( Redacted for privacy Date thesis is presented

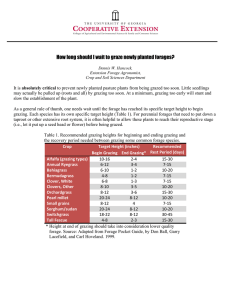

advertisement