Operations Research manuscript (Please, provide the manuscript number!)

advertisement

Submitted to Operations Research

manuscript (Please, provide the manuscript number!)

Authors are encouraged to submit new papers to INFORMS journals by means of

a style file template, which includes the journal title. However, use of a template

does not certify that the paper has been accepted for publication in the named journal. INFORMS journal templates are for the exclusive purpose of submitting to an

INFORMS journal and should not be used to distribute the papers in print or online

or to submit the papers to another publication.

Online Make-to-Order Joint Replenishment Model:

Primal Dual Competitive Algorithms

Niv Buchbinder

Computer Science Dept., Open University of Israel, niv.buchbinder@gmail.com, *

Tracy Kimbrel

National Science Foundation, tkimbrel@gmail.com

Retsef Levi

Sloan School of Management, MIT, Cambridge, MA, 02139, retsef@mit.edu,

†

Konstantin Makarychev

Microsoft Research, konstantin.makarychev@gmail.com

Maxim Sviridenko

Department of Computer Science, University of Warwick, sviri@dcs.warwick.ac.uk,

‡

In this paper, we study an online make-to-order variant of the classical joint replenishment problem (JRP)

that has been studied extensively over the years and plays a fundamental role in broader planning issues, such

as the management of supply chains. In contrast to the traditional approaches of the stochastic inventory

theory, we study the problem using competitive analysis against a worst-case adversary.

Our main result is a 3-competitive deterministic algorithm for the online version of the JRP. We also prove

a lower bound of approximately 2.64 on the competitiveness of any deterministic online algorithm for the

problem. Our algorithm is based on a novel primal-dual approach using a new linear programming relaxation

of the offline JRP model. The primal-dual approach that we propose departs from previous primal-dual and

online algorithms in rather significant ways. We believe that this approach can extend the range of problems

to which online and primal-dual algorithms can be applied and analyzed.

Key words : Joint replenishment problem, Online algorithm, Competitive Analysis, Primal-dual

History : A preliminary version of this paper appeared in the Proceedings of the Nineteenth Annual

ACM-SIAM Symposium on Discrete Algorithms, SODA 2008.

1

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

2

1. Introduction

Inventory theory provides streamlined stochastic optimization models that attempt to capture

tradeoffs between opposing costs in managing the flow of multiple types of goods through a supply chain. Uncertainty about future demands is one of the major challenges that make inventory

management problems very complex. Most traditional stochastic inventory models studied in the

literature assume that the probability distributions of the future demands are known, or at least

partially known, as part of the input. However, in many practical scenarios the underlying probability distributions are not available. Moreover, any attempt to create a distributional model of the

demands entails a significant risk of serious misspecification which may lead to very poor policies.

In this paper, we study an online version of the classical joint replenishment problem (JRP)

that has been studied extensively over the years, and plays a fundamental role in broader planning

issues, such as the management of supply chains (e.g. (5, 26)). In particular, following the classical

online framework (8), the assumption is that future demands are entirely unknown and generated

by a worst-case adversary. We consider the JRP model under an online make-to-order coordination

mechanism, where the production of finished goods is triggered only by actual demands, and

no finished goods are held in inventory (13, 19, 25). Make-to-order coordination is a classical

mechanism which is very common in scenarios with highly customized finished goods and high

setup and changeover costs, for example in the steel and glass industries. (The other common

coordination mechanism is make-to-stock, in which finished goods are produced before the actual

demand occurs, and then kept in inventory.)

The main contribution of the paper is the design and analysis of a new primal-dual based

algorithmic approach that leads to policies with robust performance. The performance is analyzed

using the classical concept of competitive ratio (8), in which the performance of the online algorithm

is compared to the optimal offline solution that is computed based on full knowledge of the entire

sequence of demands. Our main result is a 3-competitive deterministic online algorithm for the

online make-to-order JRP. That is, the cost of the online algorithm is guaranteed to be at most 3

times the cost of the optimal offline solution. In addition, we establish a lower bound of 2.64 on the

competitive ratio of any deterministic online algorithm. The online algorithms we develop employ

several new ideas and techniques (discussed in detail below) that we believe can potentially extend

∗

†

Supported by ISF grant 954/11 and BSF grant 2010426.

Part of this research was conducted while the author was a postdoctoral fellow at the IBM, T. J. Watson Research

Center. Partially supported by NSF grants DMS-0732175 and CMMI-0846554 (CAREER Award), an AFOSR award

FA9550-08-1-0369, an SMA grant and the Buschbaum Research Fund of MIT.

‡

Research was supported by EPSRC grant EP/J021814/1, FP7 Marie Curie Career Integration Grant and Royal

Society Wolfson Research Merit Award.

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

3

the range of classical inventory management problems to which online and primal-dual algorithms

can be applied and analyzed. In particular, this approach can be very effective in devising robust

policies that can be implemented under minimal knowledge about the evolution of future demands.

The details of the offline make-to-order JRP model are as follows. A set D of demands for N

different commodities is specified over a planning horizon of T discrete periods. Each demand point

(i, t) ∈ D requires certain number of units of commodity i, where i = 1, . . . , N and t = 1, . . . , T . Since

holding inventories is not allowed, demand point (i, t) can be satisfied only from orders placed in

period t or later in time. At the beginning of each period s = 1, . . . , T , we can place an order for

any combination of items, and this order can be used to serve pending demand points that arrived

in period s or earlier in time. Each such order incurs a fixed joint ordering cost K0 , as well as a

fixed item ordering cost Ki for each item (commodity) i = 1, . . . , N included in the order, regardless

of the number of units being ordered. The fixed ordering costs drive us to order in large batches.

This is traded off against delay penalty cost, which captures the costs incurred by allowing demand

points to wait for some amount of time until they are satisfied. For each demand point (i, t) and a

potential order s ≥ t, we let wits be the corresponding late penalty cost incurred by demand point

(i, t), if served from an order in period s. The only assumption is that, for each single demand

point (i, t), the delay penalty cost wits is increasing in s. This includes the case in which a demand

point must be served within a specified time window after its arrival. (In this case wits = ∞ after

the time window.) The goal is to find a feasible ordering policy that minimizes the overall ordering

and delay penalty costs.

The offline JRP model is known to be APX-Hard (4, 30). Levi, Roundy and Shmoys have

proposed a primal-dual 2-approximation algorithm for the offline make-to-stock JRP model (26),

and this has been improved by Levi, Roundy, Shmoys and Sviridenko, who proposed a 1.8approximation algorithm using an LP-rounding approach (27). Recently, Nonner and Souza (30)

studied a natural special case of the offline JRP in which each demand has a strict deadline (i.e.,

the delay penalty is 0 until the deadline and ∞ afterwards). They designed a randomized 5/3approximation for this variant, and proved that even this special case is already APX-hard. (In the

offline make-to-stock JRP model there are holding costs for maintaining physical inventory instead

of delay penalty costs. However, mathematically the make-to-stock and the make-to-order offline

models are equivalent, and all complexity results and algorithms can be transparently converted

to the offline make-to-order variants.) The special case of the offline joint replenishment problem

with a single type of commodity, also known as the single-item lot-sizing problem, is polynomially

solvable via dynamic programming (37) or primal-dual algorithms (for example, (20, 26)).

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

4

In the online make-to-order JRP model, the demand points and the length of the planning horizon

T are not known in advance. Instead, demand points arrive in an online manner, and the ordering

decision made in each time period s is based only on demand points that arrived up to period s.

This assumption is particulary realistic in settings where the demand is highly unpredictable, and

cannot be estimated appropriately from historical data. Indeed, this is the case when the products

are highly customized to customer specific requests. We measure the performance of our algorithms

by the standard competitive ratio between the cost incurred by the online algorithm and the

minimum cost obtained by an offline optimal solution when the input is generated by a worst-case

adversary. The online single-item lot-sizing problem is equivalent to the well-understood TCPacknowledgment problem. Dooly, Goldman and Scott gave an optimal 2-competitive deterministic

algorithm for this problem (15). Karlin, Kenyon and Randall gave an optimal e/(e − 1)-competitive

randomized algorithm (23). Buchbinder, Jain and Naor have recently proposed an analysis of these

algorithms using a primal-dual approach (10).

1.1. Our results and techniques

The main result of this paper is a 3-competitive deterministic algorithm for the online make-toorder JRP model. In addition, we obtain a lower bound of 2.64 on the competitive ratio of any

deterministic online algorithm. We also implemented the algorithm, and present the results of

computational experiments that test the typical empirical performance of our algorithm. In our

experiments the empirical competitive ratio ranges in the interval [1.5, 2.2] with typical value of

less than 2.

The deterministic algorithm for the online TCP-acknowledgement problem (or the online maketo-order single-item lot-sizing problem) (15) is simply based on balancing the ordering cost with the

delay penalty cost. We place an order whenever the cumulative delay penalty cost of the currently

pending demands exceeds K, where K is the fixed ordering cost. However, it can be shown that any

straightforward extension of this idea to the JRP model does not lead to algorithms with bounded

competitive ratio. The fundamental problem is the choice of which items (commodities) should

be included once the decision has been made to place a (joint) order. Intuitively, the dilemma is

whether to include in the order items for which the current cumulative delay penalty costs are

relatively low. Including such items runs into the risk of incurring high item ordering costs because

of unnecessary orders of these items; excluding them runs the risk of incurring high joint ordering

costs due to placing multiple orders, each including only a small number of items. More specifically,

it is not clear whether the future arrivals of demands will justify additional joint orders that can

be used to satisfy the currently pending demands of those items. Instead it may be better to serve

them from the order placed in the current period.

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

5

We propose a primal-dual algorithm for the online JRP model. Our primal-dual approach is

based on a novel linear programming relaxation (LP) of the offline JRP model. The LP and its

dual program guide the decisions made by the online algorithm. Specifically, we simultaneously

construct online both a feasible primal integer solution and a feasible dual solution. We then show

that the cost of the primal solution is at most 3 times the cost of the dual solution, obtaining a

3-competitive algorithm. For intuition, it helps to think of the dual variables as budgets that are

being used to pay for the cost of the primal solution, which consists of the joint ordering cost, the

item ordering costs and the delay penalty costs. The budget of each as-yet-unknown demand point

(i, t) is 0 until time t. Starting at time t, the corresponding budget can change until this demand

point is frozen.

We note that our primal-dual algorithm departs from previously known algorithms in rather

significant ways. In particular, the online nature of the problem requires several fundamentally

different algorithmic approaches compared to primal-dual algorithms that were previously designed

for offline versions of the JRP model (26), the facility location problem (22) and other combinatorial

problems (e.g., (18)). For example, all of these algorithms have a second clean-up phase, in which

the initial primal solution is modified to make it cheaper. However, this is not possible in an online

setting, and we need a different approach.

Now we describe the main aspects of the new algorithmic approach that we propose and contrast

it with the previous offline primal-dual algorithms. Joint orders are placed when the budgets of a

subset of demand points are sufficient to pay the joint ordering cost and the item ordering costs

of a certain potential order, as well as the resulting delay penalty costs incurred by serving them

from that order. (This corresponds to a dual constraint becoming tight.) However, this potential

order may be in the past, and because the problem is online it can not be used anymore. Instead

we place an order in the current period, initially including all the corresponding items, and freeze

the budgets of all the demand points that will be served by this order. As already mentioned, the

fundamental issue that arises at this point is whether to include additional items in the current

order even though their current budgets are not sufficient to pay for their respective item ordering

costs. This issue is handled through what we call a simulation step. We temporarily increase the

algorithmic time indicator beyond the current time period, and adjust the budgets of the active (not

frozen) demand points accordingly, assuming that no demand point will arrive in future periods.

Throughout this phase certain dual constraints become tight and this guides the algorithm in

including additional items in the current order. However, at the end of the simulation step all the

dual budgets are decreased back to their original values at the beginning of the simulation step,

and the algorithmic time indicator is again aligned with the current time period. In particular,

it is not guaranteed that the budgets of the corresponding demand points will eventually reach

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

6

their simulation values. Thus, unlike almost all other primal-dual approximation algorithms, our

algorithm is not dual ascent. That is, the budgets of certain demand points can temporarily go

up, and then be decreased, and go up again, until they are frozen. Intuitively, one can think of the

simulation step as a ‘loan’ taken by the algorithm to pay for additional orders of certain items.

It is not clear a-priori that it will be able to fully recap this ‘loan’ in the future. Thus, we need

to make sure that the ‘loan’ being taken is not too high; in other words, we need to carefully

monitor the simulation step and design the right stopping rule. We believe that the concept of

the primal-dual simulation step could have applications in other online and offline settings, and

extend the applicability of primal-dual approximation and online algorithms. In addition, unlike

previous algorithms, the performance analysis of our algorithm is not based on showing how to use

the dual budgets to pay the cost of each order placed by the algorithm separately. Instead, we use

the algorithm to partition the orders into clusters of phases, and then show how to use the dual

budgets to pay for the overall cost of each cluster. Specifically, we show that each dual budget is

not used more than 3 times.

1.2. Literature Review

Most traditional inventory management models assume that the underlying demand distributions

are fully specified as part of the model input. At the same time this is recognized to be a problematic assumption in many practical settings, in which it is unrealistic to expect that the demand

distributions can be characterized. In fact, misspecification of the demand distributions could lead

to meaningless output results. Several alternative approaches have been proposed to overcome this

limitation, in which only partial information about the demand distributions is assumed (e.g.,

moments, support, past historical data). There are also several frameworks (e.g., regret, minmax

and robust optimization, comparison to full knowledge of the distributions) that have been used to

evaluate the performance of the corresponding algorithms. We refer the reader to the recent paper

by Huh at al (21) for an extensive literature review.

Online algorithms and competitive analysis are the most robust framework since one has no

assumptions on the future demands, and they are assumed to be generated by a worst-case adversary (8). Moreover, the relative benchmark of comparing to an offline optimal solution is very stringent. There have been several attempts to apply the online framework to simple inventory models,

such as the well-known newsvendor problem (for a sample of papers see (31, 32, 33, 28, 29, 33, 38)).

However, these models assume a weaker adversary (e.g., one that has to draw the demand from

a given support), and some use a much weaker notion of competitiveness comparing the online

solution to the static offline optimal solution. (This solution has to commit to one action and repeat

it throughout all the periods.) Another approach to restrict the power of the adversary has been

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

7

to assume that while the adversary will choose the worst-case demands (requests), their sequence

of arrivals will be random (14, 2, 17). This framework allows remarkably good performance guarantees under certain (mild) assumptions in some scenarios. Van Den Heuvel and Wagelmans (34)

study an online variant of the classical make-to-stock single item lot-sizing problem. I their model

orders are determined in an online manner and are irrevocable, but the number of units ordered

can be modified later on in an offline manner; they showed that the best possible competitive ratio

in this case is 2, which matches the one obtained by the heuristic proposed in (6). For fully online

and worst-case adversary profit maximization variants of this problem Wagner (39) obtained optimal online algorithms, but the competitive ratios are not constants. Another inventory-scheduling

online model has been studied by (24). In this paper we study the more complex fully online

(multi-item and fixed costs) inventory model of the JRP, and obtain a constant competitive ratio

within the worst-case adversary framework.

The primal-dual approach is a well-studied discipline in the design and analysis of optimization

and approximation algorithms (35). Buchbinder and Naor (11) have recently proposed a primaldual framework for online packing and covering problems. This framework includes, for example,

a large number of routing and load balancing problems, the online set cover problem, paging, and

ad-auctions (3, 9, 7, 10), as well as other problems (See (12) for a survey). Recently, the primal-dual

approach was also used to analyze an easier random arrival model in which the input is generated

by an adversary, but is given to the online algorithm in a random order. In particular, with some

additional mild assumptions a near-optimal solution can be obtained for any packing problem

(See, i.e., (14, 2, 17)). As we shall discuss below, the algorithm we propose in this paper and the

performance analysis require new and more delicate algorithmic ideas (e.g., the simulation step

that we describe below) that depart from previous work.

2. Preliminaries

In this section we formally define our problem. Let H = {1, 2, . . . , N } be the set of item types

(commodities). In the JRP model the cost of an order does not depend on the number of units

ordered, but only on the item types in the order. The cost of an order is composed of a joint

ordering cost denoted by K0 and a fixed item ordering cost of Ki for ordering any number of units

∑

of item type i. Thus, the cost of ordering a set S ⊆ {1, 2, . . . , N } is C(S) , K0 + i∈S Ki . New

demands arrive at times t ∈ {1, 2, . . . , T } for some unknown T . Let T = {1, 2, . . . , T } be the set of

times in the planning horizon. Each demand specifies some item type that is needed. Let D be the

set of demands. Each demand is thus defined by a pair (i, t), where i is the item type associated

with the demand and t ∈ T is the arrival time of the demand.

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

8

Every demand (i, t) ∈ D can be satisfied in any time period s ≥ t after its arrival. The delay

penalty cost of satisfying demand (i, t) at time s is wits which is an increasing function of s. It is

convenient to view the delay function in increments between each time s and the subsequent time

s + 1. Let ∆its ≥ 0 be the additional penalty of delaying demand (i, t) from time s until time s + 1.

That is ∆its = wi,t,s+1 − wits .

2.1. Linear Program Formulation and Its Dual

It is not difficult to verify that there exists an optimal offline solution that makes orders only at

times at which new demands arrive (i.e., times t ∈ T). To define a lower bound on the optimal cost

we start by formulating the problem as an integer program, and then consider its linear program

relaxation whose minimum solution is a lower bound on the optimal integral cost. We define for

each set S and time t ∈ T a variable x(S, t) that is an indicator for the event of sending an order for

the types of S at time t. Let z(i, t, s) indicate the event of delaying demand (i, t) from time s until

time s + 1. The cost of any offline algorithm can be described as the linear cost function in line

(1) below. The constraints in line (2) stipulate that for any demand (i, t) and time s greater than

its arrival time, either the demand has been served by some order prior to time s, or it is delayed

at time s. Note that the number of constraints and variables in this LP formulation is exponential

with respect to the number of item types. However, since our proposed algorithm doesn’t require

solving the resulting LP explicitly, it can be implemented efficiently.

min

∑T ∑

t=1

S⊆{1,...,r} C(S)x(S, t) +

∀(i, t) ∈ D, s ≥ t :

∑s

τ =t

∑

∑

S | i∈S

∑

(i,t)∈D

s≥t ∆its

· z(i, t, s)

x(S, τ ) + z(i, t, s) ≥ 1.

(1)

(2)

x(S, τ ), z(i, t, s) ≥ 0

Again, constraint (2) ensures that if a demand (i, t) has not been satisfied by some time s ≥ t,

then one has to charge additional delay penalty of ∆its . The objective function captures the total

resulting order and delay costs. It is readily verified that if the variables are constraint to be integers

{0, 1} then the resulting integer program provides an exact formulation of the problem. Then, the

relaxation provides a lower bound.

Next, we consider (3)-(5) below which is the dual problem of the linear program (1)-(2). The dual

program in this case has an intuitive meaning. In the dual program we have a variable y(i, t, s) for

each demand (i, t) and time s ≥ t. The dual variable can be interpreted as a budget. The objective

of the dual program is to maximize the total budget earned from all demands. Constraint (4)

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

9

states that the budget earned by demand (i, t) between two consecutive times is at most the delay

it incurred between these two consecutive times. Constraint (5) stipulates that the total budget

earned by demands whose type is in S and which arrived prior to time s cannot exceed the cost of

ordering the item types in S. Thus, the intuition is that each demand of some type i earns budget

that pays for its order Ki . After it has paid for its fixed item ordering cost, it starts contributing

to the joint ordering cost K0 .

∑ ∑

max

y(i, t, s)

(3)

(i,t)∈D s≥t

∀(i, t) ∈ D, s ≥ t :

∀S ⊆ {1, . . . , N }, s ∈ T :

∑

y(i, t, s) ≤ ∆its

∑

(i,t)|t≤s,i∈S

r≥s y(i, t, r) ≤ C(S)

(4)

(5)

y(i, t, r) ≥ 0

3. The Online algorithm

In this section we describe our online algorithm. We start with intuition. It is instructive to think

first about a much simpler setting with only a single item type. Suppose that a demand (for this

one type) arrives. If no additional demand arrives in the near future, it is best to serve this demand

right away. However, if an additional demand arrives soon enough then we would benefit from

delaying the first demand and serving both demands together. Of course, we do not know which

of the two will happen. Thus, the question is how much delay cost should we incur before making

an order. It can be shown that the optimal deterministic approach is to wait until the delay cost

incurred exactly equals the order cost. This approach results in an optimal 2-competitive algorithm

(15). In our terminology, this corresponds to an algorithm that waits until the accumulated budgets

of all demands pay for their order. However, it is not hard to show that such an algorithm will fail

in the more complex JRP studied here. Intuitively, the bad example would force such an algorithm

to incur the ordering cost K0 too often. Suppose we have many item types, with orders for each at

time 0, and their respective waiting costs increase rapidly close to their deadlines but the deadlines

are equally distributed in time. Then the previous algorithm would open an order for each demand

separately very close to its deadline and incur the joint ordering cost K0 for each demand, and the

optimal algorithm will order items in batches and will not pay K0 as often. Thus, new ideas are

needed.

Suppose that a set of types of items S have gathered an accumulated budget that may pay for

the order cost of the set of types in S. That is, the accumulated budget is at least the joint ordering

cost along with the additional fixed item order cost of each type in the set S. We certainly want

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

10

to make an order to the set of types in S. However, since this ordering already pays for the joint

ordering cost, we might want to add other types that still have not fully paid for their fixed cost.

Otherwise, we might need to pay the joint ordering cost several times while the optimal solution

joins all these demands together and pays the joint ordering cost only once. On the other hand,

it is not wise to add all the types that have not yet paid for their fixed cost, since more demands

of these types may arrive in the near future. The question is how many and which ones of these

additional “premature” types should be added to the current order.

The main novel idea that is used in our algorithm is the simulation step that uses the current

known information to decide which of the types will be added to the current joint order. In the

simulation step we virtually increase the algorithmic time to future time periods assuming that

no additional demands arrive. During this process we increase the delay cost of the demands that

have arrived and are not satisfied yet, and so additional types manage to “pay” for their order

cost. These types are added to the current order, and their corresponding demands become “half

active” (defined below). Continuing the simulation for a long time has the benefit of adding more

types to the current order that already paid for the joint order cost. However, each additional type

that is added prematurely adds to the current order cost more than its current budget. Since more

demands of that type might arrive in future times, the “future” budget that convinced us to add it

to the current order is not guaranteed. Therefore, the idea is to continue with the simulation step

as long as the extra future budget that we use is at most the joint order cost, K0 . This extra budget

exactly balances between these two options. The simulation step induces a rather unique dynamics

for how the values of the dual variables change. Unlike almost all existing primal-dual algorithms

in which the dual variables only increase, in our algorithm the value of each dual variable can both

increase and decrease.

3.1. Algorithm Description

We are now ready to formally describe our algorithm. Our online algorithm uses an algorithmic

time indicator τ that starts at time 0 and is increased continuously as time progresses. At each

discrete time s the algorithm simulates a continuous increase of the time indicator τ from time s

to s + 1. Any orders that are indicated at algorithmic time τ are actually made at time s = ⌊τ ⌋.

During any time τ , each demand can be in any of the three states:

• Active demands are demands that are still unsatisfied by the algorithm.

• Half Active demands are demands that are satisfied by the algorithm still play some role in

our algorithm. Intuitively, these demands were satisfied ”prematurely” and we want them to pay

for some other costs.

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

11

• Inactive demands are demands that are satisfied by the algorithm and play no role in future

times. That is, their corresponding dual variables cannot change anymore.

Each demand (i, t) is active from its arrival time until it is satisfied at some algorithmic time

τ . At time τ the demand (i, t) may become half active for a certain time, and then it becomes

inactive forever. Let τe (i, t) be the time demand (i, t) becomes half active. Let τf (i, t) be the

algorithmic time demand (i, t) becomes inactive. If τf (i, t) > τe (i, t) then during the time interval

[τe (i, t), τf (i, t)] the demand (i, t) is half active. When a new demand arrives and is not served yet,

we set τe (i, t) = τf (i, t) = ∞. Note again that τe (i, t) and τf (i, t) are algorithmic times and do not

have to be integral.

Our proposed online algorithm maintains during each time τ a list of active (unsatisfied) demands

Aτ ⊆ D and a set Hτ ⊆ D of half active demands. These sets contain, of course, only demands that

arrived prior to time τ . At the beginning of the planning horizon A0 consists of demands that

arrived at time 0 and H0 = ∅. If the algorithm changes the status of a set of demands at time τ then

+

we denote by A−

τ and Aτ the set of active demands just before and after this change. Similarly, let

Hτ− and Hτ+ denote the set of active demands just before and after the change.

The algorithm maintains the following assignment to each dual variable y(i, t, s). Until τ becomes

s the variable is zero. If demand (i, t) is active or half active at time τ ≥ s then the variable is

increased continuously by the linear function y(i, t, s) ← (τ − s)∆its (Alternatively, dy(i, t, s)/dτ =

∆its ). The increment stops whenever the demand becomes inactive or when τ = s + 1, the earlier

of these events. From that point on the dual variable remains a constant with value min{(τf (i, t) −

s)∆its , ∆its }.

Orders are triggered when dual constraints become tight due to increments of the dual variables.

To this end, we consider at time τ any set S and any time s ≤ τ and check whether the total

sum of the dual variables that contribute to the suitable dual constraint is exactly C(S). Demands

that contribute to the constraint are demands whose type is in S and their arrival time is prior to

s. We may consider only times s that are integral (i.e. s ∈ T), since if the constraint is tight for

non-integral time τ ′ then moving backwards to time ⌊τ ′ ⌋ can only increase the total sum. This is

true since in our model no new demands arrive between time ⌊τ ′ ⌋ and time τ ′ .

When reading the algorithm description note the similarity between the dynamics of the algorithm during the simulation step and the dynamics of the algorithm during the main part. The

only difference is that demands that are being added to the order in the simulation step are marked

as half active and not inactive as in the main part of the algorithm. The formal description of the

algorithm is outlined in what follows.

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

12

Inventory algorithm: Upon arrival of a demand (i, t) set τf (i, t) = τe (i, t) = ∞.

At each algorithmic time τ :

Keep the invariant that for any set of types S and time s ≤ τ :

∑

∑

(i,t)|t≤s,i∈S

r≥s

y(i, t, r) ≤ C(S).

1. For each demand that is active or half active, increase y(i, t, ⌊τ ⌋) gradually at rate

dy(i, t, ⌊τ ⌋)/dτ = ∆it⌊τ ⌋ .

2. If at time τ , there exist a set of ∑

types Sτ and time

∑ sτ such that the dual constraint that

corresponds to (Sτ , sτ ) is tight (i.e., (i,t)|t≤sτ ,i∈Sτ r≥sτ y(i, t, r) = C(Sτ )):

(a) Set all half active demands (i, t) such that there exists a variable y(i, t, r) that

appears in the constraint to be inactive. Formally, if (i, t) ∈ Hτ and also i ∈ Sτ , t ≤ sτ then

set τf (i, t) = τ .

(b) If there are no active demands that contribute to the tight constraint return to (1).

Otherwise:

i. Set all half active demands to be inactive. Note that we may change status of some

demands that do not contribute to the tight constraint.

ii. If sτ is later than the time of the previous order made by the algorithm, then set

an order at time ⌊τ ⌋ that includes all item types in the tight constraint Oτ , Sτ .

iii. If sτ is earlier than the time in which the previous order made by the algorithm

was placed, then set an order at time ⌊τ ⌋ that includes only the set of item types of demands

that are active and contribute to the tight constraint. Formally:

Oτ , {i | ∃(i, t) ∈ Aτ such that i ∈ Sτ , t ≤ sτ }

iv. Set all active demands (i, t) whose type i ∈ Oτ to be inactive.

Simulation step:

• Simulate the execution of the algorithm in future times τ (future) > τ (assuming no new

demands arrive).

• If at some time τ (future) there are no active demands left, or the accumulated value

of the dual variables y(i, t, s) from time τ until time τ (future) is at least K0 then stop the

simulation step and return to line (1).

• Otherwise: if at time τ (future) new dual constraint becomes tight (i.e., there exists a set

′

S and time s(past) such that

∑

∑

y(i, t, r) = C(S ′ )

(i,t)|t≤s(past),i∈S ′ r≥s

1. Add to the order Oτ all types in

{

}

O′ , i | ∃(i, t) ∈ Aτ (future) such that i ∈ S ′ , t ≤ s(past)

2. Set all active demands (i, t) whose type i ∈ O′ to be half active at time τ and inactive

at time τ (future) (τe (i, t) = τ , τf (i, t) = τ (future)) and continue the simulation.

Note that the set of half active demands is the set of demands that were added to the order

in the simulation step, but their corresponding dual variables (budget) may still contribute the

the value of the dual solution (in future times). It is not hard to verify that the algorithm can

be implemented efficiently. The main procedure we need is to find out at time t if there are dual

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

13

constraints that are tight. To this end, we may consider all arrival times of the currently active and

inactive demands. Then, to check if there is a tight constraint that starts at some arrival time s, we

sum up the contributions of all item types i that contribute at least Ki value to a dual constraint

that starts at time s. It is easy to verify that if there is a tight constraint that starts at time s,

then the constraint with this subset of item types is also tight.

3.2. Analysis

The idea of the analysis is to construct a primal solution whose cost is the same as the cost of the

solution obtained by the online algorithm (this is done easily by considering the behavior of the

algorithm). Next, we construct a corresponding feasible dual solution based on the variables used

by the online algorithm. We then show that the cost of the primal solution is at most three times

the cost of the dual solution. Since the cost of the dual solution is a lower bound on the optimal

offline solution, it will follow by weak duality that the online algorithm is 3-competitive.

The primal and dual solutions are defined simply. The primal solution set an order at time ⌊τ ⌋

to all the items ordered by the algorithm at the interval [⌊τ ⌋, ⌈τ ⌉]. Also we set z(i, t, s) = 1 for

any demand (i, t) and time s such that τe (i, t) ≥ s + 1 and otherwise we set z(i, t, s) = 0. Note

when a demand becomes half active it is already served and so we can set z(i, t, s) = 0 for any s

such that τe (i, t) < s + 1. The dual solution is constructed by the assignments to the dual variables

y(i, t, s) determined during the execution of the algorithm. The following Lemma proves that the

dual solution produced this way is feasible.

Lemma 1. The assignment y(i, t, s) for each demand (i, t) and time s that is maintained during

the execution of the algorithm defines a feasible dual assignment to (4)-(5).

Proof.

First, since each y(i, t, s) ≤ ∆its all constraints (4) are satisfied. Assume to the contrary

that the assignment violates one of the constraints (5). Then there exists a set S and time s such

that:

∑

∑

y(i, t, s) > C(S)

(i,t)|t≤s,i∈S r≥s

Thus, by this (false) assumption there must be a time τ during the execution of the algorithm

for which

∑

∑

y(i, t, s) = C(S).

(i,t)|t≤s,i∈S r≥s

Also, there must be some demand (i, t) with type i ∈ S that arrived prior to time s and is active

or half active at time > τ . This follows because the dual constraint is violated at time > τ . However,

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

14

by the algorithm behavior (lines (2a),(2(b)iv)), at the algorithmic time τ all active and half active

demands that contribute to the constraint become inactive, and so we are done.

In order to prove that the cost of the primal solution produced by the algorithm is at most 3

times the cost of the dual solution we need further definitions.

Along the execution of the algorithm many dual constraints become tight. Dual constraints may

become tight either in the main loop of the algorithm or in the simulation step. As discussed earlier,

some of the constraints that became tight during the simulation step may not become tight later

on during the real execution of the algorithm. We elaborate on this issue later on. Consider R to

be any constraint (5) in the dual LP that became tight during the algorithm execution. Such a

constraint is defined by (W (R), [τs (R), τe (R)]), where W (R) is the set of item types of the dual

constraint, τs (R) is the starting time of the dual constraint, and τe (R) is the algorithmic time in

which the constraint became tight. We say that variable y(i, t, s) contributes to the constraint R if

it belongs to R (i.e., i ∈ W (R), t ≤ τs (R) ≤ s ≤ τf (i, t)) and have strictly positive value. Note that

only demands that are active or half active at time s may contribute to constraint R. We next

define the set of demands that contribute to the constraint R. These are demands that (i) arrived

prior to τs (R). (ii) The type of the demand belongs to the set of types of constraint. (iii) The

demand became inactive only strictly after τs (R) (and therefore some dual variable of the demand

contributes to the constraint R. Formally,

D(R) = {(i, t) | i ∈ W (R), t ≤ τs (R), τf (i, t) > τs (R)}

Next, for each constraint R we define W̃ (R) ⊆ W (R) to be the set of types of demands that

are active or half active at the time moment when the constraint R becomes tight. Informally

there might be demands that contribute to the constraint at first, but became inactive before the

algorithmic time in which the constraint became tight. These types do not trigger any events in

the algorithm since they don’t increase anymore. The algorithm only change the status of demands

in W̃ (R). Formally,

W̃ (R) = {i′ | ∃(i, t) ∈ D(R), i′ = i, τf (i, t) ≥ τe (R)} .

Finally, we define D(W̃ (R)) to be the set of demands in D(R) of types from the set W̃ (R).

Informally, these are the demands that are “taken care” by the algorithm at time τe (R) that the

constraint become tight. Formally,

{

}

D(W̃ (R)) = (i, t) | (i, t) ∈ D(R), i ∈ W̃ (R)

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

Phase p

Phase p+1

15

Phase p

Phase p+1

Rp,1

Rp

Tight constraints that contained active demands

Ts(p)

(a)

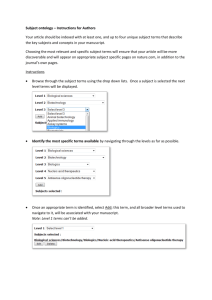

Figure 1

Te(p)

Tf(p) Ts(p+1)

(b)

Phase division (a) and the constraint Rp,1 and Rp The dashed constraints are constraints that became

tight during the simulation step and did not cause an order when they became tight.

Next, we consider the orders made by the algorithm. Let τ1 ≤ τ2 ≤ τ3 ≤ . . . be the algorithmic

times in which the algorithm makes an order. The algorithm makes an order whenever it encounters

a tight constraint that contains active demands, i.e. in our new notation D(R) ∩ A−

τe (R) ̸= ∅. Let

R1 , R2 , . . . be the tight constraints that caused these orders. We partition the time interval into

phases. A new phase p starts whenever the starting time of Ri is later then the ending time of the

next constraint Ri−1 (i.e. τs (Ri ) > τe (Ri−1 )). The first phase starts at τs (R1 ). An example of such

a partition appears in Figure 1 where we view each constraint R as an interval between τs (R) and

τe (R).

We separate the first constraint that started each phase and other constraints that became tight

in the same phase. Note that each phase contains at least one tight constraint that triggered

the first order. Let Rp,1 be the first constraint that became tight in phase p. Let Rp be all the

other constraint that became tight during phase p. The set Rp also includes the constraints that

became tight during the simulation step of the algorithm and possibly did not become tight during

the actual execution of the algorithm due to the beginning of phase p + 1 (See Figure 1). Let

τs (p) = τs (Rp,1 ) be the start of a phase p that is equal to the starting time of the first constraint

that became tight during that phase. Let τe (p) = τe (Rp,1 ) be the time in which Rp,1 became tight.

Finally, let τf (p) be the ending time period of the phase p that is the time period in which the last

constraint that caused an order in the phase p became tight. This definition induces the following

partition of the time interval τs (p) ≤ τe (p) ≤ τf (p) < τs (p + 1) ≤ τe (p + 1) ≤ . . ..

We next want to bound the total cost of the online algorithm using the value of the dual solution.

We start with some intuition that will make the technical lemmas and the algorithm behavior more

clear. Bounding the delay cost is quite easy. In Lemma 3 we show that the delay cost incurred by

the online algorithm is at most the value of the dual solution. Actually we give a slightly better

bound (that is used later on), since we sum only dual variables of active demands. Bounding the

order cost is harder. The proof reveals the ideas behind the simulation step and the partition into

phases. The first constraint in each phase is tight and thus the total “budget” inside it is enough

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

16

to pay for both the joint order cost of the first order in the phase and the fixed order cost of all

types ordered in this first order (excluding the types that are added in the simulation step). The

main observation is that if the phase did not end after the first order, then all the constraints

that become tight during the simulation step also become tight during the actual execution of the

algorithm and with the same order. We formalize this in the following lemma:

Lemma 2. For each phase p, the constraints that become tight in the interval (τe (p), τf (p)] are

exactly the same constraints that became tight during the simulation step done by the algorithm.

Proof.

All the tight constraints that become tight during this time interval have a starting time

earlier than the ending time of the previous order; otherwise, a new phase starts by definition.

Therefore, only demands that arrived prior to the previous order (in the phase p) may contribute to

these constraints. Since the simulation step simulates exactly the events that involve demands that

have already arrived, the constraints that became tight are exactly the constraints that became

tight during the simulation step, and they become tight in the same order as in the simulation

step.

In particular, note that the constraint that became tight and caused the second order in the

phase is constraint that became tight after accumulating of value of at least K0 in the dual. This

is true for each successive order as long as the current phase did not end. The value accumulated

this way is enough to pay the joint ordering cost of each of the orders from the second to the last.

Finally, we need to pay the fixed cost of the the types that were ordered during the second to

the last order in the phase and also for the types that were added due to the simulation step in

the first order. We want to sum the dual profit only until the last order of the phase in order to

bound the number of times we use each dual variable. We prove that each type that was added

due to a constraint that actually became tight before the last order of the phase can pay for its

fixed ordering cost. The only problem is with types that were added in the last order of the phase

due to the simulation step. These types are using future tight constraints. Since the phase ended,

this future budget cannot be used since it might never become available. However, by the behavior

of the algorithm during the simulation step the total future budget that is used is bounded by at

most K0 . Therefore, we may charge this extra cost to the budget of the first tight constraint in the

phase.

Lemma 3. The total delay cost of the online algorithm is at most the dual cost:

∑

s<τe (i,t)

∑

(i,t)∈D

s=t

y(i, t, s)

(6)

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

Proof.

17

By the construction of the primal and dual solutions, each time the algorithm defines

z(i, t, s) = 1 of an active demand (i, t), then also y(i, t, s) = ∆its . Note that in this case s+1 ≤ τe (i, t).

The following more involved lemma bounds the total order costs made by the online algorithm.

Intuitively, we will eventually bound the total ordering cost in every phase p by summing (sometimes twice) the dual budget obtained only inside the time interval of phase p. This allows us to

obtain later on our bound.

Lemma 4. The total order cost of the online algorithm is at most:

∑

2 ·

p∈P

∑

s<τe (p)

∑

y(i, t, s) +

∑

∑

y(i, t, s) +

s=τe (p) (i,t)∈D

s=τs (p) (i,t)∈D (W (Rp,1 ))

Proof.

∑

s<τf (p)

∑

R∈Rp (i,t)∈D (W̃ (R))

For every order of the set S of types, we pay K0 +

∑

i∈S

s<min{τe (R),τf (p)}

∑

y(i, t, s)(7)

s=τs (R)

Ki . We prove that for each

phase p, the total sum of terms that correspond to phase p is at least the total order cost of the

algorithm during that phase. As previously observed, the accumulated value of the dual variables

between each two orders after the first order in a phase is at least K0 . Thus, the sum of all dual

variables from the time of the first order of a phase until the time of the last order in a phase fully

pays for all joint order costs from the second to the last order of the phase. Formally, if there are

∑s<τ (p) ∑

M orders during the phase then: s=τef(p) (i,t)∈D y(i, t, s) ≥ (M − 1)K0 .

The second observation is that since the first constraint in each phase p is tight then

∑

∑

s<τe (p)

∑

y(i, t, s) = K0 +

s=τs (p) (i,t)∈D(W (Rp,1 ))

Ki

(8)

i∈W (Rp,1 )

Up to now, we charged to the dual variables all joint ordering costs during the phase and also

the fixed ordering cost of types that were ordered during the first order of phase p, excluding the

types that were added to the first order due to the simulation step. We are left with the fixed

ordering cost of all types that were ordered from the second to last order of phase p and the types

that were added to the first order in the phase due to the simulation step. We claim that for each

constraint R ∈ Rp that became tight in the actual execution of the algorithm or in the simulation

step:

∑

∑

s<τe (R)

(i,t)∈D(W̃ (R)) s=τs (R)

y(i, t, s) ≥

∑

i∈W̃ (R)

Ki .

(9)

18

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

The inequality (9) means that the dual variables corresponding to active demands of the inequality R are enough to pay for item ordering costs. Assume that this is not true. Then there exists

some tight constraint R ∈ Rp such that

∑

∑

∑

s<τe (R)

y(i, t, s) <

(i,t)∈D(W̃ (R)) s=τs (R)

Ki

i∈W̃ (R)

∑

∑s<τe (R)

However, since constraint R became tight we get that

s=τs (R) y(i, t, s) = K0 +

(i,t)∈D(R)

∑

i∈W (R) Ki . Since D(W̃ (R)) contains all the demands of type W̃ (R) that contribute positive value

to the demand R we get by subtracting the two equations that:

∑

∑

∑

s<τe (R)

y(i, t, s) =

(i,t) |i∈(W (R)\W̃ (R)),t≤τs (R) s=τs (R)

∑

s<τe (R)

y(i, t, s)

(i,t)∈D(R),(i,t)∈D(

/ W̃ (R)) s=τs (R)

∑

> K0 +

Ki

i∈(W (R)\W̃ (R))

This contradicts the fact that the online algorithm holds at each time a feasible dual solution

since the dual constraint that is suitable to the set of types W (R) \ W̃ (R) and the time t = τs (R) is

violated. The online algorithm also maintains a feasible dual solution during the simulation step,

so this holds also in the simulation step.

All constraints that became tight during the simulation steps made before the last order in the

phase also became tight in the actual running of the algorithm and therefore are able to pay for

their item ordering cost by the corresponding dual variables. The only problem is with constraints

that became tight during the simulation step made in the last order of a phase. We can only make

use of the values of the dual variables until the time of the last order. The main observation is

that by the algorithm’s behavior the extra budget that is used is at most K0 . Thus, if there are M

orders during the phase we obtain

∑

Order cost ≤

∑

s<τe (p)

y(i, t, s) + (M − 1)K0

(i,t)∈D(W (Rp,1 )) s=τs (p)

+

∑

∑

∑

s<min{τe (R),τf (p)}

R∈Rp (i,t)∈D(W̃ (R))

∑

s<τe (p)

≤2

∑

+

∑

R∈Rp (i,t)∈D(W̃ (R))

∑

s<τf (p)

y(i, t, s) +

s=τs (p) (i,t)∈D(W (Rp,1 ))

∑

y(i, t, s) + K0

(10)

s=τs (R)

∑

y(i, t, s)

s=τe (p) (i,t)∈D

∑

s<min{τe (R),τf (p)}

s=τs (R)

y(i, t, s)

(11)

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

19

The first term in inequality (10) bounds the joint ordering cost K0 of the first order in the phase

and the fixed ordering cost of each of the types in the first constraint that became tight. The second

term in (10) is the joint ordering cost of all orders from the second to the last. The third term is

the fixed ordering cost of all types that were ordered in the first order due to the simulation step

and the fixed costs of types ordered in the second to last order of the phase. Note that we sum

only until the minimum between the time each constraint became tight and the last order in the

phase. Thus, we add an extra cost of K0 of the extra future budget that was used. Inequality (11)

follows directly from Equation (8).

We next prove a useful claim that helps us proving our final result. An order of an item with

type i at time s by our algorithm is always caused by some dual constraint R becoming tight. One

option is that constraint R became tight at time s ≤ τ < s + 1 and contained an active demand

of type i. Another option is that during the simulation step done at the algorithmic time τ some

constraint R became tight at time τe (R) > s and caused an order at time s. In the next Lemma

we take two successive times t1 and t2 in which the algorithm makes an order to an arbitrary type

i. We prove that the starting time τs (R) of the second constraint that caused an order of type i

must be larger than t1 . Intuitively, this means that an order to type i “resets” all the constraints

that contain type i.

Lemma 5. Let t1 , t2 be two successive times in which the online algorithm makes an order for some

type i. Let τs (R2 ) be the beginning time of the second constraint that became tight (during the real

time or during the simulation) and caused an order of type i at time t2 ≤ τe (R2 ). Then τs (R2 ) > t1

Proof.

The second constraint became tight in real time or during the simulation at time τe (R2 ) ≥

t2 . This constraint must contain at time t2 an active demand (i, t) with type i (otherwise, it doesn’t

cause an order of type i). In addition, by the properties of the dual constraints the constraint only

contains variables of demands that arrived prior to τs (R2 ). Thus, demand (i, t) is active from time

τs (R2 ) until time t2 . At time t1 ≤ t2 there was an order of type i, and so the algorithm changed the

status of all the demands of type i that arrived prior to t1 to either half active or inactive. Thus,

it is not possible that τs (R2 ) ≤ t1 .

The next lemma bounds the number of times each dual variable is used in Equation (7). This

will allow us to bound the competitive ratio of the algorithm.

Lemma 6. The total number of times each y(i, t, s) appears in Equation (7) is at most twice if

s < τe (i, t) and at most 3 times if

s ≥ τe (i, t).

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

20

Proof.

Suppose first that y(i, t, s) appears in the first constraint in some phase p. By our

definitions it means that τs (Rp,1 ) ≤ s < τe (Rp,1 ) and i ∈ W (Rp,1 ). In this case it appears with

coefficient 2. We prove that in this case it does not appear in any sum of any other constraint in

Rq for any q.

The algorithm makes an order to the types in W (Rp,1 ) at time τe (Rp,1 ). By our definition of

phases τs (Rp,1 ) ≤ s is larger than the time of the last order at phase p − 1 and thus since we sum

the variables in phase p − 1 only until τf (p − 1) < τs (Rp,1 ) ≤ s, then y(i, t, s) cannot appear in any

R ∈ Rq when q < p.

Assume now that there is another tight constraint R′ with set W ′ (R′ ) that contains type i which

became tight later than Rp,1 during the execution of the algorithm, and contains the variable

y(i, t, s). Since this constraint contains the variable y(i, t, s) then it has a beginning time τs (R′ ) ≤

s < τe (Rp,1 ). On the other hand, this constraint caused an additional order of the type i after

time τe (Rp,1 ). Thus, by claim 5 it must has a beginning time τs (R′ ) > τe (Rp,1 ) which leads to a

contradiction, and so we are done.

We therefore consider from now on only variables y(i, t, s) that do not appear in the first constraint of the phase p. Such a variable may appear at most once in the second term of Equation

(7).

We now bound the number of appearances of a variable y(i, t, s) in the third term of Equation

(7). We prove that if s < τe (i, t) then it appears at most once in a sum of some tight constraint R.

If s ≥ τe (i, t) we prove that it appears in at most 2 sums of tight constraints.

Take a variable y(i, t, s) such that s < τe (i, t). We prove that it appears at most once in a

sum of some tight constraint R. Let R be the tight constraint that contains the variable y(i, t, s)

and that caused the first order that served demand (i, t). This order occurred at time ⌊τe (i, t)⌋

and the demand (i, t) became half active at time τe (i, t). Assume to the contrary that there is

another tight constraint R′ with set W (R′ ) that contains type i, caused an order later during the

algorithm execution, and contains the variable y(i, t, s). Since this constraint contains the variable

y(i, t, s) then it has a beginning time τs (R′ ) ≤ s ≤ τe (i, t). On the other hand, this constraint caused

additional order of the type i after time τe (i, t). Thus, by claim 5 it must have a beginning time

τs (R′ ) > τe (i, t) which leads to a contradiction.

Assume now that we take a variable y(i, t, s) such that s > τe (i, t). We prove that it appears in

at most two sums of tight constraints. In particular, we prove that it can appear at most once in a

constraint R such that τs (R) < τe (i, t) and at most once in a constraint such that τs (R) ≥ τe (i, t).

Let R be a tight constraint that contains the variable y(i, t, s), has beginning time τs (R) < τe (i, t),

and that caused the first order that served demand (i, t). This order happened exactly at time

⌊τe (i, t)⌋ when the demand changed its status. Assume to the contrary that there is another tight

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

21

constraint R′ that contains type i, caused an order of type i later during the algorithm execution,

and has beginning time τs (R′ ) < τe (i, t). On the other hand, this constraint caused additional order

of the type i after time τe (i, t). Thus, by claim 5 it must have a beginning time τs (R′ ) > τe (i, t)

which leads to a contradiction.

To see that there can be at most one constraint such that τs (R) ≥ τe (i, t) that contains the

variable y(i, t, s) we note first that the demand (i, t) is half active at time s. This follows simply

because s ≥ τe (i, t) and the demand is not inactive since otherwise y(i, t, s) should be equal to

zero. The first order of type i happened when the demand changed its status at time ⌊τe (i, t)⌋.

Since we sum only until the constraint became tight or the end of the phase, the next order of

type i happened after time s. Let R be the tight constraint that contains the variable y(i, t, s),

has starting time τs (R) such that τe (i, t) ≤ τs (R) ≤ s, and that caused the first order of type i

after time s. Assume to the contrary that there is another tight constraint R′ that contains type i,

caused an order to i later during the algorithm execution, and contains the variable y(i, t, s). Since

this constraint contains the variable y(i, t, s) it must be that it has a beginning time τs (R′ ) ≤ s.

On the other hand, this constraint caused an additional order of the type i after the order time

of the constraint R. Thus, by claim 5 it must has a beginning time τs (R′ ) > s which leads to a

contradiction.

Combining Lemmas 3, 4 and 5 we obtain

Theorem 1. The algorithm is 3-competitive.

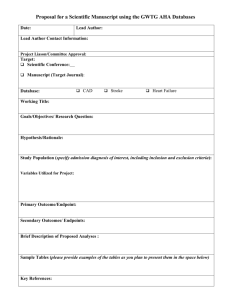

3.3. Computational Results

In this section, we present the results of computational experiments that test the typical empirical

performance of our algorithm for the joint replenishment problem with online arrival. We carried out

different scenarios of arrival parameters. Our typical input had time horizon T = 2500. Demands for

items of type i arrived as a poisson process meaning that the time between each pair of consecutive

events has an exponential distribution with parameter Λi . Recall that our algorithm has worst

case guarantee, and it does not try to learn the distribution of the input over time, so running on

longer time horizons, or changing the distribution in the middle of the process will not affect its

performance. We checked the performance of our algorithm with about 5 item types and various

values of K0 , K1 , . . . , Ki . We used mainly linear delay penalty function that had a different slope

for every item type. For such instances, we also managed to find the optimal integral solution using

CPLEX software (1). This optimum was used to compute our actual competitive ratio.

The empirical competitive ratio of our algorithm ranges in the interval [1.5, 2.2] with typical

value of less than 2. These results were obtained without any additional heuristics that we could

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

22

Time Steps

2500

2500

2500

2500

2500

Table 1

K0

Ki

10 2,3,5,8,11

10 2,3,5,8,11

20 2,3,5,8,11

20 2,3,5,8,11

10 5,8,10,12,15

Delay-penalty factor

Arrival rate

Competitive ratio

0.2 (all)

0.04 (all)

2.16

0.2 (all)

0.04, 0.03, 0.03, 0.02, 0.01

1.92

0.1,0.2, 0.3, 0.4, 0.5

0.01 (all)

1.73

0.5, 0.4, 0.3, 0.2, 0.1

0.02 (all)

1.98

0.5, 0.4, 0.3, 0.2, 0.1

0.02 (all)

1.97

The empirical competitive ratio for several randomly generated inputs. Competitive ratio was

computed with respect to the optimal offline solution obtained by CPLEX.

apply. It is not expected that an online algorithm will be able to compete perfectly with an optimal

offline solution that knows the whole input sequence. Thus, these results mean that with typical

non-adversarial input the algorithm indeed performs much better than the worst case 3 guarantee.

Table 3.3 lists several typical input parameters along with the algorithm performance.

4. Lower Bounds

Known lower bound techniques for the TCP acknowledgement problem do not extend readily to

JRP and thus we required new ideas. In the following we prove the following lower bounds.

Theorem 2. No deterministic online algorithm for the single-item case has competitive ratio less

than 2.

Theorem 3. No deterministic online algorithm for the 2-item case has competitive ratio less than

2.46.

Theorem 4. No deterministic online algorithm for the 3-item case has competitive ratio less than

2.64.

Our lower bound employs a technique that, to the best of our knowledge, has not been used in

previous related work. The technique is to drastically increase the rate at which costs accumulateat times that are, of course, unknown to the online algorithm. This allows the offline algorithm to

leave some requests unserved and ignore the additional costs so incurred. While not a particularly

realistic feature of practical problems, it adds a new trick to the offline adversary designer’s toolkit

in some problem settings.

We first illustrate a technique to be used in the multi-item case by showing a lower bound of 2

in the single-item case. The proof of Dooly et al. (15) for TCP acknowledgement applies in this

case, since different wait cost functions can be simulated by multiple TCP packets. Our technique

amounts to a new, alternate proof. Their proof achieves a lower bound of 2 by allowing the offline

solution to pay only every other acknowledgement (order cost) paid by the online algorithm, and

to pay wait costs on only half of the demands whereas the online algorithm pays wait costs on all

demands. Intuitively, we can not get a lower bound greater than 2 with this technique because it

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

23

batches only two orders that are paid separately by the online algorithm. We need to be able to

force the online algorithm to balance the order and wait costs individually for different item types,

and also to force it to pay the joint order cost for each order of each item type whereas the offline

solution pays the joint order cost only once for many orders of all item types. This will be seen in

detail in Section 4.2 below.

We will think of the adversary and the offline algorithm as a single entity; whichever term is

more natural in each context will be used. We will refer to the online algorithm simply as “online.”

The offline solution we construct will not necessarily be the optimal one, but of course it will upper

bound the optimal cost. Our lower bounds are constructed assuming time is continuous; this can

be approximated to arbitrary precision by fine granularity of discrete time steps. It will be more

convenient to express the delay cost for each order using absolute time. We write w(t) as the total

accumulated delay cost, which we call the wait cost, if an order is placed at time t.

4.1. Warmup: the single-item case

The tradeoff we must exploit, of course, is between the wait cost and the order cost. We want to

let offline choose the cheaper of the two and force online to balance them. Since each demand must

eventually be satisfied, offline needs to be able to amortize the order cost of multiple demands

in the case that the wait cost is the cheaper. We do this by collecting multiple demands into a

single order satisfying all the demands at once. This must be done after online has ordered for each

demand individually. Since offline keeps many demands open that are already satisfied by online,

we need a way to keep the wait costs for all those demand from accumulating too much. We do this

by “zooming,” making successive demands whose wait costs increase at ever-increasing rates. We

“zoom in” to a much finer time scale each time we wish offline to pay just the wait cost whereas

online must pay both wait cost and order cost.

Proof of Theorem 2.

Without loss of generality, let K = 1 be the single-item order cost. The

adversary first introduces a demand with wait cost increasing linearly with slope 1; i.e., w(t) = t.

Online waits until some time t1 and then orders, so its total cost is t1 + 1. Offline has two choices:

order the item and pay 1, in which case it may as well order at time 0 and thus pay 0 wait cost, or

pay the wait cost t1 and delay the order. Since it defers the order until some later time in the second

case, offline will pay some additional wait cost. The adversary must make this wait cost negligible.

It does this by introducing the next demand with a much greater rate of wait cost increase. For the

new demand, the wait cost increases at rate

1

ϵ

for some small ϵ; i.e., w(t) = 1ϵ (t − t1 ). Subsequent

demands will repeat this if needed, so the ith demand’s wait time grows at rate 1/ϵi−1 . Wait times

(not costs) for successive demands will decrease geometrically as will become clear. Offline will

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

24

eventually order before time t1 + 2ϵ provided ϵ ≤ 1/2, and thus pay an extra wait cost less than 2ϵ

for the first demand.

Our adversary strategy is then as follows. Initially demand an item with wait cost w(t) = t. Let

t1 be the time online orders the item. If t1 ≥ 1, offline orders at time 0 and pays 1 which is at

most half of online’s cost. Otherwise, zoom, and repeat at a time scale 1/ϵ times finer; i.e., issue

a demand at t1 with wait cost w(t) = 1ϵ (t − t1 ). In this case also offline has paid at most half of

online’s cost for the first demand, and will later pay an additional wait of no more than 2ϵ for the

first demand. Continue making demands such that w(t) = ϵ−(i−1) (t − ti−1 ), where ti denotes the

time of online’s ith order. Stop when either

1. online’s wait cost for an order is at least 1, in which case offline will order immediately after the

demand arrives and pay the order cost 1 which will satisfy the current demand and also satisfying

all outstanding demands “for free,” or

2. 1/ϵ demands have been made. In this case, we will charge equal fractions of the single order

cost 1 to each of the 1/ϵ demands.

If there are r demands, offline’s single order will come at time tr ≤ 1 +

∑r

r

i=1 ϵ .

It should be clear

that offline’s cost is less than (1 + 3ϵ)/2 times online’s cost, since each demand for which offline

pays wait cost may need to pay an ϵ share of the order cost 1, and waits no more than (1 + 2ϵ)

times as long as it does under online. Since we can make ϵ arbitrarily small, we obtain the stated

lower bound of 2.

4.2. The multiple-item case

Now we turn to the multiple-item case. Without loss of generality we assume K0 , the joint order

cost, is 1. Recall that the order cost for item type i ≥ 1 is denoted Ki .

We will use widely disparate rates of wait cost increase in two ways: we use the zooming technique

described in the previous section, and the wait cost rates for different item types will be very

different. As before, the adversary will zoom up to 1/ϵ times as necessary (we will call these rounds),

∑

and then pay a final ordering cost of 1 + i Ki which is negligible when amortized over enough

rounds.

At the beginning of each round, demands are opened for all item types. At the first time scale

(i.e., in the first round, before any zooming), each item type i will incur wait cost at some rate si .

We choose s1 = 1 and si+1 = ϵsi for i ≥ 1. In each later round of zooming, each item type’s rate of

wait cost increase will be multiplied by 1/ϵ.

Note that whenever wait cost is accumulating for type i and some higher-indexed types, the

sum of wait costs for the higher-indexed types is less than 2ϵ times that of type i. We will not

mention these wait costs for either online or offline in the following, and we will also ignore offline’s

Author: Online Make-to-Order Joint Replenishment

Article submitted to Operations Research; manuscript no. (Please, provide the manuscript number!)

25

additional wait costs for zooming and its final order cost. Thus it should be understood that each

cost in the following is approximate but within a 1 + 6ϵ factor of the actual cost, and that by

choosing a small enough ϵ the stated bounds will hold.

In each round, the adversary presents demands for all item types i, 1 ≤ i ≤ n for some n > 1, at

the beginning of the round. Our analysis below is for a single round, and the same analysis applies

to each round. In each round, the adversary will force online’s cost to be at least some factor B

times offline’s cost. Summed over all rounds, we will obtain the same factor between costs, again

with a negligible error since we defer orders to later rounds or even until after the last round.

For simplicity, we will describe just the first round, which starts at time 0.

Claim 1. For each i ≥ 1, we may assume that online algorithm orders type i no later than types

i + 1 . . . n.

Proof.

Suppose for instance that online orders type 2 at time t2 and then orders type 1 at time

t1 > t2 . The adversary will then proceed as though online ordered both 1 and 2 at time t1 . We may

assume t1 = O(1), since offline could order type 1 at time 0 and online’s wait cost s1 t1 = t1 for type

1 would imply a ratio of ω(1). Thus online’s wait cost s2 t1 for type 2 is very small since s2 = ϵ is

very small. Note that online saves a joint order cost of K0 = 1, which is much greater than s2 t1 ,

and online is thus much better off delaying the order of type 2 until t1 . Similarly, if online orders

any number of higher-indexed types before some lower-indexed type, we may delay the orders for

the higher-indexed types until that of the lower-indexed type, with negligible increase in wait costs

and saving one joint order cost, and online’s cost only decreases.

Now suppose online orders types 1, . . . , j for some j at time t1 . The tradeoff for offline (ignoring

other, more costly choices that are dominated by these two) is between

1. ordering type 1 at time 0, paying 1 + K1 , and (possibly) continuing at the current zoom level;

and

2. zooming so the order for type 1 can be deferred and paying the only wait cost t1 for item

type 1.

Note that offline obtains a significant advantage if online orders any types i > 1 at the same time as

type 1. Online pays Ki for these item types, and offline pays negligible cost. In fact, the adversary

may prefer to zoom to take advantage of this even if

it orders type 1 at time 0 (i.e., the order cost 1 + K1 for ordering type 1 at time 0 is less than

the wait cost t1 ).

4.3. The relatively simple case of 2 item types

We will now consider in detail the case of two item types to illustrate the lower bound technique.

Author: Online Make-to-Order Joint Replenishment