Piecing together the productivity puzzles Richard Disney, Wenchao Jin, Helen Miller

advertisement

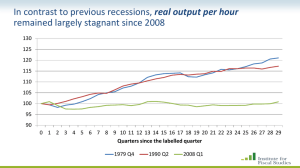

Piecing together the productivity puzzles Richard Disney, Wenchao Jin, Helen Miller © Institute for Fiscal Studies Output following each recession 108 Quarter 0 = 100 104 100 96 92 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Quarters since the last pre-recession quarter 2008Q1 output 1979Q4 output Source: figure 3.2 in chapter 3 © Institute for Fiscal Studies 1990Q2 output Output and employment following each recession 108 Quarter 0 = 100 104 100 96 92 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 Quarters since the last pre-recession quarter 2008Q1 employment 1979Q4 employment 1990Q2 employment 2008Q1 output 1979Q4 output 1990Q2 output © Institute for Fiscal Studies Source: figure 3.2 in chapter 3 20 Output per worker following each recession 115 Real output per worker (quarter 0 = 100) 110 105 2008Q1 100 3.2% 95 90 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Quarters since the last pre-recession quarter Source: figure 3.2 in chapter 3 © Institute for Fiscal Studies Output per worker following each recession 115 1979Q4 Real output per worker (quarter 0 = 100) 110 105 1990Q2 100 2008Q1 95 90 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Quarters since the last pre-recession quarter Source: figure 3.2 in chapter 3 © Institute for Fiscal Studies Output per worker following each recession 115 1979Q4 Real output per worker (quarter 0 = 100) 110 1990Q2 105 2008Q1 12.3% 100 linear trend (1990Q2 to 2008Q1) 95 90 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Quarters since the last pre-recession quarter Source: figure 3.2 in chapter 3 © Institute for Fiscal Studies Labour market • Average real wages fell by 0.7% from 2008Q1 to 2012Q3, after growing at 2.2% per year on average in the preceding decade – consumer wage has fallen by more • This is also in sharp contrast to the early 80s and 90s recessions © Institute for Fiscal Studies Low real wages Real hourly wage (first year of recession = 100) 120 115 110 1979 1990 2008 105 100 95 0 1 2 3 4 5 Years since the year in which the recession began Source: figure 3.7 in chapter 3 © Institute for Fiscal Studies 6 Labour market – low real wages • Low productivity low wage – firms may choose to or have to restrain wage growth • Low wage low productivity – low wages allow firms to retain more staff than they otherwise would have, when demand falls – low wages increase the attractiveness of labour as a form of input relative to capital © Institute for Fiscal Studies Labour market • Some economic factors affect wages directly, and have effects on productivity only through changes to wages 1. labour supply increased relative to previous recessions © Institute for Fiscal Studies Inactivity rates stayed low by historical standards Share of working-age population 27% 26% 25% 24% 23% 22% 21% 0 1 2 3 4 5 6 7 8 9 10 11 13 14 15 16 17 Quarters since the last pre-recession quarter 1979Q4 1990Q2 2008Q1 Source: figure 3.9 in the IFS Green Budget 2013 © Institute for Fiscal Studies 12 18 19 20 Labour market • Some economic factors affect wages directly, and have effects on productivity only through changes to wages 1) labour supply increased relative to previous recessions, due to – negative wealth shock work longer to make up for lost wealth – pensions reform – more stringent welfare polices 2) flexible labour market -> cut wages and hours rather than headcount © Institute for Fiscal Studies Capital markets • Business Investment fell to 16% below pre-recession peak, which was big in comparison to previous recessions © Institute for Fiscal Studies Sharp fall in investment 105 1979 1990 2008 Pre-recession peak = 100 100 95 90 85 80 75 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Quarters since pre-recession peak Source: figure 3.11 in the IFS Green Budget 2013, “Gross fixed capital formation” © Institute for Fiscal Studies Capital markets • Business Investment fell to 16% below pre-recession peak, which was big in comparison to previous recessions – gradually reduced the capital stock available to workers – lower quality of capital © Institute for Fiscal Studies Capital markets • Misallocation of capital – demand has fallen differentially for different goods and services, and it takes time for capital to move from what are now low-productivity projects to higher-productivity projects • Consistent with the observation of – higher dispersion of rates of return across sectors – widening distribution of firms’ productivity – lower exit rate than previous recessions, due to low interest rate and bank forbearance – low entry of new firms © Institute for Fiscal Studies Other popular explanations • Workforce composition – more part-time and self-employment – but also more educated, older, and have longer job tenures on average • Industrial composition – the aggregate fall in productivity has resulted entirely from falls in productivity within industries – productivity changes within finance and mining and quarrying could explain more than half of the aggregate fall in output per hour from 2008Q1 to 2012Q3 – but the productivity growth also slowed down significantly within most other industries • Labour hoarding or under-utilization – but flows into employment remained high © Institute for Fiscal Studies Public sector • Measured public sector productivity growth has been near zero in the decade till 2009 – measuring public sector output (value added) is difficult – output is calculated from inputs to various degrees across the public sector little productivity growth • We believe public sector productivity has increased since the recession – total “public sector” employment fell 6% since 2009Q4 – while output (value added) in “government services” increased – puzzling because input-based output measures make it hard for measured productivity to grow • We may be making efficiency savings, but quality and longer-term effects of public services are important as well © Institute for Fiscal Studies Summary • Output per worker has fallen since the recession and is 12% below the historical trend • This experience is very different to previous recessions • We think the most important factors in explaining the productivity shortfall are: – low real wages – low investment – a mis-allocation of capital • Other potential explanations found to be not crucial: labour hoarding and changes to composition of the economy and of the workforce • Public sector productivity probably increased, but hard to judge © Institute for Fiscal Studies