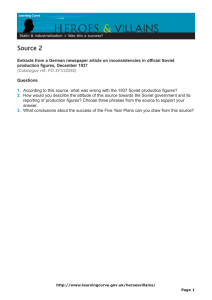

Plans, Prices, and Corruption: The Soviet Firm Under Partial Mark Harrison**

advertisement