Press Release IFS analysis of the February 2014 public

advertisement

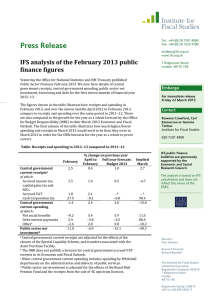

Press Release Tel: +44 (0) 20 7291 4800 Fax: +44 (0) 20 7323 4780 mailbox@ifs.org.uk www.ifs.org.uk IFS analysis of the February 2014 public finance figures 7 Ridgmount Street London WC1E 7AE Today the Office for National Statistics and HM Treasury published Public Sector Finances February 2014. We now have details of central government receipts, central government spending, public sector net investment, borrowing and debt for the first eleven months of financial year 2013−14. Embargo The figures shown in the table illustrate how receipts and spending in February 2014, and over the eleven months April 2013 to February 2014, compare to receipts and spending over the same period in 2012–13. These are also compared to the growth for the year as a whole forecast by the Office for Budget Responsibility (OBR) in their March 2014 Economic and Fiscal Outlook, which was published on Wednesday. The final column of the table illustrates how much higher/lower spending and receipts in March 2014 would need to be than they were in March 2013 in order for the OBR forecasts for the year as a whole to prove correct – assuming there are no revisions to earlier months’ data. For immediate release Contact Rowena Crawford, Carl Emmerson or Soumaya Keynes Institute for Fiscal Studies 020 7291 4800 IFS public finance bulletins are generously supported by the Economic and Social Research Council. The analysis is based on IFS calculations and does not reflect the views of the ESRC. Director: Paul Johnson Research Director: Richard Blundell The Institute for Fiscal Studies Limited by Guarantee, Registered in England: 954616 7 Ridgmount Street London WC1E 7AE Registered Charity: 258815 VAT no: GB 394 5830 17 As the OBR had access to preliminary data on tax receipts in February and early March, today’s ONS release is not enough to suggest that the OBR’s forecast for the whole of 2013–14 will be incorrect. However, the data do appear to suggest that the OBR is expecting lower receipts of income tax, capital gains tax and NICs in March 2014 than in March 2013, but that other receipts will grow more strongly in March than they have done over the year to date. The apparently high growth in central government spending on public services in February is at least in part due to a change in timing of grants to local government from central government. The OBR’s forecasts imply that this spending will be lower in March 2014 than in March 2013. Table: Receipts and spending in 2013–14 compared to 2012–13 February % change on previous year April to Full year forecast: February Budget 2014 3.5 3.8 Implied March 6.8 Central government 4.9 current receiptsa of which: Accrued income tax, 2.7 3.0 2.5 -2.7 capital gains tax and NICs Accrued VAT 5.6 5.2 5.3b 6.3b Cash Corporation tax 7.3 -0.9 -0.9 -0.7 Central government 7.6 1.8 1.7 0.6 current spending of which: Net social benefits 2.5 1.1 1.4 4.9 Debt interest payments -6.7 -0.6 1.8 44.5 Otherc 11.9 2.5 1.9 -4.4 Public sector net -10.0 28.0 -6.3 -34.0 investmentd a Central government current receipts are adjusted for transfers associated with the Asset Purchase Facility. b Since the March 2014 Budget the OBR has not published a forecast for central government accrued VAT receipts. Therefore this number assumes that the £2.4bn difference between central government accrued VAT and public sector accrued VAT in the Autumn Statement 2013 forecasts for 2012– 13 and 2013–14 remain. c Other central government current spending includes spending by Whitehall departments on the administration and delivery of public services. d Public sector net investment is adjusted for the effects of the Royal Mail Pension Fund and the receipts from the sale of 4G spectrum licences. Further information and contacts For further information on today’s public finance release please contact: Rowena Crawford, Carl Emmerson or Soumaya Keynes on 020 7291 4800, or email rowena_c@ifs.org.uk, carl_emmerson@ifs.org.uk or soumaya_k@ifs.org.uk. Next month’s public finances release, which will provide the first estimates of spending and revenues for the entirety of the 2013–14 financial year, is due to be published on Wednesday 23rd April. The Institute for Fiscal Studies Limited by Guarantee, Registered in England: 954616 7 Ridgmount Street London WC1E 7AE Relevant links: This, and previous editions of this press release, can be downloaded from http://www.ifs.org.uk/publications/browse?type=pf Office for National Statistics & HM Treasury, Public Sector Finances, February 2013: http://www.ons.gov.uk/ons/rel/psa/public-sector-finances/march2014/index.html IFS analysis of Budget 2014 can be found at: http://www.ifs.org.uk/projects/426 HM Treasury Budget 2014: https://www.gov.uk/government/topicalevents/budget-2014 Office for Budget Responsibility’s Economic and Fiscal Outlook – March 2014: http://budgetresponsibility.org.uk/economic-fiscal-outlook-march-2014/ ENDS Notes to Editors: 1. Central government current spending includes depreciation. 2. Where possible we compare figures on an accruals basis with the Office for Budget Responsibility forecast. IFS hosts two ESRC Research Centres. The Institute for Fiscal Studies Limited by Guarantee, Registered in England: 954616 7 Ridgmount Street London WC1E 7AE