Document 12756735

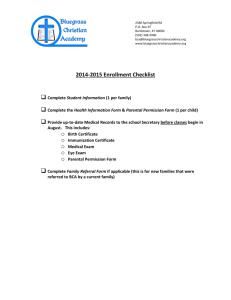

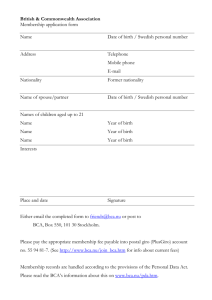

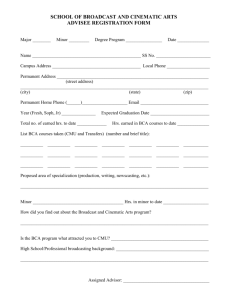

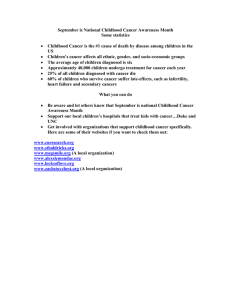

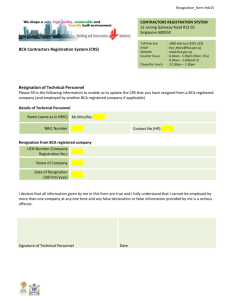

advertisement