Value Added Tax policy and the case for

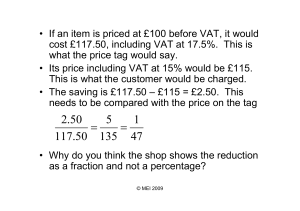

advertisement