Business and capital taxes Stuart Adam © Institute for Fiscal Studies

advertisement

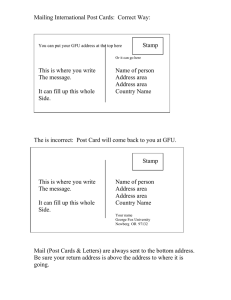

Business and capital taxes Stuart Adam © Institute for Fiscal Studies Business tax measures • Small firms’ business rates relief more generous for 1 year from October – Costs one-off £410m © Institute for Fiscal Studies Business rates, 2010 £10 000 £10,000 Before Budget £9,000 After Budget g £8 000 £8,000 Taxx payablle £7,000 £6,000 £5,000 £4,000 £3,000 £2,000 £1,000 £0 £0 £5,000 £10,000 £15,000 Rateable value © Institute for Fiscal Studies £20,000 £25,000 Business tax measures • Small firms’ business rates relief more generous for 1 year from October – Costs one-off £410m • Annual investment allowance doubled from £50,000 to £100,000 – Costs £110m • CGT entrepreneurs’ relief lifetime limit doubled from £1m to £2m – Costs £90m • Tax relief for video games industry – design subject to consultation – Costs £50m • Usual raft of anti-avoidance and anti-evasion measures – Raises about £500m © Institute for Fiscal Studies Personal capital taxes • Inheritance tax threshold to be frozen at £325,000 until 2014-15 – Yield rises each y year;; £110m by y 2012-13 • ISA limits to be indexed to inflation throughout next Parliament – Cost rises each y year;; £5m by y 2012-13 • Stamp duty threshold doubled from £125,000 to £250,000 for first-time buyers from March 2010 to March 2012 – Conservatives propose doing the same thing permanently – Costs one-off £550m over the two years • Stamp duty rate increased from 4% to 5% for residential property purchases above £1m from April 2011 – Labour’s own ‘mansion tax’ – but very different from Lib Dems’ – Raises £230m © Institute for Fiscal Studies Stamp duty land tax Residential properties £60 000 £60,000 May 1997 February 2010 Stamp d duty £50,000 First time buyers, buyers March 2010 - March 2012 From April 2011 £40,000 £30,000 £20,000 £10,000 £0 £0 £200,000 £400,000 £600,000 Sale price © Institute for Fiscal Studies £800,000 £1,000,000 £1,200,000 Temporary stamp duty cut for first-time buyers • Cuts in stamp duty generally welcome – Stamp p duty y is an exceptionally p y damaging g g tax • First-time buyers buying £125-250,000 properties in relevant period pay up to £2,500 less – Part of benefit may go to those selling them the properties • Complexity in defining “first-time” buyers • Temporary cut for first-time buyers creates distortions – Bring g transactions forward into the window – Delay buying first property until can afford somewhere more expensive – Buy bigger first property than ideally would like – Penalises joint ownership © Institute for Fiscal Studies New top rate of stamp duty • Increases in stamp duty generally unwelcome – Stamp p duty y is an exceptionally p y damaging g g tax • Those buying £1m+ properties pay at least £10,000 more – Most of loss likely to be passed on to current owners as prices fall • £1 higher price can mean £10,000 higher tax bill – Why should this be desirable? – Enormous incentive to keep transactions below £1m © Institute for Fiscal Studies Summary • One-off giveaways – Stamp p duty, y, business rates • Thereafter, mainly tax rises for the wealthy… – Stamp duty, inheritance tax • …but continued tax cuts for business – Annual investment allowance allowance, entrepreneurs’ entrepreneurs relief • Increasingly Increasingl inter interventionist entionist ind industrial strial polic policy © Institute for Fiscal Studies