Richard Blundell Earnings, Employment, Productivity and Consumption Panel Discussion, 24

advertisement

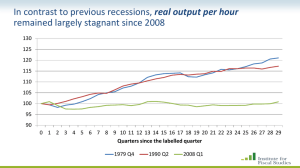

Earnings, Employment, Productivity and Consumption Understanding the Great Recession: From Micro to Macro Panel Discussion, 24th September 2015, Bank of England Richard Blundell University College London and Institute for Fiscal Studies Thanks to Cormac O’Dea, Helen Miller and Wenchao Jin In contrast to previous recessions, real output per hour remained largely stagnant since 2008 130 125 120 115 110 105 100 95 90 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Quarters since the labelled quarter 1979 Q4 1990 Q2 2008 Q1 In contrast to previous recessions, real output per hour remained largely stagnant since 2008 102.0 100.0 98.0 96.0 2015 Q1 2014 Q1 Output per worker 2012 Q1 2011 Q1 2010 Q1 90.0 2009 Q1 Output per hour worked 92.0 2013 Q1 94.0 2008 Q1 Indexed to 100 2008 Q2 104.0 Changes to total output, employment and hours worked since 2008Q1 102 100 98 96 94 Source: Cribb and Joyce (IFS, 2015) 2015 Q1 Employment 2014 Q1 Total hours 2013 Q1 2011 Q1 2010 Q1 Output 2009 Q1 90 2012 Q1 92 2008 Q1 Indexed to 100 2008 Q1 104 Mean weekly real earnings fell strongly adjusted for RPIJ inflaOon and indexed to 100 in 2008Q1 105 100 95 90 LFS ASHE 85 Source: Cribb and Joyce (IFS, 2015), and Jin (2015) Earnings and producOvity growth Output per hour compared to mean hourly earnings in LFS (GDP deflated) since 2008Q2 100 95 © InsOtute for Fiscal Studies Source: Cribb and Joyce (2015), and Jin (2015) 2015Q1 2014Q3 2014Q1 2013Q3 2013Q1 2012Q3 2012Q1 Mean hourly earnings 2011Q3 2011Q1 2010Q3 2010Q1 2009Q3 2009Q1 90 2008Q3 Output per hour worked 2008Q1 Indexed to 100 in 2008Q2 105 Change in real median hourly wages by age group since 2008 Cumula:ve change in real median hourly wages from 2008 to 2014 2% 0% -­‐2% -­‐4% -­‐6% -­‐2.6% -­‐2.7% 40-­‐49 50-­‐59 -­‐5.8% -­‐8% -­‐10% © InsOtute for Fiscal Studies 0.2% -­‐9.0% 22-­‐29 Source: Cribb and Joyce (2015) 30-­‐39 60 + Change in real median hourly wages by sex since 2008 Cumula:ve change in real median hourly wages from 2008 to 2014 2% 0% -­‐2% -­‐2.5% -­‐4% -­‐6% -­‐8% -­‐7.3% -­‐10% Men © InsOtute for Fiscal Studies Source: Cribb and Joyce (2015) Women 60% © InsOtute for Fiscal Studies Source: Cribb and Joyce (2015) 2015Q1 2014Q3 2014Q1 2013Q3 2013Q1 2012Q3 2012Q1 2011Q3 Male 2011Q1 2010Q3 2010Q1 2009Q3 2009Q1 2008Q3 2008Q1 2007Q3 2007Q1 2006Q3 2006Q1 2005Q3 2005Q1 Employment rate (age 16-­‐64) (%) Female employment stronger than male employment since the recession 80% 75% 70% 65% Female Employment rate for older workers: women aged 60-­‐64 45.0 40.0 Euro area (13 countries) 35.0 30.0 Germany (unOl 1990 former territory of the FRG) 25.0 Spain 20.0 France 15.0 Italy 10.0 United Kingdom 5.0 0.0 2003 2004 2005 2006 2007 Source: Blundell, Green and Jin (2014) 2008 2009 2010 2011 2012 Falls in Real Earnings even greater acer allowing for composiOon changes in mean real hourly earnings Average annualised change 1.5% 1.1% 1.0% 0.7% 0.5% 0.5% 0.6% 0.6% 0.0% -­‐0.5% -­‐0.4% -­‐0.6% -­‐1.0% -­‐1.0% -­‐1.2% -­‐1.5% 2002-­‐2007 Actual change 2007-­‐2012 ComposiOonal effect Source: Cribb and Joyce (IFS, 2015) and Blundell, Green and Jin (2014) 2012-­‐ 2014 Underlying change Household earnings and net incomes 2007–08 to 2013–14 (non-­‐pensioners in working households, by percenOle point) CumulaOve income change 5% 0% -­‐5% -­‐10% -­‐15% Gross household earnings Net household income (BHC) -­‐20% 5 10 © InsOtute for Fiscal Studies 15 20 25 30 35 40 45 50 55 PercenOle point Source: Living Standards, Poverty and Inequality: IFS, 2015 60 65 70 75 80 85 90 95 RaOo of income at the 90th and 10th percenOles (90/10 raOo) 5 10% 9% 4 8% 7% 3 6% 5% 2 4% 3% 1 2% 90/10 raOo (LH axis) Top 1% share of income (RH axis) 0 © InsOtute for Fiscal Studies 1% 0% Source: Living Standards, Poverty and Inequality: IFS, 2014 Share of household income held by the top 1% of individuals 90/10 raOo and top 1% income share Non-­‐ and semi-­‐durables per head 125 Quarter before recession = 100 120 1980 115 1990 2008 110 105 100 95 90 85 80 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Quarters since start of recession © InsOtute for Fiscal Studies Source: Crossley, Low & O'Dea (2015) Durables per head Quarter before recession = 100 150 140 1980 1990 2008 130 120 110 100 90 80 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Quarters since start of recession © InsOtute for Fiscal Studies Source: Crossley, Low & O'Dea (2015) Business investment has been very slow to pick up 8 Change since 2008 Q1, £bn 6 4 2 0 -­‐2 -­‐4 -­‐6 -­‐8 -­‐10 business investment © InsOtute for Fiscal Studies Prospects • Younger workers and families are acOng as if they expect a long-­‐run fall in relaOve living standards – evidence from consumpOon and saving. • Real wages, producOvity (and investment) have been slow to pick up – we can expect the palern of lower real wages at the bolom to conOnue, but with fairly buoyant employment due to increased supply. • Most actual falls in real earnings have happened – but conOnuing strain on the tax-­‐credit and benefit system – and fiscal contracOon implies large benefit cuts Prospects (cont.) • Lille evidence of earnings progression for lower skilled and part-­‐Ome workers • longer term earnings growth will mostly come from high-­‐skilled occupaOons, with perhaps some at the very bolom. • Increasing inequality across the earnings distribuOon, and increasing pressure on the tax and benefit system. • SOll much to do in focussing on older workers in general, on return to work for parents/mothers, and on entry into work. There are sOll some potenOal big gains here, – for example, as (higher skilled) women age in the workforce. • ProducOvity (and human capital) is sOll the key. Extra Slides © InsOtute for Fiscal Studies RaOo of BA (equiv.) median wage to that of A-­‐level (equiv.) Remarkably… no cohort effects! BA premium stayed constant, even through the recession. -­‐10 2008 Q1 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3 2009 Q4 2010 Q1 2010 Q2 2010 Q3 2010 Q4 2011 Q1 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2014 Q1 2014 Q2 2014 Q3 2014 Q4 Change since 2008 Q1, £ billion Business investment has been very slow to pick up 15 10 Business investment 5 0 Household consumpOon: durable goods -­‐5 © InsOtute for Fiscal Studies Household consumpOon: non-­‐durable goods Percentage Change in Food Expenditure: 2010-­‐2012 UK Change in Food Expenditure by Cen:le and HH type: 2010 to 2012 0.04 0.02 0 -­‐0.02 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58 61 64 67 70 73 76 79 82 85 88 91 94 97 All HHs Pensioners -­‐0.04 w/o children -­‐0.06 with children -­‐0.08 -­‐0.1 -­‐0.12 Notes: Understanding Society Source: Blundell and Etheridge, 2014 © InsOtute for Fiscal Studies Self-­‐employment as a share of total employment 11% © InsOtute for Fiscal Studies Source: Authors’ calculaOons using Labour Force Survey (ONS series MGRQ and MGRZ). 2014 Q3 2014 Q1 2013 Q3 2013 Q1 2012 Q3 2012 Q1 2011 Q3 2011 Q1 2010 Q3 2010 Q1 2009 Q3 2009 Q1 2008 Q3 2008 Q1 2007 Q3 2007 Q1 2006 Q3 2006 Q1 2005 Q3 2005 Q1 2004 Q3 2004 Q1 Self employment as a share of total employment 16% 15% 14% 13% 12% Earnings for employees and the self employed Percentage of employees / self-­‐employed individuals 25% Self-­‐employed Employees 20% 15% 10% 5% 0% Earnings (per week, April 2014 prices) © InsOtute for Fiscal Studies Source: Figure 2.14 of Cribb and Joyce (2015) “Earnings since the recession” 75% Unemployment rate (RH axis) 9% © InsOtute for Fiscal Studies Source: Fig 2.1 of Cribb and Joyce (2015) “Earnings since the recession” 2014 2014 2013 2013 2012 2012 4% 2011 70% 2011 5% 2010 71% 2010 6% 2009 72% 2009 7% 2008 73% 2008 8% 2007 74% Unemployment rate (age 16-­‐64) (%) Employment rate (LH axis) 2007 Employment rate (age 16-­‐64) (%) Employment and unemployment rates since 2007 ParOcularly strong growth in private sector Private (LH axis) 8.0 Public (RH axis) © InsOtute for Fiscal Studies Source: Fig 2.2 of Cribb and Joyce (2015) “Earnings since the recession” 2014Q3 2014Q1 2013Q3 2013Q1 2012Q3 2012Q1 2011Q3 2011Q1 2010Q3 5.0 2010Q1 23.0 2009Q3 5.5 2009Q1 23.5 2008Q3 6.0 2008Q1 24.0 2007Q3 6.5 2007Q1 24.5 2006Q3 7.0 2006Q1 25.0 2005Q3 7.5 2005Q1 25.5 Public sector employment (million) Private sector employment (million) 26.0 NEET rate among young people 60% 50% 40% 18-­‐21 GCSEs or above 18-­‐21 without GCSE 30% 22-­‐24 Degree level or above 22-­‐24 GCSEs, A-­‐levels, FE 20% 22-­‐24 without GCSE 0% 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 10% Source: Blundell, Green and Jin (2014) Recent cohorts are also less likely to own a home Born 1963–67 Born 1973–77 Born 1983–87 Homeownership rate (%) 80% 70% 60% 50% 40% 30% 20% 10% 0% 20 21 22 23 24 25 26 27 28 29 Age 30 31 32 33 34 35 36 37 38 39 40 Source: Figure 3.13 of Living Standards, Poverty and Inequality: 2014 © InsOtute for Fiscal Studies