Reforms to childcare policy 9. Summary

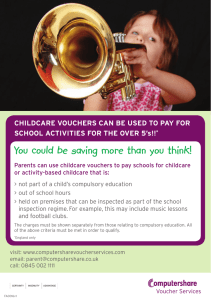

advertisement