Date thesis is presented January 26, 1965

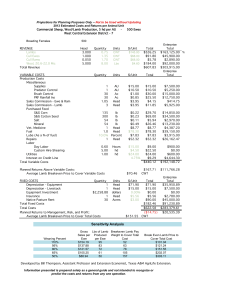

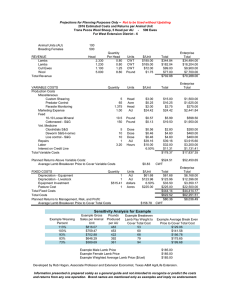

advertisement