IFS A R

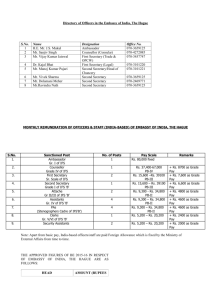

advertisement