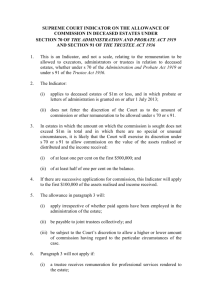

QUALIFICATION, SELECTION. JESS HALL. JR.

advertisement

QUALIFICATION, SELECTION. APPOINTMENT AND REMOVAL OF FIDUCIARIES.

AND THEIR RIGHT TO COMPENSATION.

JESS HALL. JR.

Qualification, selection, appointment and removal of fidu~iaries, ' and ;

their right to compensation. Include a discussion of who has the right 'to "'!

remove and appoint fiduciaries, jurisdiction and venue of ' such actions , 1 ~

Also what is the nature of title of property after death or removal· of a 4 't

fiduciary and prior to appointment of a new fiduciary15"J

I. SELECTION.

It.. TRUSTEE.

Th. trust•• is ordinarily originally appoint.d by tho

settlor, but he may be appointed by the court of equity or the probate

court.

In such appointment the settlor need not consider the wishes of

anyone other than himself, and need not b4t definite in his selection.

,

Equity will not allow a trust to faU' for 'lack of a trustee, unless the

setUor has selected a personal trustee, who , is one that the settlor deems

as the only one qualified to administer the trust. 1

In Texas, the settlor

is not limited to a natural person, in that the statutory definition of

"trustee" includes a corporation. 2

This is also true of the Restatement. 3

The only restriction in the case of a corporate trustee is

t~t

its charter

confer such right upon it and it be organized ..under a statute that

it to act as a trustee. 4

Under the definition of "person, "5

permit~

the Texas

settlor may select from among an individual, corporation, partnership,

association, joint stock company, business trust, unincorpora ted nrga p1; e_

,

~n,

or two or more persons having joint or common interest.

The fact of

selection and/or appointment, however, does not constitute one a trustee.

He must accept the appointment. 6

B. EXECUTOR.

Under the TeXas Probate Code the person selected to serve

as executor or administrator must meet certain qualifications,7 and others

o

are statutorUy disqualified from servine....

The Uniform Probate Code con-

tains similar information in regard to those seeking appointment as a per-1-

sonal representative,9 which includes executor, administrator, successor,

personal representative, special administrator, and persons who perform

substantially the same function under the law

gove~ning

their status. 10

The Texas code makes provisions for the surviving husband or wife, or,

if there be none, the heirs or any one of the heirs of the deceased to

the exclusion of any person not equally entitled to waive his rieht in

favor of another qualified. person. 11

It should 'be noticed that the ex-

pression "another qualified person" seems to'indicate that a person who has

been disqualified does not have such a right of selection,

and ~ it

has been

no construed. 12 The waiver need not- be eXpress, but may also be made by

conduct. 1)

c.

ElCECUrot-TRUSTEE.

l{ore arid more the testamentary trust is being used

to dispose of property rather than wills.

This is one reason that the Uni-

form Probate Code contains a section dealing with trusts. 14 Another reason,

however, is that

provis~ons

relative to testamentary trusts are. found in

many probate codes. iS Very often. under a testamentary trust, the same person w1l1 serve as both executor and trustee.

As an executor he is to wind.

up the affairs of the deceased and distribute the remainine assets as directed by the will.

As a trustee he takes the assets available and by in-

, 16

vesting them brings a profit to the trust.

It is important that the dis-

tinction be made between the functions, even when both are performed by the

same man, since an executor is not a. tru.s tee in the strict sense of the term ,

and their powers, duties, and the extent of their 'liabllities to third persons may differ. 17 Any given act of an executor-trustee will be referable

to only one of his offices.

The problem may be, which one?

If the executor-

trustee has breached a duty and he has posted bond under both offices with

-2-

two different bonding companies, the companies may well concern themselves

..

1$

with which hat the executor-trustee was wearing at the time of the breach.

In one case it became important in determining the amount of proceeds cov-

ered by tho Federal Deposit Insurance Corporation. 19 For our purposes, we

need only note that if one person f:111s both offices he will need to quali-

ry under both .tandard ••

II. APPOINTMENT.

A. 'IRUSTEE.

l1uch,. if not all, that was said ren.ativ,.e to the selection of a trustee

is applicable to his appointment, inasMUch as selection, when made public

and coupled with a purpose that a trust arise, is tantamount to appointment.

In some instances, however, the original trustee may be appointed by the

court of chancery rather than by the settlor, and in some states a testamentary trustee is deemed to be nominated by the setUor and aPPc:»inted by

the ,court. 20

B• .EXECUTOR.

It is different, however, with an executor or an administrator.

Ini-

tiation for appointment is made by an interested person!s21 making application to the court of a proper county. 22 ' This application gives the court

S~ce the application is juris-

jurisdiction to make the appointment. 2)

dictional, letters may not be granted

in accordance with the

requ1re~ents

~here

of

th~

application has not been made

statute. 24 Proper venue is

also determined by the code,25 with special attention being given to problema which arise between courts of concurrent venue. 26 Aa a general rule,

application must be made within four years of the testator's death. 21

-)-

However. the grantinc of adm1nistration more than four

ye~rs

after the death

of a person. though irregular. is not wholly beyond the court's jurisdiction

and does not rneder administration proceedings subject to a collateral

attack.~

If administration is necessary. one named in the will as executor

must present the will within thirty days after the death of the testator and

.

accept and qualify within twenty days after the probate of tile will..

29 If •

. however. he was ill. or absent from the state when the testator died or the

will. was proved. he may qualify within ·s1xty days after his return or recov-

ery upon proof to the court that he was absent or 111.

I

been granted to others. they will be

If letters have

,~

revoked.~-

However. an executor will

not be disqual1fied for failure to qualit,y within three months prov1ded for

by the will where he acted with reasonable d111gence)1

An app11cant for letters must prove certain facts before he is entitled

to appointment. 32 Additional facts must be proved for probate of will., 3'3

issuance of letters testamentary,14 or letters of administration;J5

If

prior letters have been granted, one need only' show that the one for whom

to,

they are now sought is entitled thereto by law and is not disqualified. 36,

Wh11e any person may oppose the grant1ng of letters of administration. 37

it would seem that. under section 10.)8 only an interested person may contest the granting of letters testamentary.

In the Uniform Probat.e Code, Article Three, Part Three, deals with informal probate and appointment

~roceedl.ngs,

Part Four with formal testacy

and appointment proceedings. and Part Sw1th supervised· administration.

In.

QUALIFI~TION.

A. TRUSTEE.

Qualification is a technical word in the law of trusts and means .per-

-4-

forming all acts required by the settlor. the court. or by statute as a prerequisite to taking possession of the trust property and beginning the administration of the trust.

'!he requirements of the settJ.or will normally

.

be given effect. althoush ho.eannot dispense -with or oVerrido statutory requirements. As a

~eneral

rule the court will not override the settJ.or unless .

it is clearly in the be~t interests of the be~efic1aries.J9

If' a trustee

fails to qualify according to any controll.ing authority. two approaches

may be taken.

S9me courts hold that he is not a trustee and. has no power

under the trustl ethers hold that if he has accepted the trust the failure

.

I.

,

. to qualify does not affect his powers, ' although it is a breach of his duties not to qualify and he cannot legally BXercise his powers.

In neither

case does failure to qualify prevent ' the trust from coming. into being. except in the case of the .personal trustee.

The approach taken becomes sig-

nificant when the trustee has taken some action before qualifYing.

The

effect of later qualification upon the prior act may depend on the theory

adopted by the jurisdiction.

If' qualificatio~ is necessary to the possess-

ion of power. then the act would be a nullity unless reaffirmed after qualification.

However. if a trustee gets his powers apart from qualification

and is merely prohibited from using them until qualification. then the -later

qualification could itself be treated as a validation of the prior act. 40

Inasmuch as there is no provision for qualification in the Texas Trust Act.

it would seem that Texas falls,into tne latter category.

The most commonly required act of qualification is the posting of bond.

In addition. a few states require the taking of an oath.

While TeXaS does

not require an oath. it does require bond for trustees. except for corporate

trustees which are authorized by law to act as trustee .of any trust affected

by the Texas Trust Act. unless the instrument creating the trust provides to

the contrary • . The bond is conditioned on the.faithfal

-5-

perfo~nce

of the

trustee's duties, payable to all interested persons as

th~ir

interest may

appear, and is set in such amount and with such surety as the District

.

111

Court directs and approves. ·-

Article Seven of the Uniform Probate Code

dispenses with the necessity of bond to secure performance unlbss required

by the terms of the trust, reasonably requested by a beneficiary, or found

by the court to be necessary to protect the interests of the beneficiaries

who are notable to protect themselves and whose interests are not other42

wise adequately represented.

The f1line; and amount of the bond. is gov.

orend by the sections relating to the bona of a personal representative .

4)

B. ECECUTOR.

The Texas Probate Code provides that a personal representative shall be

deemed to have qualified when he has taken and filed the

r~uired

oath,

made the required bond, had it approved by thG judee, and filed it with

the clerk, except that, where bond is not

taking and filing the oath. 44

requ~ed,

he is qualified upon

Until the personal representative-has qual-

ified as required by law, appointment is voidable. 45 The time for qual i- .

fication :. (time ~ or::..taking~ oath and

giving bond) is any time before the ex-

piration of twenty days after the date of 'the order granting letters testamentary or of administration, and before such

, letters have been revoked for

a failure to qualifY within the limited time.

46 However, special provi-

sions are made in cases of 1l1ness and absence. 47 I f an administrator does

not qualify within the time period,

but. his

,

. appointment is later confirmed

without objection, the mere irregularity of his appointment cannot be held

to vitiate his acts .:which are otherwise legal in a collateral proceed1ng. 48

The expres*ion "before such letters have been revoked for a failure to qual11'y within the time allowed"· would Beem to shor1:en the time, but courts may,

-6-

in their discretion, extend the time for qualification beyond the time pre0.9

scribed, and permit qual1f'ication at any ·time before removal, .

1. Oath. Texas is among the states that require an oath of an executor

or administrator. 50

Particular oaths are prescribed for an ex~cutor or an

administrator with will annexed, 51 an administrator,5 2 and a temporary administrator. 53 However, it has been held that taking an oath as independent eXecutor is not a necessary prerequisite to possession and exercise of

; r!lt.

the duties and responsibilities of the

The manner of taking,

office.~ ·

•

,

fUing, and recording the oath is also prescribed.

2. Bond.

5S

The Texas Probate Code requires that a bond be made before

letters testamentary or of administration will be granted, unless the provisions of the Code allow otherwise. 56

The conditions of the bond are

apelled out,57 and if a personal representative fails to give bond as required within the time fixed, another person may be appointed in his stead.~3

The exceptions to posting bond are when any will probated in Texas directs

that no bond or security be required of the executor, or the personal representative is a corporate fiduciary. 59 If, however, it appears that an independent executor who has not been required to give bond is mismanaging the

property, or has betrayed or .is about to

b~tray

his trust, or has in some

other way become disqualified, then, upon proper proceedings had for that

60

purpose, such executor may be required to give bond.

Any person having a

debt, claim, or demand against .. the est:ate:, to the justice of which oath has

been made by himself, ,his agent, or attorney, or any other person

interes~

ted in such estate, may file a complaint in writing in the court where the

will is- probated.

The court will cite such executor to appear and show

Cause why he should not be required to give bond.

-7-

61

'£l'lthe:t' oourt finds the

complaint valid it wU1 enter an order requiring the executor to give bond

within ten days of the order.

62 The nature of the bond63 ' and the penalty

for failure to give it 64 are also set forth.

The form of the bond which

should be substantially complied with is set forth by the code,'65 aa well

as special provisions for bonds of joint representatives,66 married women,67.

and a married person under twenty-one years of age. 6S

The Uniform Probate Code also makes provisions for bond under certain

conditions, although as a general rule, no bond is required of a personal

representative appointed in informal proceedings.

There are sections gov'/0

I

erning the amount of bond, secutiry, procedure ard reduction, ' demand for

bo~

by an interested person,71 and terms and corditions of

bO~S. 72

lV,. RD-jOV.A.L •

~.

TRUSTEE.

1. Grounds for removal.

Trustees ha.ving materially violated "ny express

trust, or who have attempted. to violate any e)Q)1"ess trust, resulting in any

actual financial loss to the trust, or who becomes incompetent or insolvent,

or of whose solvency or that of the sureties ther.e is reasonable doubt, or

for other cause in the discretion of the court having jurisdiction, may, on

petition of any person actually interested, after hearing, be removed by

the court and denied compensation in whole or part. 7)

The burden of proof

is on the party that seeks to remove the trustee. 74 However, due to the

"

'

;

"

,

adverse effects of haYing been removed upon the repufation of the trustee

ard the fact that the court hesitates to substitute its judgment for that of

the creator of the trust ' in removal of the settlor's choice and appointment

of a ¥uccessor, the courts are reluotant to remove"a trustee. 7S The party

-8-

seeking removal must prove Serious daneer to the interests of the beneficiaries fl-om continuing the truste.e:h office, either because of his condition and habits or on account of breaches of trust which he has committed

or threatens to oommit.

Facte regarding the statue ot the trustee which

have been held sufficient to warrant his removal are insanity, habitual

drunkenness, extreme improvidence, conviction of a crime invovling dishonesty, insolvency, bankruptcy or receivership, and absence ·from the

jurisdiction. 76

Under the Uniform Probate Code. if .the principal place of business

becomes inappropriate for any reason. the court may enter any order furthering efficient administration

~nd

the interests of beneficiaries. in-

cluding removal of the trustee and. appointment of a trustee in another

state.?? The Restatement sets forth grounds for removal as lack of capacity to administer the trust. the commission of a serious breach of trust.

refusla to give a bond if a bond. is required, refusal to account. the

commission of a crime (particularly one involving dishonesty). unfitness

(whether due to old age. habitual drunkenness. want of ability or other

cause). permanent or long continued absnece tram the state, the showing of

favoritism to one or more beneficiaries, unreasonable or sorrupt failure to

cooperate with his co_trustees. 78

2. Who may remove?

A trustee may be removed by either a proper court

or by the person, if any, who by the termS of the trust is authorized to

remove the trustee. 79

'This power may be conferred upon the setUor, the

beneficiary, or a third person, and can be exercise only if the requirements of the terms of the trust as l to the exercise, of the power are com-

-9-

plied with. 80 BeneficiaDDs cannot remove a trustee even though they all desire his removal except upon application to the proper court for cause

shown, unless the trust instrument authorizes them to do so.

However, they

.

can in substance do the same thing if the trust authorizes them to terminate

the trust and compel the trustee to transfer the corpus to them, in that

immediately following terc1nation they can create a new trust on the same

.

81

terms and . appoint a new trustee.

Under the Texas 'T rust Act ~ny person

0 "

actually interested may petition for removal. v

3. Court of jurisdiction.

In the

be s ought in a court of equity. B)

4

rbsen~e . of

statute the removal should

In Texas the district court has original

jurisdiction to construe the provisions of any trust instrument, to determine the law applicable t hereto, the powers responsibilities, duties and

liability of the trustee, the existence or non-oxistence of facts affecting

the administration of the trust estate, to require accounting by the trustee ,

and to surcharge th~ trustee. 84

If there is a single tru stee venue is in

the county of his residence. if a corporation, in the county of its principal place of business J 1£ two or more trustees, in the county where the

principal office of the trust is maintained. aS This section also designates who may bring an action and the necessary parties thereto and the

rules that shall govern such actions. 36. The Unifo.1'!'l Probate Code places

.

8

All

exclusive jurisdiction to appoint or remove a trus.t ee 7 in The Court,

which is defined as the court ~r brandh having jurisdiction in matters relating to affairs of

~ecedents,89

which in Texas is

th~

county or probate

court, synonomous terms as used in the Texas Probate Code to denote

county courts in the exercise of their probate

-10-

jur~sdiction

and courts

created by statute and authorized to exercise original jurisdiction. 90

4 . Nature of title durine procedure.

When proceedings 'are brought for

removal and its appears necessary or proper during the course thereof that

•

the truet .hduld b. adminl.tGrDd under tho "uporvi"ion of the court, tho

court may appoint a receiver until it is determined whether the trustee

should be removed and a new trustee appointed.

The receiyership will be

terminated by the coutt when the old trustee

absolved, or when a neW

~s

trustee is appointed and the title to the trust property is vested in

him.91

Upon the death of a sole trus~ee (in' case of a joint trUstee

•

title remains in the survivor) intestate, and inthe absence of statute,

the title to the property vests in the trustee's heirs or personal representative, depending upon the nature of the property, whether real or

personal.

If he dies testate, title to the trust property, but not the

trust office, passes to the devisees or executor named inthe will.

st,,:~ute·

3y

in several states, on the death of a sole trustee the title to

the trust property vests in the court of equity.9 2 The title of either

will be transferred to a court appointed new trustee. 93 Texas seems to

have no specific provisions beyond stating that .the SUccessor trustees

are vested with::the title to properties conferred upon the trustee by the

trust instrument. 94

B. EIEC1JI'OR.

1. Grounds for removal.

There is a problem in regard to the removal

of an independent administrator.

In Bell v. st1ll95 the court held that

a probate court cannot remove an independent executor' unless he fails to

give· bond after having been required to do so.

'fl:1e

supreme:~· court

adopted

the court of civil appeals ' decision but expressed doubt as "to the l1isdom

of a policy under which an independent exe9utor, accused of gross misman- 11 -

agement of an estate, is not subject to removal by the prObate court as any

other executor or administrator. II 96 The court avoided the difficult issue.

however. by rofUsing to decide whether or not the district courts have this

power.

Though not mentioned by the court. there is case authority that

supports the proposition that a district court has the power to grant appropriate relief based upon allegations that the independent executor has withheld

funds. 97 dissipated the assets of the estate. 98 or claimed sole ownership or

~.,,~ .: ~ p","I~ .', ~;d.s4tp".J ~<J

property belonging to the estate. 99 a.r'.·: ~"'\ u. ".e~

qq~ .

.

,

. . . . . ..

An administrator under court supervision is treated differently.

,

The

probate court may remove without notice a representative under its control

for failure to qualify in the manner and time required by law. failure to

return an inventory and list of claims within sixty days of qualification.

failure to give a new bond in the time required by law. absence from the

state without the courts' permission or removal from the state, and inability to be served because of unknown whereabouts or eludingservi~e.l00

There are numerous circwnstances in which the administrator can be removed

upon notice. including failure to settle the estate within three years atter

the grant of letters unless extended by the courr on a showing of

cient cause supported by oath.

101

suff~-

other grounds for removal are failure

of an executor to give a bond required by statutory proceedings on proof

that he is wasing. mismanaging. or misapplying the

102

estate, ~

purchase by

an administrator or executor ot claims agkinst the estate,10J and establishment of a claim which has been rejected through failure of a personal

representative to accept or disallow it within tile required thirty days

after its presentation,

104

The Uniform Probate Code also makes provisions for termination of

-12-

appointment by removal, and sets forth grounds and ~roCed~res. l0 5

2. \iho may remove? Under both the Uniform Probate Code 106 and the

Texas Probate Code10? an interested person may bring a removal ,action.

In

the tormer an intereated peraon ino1udea heirs, devisees, chl1dren, spouses,

creditors, beneficiaries and aqy others having a property right in or

claim against a trust estate or the estate of a decedent, warn, or protected person which

~y

be affected by the proceeding.

It also includes a per-

son having priority for appointment as per,sonal representativE! , and other

fiduciaries representing interested

p~rson q .

The meaning as it relates to

particular persons may vary from time to time and must be determined accord1ng to the particular purposes or, and matter involved in, any proceeding.

Under "the latter, the term is defined to include heirs, devisees, spouses

"creditors, or aqy others "having a property right in, or claim against, the

estate being administered, and anyone interested in the welfare of a minor

or iricompetent ward..

In addition, in Texas the court may bring the action

on its cwn motion. 110

J. Court of proper jurisdiction. Jurisdiction is placed

previously defined by the Uniform Probate Code. 111

section 1-303.

,

in The Court as

Venue is governed by

112

Texas Puts power of removal in the probate court.

Venue

i s fixed by section six, with section eicht !elating to concurrent venue and

transfer of proceed1ncs.

neference has already been made to the jurisdic... . ·":

tional problem encountered in r~moval of a~" independent ,executor.

4. Nature of title during procedure.

When a person dies, leaVing a law-

ful will, all of his estate devised or bequeathed by such will shall vest

immediately "in the devisees or legatees, and all the estate of such person

- 1)-

not devised or bequeathed shall vest immediately in his heirs at law.

When

a person dies intestate, all of his estate shall vest immediately in his

heirs at law.

Upon issuance of letters testamentary or of administration,

the executor or administrator has the right to possession of the estate as

it existed at the death of the testator or intestate,11)

problem

of passage of title,

,

Thus, there is no

However, a successor representative shall be

required to accoll!lt for all of the estate whigh came into the hands of his

predecessor and shall be entitled to any ?rder or remedy which the court has

power to give in order to enfo:rce thq

del~very

of the estate and the lia-

bility of the sureties of his predecessor for so much as is not delivered.

He is excused from accounting for such of the estate as he has failed to

fecover after due diligence. 114

V. RIGHT TO COMPENSATION.

A. TRUSTEE.

A trustee is

e ~titled

to compensation for his services unless he has

agreed otherwise, the amount to be f1xed by the trust instrument, or by

agreement between the trustee and the settlor or beneficiaries, - Compensation is covered by statute in many jurisdiction,

allowing either reasonable

,

compensation or setting up a fee schedule.

In the absence of statute, the

court will eenerally allow a reasonable amount, taking into account the

skill and diligence of the trustee, the yalue of the corpus, and the results

,

of his administration.

The right to compensation may be waived if, for in-

stance, the trustee pays trust income to the beneficiary without claiming

any right to make a· deduction for his work, or where on making an accounting

he asserts no r1eht to compe ns ation and distributes the trust property

accor dinely.

Courts may deny or reduce compensation whon' tho trustee has

been guilty of a serious breach. ll 5

The TeXas Trust Aot makas no provisions relating to compensation beyond allowing same to be charged against the income of the trust, or, in

11 6

the case of an unproductive trust against the principal,

and providing

for the denying of compensation in whole or i~ part in case of removal. ll ?

The theory of the Uniform Probate Code is thAt the trustee may fix his

own feel however, it is subject to coprt review upon the petition of an

,

l1R

interested person after notice to all interested persons.

B. El{ECUTOU.

The Texas Prob'a te Code fixes compensation for executors 'and aciministrators at

,5;

on all sums they may actunlly receive in case, and the same per

cent on all sums they may actually pay out in cash in the administration of

the estate, excepting cash on hand or on deposit in a bank at the time of

death and the dis tr~bution of the estate, limited to no more than ~ of the

gross fair market value of the estate subject to administration.

If, how-

ever, he manages a farm, ranch, factory, or other business of the

esta~e,

or

if the compensation as calculated is unreasonably low, the court may allow

119 It apparently is not

him reasonable compensation for his services.

possible for the amount as calculated to be unreasonably hight

Under the Uniform Probate Code a persorlal representative is entitled to

reasonable compensation.

I f the will provides for compensation and there

is no contract with the decedent regarding compensation, the personal representative may renounce t he provision before

to , reasonable compensation.

qual~ying

and be entitled

He may also renounce his right to all or any

part of the compensation. 120 '-

-15-

FOOTNOTES

1.

BOG!l!T, U\~ OF . mUSTS. I 29 (4th ed. 1963). (Hereinafter cited as

BOGERT.) .

2. TEXAS THUST ACT

§

4(c). (Hereinafter cited as TTA.)

1 ItESTATEl iENT OF TRUSTS. SEX:OllD,

I 96

Res't.l.'temen't~"rDreaner.n-;--·s6if-Chapter

(1959). (Hereinafter cited as

4.

4. Port Arthur Trust Co. v. Muldrow, 155 Tax. ,612, 291 S.W. 2d 312 (1956).

5. TTA

I

4.

S.~.

6.

Gray v. McCurdy, 114 Tex. 217, 266

7.

Texas Probate Code. 77. (Hereinafter cited as TPC.)

8.

~ I 78.

9.

Uniform Probate Code S )-203. (Hereinafter cited as

10. UPC

§

396 (1924).

~.)

1-201(30).

11. !!:f:. 6 79.

12. Slay v. Davidson, 88 S.W. 2d 650 (TeX. Civ. App. 1936, writ ref.)

13.

\~aters

v. Kine , 353 s.W. 2d 326 (Tex. Civ. App. 1961). For additional

instances of implies waiver, see y!!§. Probate Code § 79.

14. UPC Article 7.

15. Wellma.n'. Uniform Probate

and Estates 29 (1969)

16. Baker, The

Codel Report ~ Progress To Dato, 108 !,rusts

Ex~~utor-Trustee.

13 Okla. L. R. 408 (1960).

17. Scott; .. The Law .of Trusts •• 6 (2d. ed. 1956).

18. However, the surety on an executor's Dond Can be held liable on the

basis of estoppel--even where the executor-trustee has clearly begun

to act in his capact1y of trustee only. United States Fiduciary and

Guar. Co. v. Word.

35 Ohio App. 224, 172 N.E. J83 (1929).

19 Phair v. Fed. Dep. Ins. Corp., 74 F. Supp. 693 (D • .N.J. 1947).

20. BOGERT,

21. TPC

§

D29.

3(r).

- 16-

22. TPC

For a check list in taking out administration, see

For a check list for special probate procedure,

see 25 lex. B. J. 7J4.

§

76,

2Jr1ex. o.J . 7J4.

23. In re Campbell's Estate, 181 S.W. 2d 712 (Tex. elv. App. 1944, wrlt

ref. W. M.).

24. Riviera v. Atchison, T. & S.F. R. Co., 149 S.W. 223, (Tex. Civ. App.

1912, no writ). For contents of application, see, TPC RD 81, 82.

For procedure pertaining to a second application, see TPC § 83 •

. 25. TPC ;; 6.

26. TPC.

§

8.

27. TPC • 74.

Does not apply in any case where administration is necessary

in-order to receive or recover fUnds or other property due to the estate

of the decedent.

28. Roberts v. Roberts, 165 S.W. 2d 122 (Tex. Civ. App. 1942, ref. w. m.)

29. TPC

g

178(b).

)0. TPC § 220 (d).

1908

31. Von Rosenburg v. Wickes, 109 S.W. 968 (Tex. Civ. App./err. ref.)

32. TPC • 88(a) .

33. TP£

34.

g

88(b) •

TPC • 88(0).

35. TPC • 88(d) •

36.

~~ §

88(e ).

37.

'fPC •

179.

)8. TPC

g

10.

39. BOGERT,

§

33.

40. BOGERT,

g

33.

41.

TTA I

25(L) •

42. UPC I 7-304.

43. UPC.

II

3-604, 3-606.

-17-

22. TPC

§ 76,

~ex.

For a check list in takinr, out administration , see

734. For a check list for special probate procedure,

see 25 lex . B . J. 734.

o. J.

23. In re Campbell's Estate, 181 S.W. 2d 712 (Tex. Civ. App. 1944, writ

ref. W. M.).

.

24. Riviera v. Atchison, T. & S.F. R. Co., 149 S.W. 223, (Tex. ' Civ. App.

1912, no writ). For contents of application, see, TFC as 81, 82.

For procedure pertaining to a second application, see 'fPC. i 83 •

.

.

25. TPC

~

6.

26. TPC

§

8.

27. TPC D 74.

Does not apply in any case where administration is necessary

to receive or recover funds qr other property due to the estate

of the decedent.

~order

28. Roberts v. Roberts. 165 S.W. 2d 122

29. TPC

6

(Tex~

Civ. App. 1942, ref. w. m.)

178(b).

30. TPC i 220 (d).

1908

31. Von Rosenburg v. Wickes, 109 S.W. 968 (Tex. Civ. App./err. rer.)

32. TPC • 88(a).

33.

!!'.:. 6 88(b).

34. TPC

6

88(0).

35. TPC • 88(d) •

36.

J;~ §

ll8(e).

37. IT£ • 179.

38. TPC

6

10.

39. BOGERT,

§

33.

40. BOGERT, I 33.

41.

TTA. •

25(L).

42. UPC I 7-304.

43. UPC. II 3-604, 3-606.

-17-

44 . TPC

§

189.

45. 11a11ace v. Dubose, 242 S.W. 351 (Tex. Civ. App. 1922, no writ).

46. TPC U 192.

4~.

'f PC

§

220

48. Le"is v. Ame~, 44 Tex. 319 (1898), Yount v. Fagin, 244 S.W. 1036

(Tex. Civ. App. 1922).

49. Willu:i v. Cleveland,

50. TPC

D

190.

§

190(a).

52. TPC

§

190(b).

53. TPC

§

190 (c).

51.

54.

m

J8 S.W. 222, (Tex.

C~v. App.

1896).

Podgoursky v, Frost, 394 S.W. 2d 185, (Tex. Civ. App. 1965, ref. n.r .e.).

55. TPC

§

190(d).

56. TP~

e 194.

57. ,'ld.

58. TPC U 213.

59 . TPC I 195. For definition of Corpcrate fiduciary, see

60. :J:E.C I 149.

61. 1'FC

§

214.

62. TPC

§

215.

63. TPC. I 216.

64. TPC § 217.

65.

rn:. §

196.

66. TPC § 198.

67.

m

~ 199.

68. TPC § 200.

69. ~ § 3-603.

, -18-

I~

• 3(d).

70. UPC 6 3-604.

71. UI'C .6,3-605.

72. UPC S 3-606.

73.

TTA

6 39.

~.

74. Penix

First National Bank, 260 S.W. 2d 63 (Tex. Civ. ·App. 1953, writ

ref.) •

75. aOGffiT, 6 160.

76. !>l .

77.

~~

6 7-305.

78. Hesta tement. 6 107,

,,

comment~.

80. Id., 8 107, comment 11,

81.10., § 107,

see

62.

II

comment~.

For powers ot benef1ciare8 to . terminate trust,

337-)40.

a9 •• j .

T'I~ 6

63. BOGEllT,.

§

160,'

84. IrA 6 24{A}.

85.

!0

6

86.

~

6 24{6}{D}.

24{B}.

87. llfC 6 7-201{a}{1}.

88.

~

89.

~~ .

90.

~

6 7-201{a}.

6 1-201{5}.

6

3{e}~g }.

91. Bestatement. 8 199, oomment g.

92. Bogert, 8 32.

93. !>l.

94. TTA 8 40.

-19-

95. 403 S.W. 2d (1966). Adopting opinion of Tex. Civ. App., 389 S.W. 2d

605 ••

96. 403 S.W. 2d at 353.

97. Stanloy v. Hondorson, 139 Tox. 160, 162 S.W. 2d 9"" (1942).

98. First State Bank v. Gaines, 121 Tex. 559, 50 S.W. 2d 774 (1932).

99. Huth v. Huth, 110 S.W. 2d 1011 (Tex. Civ. App. 1937, writ diomissed) .

99}. Hetting v. Metting, 431 S.W. 2d 906 (Tex. , Civ. App. 1968, no writ).

100.

):~ §

222(a).

101. tE9

§

222(b).

102. TPC

§

217.

103.

~ I

324.

104.

'!!.9

310.

I

105. UPC I 3-611 • .

106. )fl .

107. , TPC § 222.

108.

~ §

1-201(20).

109. lE.C

§

3(r).

110.

m

§

222.

111.

~ §

112.

'~ 88

1-302.

222, 3(e)(g), ".

113. TPC

§

37.

114. TPC

§

224.

115. Bogert,

§

144 •. See

~lso

116. TTA §

36.

117. TTA

§

39.

118. UPC

§

7-205 and oomment.

119. TPC

§

--

120.

-

~ §

Restatement. I§ 242,243.

241(a).

3-719.

- 20-