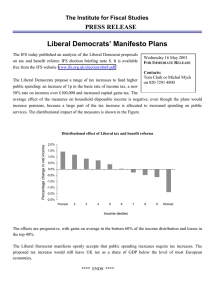

Taxes and Benefits: The Parties’ Plans

advertisement