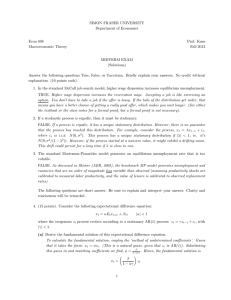

Macro Qualifying Exam January 13, 2014

advertisement

Macro Qualifying Exam

January 13, 2014

Instructions. The exam consists of two parts. Please answer 3 out of 4 questions in Part I, and 8 out

of 9 questions in Part II. Start your answer to each question on a fresh sheet of paper. Clearly label the

problem number and your assigned ID at the top of each page.

Try to answer as many parts of each question as possible. It is OK to skip part of a question and still

try to answer later parts to the extent this is possible. Nevertheless, verbal answers that do not engage the

math (when math is expected) will receive little or no credit.

You are strongly encouraged to work out your initial algebra attempts on scrap paper so your final

answer is clean and easy to grade; your final answer should nevertheless include all relevant steps. Messy or

confusing answers will be marked down.

Keep in mind, you will not receive any credit for answering a different question than the one being asked.

For this reason, it is very important that you read each question carefully. Be as precise in your answers as

possible.

You are encouraged to read over all questions for each part before choosing which ones to answer.

You have 5 hours to complete the exam. Part I will count for two-thirds of the total points and part II

will count for one third, so please allocate your time wisely. Try not to spend too much time bogged down

on any one question; you are better off moving on and trying to return to it later.

Good Luck!

1

Part I: Modeling Exercises. Answer 3 out of 4 questions.

Exercise 1 Consider the following version of the cake eating problem with depreciation and “rodent” uncertainty. The goal is to choose a path of consumption {ct }∞

t=0 to maximize the following objective function

∞

X

β t u(ct ),

t=0

where Wt , the amount of cake remaining at the beginning of period t, evolves according to the following

transition equation:

Wt+1 = (1 − δ)ζt (Wt − ct ), t = 0, 1, 2, . . . ,

with W0 > 0 given. β is a discount factor between zero and one. δ is the fraction of a unit of cake that

goes bad between t and t + 1 (and thus cannot be consumed). ζt+1 is a stochastic parameter (realized at the

beginning of period t + 1) which indicates the amount of cake that mice in the attic manage to eat between

t and t + 1. It is assumed to follow a known Markov process. The utility function, u(·) is strictly increasing

and strictly concave.

1. (10 points) Identify the state variables for the problem and write the Bellman equation. Write the

Bellman equation so the amount of cake next period (W 0 ) is the control variable today. When writing

the Bellman equation, be sure to clearly indicate the lower and upper bounds on the control variable

W 0.

2. (15 points) Derive the stochastic Euler equation. Indicate the steps you take in doing this.

3. (5 points) Interpret the stochastic Euler equation just derived.

For the next two questions, assume that there is no uncertainty (ζt = 1 for all t). Further assume that

utility is logarithmic (u(c) = ln(c)). We will relax these assumptions again later on.

4. (30 points) Solve the restricted problem using guess and verify. Be sure to indicate all relevant steps

in your solution.

5. (10 points) Use the derived policy function to explain the impact of depreciation on the optimal amount

of savings. Explain intuitively why this mathematical result makes sense.

For the remaining questions, return to the“full” problem with uncertainty and CRRA utility (i.e.,

1−η

u(c) = c1−η ).

6. (15 points) Explain how you would proceed if you needed to solve the “full” problem. Be as specific

as you can about the steps you would take, while restricting your answer to 8 sentences or less.

7. (15 points) Indicate what restrictions you would need to place on the stochastic process ζt for the

approach explained in the last question to work? Provide an explicit example (with numbers) of a

process that fits these restrictions.

2

Exercise 2 Consider the following stochastic savings problem with isoelastic (CRRA) utility and linear

production. Agents choose consumption {ct }∞

t=0 to maximize the expected present discounted value of

future utility

∞

X

c1−η

E

βt t .

1−η

t=0

subject to

At+1 = Rt+1 (At − ct ), t = 0, 1, 2, . . . ,

At is the amount of savings that an agent holds in period t. Rt+1 is the return on savings between t and

t + 1. It is an iid random variable, and we assume that consumption must be chosen in period t before

observing Rt+1 .

1. (15 points) Identify the state variables for the problem and write the Bellman equation. Write the

Bellman equation so the amount of savings next period (A0 ) is the control variable today. When writing

the Bellman equation, be sure to clearly indicate the lower and upper bounds on the control variable

A0 .

2. (10 points) Define stationarity and argue as to whether or not the above problem is stationary.

For the remainder of the problem, assume that Rt is deterministic with Rt = 1 for all t.

3. (20 points) Guess that the value function takes the form V (A) = D + E ln(A). Go through the

necessary steps to verify if the guess is correct.

4. (20 points) Guess instead that the value function takes the form V (A) = DA1−η . Go through the

necessary steps to verify if the guess is correct.

5. (25 points) Derive an expression for the policy function in terms of fundamental parameters of the

model.

6. (10 points) Plot the policy function.

3

Exercise 3 Consider the following one sector growth model. Assume that individuals have linear intertemporal preferences

over consumption streams, so that the present discounted value of utility over an infinite

R∞

horizon is 0 e−ρτ yτ dτ , where τ is an index for time. Each of the L individuals in an economy is endowed

with one unit flow of labor which s/he provided inelastically, so that L is also total labor supply. Population

is constant.

Output of the consumption good is produced according to the usual Cobb-Douglas specification y =

Axα , α ∈ (0, 1), where x is the amount of the intermediate good used. Innovations develop new quality of

the intermediate good that replaces the old one, and raises the productivity parameter by an amount γ > 1.

Subsequent intermediate product generations are indexed by t = {0, 1, 2, ...} =

6 τ ∈ [0, ∞).

The economy’s labor supply L has two competing uses. It can be utilized in manufacturing one for one,

or in R&D. Denote R&D workers by n.

1. (5 points) Write the labor market clearing condition that must hold at any period.

When n workers are employed in R&D, innovations arrive at a Poisson rate equal to λn, where λ >

0 indicates the productivity of the research technology. A firm which is successful in innovating

monopolizes the intermediate goods sector.

2. (10 points) Derive, and explain why the amount of labor devoted to R&D is determined by, the

following arbitrage condition:

wt = λVt+1

where t denotes product generations, w denotes the wage, and Vt+1 denotes the value of the next

generation innovation.

3. (10 points) What is the asset equation determining Vt+1 ? Interpret this equation.

4. (10 points) Show that equilibrium profits for the t-th intermediate goods producer are equal to

πt =

1−α

wt x

α

5. (10 points) Write down a system of difference equations describing the evolution of researchers and the

evolution of the productivity-adjusted wage over time.

6. (15 points) Show that the system above has a unique steady-state equilibrium in which the productivity

adjusted wage and the number of researchers are constant over time.

7. (5 points) (a) Considering the consumption good at time τ , by how much is its logarithm increased

each time an innovation occurs? (b) What is the average growth rate of the economy in steady state?

8. (15 points) Determine the effect on the equilibrium growth rate of the economy and on the steady

state population of researchers of i) an increase in labor supply; ii) a decrease in the interest rate;

iii) a decrease in the degree of market competition; iv) an increase in the innovation size γ and v) an

increase in the productivity of R&D λ.

9. (20 points) State and solve the problem of a social planner choosing x, n to maximize the steady

state utility of a representative consumer in the economy. Make sure you identify the main sources of

difference between the decentralized allocation and the optimal one.

4

Exercise 4 Consider the following matching model. The process of trade between workers looking for jobs

and firms with vacancies is described by the following iso-elastic matching function:

M (uL, vL) = (uL)η (vL)1−η

where η ∈ (0, 1), L denotes total labor supply, uL is the number of unemployed workers and vL is the number

of vacancies. We consider the role of capital stock in the framework. The labor productivity parameter p

that you are familiar with in the basic matching model is reinterpreted as labor-augmenting technology,

exogenous, that converts labor into effective labor. Denoting aggregate capital and employment by K, N

respectively, the aggregate production function is F (K, pN ), with diminishing returns to capital and effective

labor, and constant returns to scale. Denote output per effective worker by f (k) ≡ F (K/(pN ), 1), which

satisfies the usual Inada conditions. Further, denote the depreciation rate on capital stock by δ > 0. Finally,

we assume that there is a perfect market for second-hand capital goods, so that it makes no difference to

own or rent capital from a firm’s perspective, as the rental price of capital is equal to its rate of return.

A vacancy with expected present discounted value V costs cp per unit time, c > 0. The difference that

capital stock makes is in the determination of the expected present discounted value of a matched job. In

fact, when a job match occurs, the firm hires capital k for each efficiency unit of labor. The capital stock

owned by the firm becomes part of the value of the job, so that the asset value of an occupied job is given

by J + pk.

The expected present discounted value of unemployment is denoted by U . Jobs are destroyed at an

exogenous rate λ. The vacancy/unemployment ratio is considered as a separate variable and denoted by θ ∈

[0, 1]. Employed workers receive a wage w for their labor services, and the interest rate is fixed exogenously

at r. There is no unemployment compensation. We assume that V, U, J are all stationary over time, and we

focus on steady state values of capital stock.

1. (10 points) (a) Write down the rate per unit time at which job matches occur, and the rate at which

workers transition out of unemployment. (b) Calculate the elasticity of both rates with respect to θ,

and provide an economic intuition behind the signs of these elasticities.

2. (10 points) (a) Write down a differential equation describing the evolution of the unemployment rate

over time, and solve for the steady state value of the unemployment rate. (b) How does steady state

unemployment slope in the (w, θ) plane? and how does it slope in the (u, v) plane?

3. (30 points) (a) Write down asset equations for V and J + pk. (b) What must be the value of V in

equilibrium, and why? (c) By maximizing over capital stock per worker the equation describing the

value of an occupied job, show that the typical condition f 0 (k) = r + δ must hold. (d) Considering the

equilibrium value of vacancies, show that the job creation condition for this model is:

p[f (k) − (r + δ)k] − w =

(r + λ)pc

q(θ)

and provide an economic intuition for it.

4. (10 points) Let W denote the stationary present discounted value of expected income streams for an

employed worker. (a) Write asset equations for U and W , and (b) give a solution for rU, rW in terms

of the wage rate w, the job destruction rate λ, and the vacancy/unemployment ratio θ.

5. (10 points) We now turn to wage determination. The asset equations for J and W are firm-specific

in that they depend on the firm-specific wage wi , i = 1, . . . , N being an index for firms. Workers

and firms that are matched and create a job share the equilibrium rents arising from job creation by

agreeing on a wage that maximizes the Nash product of their respective gains from a job match:

(W (wi ) − U )β (J(wi ) − V )1−β

where β is workers’ bargaining power, while U is independent from wi and satisfies the equation you

found above in which w is the average wage in the labor market. Since the market for capital goods

is perfect, the introduction of capital makes no difference as far as wage determination is concerned.

Solve the Nash bargaining problem and show that β is the share of workers in the total surplus created

by a job match.

5

6. (15 points) (a) Show that the surplus-maximizing wage depends only on rU, β, p[f (k) − (r + δ)k], and

is therefore equal for all firms. (b) Solve for rU as a function of β, p[f (k) − (r + δ)k], c, and θ, and (c)

write down the equilibrium wage equation representing the wage as a function of θ, capital stock, and

the other parameters of the model.

7. (15 points) (a) Define in one sentence the equilibrium of the labor market, and (b) write down the four

equations that solve for an equilibrium. (c) Briefly explain what differences the introduction of capital

stock makes relative to the benchmark model with no capital.

6

Part 2: Short Essay Questions. Answer 8 out of 9 questions.

Your answer to each question in part 2 should not exceed 15 lines.

1. Define a balanced growth path. Does the Solow model with constant population and constant technology converge to a balanced growth path? Justify your answer (a verbal response is sufficient).

2. What data is needed to run a Barro regression? What question was this approach originally designed

to answer?

3. Suppose

Z(t) =

A(t)

,

B(t)

where A(t) = A(0)eat and B(t) = B(0)ebt for constants a and b. What is the proportional growth rate

of Z(t)? Prove your answer using known rules of calculus.

4. When solving the OLG model considered in class, we made use of a no-arbitrage condition. In words,

explain what this condition required and why it is plausible.

5. Most economic models based on forward–looking dynamic optimization generate saddle path dynamics.

(i) In a two–dimensional dynamical system, outline a procedure to approximate the saddle path around

the steady state, and (ii) illustrate the role played by forward–looking variables in ensuring convergence

to the steady state.

6. (i) Explain in one sentence what is the ‘scale effect’ in first–generation endogenous growth models.

Suppose that the stock of technology A satisfies: Ȧ(t) = λLA (t)γ A(t)φ , γ ∈ (0, 1), φ ∈ (0, 1), where

LA (t) is the number of researchers employed in R&D. Let the labor force grow over time at a constant

rate equal to n > 0. (ii) Will this model generate a scale effect? (iii) Will R&D incentives/subsidies

play a role in influencing the growth rate?

7. Give an example of a production function that violates the Inada conditions, thus enabling sustained,

endogenous growth in the long run even with perfectly competitive markets, and briefly explain the

reason why.

8. Illustrate the skill-premium puzzle, and explain how endogenous growth models of directed (skillbiased) technical change (SBTC) can make sense of it. Some authors have argued that the analysis by

Piketty and Saez (2003, 2006...) provides contrary evidence to SBTC predictions. Why?

9. Explain the reason why the decentralized equilibrium paths in: (i) the Lucas (1988) human capital

model; and (ii) in the Jones (1995) R&D–based growth model respectively, are not Pareto–efficient.

7