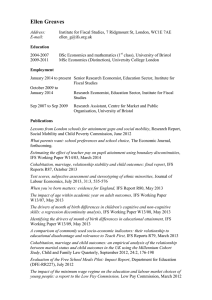

IFS A R

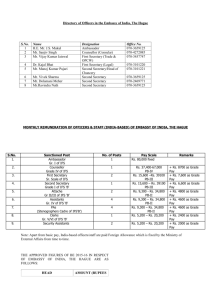

advertisement