.edu Telephone: (714) 686-0564 Office: ACC 111 Class Meeting Time and Location Tuesdays & Thursdays ACC 205 Office Hours and Location Tuesdays & Thursdays 2:00 - 4:00 pm and by appointment Communication Blackboard and Marshall email Course Notes Lecture slides, handouts, and supplemental readings/articles will be available on Blackboard Required Materials The Art of M&A, A Merger / Acquisition / Buyout Guide, 4th Edition Reed, Lajoux, Nesvold Prerequisites 1 from BUAD 215 or BUAD 306 and 1 from ACCT 370 or ACCT 370B or ACCT 415 12:00 - 1:50 pm Course Description and Objectives ACCT 417 is an advanced presentation of financial accounting for users of accounting and financial reporting information. The course will help you develop capabilities to identify, articulate and interpret financial statements reflecting complex merger and acquisition activities, with a focus on financial analysis and investment banking. This course is not open to accounting majors. Learning Objectives The objectives for this course are to develop your understanding of advanced accounting and financial reporting topics from the perspective of a user of the financial information. This course will help you develop the following: • • • • Understanding of the similarities and differences between IFRS and US GAAP Working knowledge of equity method accounting and financial statement consolidation principles Understanding of various legal forms for operating an entity, various merger and acquisition transaction structures, and respective accounting and reporting ramifications Appreciation of special issues for M&A in U.S. public companies Assignments and Grading Policy Attendance and general participation 10% Participation points are awarded for class attendance and active, substantive contributions to class discussions. You are responsible to sign the attendance sheet for every session that you attend. Current business news presentation [Group] 10% Groups will be comprised of 2-3 persons. Each group will present a current business news item on a selected day. The presentation should be 5-10 minutes long and include background information on the topic as well as facilitating class discussion. Midterm exam 20% The midterm exam is planned for Thursday, March 29, 2012 at 12:00-1:50 pm. The midterm exam will be based on topics and material covered during lectures and will consist of multiple-choice, short answer and or problems. Project 1 [Individual] 20% IFRS vs US GAAP Project 1 is due Tuesday, April 10, 2012 at beginning of class Project 2 [Group] 20% Strategic Fit and Acquisition Assumptions Groups will be comprised of 2- 3 persons Project 2 is due Tuesday, April 24, 2012 at beginning of class Final exam 20% The final exam is scheduled for Wednesday, May 9, 2012 at 2:00-4:00 pm. The final exam in noncumulative, will be based on topics and material covered during lectures and will consist of multiple-choice, short answer and or problems. Grand Total 100% Evaluation of Your Work Assignments will be graded on the quality of content as well as the organization and presentation of your analysis. Just like in real life … the quality of your analysis (i.e., what you present) and how you present it are each an important component of how you are evaluated. You may regard each of your submissions as an “exam” in which you apply what you’ve learned according to the assignment. I will do my best to make my expectations for the various assignments clear and to evaluate them as fairly and objectively as I can. If, however, you feel that an error has occurred in the grading of any assignment, you may, within one week of the date the assignment is returned to you, write me a memo in which you request that I re-evaluate the assignment. Attach the original assignment to the memo, and explain fully and carefully why you think the assignment should be re-graded. Be aware that the re-evaluation process can result in three types of grade adjustments: positive, none, or negative. ACCT 417 | Advanced Accounting for Non-Accounting Majors [Spring 2012 Section 14110] Syllabus - Page 2 Assignment Submission Policy Assignments must be turned in on the due date/time either electronically or in printed form as outlined for the specific assignment. Any assignment turned in late, even if by only a few minutes, will receive a grade deduction (for example, if your work is a B+ grade, you will be given a C+ grade). If your internet breaks down on the due date, you must deliver a hard copy at the beginning of class on that day. If you are unable to attend class on that day, make arrangements for it to be delivered to the classroom or to my box by the start of class. Late or not, however, you must complete all required assignments to pass this course. Final Course Grades Final course grades represent how you perform in the class relative to other students. Your grade will be based on your performance, not based on a mandated target. Historically, the average grade for this class is approximately a “B”. Three items are considered when assigning final grades: 1. Your average weighted score as a percentage of the available points for all assignments (the total of points you receive divided by the total number of points possible). 2. The overall average percentage score within the class. 3. Your ranking among all students in the class. Important Dates First day of class Last day to add Last day to drop without a “W” Last day to drop with a “W” Last day of class Final Exam Tuesday, March 6, 2012 Monday, March 12, 2012 Monday, March 12, 2012 Monday, April 9, 2012 Thursday, April 26, 2012 Wednesday, May 9, 2012 at 2:00-4:00 pm Add / Drop Policy In compliance with USC and Marshall’s policies, classes are open enrollment (R-clearance) through the first week of class. All classes are closed (switched to D-clearance) at the end of the first week. This policy minimizes the complexity of the registration process for students by standardizing across classes. I can drop you from my class if you don’t attend the first two sessions. Please note: If you decide to drop, or if you choose not to attend the first two sessions and are dropped, you risk being not being able to add to another section this semester, since they might reach capacity. You can only add a class after the first week of classes if you receive approval from the instructor. Marshall Grading Guidelines Course Grading Policy: Marshall’s target mean GPA is 3.0 for required classes and 3.3 for electives. The mean target for graduate classes is 3.3. Assignment/Exam Grading Policy: The instructor determines what qualifies as an accurate grade on an assignment, exam, or other deliverable, and the instructor’s evaluation of the performance of each individual student is the final basis for assigning grades for the course. ACCT 417 | Advanced Accounting for Non-Accounting Majors [Spring 2012 Section 14110] Syllabus - Page 3 Retention of Graded Coursework All graded work which affects the course grade will be retained for one year after the end of the course if the graded work has not been returned to the student (i.e., if I return a graded paper to you, it is your responsibility to retain it). Technology Policy Laptop and Internet usage is not permitted during academic or professional sessions unless otherwise stated by the respective professor and/or staff. Use of other personal communication devices, such as cell phones, is considered unprofessional and is not permitted during academic or professional sessions. ANY e-devices (cell phones, PDAs, iPhones, Blackberries, other texting devices, laptops, iPods, iPads, etc.) must be completely turned off during class time. Upon request, you must comply and put your device on the table in off mode and FACE DOWN. You might also be asked to deposit your devices in a designated area in the classroom. Videotaping faculty lectures is not permitted, due to copyright infringement regulations. Audio taping may be permitted with prior approval by the professor. Use of any recorded material is reserved exclusively for USC Marshall students. Statement for Students with Disabilities Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m.–5:00 p.m., Monday through Friday. The phone number for DSP is (213) 740-0776. Statement on Academic Integrity USC seeks to maintain an optimal learning environment. General principles of academic honesty include the concept of respect for the intellectual property of others, the expectation that individual work will be submitted unless otherwise allowed by an instructor, and the obligations both to protect one’s own academic work from misuse by others as well as to avoid using another’s work as one’s own. All students are expected to understand and abide by these principles. SCampus, the Student Guidebook, contains the Student Conduct Code in Section 11.00, while the recommended sanctions are located in Appendix A of the Student Guidebook. http://scampus.usc.edu/university-governance/ Students will be referred to the Office of Student Judicial Affairs and Community Standards for further review, should there be any suspicion of academic dishonesty. The Review process can be found at http://www.usc.edu/student-affairs/SJACS/ Failure to adhere to the academic conduct standards set forth by these guidelines and our programs will not be tolerated by the USC Marshall community and can lead to dismissal. Emergency Preparedness/Course Continuity In case of emergency, and travel to campus is difficult, USC executive leadership will announce an electronic way for instructors to teach students in their residence halls or homes using a combination of Blackboard, teleconferencing, and other technologies. ACCT 417 | Advanced Accounting for Non-Accounting Majors [Spring 2012 Section 14110] Syllabus - Page 4