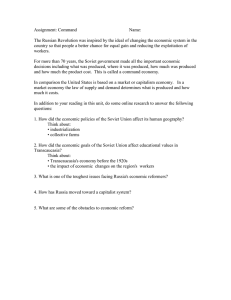

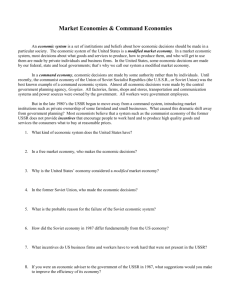

Economic Growth and Slowdown*

advertisement