Living standards and inequality Wenchao Jin, IFS May 13 , 2011

advertisement

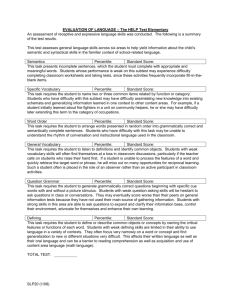

Living standards and inequality Wenchao Jin, IFS May 13th, 2011 © Institute for Fiscal Studies What’s coming up Living standards • Household income data from the last financial year of the recent recession • How household incomes evolved during the 13 years of Labour’s government Income inequality • How has the gap between rich and poor evolved? How incomes are calculated • Net of direct taxes and benefits • Measured at the household level • Adjusted for household size (equivalised) • Both before and after housing costs • Adjusted for inflation • Based on Family Resources Survey (FRS) – All statistics subject to sampling error • UK figures from 2002-03, GB only in earlier years – Report income trends on a GB basis GDP per head shrank substantially 1.10 1.08 1.06 2003 Q1=1 Real quarterly GDP per head 1.12 1.04 1.02 1.00 0.98 GDP per head 0.96 0.94 2003 Q1 2003 Q4 2004 Q3 2005 Q2 2006 Q1 Source: ONS, Economic and Labour Market Review 2006 Q4 2007 Q3 2008 Q2 2009 Q1 2009 Q4 2010 Q3 How does the GDP growth compare with household income growth? Annual changes in average real incomes (GB) Real percentage increase 6% 4% 1.6% 0.9% 2% 0% -2% GDP per head Mean (BHC) Median (BHC) -4% Source: ONS and HBAI data 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–00 1998–99 1997–98 -6% Income growth by different periods Annualised changes in average real incomes (GB) 2.5% 2.1% 2.0% 1.9% 1.6% 1.6% 1.5% 1.0% 0.5% 0.0% Conservatives 1979 to 1996-97 Mean BHC Source: HBAI data © Institute for Fiscal Studies Labour 1996-97 to2009-10 Median BHC Did growth differ during Labour’s 13 years? Annualised changes in average real incomes (GB) 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 3.4% 2.9% 1.3% 0.9% 0.8% 96-97 to 01-02 01-02 to 07-08 Mean BHC Source: HBAI data © Institute for Fiscal Studies Median BHC 0.8% 07-08 to 09-10 So why did household incomes grow in 2009-10 and during the two recession years? • Not due to earnings – Official statistics imply household incomes from earnings stagnated or fell slightly between 2007-08 and 2009-10 • Partly due to a methodological change – Mean income growth = 1.2% rather than 1.6% if use old methodology – little difference in median income growth => little impact on poverty statistics © Institute for Fiscal Studies So where did growth in 2009-10 come from? % of total income in 2009-10 Earnings 65% Benefits 21% Savings, pensions 10% Self employment 8% Other 3% Payments -6% Total -4% -2% 0% 2% 4% 6% 8% Real growth in components of income (GB) 2009-10 Note: excluding households whose incomes were adjusted under HBAI methodology How did the change in each income component affect total growth in 2009-10? Contribution to growth by income component in 2009-10 Earnings -0.7% Benefits 1.3% Savings, pensions 0.0% Self employment 0.3% Other 0.0% Payments 0.1% Total -1.0% 1.1% -0.5% 0.0% 0.5% 1.0% Note: excluding households whose incomes were adjusted under HBAI methodology 1.5% And during the recession? Contribution to annualised growth by income component, between 2007-08 and 2009-10 Earnings 0.0% Benefits Savings, pensions 1.1% -0.2% Self employment 0.0% Other 0.1% Payments 0.1% Total -1.0% 1.1% -0.5% 0.0% 0.5% 1.0% Note: excluding households whose incomes were adjusted under HBAI methodology 1.5% Why did income from benefits and tax credits rise so significantly? • Income from benefits and tax credits rose by 6.7% in 2009-10 in real terms; and 5.6% per year between 2007-08 and 2009-10 • Why? – Uprating rules and falling inflation during the recession – Discretionary changes – Rising unemployment © Institute for Fiscal Studies So far so good..... But, © Institute for Fiscal Studies Pain is yet to come (or to appear in data): • Inflation measured by RPI averaged 5.0% in 2010-11 => but most benefits and tax credits uprated by around 2% in April 2010 • Real average earnings fell by 3.8% while employment rate stagnated in the first 11 months of 2010-11 • Previous IFS work forecast a real-terms 2.2% fall in median income between 2008-09 and 2010-11 – implies a real fall by 3.1%, greatest since 1981 • Planned welfare cuts and tax rises to take effect gradually over the parliament Living standards: summary • Average household incomes continued to grow in 2009-10, despite the recession • Robust growth in income from benefits and tax credits during the recession • Significant fall in average incomes in 2010-11 looks likely Inequality Picture source: the New York Times The UK income distribution in 2009-10 Number of individuals (millions) 2.0 Median, £413 1.5 Mean, £517 1.4 million individuals with household income above £1,500 per week 1.0 0.5 0.0 0 100 200 300 400 500 600 700 800 900 1,000 1,100 1,200 1,300 1,4001,500+ Equivalised household income BHC, £ per week, 2009-10 prices Source: HBAI data Income growth by percentile group: 2009-10 (GB) 10% Real income gain (%) 8% 6% 4% 2% 0% -2% -4% 10 20 30 40 50 60 70 80 Percentile point st nd th Notes: The changes in income at the 1 , 2 and 99 percentiles are not shown on this graph due to very high levels of statistical uncertainty. Incomes have been measured before housing costs have been deducted. Source: Authors’ calculations using Family Resources Survey, 2008–09 and 2009-10. 90 Top percentile income growth highest in a decade Real income growth 14.0% 12.0% 10.0% Top percentile Median 8.0% 6.0% 4.0% 2.0% 0.0% -2.0% -4.0% Note: incomes are measured before housing cost. Source: HBAI data © Institute for Fiscal Studies Old methodology Average annual income gain (%) Income changes by percentile group: from 1996-97 to 2009-10 (GB) 5% 4% 3% 2% 1% 0% 10 20 30 40 50 60 70 80 -2% Percentile point -3% st Notes: The change in income at the 1 percentile is not shown on this graph due to very high level of statistical uncertainty. Source: HBAI data 90 Average annual income gain (%) Income changes by percentile group: from 1996-97 to 2009-10 (GB) 5% 4% 3% 2% 1% 0% 10 20 30 40 50 60 70 80 -2% Percentile point -3% st Notes: The change in income at the 1 percentile is not shown on this graph due to very high level of statistical uncertainty. Source: HBAI data 90 Average annual income gain (%) Income changes by percentile group: from 1996-97 to 2009-10 (GB) 5% 4% 3% 2% 1% 0% 10 20 30 40 50 60 70 80 -2% Percentile point -3% st Notes: The change in income at the 1 percentile is not shown on this graph due to very high level of statistical uncertainty. Source: HBAI data 90 Average annual income gain (%) Income changes by percentile group: from 1996-97 to 2009-10 (GB) 5% 1979-1996-97 4% 3% 2% 1% 0% 10 20 30 40 50 60 70 80 -2% Percentile point -3% st Notes: The change in income at the 1 percentile is not shown on this graph due to very high level of statistical uncertainty. Source: HBAI data 90 The Gini Coefficient:1979 to2009-10 (GB) Gini Coefficient 0.40 0.35 0.30 0.25 Thatcher Major 0.20 Source: HBAI data and Family Expenditure Survey, various years Blair/Brown Did Labour increase the rich-poor gap? • Gini has gone up from 0.33 in 1996-97 to 0.36 in 2009-10 • Many possible reasons; and IFS analysis suggests: – Gini would be 0.03 higher if the tax and benefit system had simply been uprated in line with RPI – Gini would be 0.01 higher had the system simply been uprated in line with GDP • Labour’s changes to the tax and benefit system acted to mitigate the rise in inequality Looking ahead • New tax measures including the 50p tax rate from April 2010 will reduce income growth at the very top of the distribution • Changes to the income tax personal allowance will have ambiguous impact on inequality • Significant cuts to welfare spending likely to increase inequality year after year; especially the switch to CPI indexation © Institute for Fiscal Studies Inequality: summary • Robust income growth towards the bottom of the distribution in 2009-10, but also exceptional growth among the richest • Significant increase in Gini under Labour; but mitigated by their benefit and tax policies • Uncertain future for inequality